During the 18th-century Industrial Revolution, railways were deemed the backbone of the rapidly evolving global economy, playing a pivotal role in connectivity and facilitating trade. Fast forward to the 21st century, the importance of railways may have diminished significantly.

Instead, a new form of infrastructure has emerged – digital railroads, spearheading the evolution of connectivity. The telecom sector serves as the cornerstone of this infrastructure, functioning as a multisectoral pass-through point and delivering great value to modern economies.

In Pakistan, the sector appears to have become entangled in its own array of issues, significantly impeding progress. While this situation may apply to multiple sectors considering the economic conditions over the past two years, the deterioration in the telecom sector began long before that time.

This crisis has prompted numerous players, including Cellular Mobile Operators (CMOs), to weigh their choices. These options vary from exiting the market (case in point: Telenor’s departure from Pakistan) to divesting assets to improve cash flow.

The latter has been a focus area for many players with Jazz being the flag bearer of the movement.

The telecom giant established a subsidiary company, Deodar, in August 2016, which assumed ownership of Jazz’s tower sites. The intention behind creating a tower company for Jazz was evidently to prepare it for sale. In pursuit of this objective, the telecommunications company engaged in an agreement with Edotco, one of the largest tower operating companies, in 2018. However, the deal encountered a setback when the regulator intervened and withheld approval for the transaction.

Then it took Jazz four more years to find another suitable buyer which it eventually did in 2022 in the shape of a consortium formed between the Pakistani conglomerate TPL and UAE based TASC Towers Holding. But almost a year and half later, there is a deafening silence on the deal.

The deal appears to have fallen through once again, and this time, the regulator may not be the reason behind it. Let’s delve deeper and figure out what is holding back Jazz from going “asset-light”.

Surviving the telecom sector, a task and a half

Before diving into what became of the tower deal, it is essential to first grasp the context in which it was being carried out.

As per the 2023 sector analysis published by VIS credit rating, “The telecom market in Pakistan reflects a diverse landscape dominated by key players. Jazz emerges as the leading operator, commanding a substantial market share of 36.8%. Close behind are Zong and Telenor, each holding approximately a quarter of the market share at 24.0% and 24.2%, respectively.”

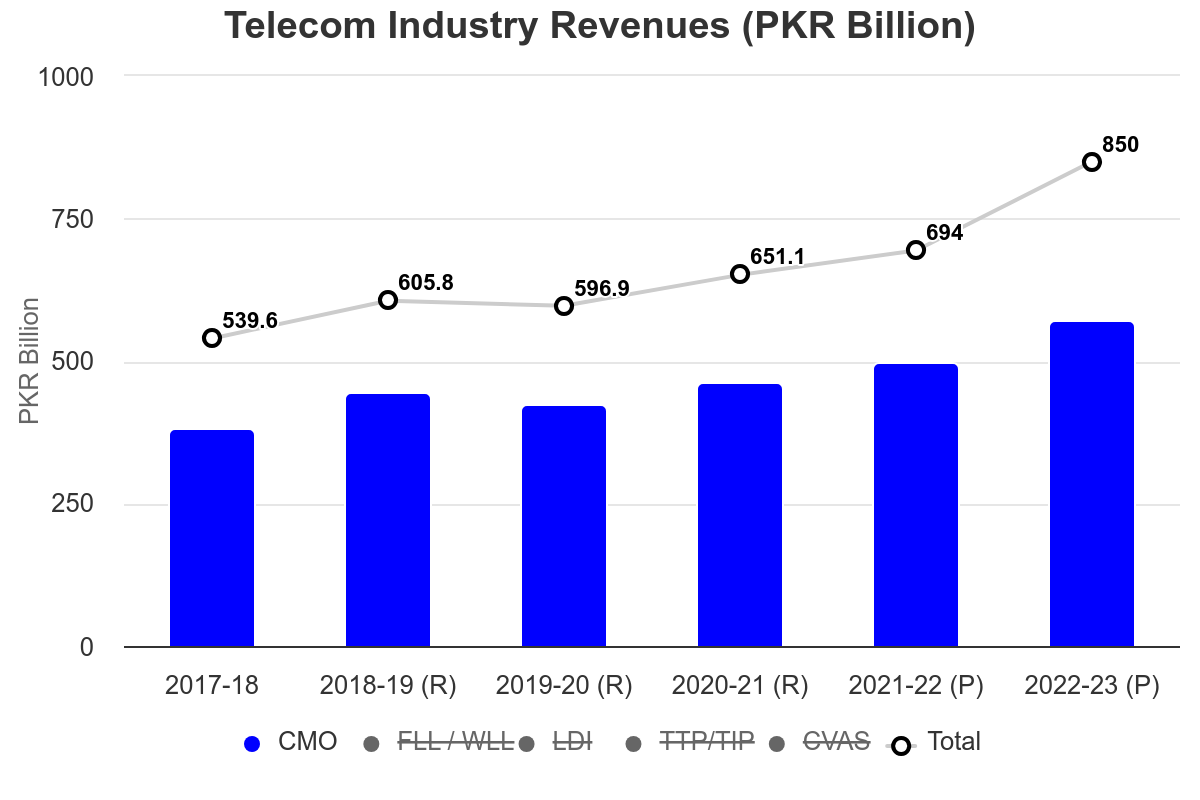

Source: PTA

Source: PTA

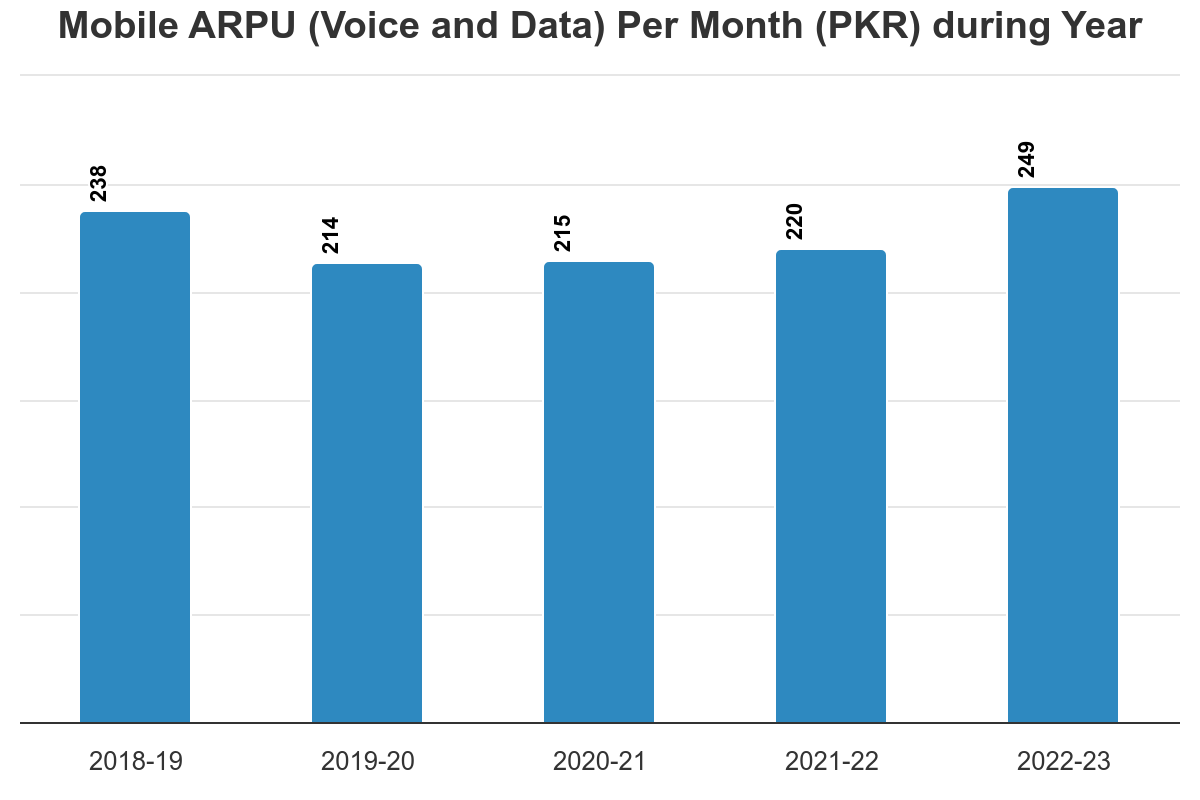

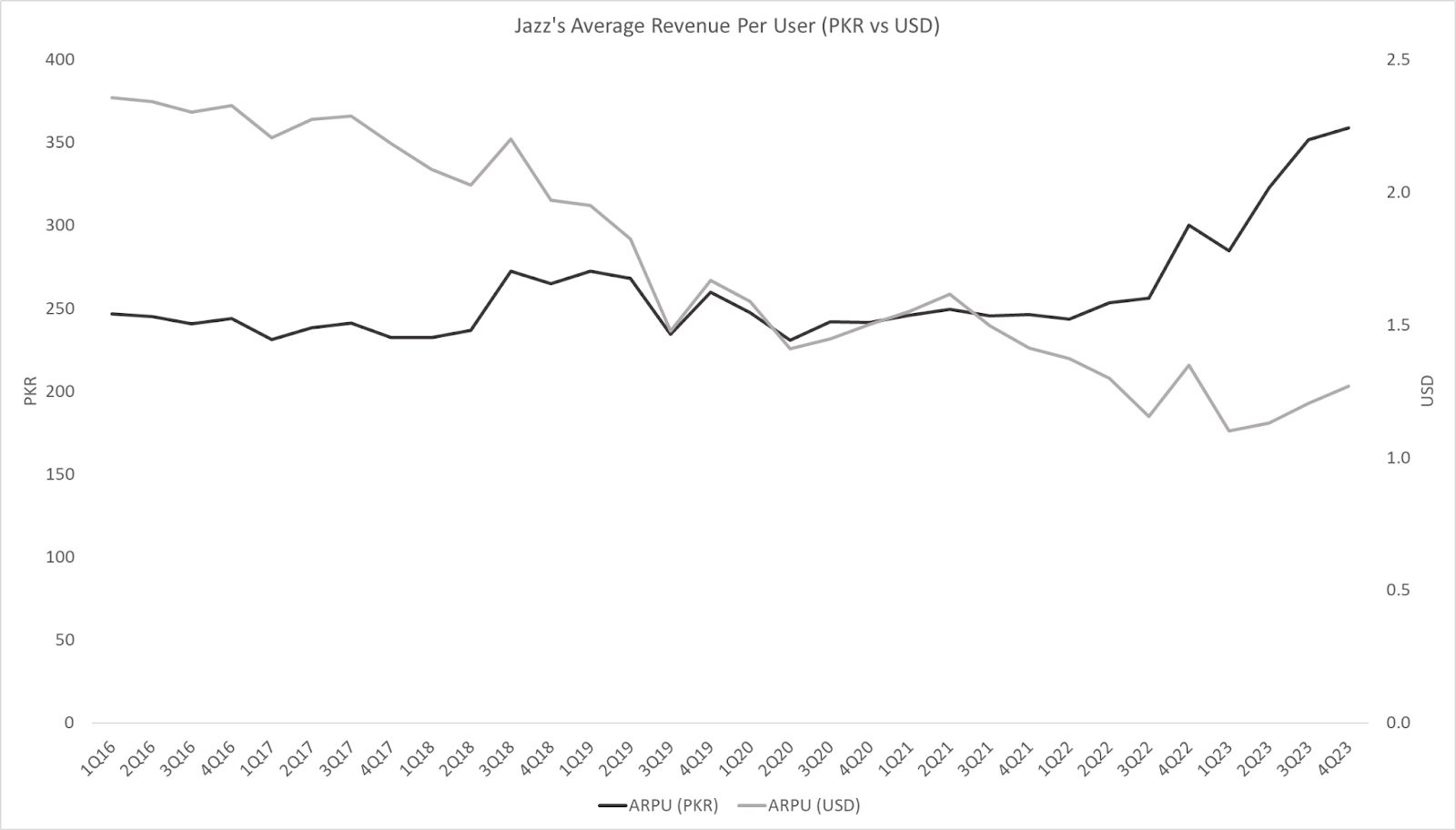

While the industry revenues present an upward trend, it is a slightly misleading picture in terms of the feasibility of operating in the sector. The average revenue per user (ARPU) has grown at a much slower pace not keeping up with inflation and customer acquisition costs.

Source: PTA

Source: PTA

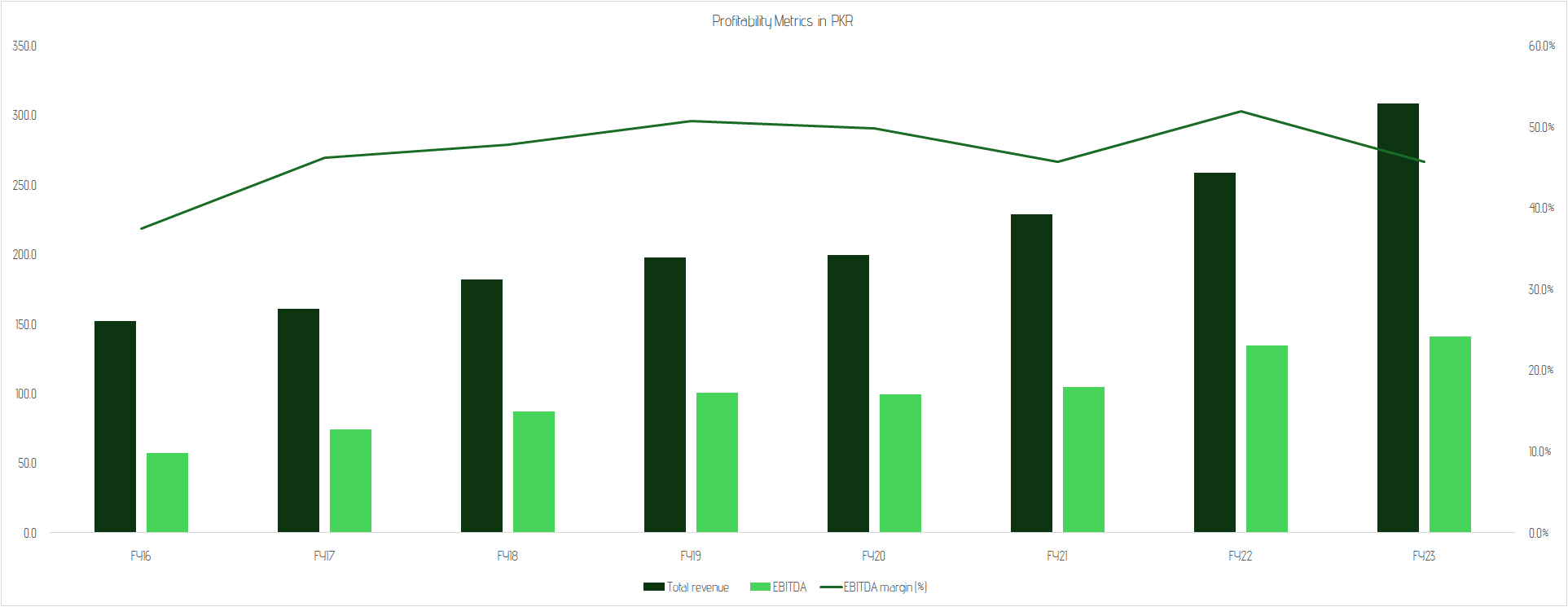

The case for Jazz is not much different. On the face of it, things seem to pan out really well. As per VEON’s annual report, “In FY23, total revenue grew by 19.9% YoY and EBITDA grew by 4.9% YoY. Normalised for one-off recorded in 2022, FY23 total revenue growth of 23.0% YoY and EBITDA growth of 23.6% YoY were supported by Jazz’s successful execution of its digital operator strategy.”

Source: VEON’s financial results

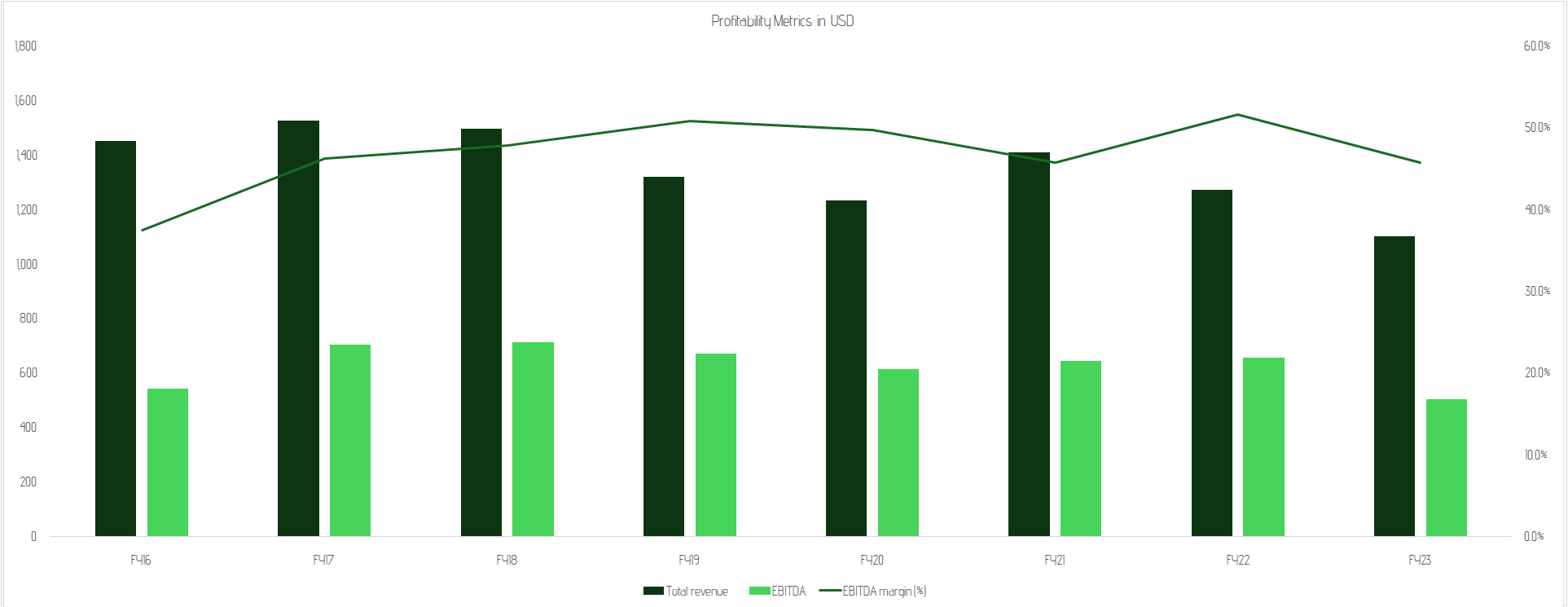

However, one thing needs to be understood. Multinationals like Veon (Jazz’s parent company) evaluate the performance of their local subsidiaries in dollars and this is also the currency in which the subsidiaries will be valued so any significant devaluation of domestic currency would have ramifications for local subsidiaries. This is exactly the case with the Pakistani rupee and Jazz.

In dollar terms, the revenue in Pakistan was down by 12.9% in 2023 compared to 2022, and the EBITDA was down by 23%.

Further, the ARPU in dollars also paints a contrasting picture when compared to the same in rupee.

Source: VEON’s financial results

Source: VEON’s financial results

So a very rational response to this would be to invest aggressively in growth of product and service delivery to maximise ARPU while also protecting cash flows through going “asset light”.

“Infrastructure sharing holds significant importance for Pakistan amidst various economic challenges such as inflation, low ARPU, escalating fuel prices, revenue constraints, and the substantial capital investment required for the integration of emerging technologies such as 5G. The imperative to extend connectivity to underserved regions, deploy cost effective strategies to meet burgeoning capacity demands, deliver social benefits, and achieve nationwide coverage further underscores this necessity,” reads the VIS report.

For Pakistani CMOs, the logical first step towards infrastructure sharing is tower sharing.

The tower business in Pakistan

In the world of telecom, a company owns and manages the physical infrastructure used for wireless communication, such as cell towers and related equipment. When CMOs set up shop in Pakistan, they did not compete on price, or services, rather they chose to compete on something that was an automatic choice for Pakistan’s diverse terrain; coverage. Each company spent billions in making its network as accessible as possible. Towers were set up far and wide, all across the country.

While Pakistani telcos outspent each other, setting up new infrastructure, the world was moving towards more elegant solutions. Telecom companies realised that the capital expenditure that went into setting up their proprietary tower infrastructure was massive and was not likely to pay dividends quickly. Therefore, telecom companies around the world devised a way to share this infrastructure. Such that one company could use the towers of another company to transmit and multiple companies could use one tower as well.

This led to the emergence of infrastructure sharing companies that started erupting left and right. Companies that would set up a portfolio of properties on which they rented space to multiple telco operators. This resulted in mobile operators relaxing their grip on their network infrastructure via ad hoc arrangements by operators to sublet space on their sites.

The primary advantage of tower sharing is cost reduction. Building and maintaining a cell tower infrastructure can be prohibitively expensive, especially in densely populated urban areas or remote rural regions where demand for connectivity may not justify the investment. By sharing towers, telcos can pool their resources, share the financial burden of infrastructure development, and achieve cost savings through economies of scale.

Furthermore, tower sharing promotes infrastructure optimization and environmental sustainability. It also contributes to network performance enhancement and service quality improvement. By sharing infrastructure, telcos can strategically deploy equipment on existing towers to optimise coverage, capacity, and signal quality. This enables more efficient use of spectrum resources, reduces interference, and enhances the overall reliability and performance of mobile networks.

“When we were building most of our sites back in the 2004-2008 period, there were no tower sharing companies. Therefore, we had to build our own infrastructure but now we are sharing and we are sharing quite substantial numbers,” the then CEO of Telenor, Irfan Wahab, told Profit in an interview in 2022.

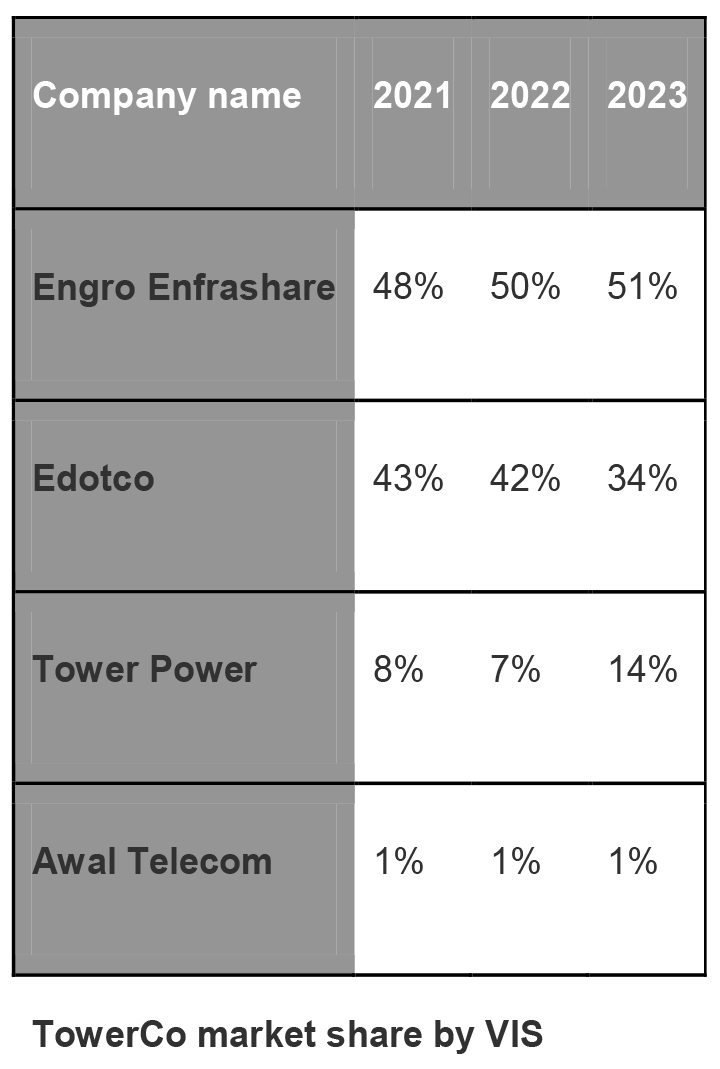

Currently, the industry’s market share is distributed among four major players: Engro Enfrashare, Edotco Pakistan (Pvt) Ltd, Awal Telecom, and Associated Technologies (Pvt.) Limited (now under the ownership of Tower Power (Pvt) Limited). In the country, as per VIS credit rating, there are around 42,000 towers installed, with approximately 6,000 managed by TowerCo companies.

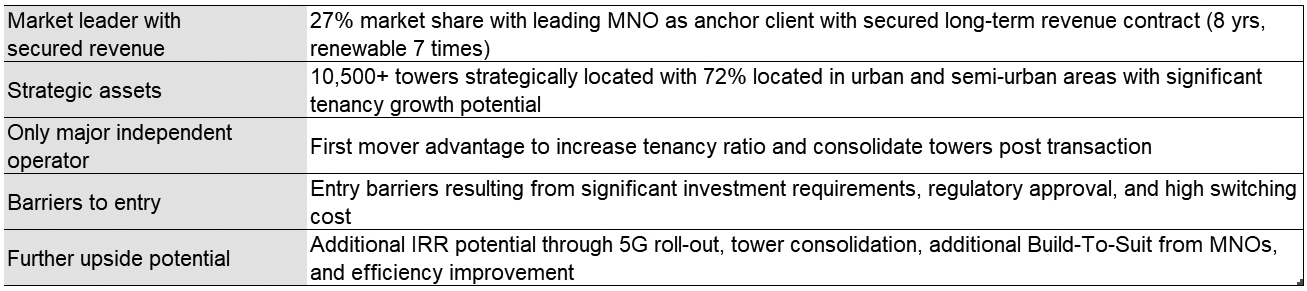

These figures indicate significant potential for growth in this sector, as well as investor’s interest in participating. Jazz sought to capitalise on this opportunity and managed to secure a great deal.

Deodar; an attempt to sell

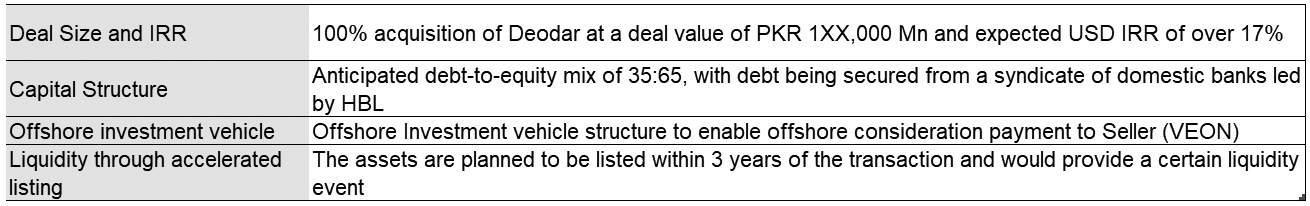

In December 2022, it was announced that Jazz had conditionally agreed to sell its 10,500+ towers. The successful bidder was a consortium of TPL REIT Management Company (TPL RMC) Limited and UAE-based TASC Towers Holding (TASC). The estimated deal size at the beginning of the negotiations was approximately $600 million.

In terms of the deal structure, the ownership of Deodar was intended to be transferred to a holding company Veon Pakistan Tower Holding B.V (VPHL), incorporated in the Netherlands. Jazz in its extraordinary general meeting held in July 2022 provided approval for the sale of 100% shares of Deodar (Private) Limited to VPHL, subject to regulatory approvals.

During Q3-22, a Share Purchase Agreement (SPA) was also signed between PMCL & VPHL setting out the arrangement for the transfer of shares for a purchase consideration of Rs 100,000.

On the buyer end, the TPL-TASC consortium aimed to establish a Special Purpose Vehicle (SPV) in Abu Dhabi and a feeder fund in Pakistan. The SPV was planned to invest in the feeder fund, in conjunction with local investors, to ultimately acquire Deodar’s assets.

The offshore entities for Jazz and the buyer were established to facilitate transactions outside of Pakistan and mitigate potential liquidity concerns.

The buyer consortium had a clear roadmap on how to execute the deal and the massive benefits they were deriving from it were quite evident.

Source: TPLP investor presentation

“TPLP is all set to launch the Digital Infrastructure REIT Fund to facilitate the transaction of selling and leasing back 10,500 cellular mobile towers from Deodar . The company is in discussion with the regulatory body to finalize the procedural modalities of the project. Commencement of this project would benefit TPLP through investment management fees. We think that the combined synergy of TASC and TPLP will improve the tenancy ratio and IRR that would increase the fund’s NAV and thus management fees of TPL RMC. Moreover, the partnership may further consolidate tower assets across the country and internationally through its Abu Dhabi subsidiary,” read an analyst note in December 2023 by Ktrade.

Source: TPL investor presentation

A sale not to be

However, despite the robust execution plan, the sale never materialised, and Deodar’s assets were not transferred to VPHL.

Sources familiar with the situation have indicated that Jazz’s management has put the transaction on hold due to political and economic instability in the country and the devaluation of the Pakistani Rupee. They also mentioned that Jazz’s management is hopeful that once the IMF-related matters are resolved, the transaction can progress. It is anticipated that the transaction will be finalised approximately within a quarter after the signing of a long-term IMF program.

Given the prevailing forex crisis and the difficulties faced by companies to repatriate profits, any investor is likely to have its reservations while investing in the country.

A concern reiterated by Telenor’s global CEO, “It’s very challenging to do business in Pakistan right now. That’s one of the reasons why we have decided to exit. If an investor cannot repatriate profit from a country, then the investor probably will, over time, leave.”

Sources privy to the development also state that the sale of Telenor also plays a big role in the pricing of Deodar’s deal. The Norwegian parent company of Telenor Pakistan, sold its entire business, including brand equity and non-technical assets for around $490 million, an amount less than what Jazz is demanding for Deodar. This prompts a comparison between the deal value for any potential buyers.

Although the TPL-TASC consortium remains involved in the sale discussions, other industry players are reportedly engaged in negotiations with Jazz, seeking to reach a middle ground for the acquisition of Deodar’s tower assets.

Profit reached out to Jazz for more information regarding the deal. “Jazz is continually exploring opportunities to enhance our strategic position and engage with various stakeholders in the industry. However, we do not comment on specific discussions or potential engagements unless there is a definitive outcome to share,” the CMO responded.

Appears to be a well researched article. Perhaps someone more in the know can verify?

But a great effort nevertheless👍🏼