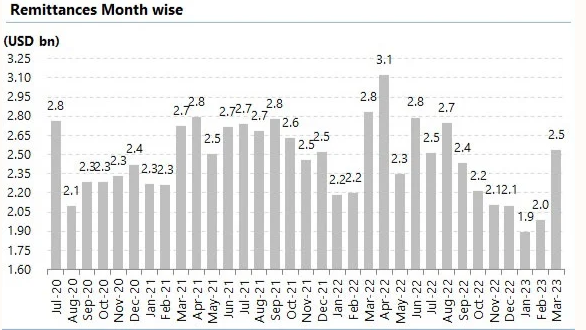

The inflow of remittances from overseas workers experienced a substantial hike at $2.5 billion in March 2023. According to data released by the State Bank of Pakistan (SBP) on Monday, March recorded an increase of 27.4% in remittances on a month-on-month basis, compared to the inflow of $1.98 billion in February 2023. The influx of non-commercial foreign currency was recorded at a seven-month high since August 2022. The increase in remittances can be associated with the month of Ramadan, wherein household expenditure and spending on food goes up every year.

What are remittances?

Remittance is money flowing into the country from non-commercial sources, mainly in the form of financial support from workers in a foreign country. These workers are mostly first generation members of a diaspora community or foreign citizens with familial relations in the home-country, who rely on financial assistance to manage their household expenses.

Remittances are quite common in Pakistan and other low-income, developing countries, from where several skilled and unskilled labourers migrate to foreign countries to improve their financial status.

Is this phenomenon of remittance hike during Ramadan an annually occurring event?

It is not uncommon for expenditure to increase during the month of Ramadan and thereby, the influx of remittances also increases to cater to the growing expenditure.

In comments given the the media, Saad Khan, Head of Research at IGI Securities, said, “This is a seasonal rise due to the ongoing month of Ramadan, where a lot of funds are remitted on account of Zakat and other charities, which is reflected in the increase in remittances,”

He went on to share that, “On account of increase in remittances, the current account deficit for the month of March is likely to be negligible, and there is also a strong possibility of a current account surplus this month.”

Moreover, given the unprecedented rate of prevailing inflation, in tandem with the deteriorating economic condition, there is a general economic pessimism. According to Gallup’s latest survey, 73% of Pakistanis believe the country’s economic condition has worsened in the last six months. Along with this, people have also experienced a reduction in their buying power, with 73% of Pakistanis reporting a decrease in their household savings in the last six months. This can perhaps be another explanation for the rise in remittances, especially during the month Ramadan and the approaching event of Eid-ul-Fitr.

What does the current remittance influx look like in comparison to previous trends?

In February 2023, remittances totaled $2 billion, marking a 9.5% decrease compared to the same period last year. While on an annual basis, remittance inflows declined by 11%, with $2.83 billion recorded in February 2022.

For the July to March period of the fiscal year 2022-23, remittance inflows were $20.527 billion, indicating a 10.8% decrease from $23.018 billion for the same period of the previous fiscal year. This amounts to a drop of nearly $2.5 billion in remittance inflow.

Khan disclosed that the average remittance figure for FY22 was $2.6 billion, indicating that the latest figures are not particularly encouraging, however, the remittance clock in, compared to last month is notable.

The depreciation of the rupee and the increase in black market premiums are causing people to divert their inflows from formal channels, leading to the ongoing decline in remittance figures. In January, foreign remittances stood at $1.9 billion, the lowest in 31 months. Overseas Pakistanis in Saudi Arabia recorded the largest remittance amount in March 2023, sending $564 million during the month, an 18% decrease from the $686 million sent by expatriates during the same period last year.

In March 2023, remittances from the United Kingdom increased by 5%, rising from $402 million in March 2022 to $422 million. During the month, remittances from the United Arab Emirates declined by 22%, amounting to $407 million compared to $521 million in March 2022. Remittances from the European Union, on the other hand, increased by 6%, amounting to $299 million in March 2023. Lastly, overseas Pakistanis in the US sent $316 million in March 2023, reflecting a year-on-year growth of 5%.