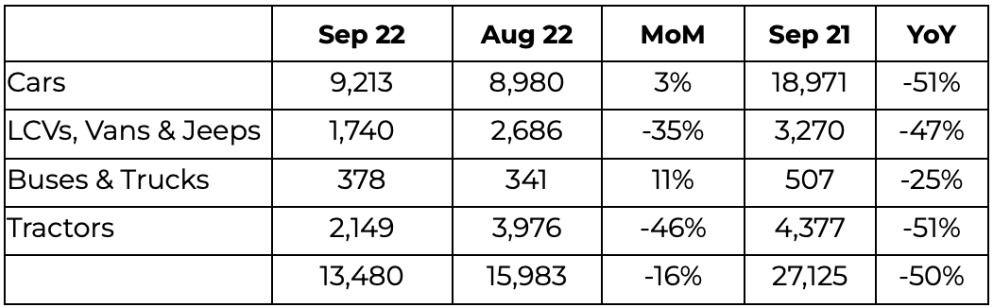

LAHORE: The Pakistan Automotive Manufacturers Association (PAMA) on Wednesday released their members’ sales figures for the month of September. Looking at just the figures for four-wheelers, month-on-month (MoM), there has been a decline of 16 per cent in volume. Cumulatively, from July to August, this is the single worst start to a fiscal year for four wheelers in the past 5 years.

Comparing September’s figures with those of last year, there is a more pronounced year-on-year decline of 50 per cent. The sales reduction across the month of September comes in despite the fact that most automotive manufacturers revised their prices downwards to correct for the rupee’s gains, whilst the rupee also stabilised relative to the previous months.

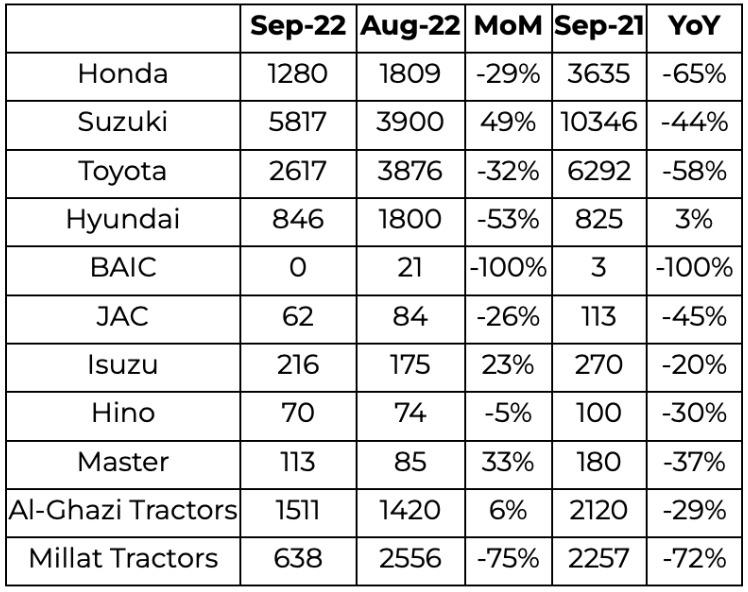

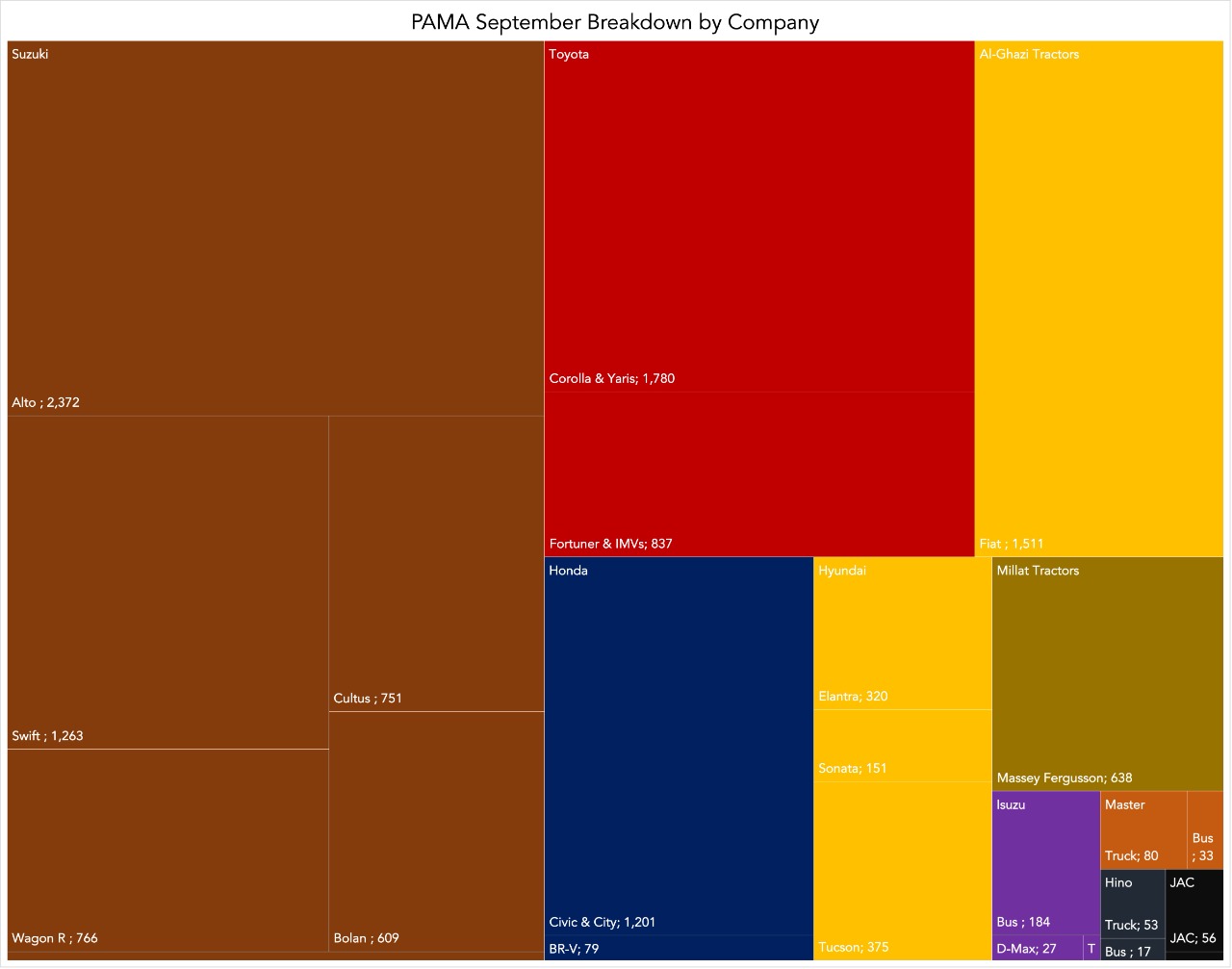

Of the Big 3, only Suzuki was able to increase its MoM sales. This is despite the company repeatedly observing non-production days (NPDs) across the month of August. Overall, MoM, the entire four-wheel sector suffered significantly despite Master and Al-Ghazi Tractors (ALGT). The former benefits from having brand equity and a lower base, whereas the latter benefits from Millat Tractors (MTL) having to halt their operations on account of the floods. It is important to note that, unlike MTL, ALGT did not cease their operations. This is likely the main reason it was able to beat MTL’s sales figures. An aberration when looking at a longer term horizon.

On a YoY basis, all four-wheeler companies, with the exception of Hyundai, saw a dip in their sales. Hyundai’s increase, similar to the aforementioned Master, is likely on account of having a lower base in the previous comparison period.

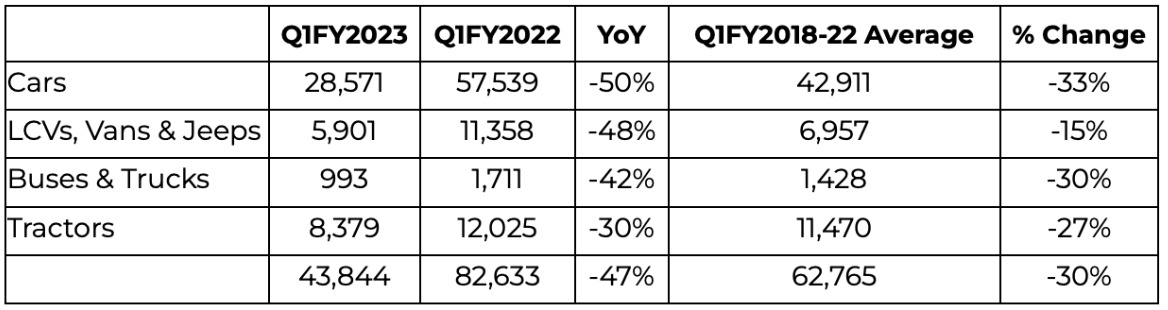

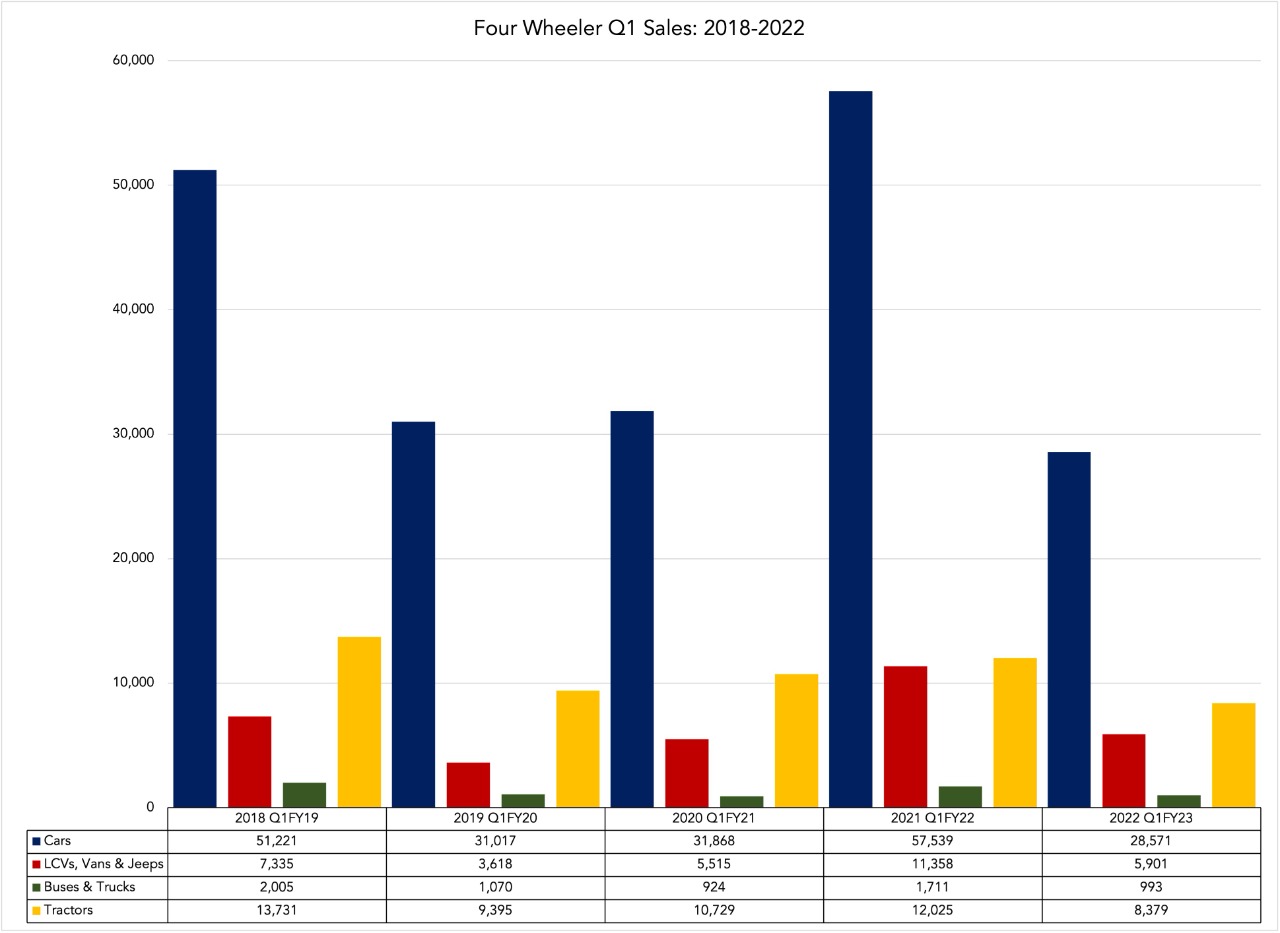

Cumulatively, looking at the period from July to September, Q1FY23 is the single worst start to a fiscal year for the entire four-wheeler segment over the past four years. The YoY decline in sales is significant at 47 per cent. It would be remiss to not highlight that FY 2021-22 is a high base year for any other year to have outpaced. However, if Q1FY 2023 had simply stayed with the average sales seen in the same period over the past four years then its sales figures would have been 30 per cent higher than what it did record.

Q1FY 2023 also saw a thorough decline across all segments of four-wheelers. Looking at a 5 year horizon, the dip in LCVs, Vans, & Jeeps is the smallest. The somewhat limited scale of this contraction, relative to the other segments, is likely a result of LCVs, Vans, & Jeeps seeing increased popularity over the course of the past few years. Notable additions to the segment over the years include BAIC’s BJ40L and the Hyundai Tucson. The Toyota Fortuner, a staple of the segment, has also seen YoY increases on account of its newer iterations and variants.

The severity of the contraction should be, and is likely, a concern for both the industry and onlookers. This is because it is a result of a myriad of intertwined factors that still exist. These factors are likely to also persist in the months to come as well.

First and foremost, ipso facto, the rate of inflation at above 20 per cent on average for the entirety of Q1FY23 leads to a collapse of consumer spending across the board. “There is too much inflation. Fuel is also expensive. Customers cut demand on cars first as everything becomes expensive.” said Asghar Ali Jamali, CEO Toyota Indus Motor Company, when asked by Profit earlier about why there had been demand destruction in the sector.

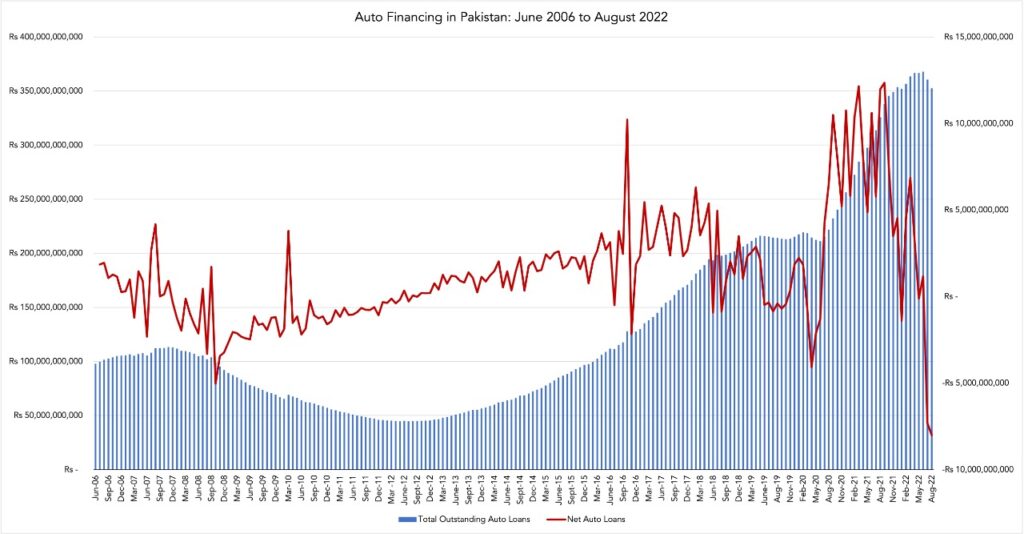

The State Bank of Pakistan’s (SBP) amendments to the prudential requirements for autofinancing.Earlier this year,the SBP amended the prudential requirements again to reduce tenors from five to three years for cars above 1000cc. This was on top of last year’s measures, which saw the SBP cap tenors to five years, increase the down payment from 15 per cent to 30 per cent, cap financing at Rs3 million, and disallow financing to be used for imported vehicles.

These amendments alongside the price of vehicles and general inflation led to the. Net automotive loans reduced by 2.2 per cent ojn a MoM basis from July to August for a contraction of Rs8 billion. This was the single greatest contraction in net automotive loans in history.

Muhammad Faisal, President Automotive Division at Lucky Motors, had said to Profit in a conversation in June that “30-40 per cent of industry volume is because of auto-financing. 30-40 per cent of demand will be wiped out just because of the high interest rate, low tenor, and high up-front payments’ ‘. Faisal’s prediction adequately elucidates upon the demand destruction that is now unfolding. Profit had speculated that these numbers would likely dip further in the future. Subsequently, as they dip, the sales figures for vehicles, for both commercial and personal use, will also likely decrease.

Finally, perhaps the greatest contributor to the falling demand for cars is Pakistan’s forex position. The Government had increased the SBP’s administrative oversight over the import of completely-knocked-down (CKD) kits earlier in the summer to stem the outflow of forex. The SBP subsequently introduced a quota to ration out forex reserves across the industry for players to import their necessary components. This measure has been the main reason for why automotive companies across the board have had to observe NPDs and also limit the availability of vehicles they provide so as to effectively optimise their import bill given the quotas.

The quotes have led to insufficient supply levels across the industry and led to them limiting the bookings for their cars. “The issues surrounding the industry are highly complex. Take our parts manufacturers for example. They are suffering delays, and if a car is made up of 100 parts, then we cannot very well roll out a car with 99 parts, can we? As long as all these problems are not addressed, delays and price uncertainty will continue to reign,” said Abdul Waheed Khan, Director General of PAMA when Profit inquired about the matter with him earlier this month.

The SBP’s measures, however, have not borne fruit as the country’s balance of payment position remains precarious. The Rupee’s continuous volatility in forex markets have led to automotive manufacturers constantly repricing their vehicles almost every month. This has exacerbated the sales decline, as customers are now putting off the limited number of cars that are available to them as they wait to see what the long-term clearing price for vehicles will be.

Looking ahead, it remains to be seen whether these MoM and YoY dips continue. Macroeconomic indicators make it likely that demand will likely continue to dip going forward.Jamali believes that demand will contract by 40-50 per cent going forward whereas Faisal cites automotive volumes to be 40 per cent lower in FY23 compared to FY22.

Perhaps the silver lining for the automotive industry, in the absence of actual actionable measures and solutions, is that the size of the MoM contractions will decrease due to the newer base being revised significantly with every passing month. YoY contractions will still likely remain at exorbitant levels simply due to how high FY22 is as a base year.