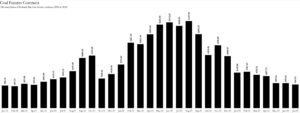

The price of futures contracts for Richards Bay coal—coal from the city of Richards Bay in South Africa and the primary coal imported into Pakistan—has plummeted to its lowest price since May 2021. Contracts currently trade at $94.35 (Rs 26,124.45 at a spot rate of $1 to Rs 277) per tonne, compared to $105 (Rs 29,085 at a spot rate of $1 to Rs 277) per tonne in May 2021. The trend is a continuation of the downward revision that has taken place in the price of Richards Bay coal every month since its recent high of $347.50 (Rs 96,217.50 at a spot rate of $1 to Rs 277) per tonne in August of last year.

Cement manufacturers and electricity consumers are set to be the primary beneficiaries of this downward revision. But first, what even is a futures contract?

Futures contract explainer

A futures contract is an agreement between two parties to buy or sell a specific commodity at a set price on a future date. This allows the buyer and seller to lock in a price for the commodity in advance, reducing the risk of price fluctuations.

For example, a farmer might enter into a futures contract to sell their crop at a set price, protecting them from potential drops in the market price. Futures contracts are traded on exchanges and are standardised, meaning that the terms of the contract—such as the quantity and quality of the commodity—are set by the exchange.

Post Eid gift for cement manufacturers

“Cement margins should expand,” explains Yousuf Farooq, Director of Research at Chase Securities. “Cement players use around 130 kg of coal per tonne of cement produced. So, a $10 (Rs 2,770 at a spot rate of $1 to Rs 277) per tonne decline in coal prices has a pre-tax impact of around Rs 360 per tonne.”

Does this mean that cement manufacturers in the South—those closer to the port—will have an advantage over those in the North? “Afghan coal prices should drop further,” Farooq adds. “Afghan coal prices will come under further pressure as cement players are now able to import coal by sea.”

“All cement players will benefit from this decline in coal prices,” Farooq continues. “Profit before tax was around Rs 2,000-3,000 per tonne in 3QFY23. These margins are likely to increase going forward.”

Respite for electricity customers?

“Cement manufacturers will indeed see their margins increase,” explains Fahad Rauf, Head of Research at Ismail Iqbal Securities. “But more importantly, it is also significant from an economic perspective because we also generate a considerable chunk of electricity from imported coal.”

To be precise, Pakistan annually imports almost 19 million tonnes of coal (having tripled since 2015), half of which is consumed by the power sector according to the International Growth Centre.

“This will impact the cost of generation in the country because coal-based power generation accounts for about 15-18% of the generation mix and roughly 70% of the coal used for generation is imported,” explains Mustafa Mustansir, Director Research and Business Development at Taurus Securities.

“11MFY23 share of coal-based power generation in the overall generation mix was 16%,” Mustansir adds. “If international coal prices continue to tread downwards we may see the proportion of coal-based power generation increase given peak demand during summer months.”

Strictly in terms of energy, will customers benefit from lower tariffs and will the sector benefit from lower circular debt? “Yes, but it’s difficult to quantify,” posits Mustansir. “It will have a direct impact on fuel cost adjustments.”

Whilst Mustansir leaves much to the imagination, Rauf states that “Tariffs have been reducing as coal prices were already on the decline, and impact of recent decline will follow in coming months.” However, unlike the benefit customers are set to reap, Rauf states that the industry will not benefit from a reduction in circular debt stating that “Circular debt is mainly due to capacity payments—not fuel charge.”

When prices go up, these never come down in Pakistan, whatever be the market dynamics. A decrease in prices is rare except in cases where perishable commodities (onions) are concerned. Even if there is a decrease in other cases, it will be minimal. In this particular case, only the manufacturers will benefit and hardly any relief will trickle down to the common man.

Please remember, this is a country where hoarders, profiteers and adulterators prosper and mafias rule the roost. Please look around carefully to see what I mean.