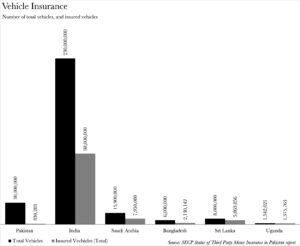

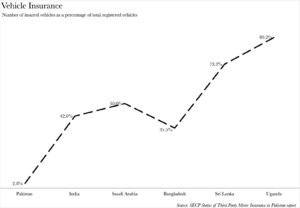

The Securities & Exchange Commission of Pakistan (SECP) has unveiled a startling statistic — a paltry 2.77 percent, or 8.3 lakh, of the total 3 crore registered vehicles in Pakistan are insured. At 2.77%, Pakistan trails woefully behind countries such as India, Saudi Arabia, Bangladesh, Sri Lanka, and Uganda in terms of insured vehicles. These revelations were part of the findings released by the SECP in its “Status of Third Party Motor Insurance in Pakistan” report earlier this week.

The report categorises the 3 crore registered vehicles into 2.3 crore motorcycles and 70 lakh motor cars. Furthermore, it identifies a mere 12,557 vehicles as having motor third party (MTP) insurance and 9 lakh vehicles as having comprehensive motor insurance. The primary distinction between MTP and comprehensive insurance is the type of coverage each provides. Whilst MTP covers you against third-party damages and losses, comprehensive car insurance also covers your own damages.

“Motor insurance forms the cornerstone of overall insurance penetration because almost 50% of global insurance penetration is attributable to motor,” elucidates Azfar Arshad, Chief Operating Officer at Jubilee General Insurance and ex-Chairman of the Insurance Association of Pakistan. “In regions where motor penetration is higher, overall insurance penetration is also elevated — and that is a disheartening reflection in the case of Pakistan,” Arshad continues.

So, what is going on? Why is motor insurance so low in Pakistan compared to other countries?

It’s not mandatory

“The issue in Pakistan is not really an issue per se. In most countries where motor insurance penetration is exceptionally high, the reason for that is because it is a legal requirement,” elucidates Arshad.

He continues, “You cannot operate a vehicle without a valid insurance certificate, and you may not even be able to purchase a vehicle. Similarly, in the case of registration, you can’t register your vehicle with the motor vehicle authorities if you don’t have a valid insurance policy to show. Sometimes even during routine checkups, motor vehicle insurance is a necessary prerequisite document that law enforcement agencies check. If you don’t have that, then there are various fines and penalties.”

He concludes, “You can easily distinguish between those countries where implementation is slightly low — there you will find a lower percentage. In those countries where implementation is high, you will find an exceptionally high percentage,” Arshad muses. Is the answer to then just make vehicular insurance mandatory? Not quite.

“The presence of a large number of unregistered and unlicensed vehicles in the country,” emphasises Amir Hameed, Executive Director and Chief Operating Officer at United Insurance. “These vehicles often operate without any form of insurance, including third-party liability coverage — posing a significant challenge in effectively implementing the compulsory insurance requirement,” Hameed continues.

However, Hameed contends that there are perhaps easier remedies to increasing the rates of penetration.

Lack of awareness

“First and foremost, there may be a dearth of cognisance amongst the general populace regarding the significance and advantages of possessing motor insurance,” elucidates Hameed. “Numerous individuals might not fathom that having motor insurance can furnish financial safeguarding in the event of accidents, theft, or damage to their vehicles.” Hameed continues, “Secondly, there could be concerns pertaining to affordability. Certain individuals might perceive motor insurance as an ancillary expenditure and prioritise other financial obligations over it.”

“Furthermore,” Hameed adds, “the intricacy of the insurance industry and the process of procuring insurance might dissuade people from pursuing motor insurance. It can occasionally be perplexing and time-consuming to navigate through the sundry policies, coverage options, and paperwork involved.”

Are all these concerns fixable? Yes. However, Arshad highlights that even if the aforementioned impediments were to be fixed then there would still be one inherent factor that would lead to car buyers not actually pursuing insurance: the class factor in road accidents.

Case of class, and proving legal liability

“In Pakistan, the implementation of legal liability presents a formidable challenge. In the majority of cases, the victims of road traffic accidents belong to a lower economic stratum, while the offender represents a higher economic stratum,” explains Arshad.

“Consequently,” Arshad continues, “it is exceedingly difficult for those that are affected to initiate a legal proceeding and establish a legal liability against the driver of the vehicle.” “This creates a conundrum with the third-party component of motor insurance — which is necessary. It is intended to secure not the driver but the victims of road traffic accidents. You don’t take it for yourself; you take it in case your car causes harm to someone else or someone else’s property,” adds Arshad.

How to pump up the numbers?

In the face of the aforementioned problems — where do you go from here?

“Enhancing the prevalence of motor insurance in Pakistan necessitates a multi-faceted approach,” elucidates Hameed. “Some pivotal strategies encompass elevating awareness about the advantages and legal obligations of motor insurance through comprehensive campaigns. Streamlining the insurance procedures to make them more accessible is also crucial,” Hameed adds.

“Providing affordable options — such as flexible payment plans and bespoke coverage — can aid in increasing uptake,” Hameed continues. “Collaborating with governmental bodies to enforce compulsory insurance regulations is another key strategy. Forging partnerships with financial institutions and the automotive industry to integrate insurance offerings can also prove effective,” concludes Hameed.

nice info to read this article you are on right place

Not a surprise considering that in Pakistan, getting a vehicle registered does not require having insurance.

Arceus X is the app by which you can get the Arceus scripts to use in various Roblox games. Using the scripts of Arceus X in the Roblox games causes you to unlock all the locked items in the game, and you can enjoy the modded version of Roblox games in this way.

Yes, the number of registered cars are too low. I would recommend the government to at least make is compulsory like EU countries where you cannot take the car on road if it’s not registered