Fatima Mazhar started her career as an investment banker in Dubai. She worked as the Chief Operating Officer (COO) of a company in the Gulf state, and was doing pretty well for herself as a young, up-and-coming senior executive.

Then she left.

Not excited by her job anymore, Fatima began searching for her next step when she came across a startup called Careem. The company felt like a good fit, and so Fatima started work there – as a call centre agent. Within a few years, Fatima would go on to become Careem’s head of expansion and eventually launch the ride-hailing app in Pakistan as well.

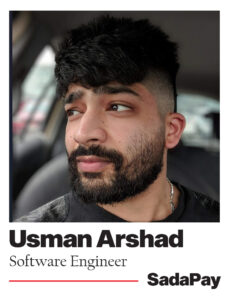

Usman Arshad has a similar story. He was a Vice President at J.P.Morgan where he had started off as a talented network engineer. He left the investment bank to join Pakistani fintech startup Sadapay. He still works for Sadapay out of Scotland.

Fatima and Usman are part of a rising crop of people that have chosen to work in Pakistan’s emerging startup ecosystem rather than for large legacy companies, MNCs, banks, and FMCGs. This, perhaps more than anything, is the biggest contribution that the startup ecosystem has made to Pakistan.

On the one hand, there are seasoned executives with decades of experience that have shifted careers from legacy banks and MNCs to join startups in leadership positions. Then, there are fresh graduates with degrees from foreign universities and from institutions like LUMS, IBA, and the like that are choosing to apply to and work for startups.

This has created a base of talent in Pakistan that is being trained in a very different way from how they would traditionally come up through the ranks. Because startups are small operations and focus very much on culture, young employees fresh on the scene get the opportunity to have direct contact with decision makers and take on tasks that they would not normally do in larger corporations. On top of that, they are also paid very well – with average starting salaries at startups beginning close to the six figure mark. Progress through the ranks is also quick, and there is a definite sense of ownership that exists as well.

At the same time, these young professionals get to interact with and learn from seasoned industry professionals that have decades of experience and have chosen to shift from their traditional career trajectories to work for startups. What does this cultural change in Pakistan’s job market look like? Profit profiled ten of these professionals from different startups – both senior executives that have shifted to startups and recent graduates still making their way to the top.

Confident, candid, and unflappably true to herself, Fatima’s story is grounded in hard-work, self belief and a complete dedication to whatever it is she is doing at any given moment. Perhaps, what strikes out most about her is her complete lack of pretences. Maybe that is why at different points in her career she has been able to accept jobs that others would have baulked at and do them with the same enthusiasm with which she has approached her executive level posts.

Confident, candid, and unflappably true to herself, Fatima’s story is grounded in hard-work, self belief and a complete dedication to whatever it is she is doing at any given moment. Perhaps, what strikes out most about her is her complete lack of pretences. Maybe that is why at different points in her career she has been able to accept jobs that others would have baulked at and do them with the same enthusiasm with which she has approached her executive level posts.

“I play Polo, and people say that playing polo is like playing golf during an earthquake. I think that stands true for a regular job and a startup job as well. Working at a startup is like trying to work during an earthquake. You are constantly firefighting and combating disasters. For people that are free flowing and creative that works much better than a corporate job,” she tells Profit.

“For me, the most important part has always been making sure I’m justifying the salary I am getting for whatever job I am doing. And I think if you put in the effort, particularly in the startup ecosystem, you will get the recognition you deserve.”

“I started in 2008 as an investment banker. I did that because I was told it was the place to be. Then the financial crisis hit and I was without a job, so I took up a sort of internship at this company and within two years I became their Chief Operations Officer – which is also where I discovered I was good at operations and wanted to pursue it as a career.”

Now, Fatima could very easily have stuck to this role. It paid well, it was a cushy job in the Gulf, and it could have led her to more senior positions at larger companies. But in 2013 when she started to feel like she wasn’t excited about the work she was doing, she left. “I have never quit a job while I’ve had another job lined up. I feel like that is cheating on the company. At this point, a friend told me that Uber was entering the UAE and I thought that sounds interesting and started looking them up,” she explains.

“However, anytime I would google them, Careem would pop up because of how strong their search engine optimization was. This really intrigued me, and when I saw they had a Pakistani founder I reached out immediately because it seemed like the right fit for me.”

Careem was new, however, and Fatima had to start off there as a call centre agent since there was no other opening. Careem told her she would grow with the company, and she did. “I remember my first meeting with Karl Magnus Olsson, one of the founders of Careem. I think if God-forbid I am old and riddled with Alzhemiers that meeting will be one thing I won’t forget. Because when I saw him talk about Careem, I kid you not I saw his eyes light up. And I thought, this is the sort of work I want to do. I want to be passionate about what I do. So I took up the job without a second thought.”

After this, Fatima threw herself into her work entirely. She rose to become the head of expansion for Careem. She would go to a city, hire a team, train them, launch the app, and then move on to the next city. In two years, she did 286 flights. And the reason she was able to do this was because of the startup ecosystem.

“At startups you have direct access to the decision makers. Someone at Pepsi won’t be able to meet their COO more than once a month but in a startup an intern can stand up and have their voice heard without consequence. And then of course, everytime someone calls a Careem or mentions it in Pakistan I feel proud because I launched it here and I can claim that this is something I did,” she says.

In that way, culture has been very important to Fatima. When Uber was acquired by Careem, she had taken a sabbatical to complete her MBA from MIT. She resigned from Careem and moved on to WeTruckIt in Pakistan and worked there for two years. She briefly founded her own startup which did not work out and is currently the COO of Colabs.

“In the beginning I would stay 20 hours to learn everything about the job. I learned how to code. I got very involved and was even the product manager for a while. That is the thing about this job. It is the same equation – do you want to be a small fish in a big pond or a big fish in a small pond. I feel like the latter is the better option.”

Talib Rizvi has 25 years of experience in commercial banking. He has held leadership positions at Bank Alfalah, Dubai Islamic Bank, and Habib Metro. Articulate, and unfailingly polite, he is completely devoid of the stuffiness that often plagues career bankers whose lives have been spent getting signatures and waiting on a ridiculous chain-of-command that exists in these financial institutions.

Talib Rizvi has 25 years of experience in commercial banking. He has held leadership positions at Bank Alfalah, Dubai Islamic Bank, and Habib Metro. Articulate, and unfailingly polite, he is completely devoid of the stuffiness that often plagues career bankers whose lives have been spent getting signatures and waiting on a ridiculous chain-of-command that exists in these financial institutions.

Currently, after decades of working in traditional banks, Talib is working as the Executive Director of a financial technology startup TAG. “Nobody can take my banking experience away from me. I am one of the few faces in startups to have moved from commercial banking and I think many of my colleagues will realise this soon enough. All banks need to look towards digitisation. They are trying right now, but currently digitisation is not their core competence. I am simply trying to stay with the curve, and I think people that move into this early will have an advantage.”

Talib believes that as the world changes, banks will be slow to digitise which is why institutions like TAG will have an edge in the years to come since their entire foundation will be digital. However, he believes that the young, energetic, founders, investors, and employees coming into these companies need guidance since they are still working within the same regulatory framework that traditional banks are working under.

“There are so many talented young professionals coming in to work with us. The founders of these startups are also so full of energy and brimming with ideas it is brilliant to witness. I realised looking at this that if people with good financial fundamentals can adapt to the tech wave then there is huge potential for them in this ecosystem,” he explains. According to Talib, while these founders have great ideas they often require a guiding hand from seasoned professionals such as himself.

{Note from the editorial staff: The English expression, ‘seasoned professionals’ doesn’t do justice to what we mean. ‘Manjhay huay’ in Urdu is what we are essentially trying to describe.}

“I’m one of the few senior bankers that have shifted to the startup ecosystem. I think there is a big role that my colleagues and I have to play in this. These kids are talented but they are free souls. People need to be around to channelise this energy. That is where experience comes in,” he says. “This is a big challenge particularly with financial sector startups. It is a steep learning curve, but that is why I am around as a guide to take them through the regulatory environment.”

In this way, Talib imagines a scenario in which the young up-and-coming entrepreneurs aided by professionals such as himself can come together to build a new product in Pakistan’s regulatory environment. It is a question of using each person’s strengths and tailoring them for solutions.

“Startups are agents of change. A person like me respects the SBP as a fatherly department not as a challenge. Their regulations are not hurdles, they are a facilitation. The problem is that founders and investors have so much energy they do not always know how to control it. The enthusiasm overflows at times. This is where experience comes in. Since I have an understanding of and respect for the regulator, I can help these founders in charting these waters.”

“In all of this the most important factor will be the kids coming in. This is highly skilled labour and it is the backbone of any economy, and let me tell you there are not enough startups in Pakistan right now. There are many more to come and people will continue gravitating towards them. Startups offer a more open work environment, you get to have an impact, and they are also getting very good salaries.”

With a bachelor’s degree in economics from Yale and training and experience as a financial journalist, Meiryum Ali is also a budding executive who has been working at Elphinstone – a personal financial advisory platform – for more than a year.

With a bachelor’s degree in economics from Yale and training and experience as a financial journalist, Meiryum Ali is also a budding executive who has been working at Elphinstone – a personal financial advisory platform – for more than a year.

Meiryum actually started her professional life as a journalist. She was an award-winning correspondent for Soch and later worked at Profit magazine, where she was both writer and editor. Her stories were crisp, informative, written with talent, and widely well-received. While it was a career she enjoyed, it was the possibility of building something from the ground up that made her gravitate towards joining a startup.

“I wanted to build something from the ground up. I had spent a lot of time reporting on things being built which created a natural curiosity about how things work. A lot of my friends my age in other careers with very different backgrounds were also gravitating towards tech jobs. Everyone wants to be a part of something new. I just wanted to be a part of something, and while that is a risky business, that risk is something I actually enjoy,” she says.

However, Meiryum also believes that while the ownership aspect is an important factor in what is attracting young professionals towards the startup ecosystem, equally important is how startups often offer very competitive packages. Since startups are small teams and dedicated to providing quality products, human resources are something they usually spend extravagantly on.

“I have noticed that a lot of startup and tech jobs have really good salaries and benefits. That’s a pretty good way of looking at it. People are being valued. Assuming the bubble doesn’t break, and that this ecosystem is still around, other fields might actually have to pull up their salaries as well.”

“There is, of course, an element in startups that involves working in disorder, but the people coming in are very talented and take it head first. We are fire-fighting everyday in the startup ecosystem, and in my experience a lot of the young professionals coming up are extremely self motivated self starters that would be valued in any industry anywhere. A lot of fresh grads are really, really used to having a lot of agency. No one is comfortable with hierarchy and that’s a really good thing. I don’t know if that is a generational thing but it is very good.”

Usman Arshad is a young Scottish network engineer with years of experience including working at J.P.Morgan. Ethnically Pakistani, Usman is currently working at SadaPay where he has made a major impact, and was recently part of the team that made in-app biometric verifications possible.

Usman Arshad is a young Scottish network engineer with years of experience including working at J.P.Morgan. Ethnically Pakistani, Usman is currently working at SadaPay where he has made a major impact, and was recently part of the team that made in-app biometric verifications possible.

But why would he leave a company as established as J.P.Morgan to join a relatively new Pakistani startup, that too when it was still very much in its infancy? “In order to produce a high quality product you need to interact with the customer. JP paid me really well but that wasn’t something I got to do there. It’s hard to make changes in a big ship. It takes a long time and a lot of effort. By the time a change is made, it is already too late – so I got sick of that environment,” he tells Profit during an interview.

Usman is, of course, an anomaly. To maintain a link with his country of origin, he had wanted to get involved in and do work for Pakistan. “I was already looking into things like investment screening. There’s no way to check out the details of a company you want to invest in – how halal it is, how eco friendly etc. Since ethnic Pakistanis would be the biggest market for this, I was looking around when I stumbled across SadaPay and found it fascinating. Because of how unbanked the population is I thought this was definitely good, meaningful work. I got introduced to Brandon, to John etc and I realised this was not what I expected from Pakistan.”

Usman says that the culture in Pakistan is very ‘consultancy’ based – in that companies look for quick fixes rather than producing quality products and results. In startups, since it is entirely customer focused, you need high quality solutions. “I realised the culture here was very different. I feel like I’ve been able to influence the culture here and helping the unbanked is a noble cause. The goal is to make people’s lives better and easier. That is what we have done, for example with biometric verification,” he explains.

The biometric verification that SadaPay has enabled in its app has been widely lauded and will remove so many barriers for a lot of people to increase their SadaPay account limits. Under it, people can simply verify their NADRA biometric record through the SadaPay app.

“At JP, I had autonomy and a big salary but not the same impact. With SadaPay, I get that impact and opportunity to do the work. There is also a bias for people in smaller areas. We want to use technology to bridge that gap. We’re helping customers and that’s the main thing for me – giving opportunities to people that would not otherwise necessarily have those opportunities. That’s the magic of technology and what we can do with it for betterment.”

In 2020, Kinza Adnan had just completed her MBA from LSE when a friend approached her and asked her to apply to a financial technology startup called SadaPay. Right after graduation is an exciting time for people with MBAs. That is the time you are applying to, and actually being considered by large companies like Coca Cola, Nestle, Unilever, and the like.

In 2020, Kinza Adnan had just completed her MBA from LSE when a friend approached her and asked her to apply to a financial technology startup called SadaPay. Right after graduation is an exciting time for people with MBAs. That is the time you are applying to, and actually being considered by large companies like Coca Cola, Nestle, Unilever, and the like.

Large salary packages are dangled in front of you, and a clear if boring career trajectory presents itself. Having an MBA is the perfect route to becoming a ‘company-man’ and diving head first into the world of corporate bureaucracy. But all of it comes with a price, and one that the current generation of fresh graduates might not be willing to pay. “Back then people did look at me strangely for joining a startup rather than a big company, and I did see my friends getting large salaries. But a year into working at SadaPay and now my friends at Coca Cola and other large companies are asking me if they can send me their CVs,” she tells Profit.

Young, sharp-minded, and carrying an obvious passion for the work she does, Kinza is one of the many fresh graduates who have chosen startups as their first jobs. She had chosen to do an MBA right after graduating and done some work as a Teaching Assistant at LSE, but she had largely stuck to education until this point. Why did she choose to go this route? In her opinion, workplace culture was the biggest motivating factor.

“I had it in mind that I wanted to join a startup, particularly a fintech company since I felt there was a lot of room to grow in one. I felt like there were more growth and learning opportunities here. There is generally a casual, fun environment and that helps with creativity. Pakistan is a hotspot for innovation right now, and in a company like SadaPay you have direct access to decision makers which means you can have an impact.”

“Maintaining this sort of culture is difficult, of course. But our COO still has monthly one-on-ones with everyone. If I ever want to speak to Brandon, I can simply book a slot and not be afraid that I won’t be heard. Then we have things here like a women’s corner, and I think that creates a certain bond among the women working in this space as well,” she says.

“There is a lot I’ve done here that I’m proud of. I’ve learned to multi-task, I’ve gotten over anxieties, I’ve been the top performer in the customer experience department and have recently been promoted to a role in HR as well – all within a year. In hindsight, there aren’t any regrets and I think this is a great place to be.”

What does a banker have to do with an online job hunting platform? Apparently, a lot. That is why Shahid Kazi, a former commercial banker with decades of experience, became the CEO of Rozee.pk – a career seeking platform that collects resumes for candidates and matches them with businesses where their skills are required.

And while Kazi brings with him a wealth of experience, one of the reasons for shifting to a platform like Rozee.pk was the desire to build and be part of an organisation centred in innovation and creative decision making. “I am primarily a banker and headed strategy at Bank Alfalah and collaboration with Warid as an extension,” Kazi tells Profit. “I had spent a year in East Africa and that’s when M-PESA was unfolding. Upon return to Pakistan, the initiation of the digital journey of Alfalah was started by the team. Later I moved to CIBG and transaction banking at Habib Metro.”

Kazi is not new to technology. Right before Rozee, he worked at Finca Microfinance Bank as chief operating officer in his last role, overseeing the blending of microfinance with technology when the bank digitised its lending process. This experience brought in him the understanding of and fascination for technology.

Now, Kazi is leveraging his experience in the financial sector in a purely tech company to build a financial wellness platform. “I was part of developing it and that was a major experience in Pakistan’s tech stack. The way the penetration of smartphones and 3G and 4G were increasing, we knew a change was in the offing and we went for it.”

“The signs were very visible. Especially with formalisation and eCommerce and behaviour changes, there was a lot of opportunity. People are catching on but we still have not achieved scale. There is a lot more growth and space left,” Kazi explains.

Kazi understands the risks of working at a startup but argues that the culture of innovation that is building in Pakistan presents a great opportunity for creating something meaningful. At Rozee especially, since it was a startup when startups were not even a thing in Pakistan, the culture of innovation is more vigorous. “The stakes are high but there is an enabling culture too. It’s moving in the right direction. Taking entrepreneurial initiatives comes with financial rewards as well as valuable experience.”

Rubab graduated from the Lahore School of Economics in 2019 with a degree in marketing. Almost immediately after graduating, she got a job at a digital marketing agency and worked on some accounts for big clients. The work, however, was not quite as freeing and creative as she expected it to be.

Rubab graduated from the Lahore School of Economics in 2019 with a degree in marketing. Almost immediately after graduating, she got a job at a digital marketing agency and worked on some accounts for big clients. The work, however, was not quite as freeing and creative as she expected it to be.

“I had actually gotten into Pepsi’s Management Trainee Officer Programme. Back during our time at university, we used to do case studies and it seemed the only route to professional success and happiness was to join these large companies.I realised, however, after handling digital marketing accounts that there is very little freedom to do what you want. This is something I have a lot of passion for.”

This is a reality of marketing jobs. A lot of talented, creative people such as Rubab go into it. But good ideas are very regularly dismissed or not taken up because of the vast bureaucracies that run big account corporations. That is why when Rubab received an offer from an edtech startup called Tabeer Academy, she decided to take the plunge.

“When I joined, Tabeer had yet to be fully launched. It was my first experience at a startup and I was hired in the marketing department. I spent an entire year there and got a full first-hand experience and a chance to interact directly with the entire team. The product was still in the development stage, and we worked tirelessly on it. That is also where I got a feel for flexibility and having a voice,” she explains to Profit.

“Startup roles are more empowering and there is a lot of room to make mistakes. The budgets are small, but you know how to be flexible and the learning curve is great in startups.”

But then, Covid hit. For six months straight Rubab worked from home like everyone else. While she continued to work hard at Tabeer, she was not satisfied with the productivity she was achieving at home and wanted an environment where she could thrive again – so she actively started looking for opportunities that were not remote.

“That’s when I got a call from Rozee. I was asked to come in for an interview for a marketing role. I found out they were actually hiring for Dukaan.PK. Since they knew I had a tech background, they chose me as their first employee. Rozee focuses on ecommerce and digitising small scale entrepreneurs. That was an interesting experience handling the marketing all on my own. Eventually, however, I got an offer from Colabs and moved there.”

Colabs was another place where she realised that she wanted to be in the startup environment. Normally, if you join a bank or an MNC, you get pigeonholed into the role you begin with. Shifting from marketing to communications is difficult enough in a legacy company even though the two are linked – so shifting from something like marketing to product is nearly impossible. And while Rubab did not begin her stint at Colabs in marketing, that is where her passion lay and the Colabs leadership decided to give her a shot there.

“I was at the Colabs marketing department for a few months and enjoyed my time there. Eventually, I got another offer from Educative – another edtech company and decided to move back to the sort of work I started with. I am now handling their online marketing.”

One of the most prominent fintech startups in Pakistan, SadaPay, is gunning to build a robust digital financial services ecosystem for the banked, as well as the underbanked and the unbanked. As you’d be aware that for any organisation, cybersecurity is crucial for smooth running of operations.

One of the most prominent fintech startups in Pakistan, SadaPay, is gunning to build a robust digital financial services ecosystem for the banked, as well as the underbanked and the unbanked. As you’d be aware that for any organisation, cybersecurity is crucial for smooth running of operations.

At SadaPay, the person at the helm of protecting data and smooth availability of all systems is Umair Aziz, whose yearning to build information security systems from ground up brought him into the startup world in 2021 after a long stint at legacy tech businesses.

A graduate of the National University of Science and Technology (NUST) in Islamabad, Umair is one of the fortunate ones to have found a job while he was in college. “I started my career in 2011 with a local company handling their security projects. After that I moved on to Saudi Arabia and worked on national level projects as senior security analyst,” Umair recollects his memory of early days working in IT security. “In 2018, I moved to Dubai to work in a company that provided IT services to auto companies and right before Covid hit, I moved to EasyPaisa in their IT security department.”

From his prior experience, Umair could tell with certainty that at legacy companies working in a set way, flexing new ideas was not gladly received, that these corporate laggards would stifle his hunger for innovation and freedom to do things in the most fitting of ways.

This moved the needle for Umair and he switched to SadaPay where decision makers were easily accessible, decision making was easy, and freedom of thought and initiative was welcomed. “The motive all this time has been to do things right from my own perspective,” Umair tells Profit. “I wanted to do things in a better way with more freedom and make a change, which brought me to SadaPay.”

“If you work at a bank, you are not building anything; you’re steering an already afloat ship. But here, you have an opportunity to build foundations,” Umair says. “This is also why SadaPay’s success is personal to me.”

Here, Umair was an active part of the team that got the electronic money institution (EMI) licence from the State Bank of Pakistan (SBP). SadaPay’s EMI licence was announced in April this year. “This was the team which really did it! I would never have had the experience of working on the regulations had I been working at a bank,” he tells Profit.

It goes without saying though that while startups might look like a dazzling career choice, they are in fact very risky. Which is why the liberty to do things in one’s own way is perhaps the best way to get things done in the most efficient of ways. Before that, however, you need to be convinced that the idea that you are working around, convinces you as an employee.

“There is obviously a risk to these career moves. It is a leap of faith you take in the system but also in the idea. When you come on board, you are buying into the idea first,” says Umair.

An economics graduate from the Lahore School of Management Sciences, Saniya Sultan is the leader of the customer experience department at the B2B marketplace Dastgyr. At 25 years old, this is the second startup Saniya has had a pivotal role in shaping.

An economics graduate from the Lahore School of Management Sciences, Saniya Sultan is the leader of the customer experience department at the B2B marketplace Dastgyr. At 25 years old, this is the second startup Saniya has had a pivotal role in shaping.

“My degree was in economics, but that wasn’t where my talents or interest lay. I took a lot of marketing and business courses while I was at LUMS. When I was graduating, I did apply to some MNCs and legacy companies and that was definitely a route I was considering. I made it to the final round interviews at one company but didn’t make the cut. After that I had other decisions to wait for, but I got an offer from Swvl and didn’t want to wait any longer so I took it,” she tells Profit.

From here, there was no looking back from Saniya. During her Junior year at LUMS, Saniya had interned at Careem and another startup based out of Plan9 in Lahore. So she already had a flavour for the sort of freedom and creativity that working at a startup offered. Cool-headed, concise, and possessing insights on the startup ecosystem beyond her years, Saniya is exactly the kind of fresh graduate that encapsulates the emerging talent we are trying to shed a light on. When asked why she chose to take a job at Swvl and then again at Dastgyr and stick by the startup route rather than go to a traditional legacy company, she poignantly put that in startups it is the people that matter, not the funding.

“It is not about how much funding a startup has, it is about the people running it. If the founders and managers of a startup do not understand, for example, how to navigate a choppy economy like Pakistan, then it does not matter how good an idea is or how much funding that idea has behind it the startup will face trouble. Even when I joined Dastgyr, the one thing I looked at very carefully was the founders. I researched them, their work, and asked around about their reputation as managers. I got glowing reviews in response and that is why I decided to take on the job.”

“Of course having great founders does not mean the business will always succeed. A lot of factors come into play here – the economy, the business model etc. It just means that they will get back up and build another business and work to succeed.”

This kind of insight is rare even in seasoned professionals. Coming from a 2019 graduate with two or three years of experience under her belt, it shows that a lot of these up and comers have a deep understanding of the environment in which they work. It is insight that has served Saniya well in her time at Swvl and Dastgyr. At Swvl, she started off as a customer experience executive. “That’s what I loved about the startup space. Immediately after being hired I was thrown into the deep end and I really got a flavour for having this kind of agency and responsibility. After setting up that department I shifted to sales which proved to be awesome exposure. I got promoted from there until eventually Dastgyr asked me to come in and lead their customer experience team.”

This, as well, is a stand-out in the startup ecosystem. In most traditional companies, as we have mentioned before, moving between departments is a painful process. In this case, Saniya successfully moved from customer experience to sales and thrived in both roles. As a result, she now possesses skills in both fields and has doubled her portfolio.

“I think the most important factor that gets you hooked to the startup culture is that you have no constraints. As an entry level executive, you have the opportunity to come up with and implement your vision. You are given a lot of responsibility but as a result a lot of freedom as well. The only constraints I can think of are budgetary, but even with those you have access to decision makers and can make a case for yourself – something that doesn’t happen in MNCs or other large companies,” she explains.

“There are two parts to this, the first is the sense of ownership and the second is the faith that your company puts in you. At Dastgyr, I know I can form my own team and make calls. Plus everyone is so energetic and bouncing ideas off each other that we can actually take those ideas, experiment with them, execute them, and if they work even scale them. And if you get to that stage, you feel proud looking at something that is your brainchild.”

What does working for the world’s biggest private employer teach you? In his time at Walmart, Taimoor Ali learned that at legacy corporate machines, it is impossible for employees to bring innovation and new-age thinking in business processes.

What does working for the world’s biggest private employer teach you? In his time at Walmart, Taimoor Ali learned that at legacy corporate machines, it is impossible for employees to bring innovation and new-age thinking in business processes.

Taimoor currently serves as COO at Pakistan’s leading online ticketing portal Bookme.pk. Before this, he had briefly founded his own startup in the early days of Pakistan’s startup ecosystem, and later had a stint at Walmart where he found that legacy corporations were not his speed. A 2012 graduate from Pakistan’s COMSATS University, entrepreneurship has driven him from an early age. .

An enterprising individual with a knack for taking on mean problems, Taimoor took a crack at solving the energy problem for Pakistan and founded a renewable energy startup. “The ecosystem back then was not very conducive to new ideas,” Taimoor tells Profit.

From his first startup right after graduation, Taimoor moved to London for his MBA in Leadership and Strategy, following which he joined Walmart and had first-hand experience of how corporate bureaucracy works. “At Walmart, you’d be isolated from other departments and it would be years before you could get to know how things are done in collaboration with other departments. You are restricted to your JD,” says Taimoor.

After his stint at Walmart and before Bookme, Taimoor worked at Lahore-based startup RepairDesk as product manager. “In startups, you have an overarching experience of how a business is run. How they become profitable,” Taimoor tells Profit. “You may be an IT guy but you get to start to learn about the business side as well. This eventually grooms your skills and you are an entrepreneur in the making.”

Conclusion

The startup ecosystem in Pakistan has done a lot for the country. It has introduced a spirit of innovation, it has brought funding to Pakistan, and it has created an entire system that is thriving and exciting people. The most important contribution of this ecosystem, however, is the people that it has raised.

Young professionals get the freedom to enact brilliant ideas, and work in tandem with experienced individuals that have put their faith in this ecosystem. There are a lot of things in this ecosystem that need to be improved. It is not infallible. There is always room for improvement. But this in itself is an achievement that Pakistanis can be proud of.

Highly skilled labour is a crucial pillar of the economy. The startup ecosystem has given it a boost. The stories of people like Fatima Mazhar and Usman Arshad inspire confidence in the people leading this ecosystem. The stories of up-and-comers like Saniya Sultan and Meiryum Ali give hope for the generations that will eventually inherit this ecosystem.

Perhaps one of the most significant signs that this is an ecosystem promoting good work culture is the presence of a large number of women that are gaining prominence in this space – something this week’s second editorial points towards. All in all, it is a heartening revolution to witness. We are all for it, and hope it will grow and become better than ever.

Ecosystem big shot goes to London.

“ektuwelly i am go to the LUMS.”

“Lums…never heard of him.”

Elite is right (professionals or not). & These startups also need to be monitored for issues lik money laundering, etc.

of all the profiles only 2 C level

this article not worth the time

Indeed, these bunch of enterprising people are an insipration for many others. Pakistan really needs to encourage the youth to explore more entrepreneurship opportunities.

They are true inspiration.

Very nice article, and thank you for profiling c-level as well as foot soldiers, MS. Fatima’s story is inspirational.

Nice article about about inspiration in Pakistan to professional

Undoubtedly, Pakistan has a lot of potential, and a lot of new talent has emerged in a variety of sectors, which is encouraging. However, if you ask me if we are progressing at the right pace, I will give you a resounding “NO.” In our country of 220 million people, there are no examples of companies that had a breakthrough idea, transformed their area, and became multi-billion dollar businesses. The underlying cause is multifaceted. On the one hand, we lack a robust educational ecosystem to support intellectuals in various sectors who have a desire to innovate new products or services and become leaders.

Another issue is related to the country’s economic situation, which has had a negative effect on middle-class consumers’ purchasing power and consequently reduced the potential for demand. There is a lot of potential in the startup ecosystem because we are a country with a 220 million population and a big proportion of young people. Thus, there is a need for new businesses, especially in the field of eCommerce, which can be crucial in promoting locally produced goods or products in global marketplaces and boosting the economy of the country.

I dеfinitely loved every little bit of it and I have you book marked too check .

온라인 카지노

j9korea.com