KARACHI: In a surprise announcement that has left the banking industry puzzled, Shazad Dada has been replaced as President and CEO of United Bank Limited (UBL) after a three-year tenure. Muhammad Jawaid Iqbal will take charge in his place.

The news has already caused speculation within the banking industry over whether Dada resigned or was asked to leave. The notification issued to the PSX announcing the change in management claimed Dada was leaving because of personal reasons. However, sources within the senior management of UBL said they were as surprised as anyone else since Dada was a well liked and well connected CEO.

Another credible source revealed to Profit that this decision is not completely unexpected. Shazad Dada has been a pedigree foreign banker and UBL was his first local bank stint. However, Dada’s unique leadership style created tension between him and the UBL board for the past year or so. The board frequently interfered with Dada’s work and sometimes expected him to serve as a rubber stamp CEO, which was not acceptable to Dada. Consequently, at the end of 2022, Jawaid Iqbal was added to the board with the clear intention of taking over from Shazad Dada.

Dada had been appointed as President and CEO back in July 2020 for a three year period. Dada was, at the time, the highest paid banking executive in Pakistan, setting a record for earning the highest income from the banking industry at a staggering Rs. 340 million.

While his tenure was coming to an end, most people expected his contract with the bank to be renewed given his tenure saw UBL post strong financials. The bank outperformed its competitors in terms of profitability, and also managed to bolster their digital banking wing and revamp their mobile banking application.

Dada’s legacy

A seasoned banker, Dada joined UBL in July 2020 in the middle of the Covid-19 pandemic. However, the appointment was a challenging one. Up until this point Dada had mostly served in foreign banks. He had spent the first two decades of his career from 1990-2010 at Deutsche Bank before assuming his first charge as CEO at Barclays Pakistan, where he worked for four years. His immediate appointment prior to UBL was as CEO of Standard Chartered Bank (SCB) in Pakistan from 2014-2020.

The jump from Standard Chartered to UBL marked a transition from the head of a small foreign bank (currently the only foreign bank in Pakistan with commercial operations) to one of Pakistan’s largest banks. On top of this, he was replacing Sima Kamil. Kamil had joined as the CEO in June 2017 for a three year tenure but was also not given a renewal. Reportedly, UBL’s shareholders were unhappy with some of Kamil’s hiring decisions at UBL. Apparently there were also some concerns over UBL’s international divisions loan portfolio, a problematic area that had persisted since before Kamil’s time.

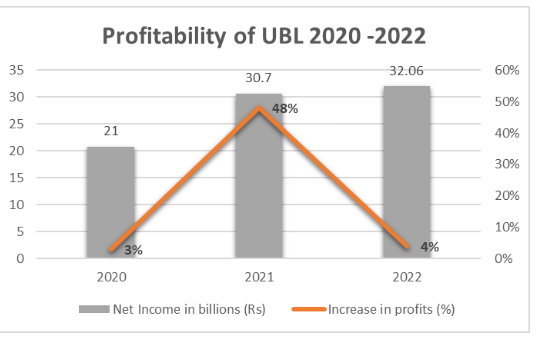

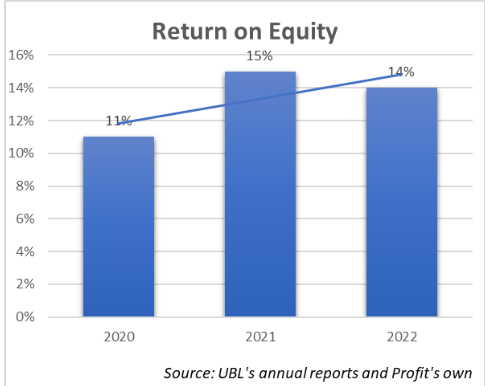

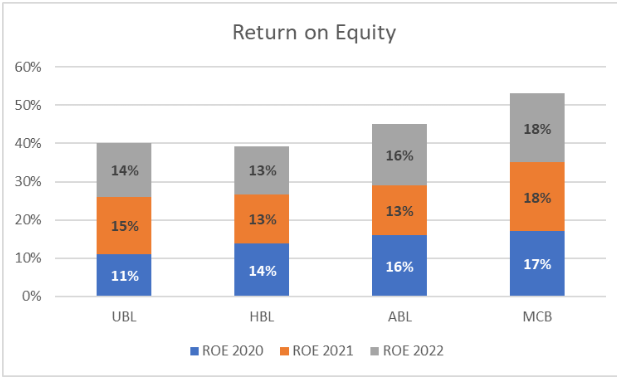

Despite the challenging circumstances and this being Dada’s first foray into a legacy Pakistani bank, he managed to steady the ship and steer the bank in a profitable direction. Under his leadership the bank’s profits increased consistently from Rs 21 billion in 2020 to Rs 30.7 billion in 2021 and Rs 32 billion in 2022. Similarly, return on equity (ROE) increased consistently by 11%, 15%, and 14% in 2020, 2021, and 2022 respectively. Perhaps what will have made shareholders most happy is that UBL outshone other banks in its boxing division. UBL’s ROE for 2021 and 2022 was higher than HBL despite the latter having a bigger network.

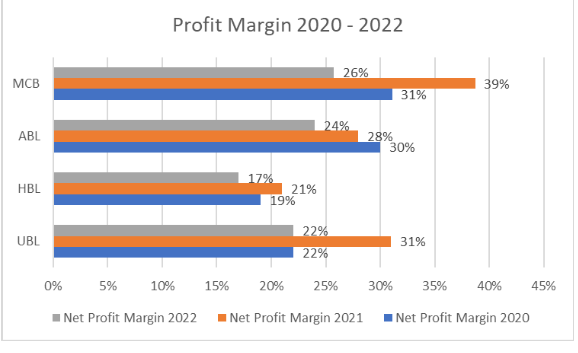

Moreover, the profit margin of UBL is also significantly higher than HBL’s, with UBL recording an impressive 22% profit margin in 2022, 31% in 2021, and 22% in 2020, in contrast to HBL’s 17%, 21%, and 19% profit margins in the fiscal years 2022, 2021, and 2020 respectively. UBL’s profit at year end 2022 stood at Rs 32 billion while Allied Bank Limited (ABL)’s and MCB Bank Limited (MCB)’s profit stood at Rs 21 billion and 31 billion respectively.

Strides in digital banking

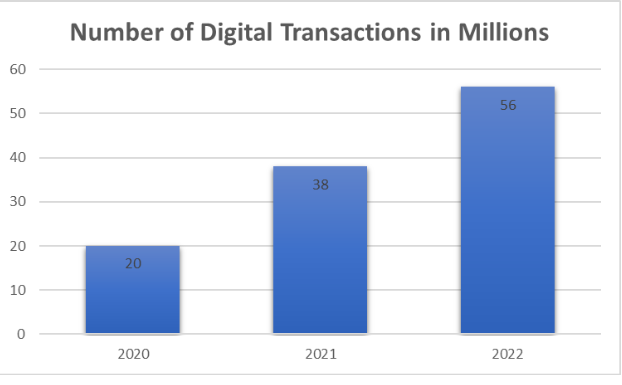

Dada’s tenure also oversaw strides in the realm of digital banking for UBL. The bank witnessed a remarkable increase of 90% in the number of digital transactions from 20 million in 2020 to a staggering 38 million in 2021. The momentum continued into 2022, with UBL recording a 47% year-on-year growth in the number of digital transactions, reaching an all-time high of 56 million, up from 38 million in the previous year. This unprecedented growth is a testament to UBL’s commitment to innovation, progress, and meeting the evolving needs of its customers in the fast-paced digital age.

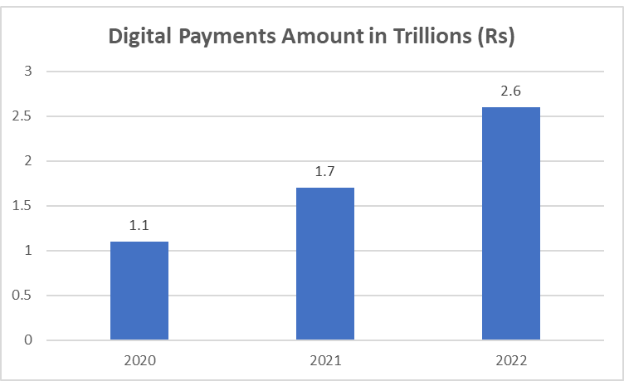

Likewise, the payments transacted digitally through UBL’s platform increased by 55% from Rs 1.1 trillion in 2020 to Rs 1.7 trillion in 2021 and by 53% to Rs 2.6 trillion in 2022.

The replacement — Jawaid Iqbal

Profit reached out to Shazad Dada to ask whether he had in fact stepped down for personal reasons or had called it quits for some reason. However, Dada has not responded to queries as of yet. In the meantime, Muhammad Jawaid Iqbal will be replacing Dada as the CEO and President of UBL.

The new hiring, which is also for a three year term, has been made from within the bank where Iqbal is currently Chairman of the Board Risk & Compliance Committee (BRCC) and a member of the Board Human Resource & Compensation Committee (HRCC). He has been a member of UBL’s BoD since December 2022.

Iqbal also has an investment background. He is the founder of Providus Capital (Private) Limited, an investment firm that primarily invests in public equity markets of Pakistan. With over two decades of banking experience, he has worked at senior managerial positions in Emirates Bank International PJSC Pakistan, National Bank of Pakistan, and Allied Bank Limited. He holds an impressive educational background, including a Master’s in Business Administration from Bahauddin Zakariya University, Pakistan, a Chartered Financial Analyst (CFA) from CFA Institute, USA, and an Advanced Management Program from Harvard Business School, USA.

I think UBL was growing well in the era of Shehzad dada

Please do not play with the honest efforts of all UBL staff across the country…

اسلام علیکم ہنڈا پرائڈر دو سال کے پلان پہ لینا ہو تو کیا پراسس ہو گا

sufiad ali

I hope the new CEO will know how to deal with masses in a respectful way. staff is so rediculous in all branches. policy should always move around respect and courtesy. this should be the basics of all the banks.

Mr. Jawaid Iqbal is Very well deserving and seasoned Banker and will Lead the Bank to its New Hights among the Big 5 of Pakistan Banking Industry

Fake

Mera Landd lay lo Asif Bhai

Mera chassourra laga lo yasir bank mai

tum logon nay apni maa chuddwaa li mujhay nikaal kay

Meray ko VP nahi kara aur yahan maa chudaaayi lagaaai hoii hy tum logon nay kanjaro

New CEO Jawaid iqbal nay agar inflation adjustment nahi dya taw us ki kuuttttt hay building kay andar hi nanga kar kay ,, ye baat mai adnan sherazi bol raha hun

mera number hay 03333281534

Mera number bhi likh lo apni maa ko chudwanay k liyyay

03213778474

mai lahore ki aik randi hun jo UBL mai hun

mai UBL Compliance ki aik Bewa hun