Imagine the thrill of cruising down the streets of your beloved cities, the wind in your hair, the unbridled freedom of the open road, and the heady scents of Karachi’s salty sea breeze, the misty mountains of Islamabad, or Lahore’s pungent potpourri of spices. For those belonging to the middle-class, car ownership is not only a symbol of triumphant success but also a testament to their hard work and tireless perseverance in the pursuit of a better life.

In a country where public transportation is fraught with inconvenience and unreliability, owning a car is not just a hard-earned luxury – it is a veritable necessity, a means to unfettered mobility, independence and convenience, and an emblem of personal progress as well as social mobility.

However, that once-cherished dream is now disintegrating, crushed by soaring rates of inflation that have left many families reeling, struggling to keep their heads above water. Middle-class families, who have striven and struggled to attain the dream of car ownership, are now facing a dilemma: relinquish a reward for their rigorous labour or forgo other essentials, and risk plummeting into destitution.

The depreciation of the Pakistani Rupee, and the higher taxes imposed by the Pakistani government amidst skyrocketing inflation have brought many to a gut-wrenching realisation that the cherished ideal of car ownership, one that seemed within sight may now become a distant memory for many.

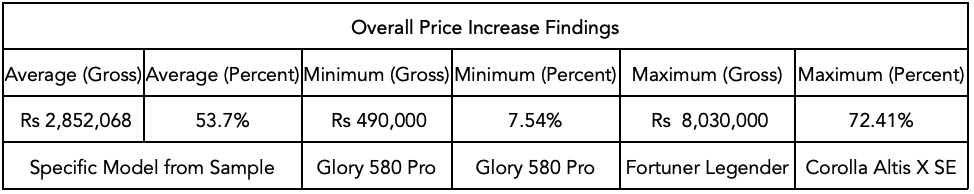

It is almost a guarantee at this point that one can expect car manufacturers to increase their prices with ever reducing intervals, sometimes within a fortnight even. And each revision leaves us aghast at the numbers. Looking at just the cars that saw their prices revised following the Federal Board of Revenue’s (FBR) increase in the GST, Profit found that customers fork out an additional Rs 2.8 million on average for their vehicle compared to what they would have just a year ago. On a year-on-year basis, car prices have risen by 53.83% on average from March of last year to March this year. The further back we go, the more depressing this statistic gets for prospective customers.

What’s the reason?

The rupee’s depreciation against the US Dollar is the quick answer

Are we in crisis mode?

Of course.

Will prices go down?

Unlikely.

Is there hope?

Yes.

Let’s first start with how bad the prices are to begin with.

Staring into the abyss

The constant flurry of price revision via company circulars has probably desensitised many prospective buyers from even pondering over whether they should purchase their vehicle of choice. However, it’s important to take a deep dive into how bad things are to get an idea of what we’re talking about.

But first, let’s explain how we did the maths here. Profit has only looked at the car prices that had been revised after the FBR’s decision to levy the 25% GST. The cars also had to be a year old in terms of their availability which means that they must have been available for customers to buy in March 2022. Furthermore, cars selected based on the aforementioned criteria were done so as of writing this article; March 15. The companies in question that were thus explored for the article were then Toyota, Honda, Hyundai, Changan, BAIC, DFSK, KIA, and Peugeot. It is also worth mentioning that not every model across the aforementioned brand pool could be explored due to the limitations of the criteria we outlined.

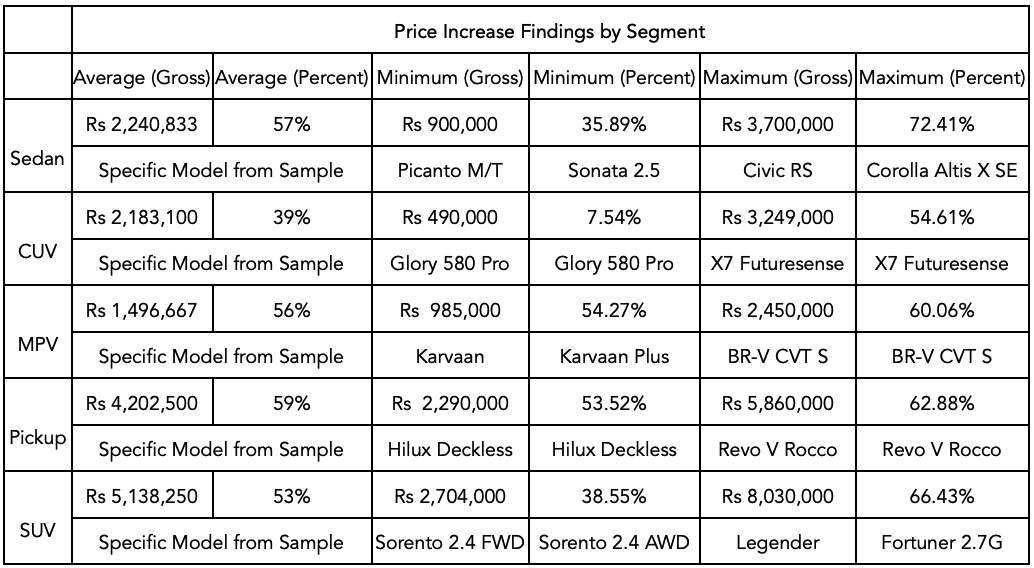

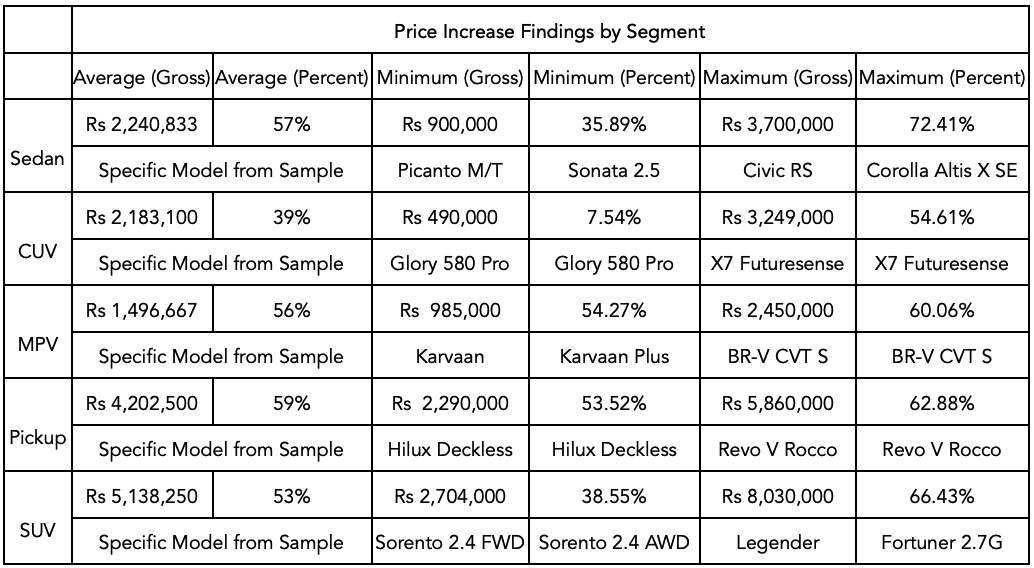

Upon examining the chosen brand portfolio, Toyota stands out with the highest average price increases, both in absolute and relative terms. On average, Toyota cars increased in price by Rs 3.795 million, or 62%. Moreover, the SUV segment had the largest gross increase in price, with a surge of Rs 5.1 million. Meanwhile, pickups had the largest relative price increase, at 59%, since March.

In terms of simply looking at cars you might have been interested in buying. DFSK’s Glory Pro 8 recorded the lowest absolute and relative price increases at Rs 490,000, and 7.54% respectively. In contrast, the Toyota Legender recorded the greatest gross increase whilst the Corolla Altis Special Edition recorded the greatest relative increase. The former saw an absolute increase of Rs 8 million, whilst the latter saw a relative increase of a whopping 72.41%.

How did we get here? And what is the way out?

“The greatest reason for the price increase is the rupee’s depreciation against the US dollar. Maqsood Ur Rehman Rehmani, Vice President and Company Secretary at Honda Cars, tells Profit. Similarly, “The raw materials used in the manufacturing of an automobile constitute a major cost. This cost can be compared to that of a house where construction expenses form a significant part of the overall cost structure. When the rupee depreciates against the dollar, it results in an increase in the prices of parts across the supply chain.,” says Syed Shabbiruddin, Director Sales & Marketing at Master Changan Motors.

“If the rupee were to appreciate against the US dollar then there is a possibility for price reductions,” says Rehmani, however, there is a caveat to his statement which he explains in conversation to Profit. We’ll get to that later though.

The rupee has depreciated a whopping 57.83% from its value of Rs 179 on March 15, 2022, to Rs 283 on March 15, 2023, against the US dollar. The depreciation is also largely consistent with the average price increases seen across the industry following an increase in the GST. Profit found that across its entire sample, the average price increase sat at 53.7%. Are these prices, however, the norm? Most likely.

“I don’t think the rupee is going to appreciate in any material way,” says Fahad Rauf, Head of Research at Ismail Iqbal Securities. “There are a lot of challenges on the macro front and there does not seem to be an easy way out. The pressure would continue to mount on the rupee. It would be great if it could only stabilise around 275 and not depreciate beyond 300. So, in that sense, I don’t see car prices going down,” Rauf continues.

What if the Rupee did appreciate in value?

Economics dictates that prices tend to be downward sticky.This is where the caveat we mentioned comes into play. Now, Rehmani did agree to the fact that an appreciation of the rupee against the dollar – however likely it seems based on Rauf – would lead to a reduction in the prices of our favourite cars. The degree to the price reduction is, and whether it will be significant, is the next point of concern.

“The dollar is not the only factor. There are other factors too,” says Rehmani. “The cost of doing business has significantly increased now. Look at the state of general inflation.There has been a multiplier effect in terms of the costs we now incur due to the state of the economy,” Rehmani continues.

Shabbiruddin responded similarly when asked if a rally by the rupee could lead prices to be revised downward, stating “Although this is how things are supposed to work in theory, it’s not always the case due to various complexities. Companies typically set their prices based on their expected future costs. For instance, if we order parts in March and expect them to arrive by June, we may set our prices based on the anticipated costs of clearing the parts when they arrive at the port”.

“If we set our prices based on the expectation that the dollar will reach Rs 280 when our parts arrive and it doesn’t happen, we face the opportunity cost of our savings. We may choose to reduce car prices, advertise more, increase worker salaries, or save the money for a rainy day if we anticipate future cost increases such as electricity,” Shabbiruddin continued.

So what are the rising costs that these companies have faced beyond the immediate cost to import their parts?

“The cost of materials has risen, the cost of utilities has risen, the cost of petrol has risen. The companies that transport the cars to and from the plant to the showrooms have increased their costs. Our vendors have increased their costs,” explains Rehmani.

Again, “Let’s consider a tier 3 vendor that produces rubber seals for a car’s shock absorbers. Typically, these vendors hire individuals from lower income strata, so any increase in inflation rates may lead to higher salaries demanded by their workforce. The vendor’s increased labour costs will result in higher prices for the rubber seals sold to tier 2 vendors. Similarly, the tier 2 vendor may increase the price of the shock absorber, citing the increased cost of one of its key subcomponents. By the time the product reaches the car manufacturers, the cost of inputs has already gone up by several rounds,” explains Shabbiruddin.

“Automotive companies typically do not have high profit margins compared to their peers in industries such as cement and sugar. The illusion of high profitability is often assumed by outsiders. Thus, when a company faces higher costs for a particular part, they may pass on that cost to consumers, which can reduce demand for cars. Reduced demand may lead to a tier 3 vendor reducing production levels, which in turn can result in higher per unit costs for the part. This cycle of spiralling costs can perpetuate itself over time,” Shabbiruddin continues to explain.

For whatever its worth, companies are likely to extract every last rupee they can to cover their own costs as best as they can. Not just because they’re suffering from spiralling costs but there are also theoretical caps on how many cars they can make too now.

What do we mean now?

Well, the State Bank of Pakistan (SBP) enforced its own version of India’s Licence Raj when it enacted administrative controls to stem the outflow of foreign exchange from the country. Profit has covered this previously.

Read more: The SBP is controlling car imports

The tl;dr edition of what is relevant for us is that car companies could only import a very certain amount of parts. The consequence of that decision unfolded across the latter half of 2022 when car companies began to hike their prices as a consequence, in order to maximise their per units profitability.

The administrative controls came to an end on December 27 with the SPB’s EPD Circular Letter No. 20 of 2022. The circular put an end to the administrative controls, however, in name only. The circular instructed banks to follow a hierarchy in terms of necessity for approving imports. Munir Bana, Chairman of the Pakistan Association of Auto Parts & Accessories Manufacturers, told Profit that “The auto industry is not an essential item and therefore our imports will continue to be controlled and rationed by SBP,” when the circular was first issued. Bana’s words have been on the mark with the sheer number of non-production days across the industry, with each non-production day notification blaming the decision solely on the SBP’s circular.

The circular does highlight how companies who can obtain deferred payments for 365 days should be given preference by local banks. Firstly, what do deferred payments in this context even mean? “We have been told to procure our imports, and make the payment for them after 365 days. The letters of credits that will be issued will be usance letters of credits, for which payments will be made at a later date,” Rehmani explains.

Now this has had its own problems. Rehamni states that this decision has led to a lot of problems with suppliers. “When you make the payment after 365 days, how will you know the rate of the rupee to the dollar will be then? The rupee’s current volatility has made this near impossible. Itni lambi forecasting kon kar sakta hai?” says Rehmani. For those companies that fare better than Rehmani in negotiating with their suppliers, the most likely step is to maximise their profits even more so due to the fear of a worst case scenario for the payment they have to make next year.

“There is a restriction on completely knocked-down imports. So companies will try to compensate to some extent by keeping prices high, even if the cost of certain components comes down,” adds Rauf.

So, where are we then? Let’s recap. The rupee looks unlikely to appreciate against the dollar. On the assumption that it does, it’s likely that companies have now priced in the general level of inflation and a possible worst case scenario for the payments they have to make to their suppliers in a year’s time. In the absence of hope that car prices are going to come down, should we all forsake our dream to own a car? Maybe, at least for a bit longer.

Bracing the storm

Given the aforementioned complications associated with prices being revised downwards, is the middle-class dream of owning a car in tatters because of the state unaffordability then? “I’m not sure that is true. I think there is a lull period instead,” says Dr Ali Hasanain, Associate Professor and the Head of the Economics Department at LUMS. “Till incomes eventually rise 3x, which I’d hope to see in the next couple of years. Maybe a bit longer this time. Hard to assess,” Hasanain muses.

“This crisis of affordability is very short-term, and is being faced by a very limited number of people. This is not being experienced in the villages. As soon as a crop is harvested, things improve in the villages – relatively,” says Yousuf M.Farooq, Director of Research at Topline Securities.

“You need to be mindful of one thing, 40-45% of Pakistan’s population is employed in the agricultural sector. The agricultural sector is protected from devaluation, and thus 40-45% of the population is insulated as well,” explains Farooq. “As soon as the wheat or sugar is harvested in Sindh, you will see that even the dollar has appreciated, the support price of sugar will have immediately risen. It will be harvested for Rs 360-370 which was not the rate last year because the support price was lower. The same applies to wheat. If you notice, then the Corolla picks up in sales after every crop cycle regardless of what is happening in the cities,” explains Farooq.

Where does that leave people who live in the cities? Well. not in the best of spots, “The incomes that are affected because of devaluation are the ones in the cities, and those too for individuals that are on fixed salaries,” Farooq explains. Have people in the cities been given the short end of the stick then? Based on Farooq’s statements, yes.

However, there is hope even for them. “Incomes for those on fixed salaries in the cities tend to readjust within a span of six-to-eight months to a year. Things recover. If devaluation happens, and someone receives a certain salary then it’s likely they’ll receive the same salary for the next six months. However, things will improve after a year,” Farooq explains. Despite Farooq’s statements, he does not paint a complete rosy picture of things to come.

“It might take some time for demand and purchasing power like that to pick up, and incomes might not readjust to their previous levels for a while,” says Farooq. “We probably need to run a current account for the next 10 years now to cover for the antics we’ve been pulling for the last 20 years,”. Despite Farooq’s warnings, there can be no talk of the current account without mentioning Pakistan’s historical proclivities. And that is where middle class car buyers might find their last hope to once again buy cars.

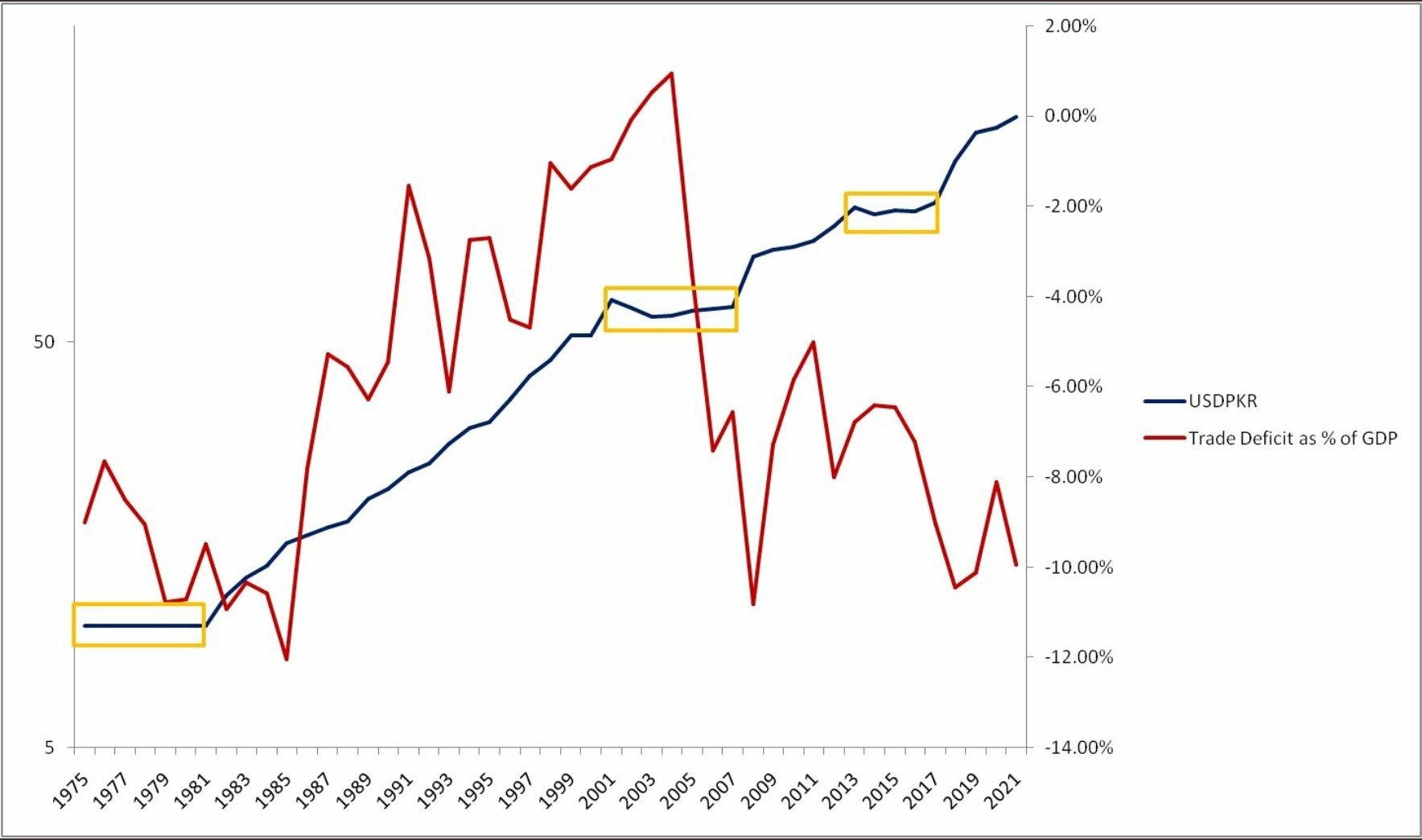

One man’s folly is another man’s new Civic

Looking at Pakistan’s historical economic track record, to say we have an addiction with an overvalued rupee is an understatement. Pakistan has had three notable periods of an overvalued currency; the 1960s to 1982, 2002 to 2007, and 2013 to 2017. These time periods are key. Why? “The earliest Daronomics was before the car industry anyway,” says Hasanain. The automotive industry may not be the reason for Pakistan’s addiction to an overvalued rupee, but it is most definitely a beneficiary of it.

A return to ways of old might just rekindle the hope that most of us have for being able to buy their favourite. However, one would assume this to be something of the past, right? That Pakistan has learnt from the recent bout of economic plight to not relapse? No. Pakistan has most recently returned to its old ways as recently as last month. Profit has written on the most recent episode of an overvalued currency for those interested.

Read more: Dollar Cap, IMF, Ishaq Dar and ECAP; A week of showdowns at the exchange market

What’s relevant is that if we did not learn amidst a collapsing economy, it’s likely that we have not learnt at all. Now is this something to look forward to? It depends. Are you looking to buy a car, or are you the one managing the crisis?