Ending 2022 on a low hasn’t been easy; especially when inflation and interest rates are at a multi-year high.

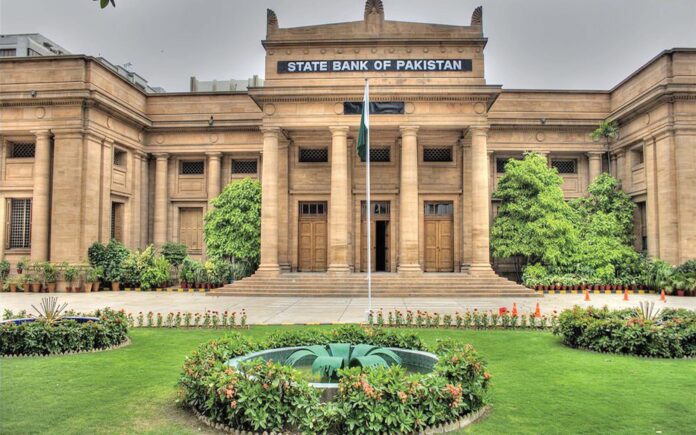

Despite being in negative real rates territory, the State Bank of Pakistan (SBP) in its annual report, however, says that the Monetary Policy Committee (MPC) has reversed the accommodative monetary stance.

“The monetary policy committee reversed the accommodative monetary policy stance and increased the policy rate by a cumulative 675 bps during FY22, as a host of domestic and global developments weighed heavily on Pakistan’s performance and increased the risks to macroeconomic stability during the year,” read the report.

This calendar year, the SBP hiked the policy rate by a cumulative 625 bps.

Pakistan’s central bank has been one of the seventh most aggressive rate hikers in the world during the calendar year. War struck Ukraine stands at number one, followed by Hungary, debt stuck Sri Lanka, Colombia, Chile, and Kazakhstan at number six.

Despite such a large jump bringing the policy rate to 16%, the SBP has not managed to contain inflation. Here is a summary of the SBP MPC meetings over the year. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

Wonderful article!

I understand what you’re referring to, it’s very nice, easy to understand, very knowledgeable.

사설 카지노

j9korea.com