Sometimes the big guy is exactly that — the big guy. And on most occasions when the Goliath comes out on top, they don’t leave more than a few crumbs for the many proverbial Davids to fight over.

But on other, rarer, occasions the small players are not quite as small as you’d think. The picture is similar in Pakistan’s snacks and confectionery market. As one would expect, the largest players in the market are English Biscuit Manufacturers (EBM) and Mondelez Pakistan. EBM is a homegrown company that has been around for the past five decades and has produced household brand names such as Peek Freans and Modelez is the international company that owns and operates Cadbury among many other brands.

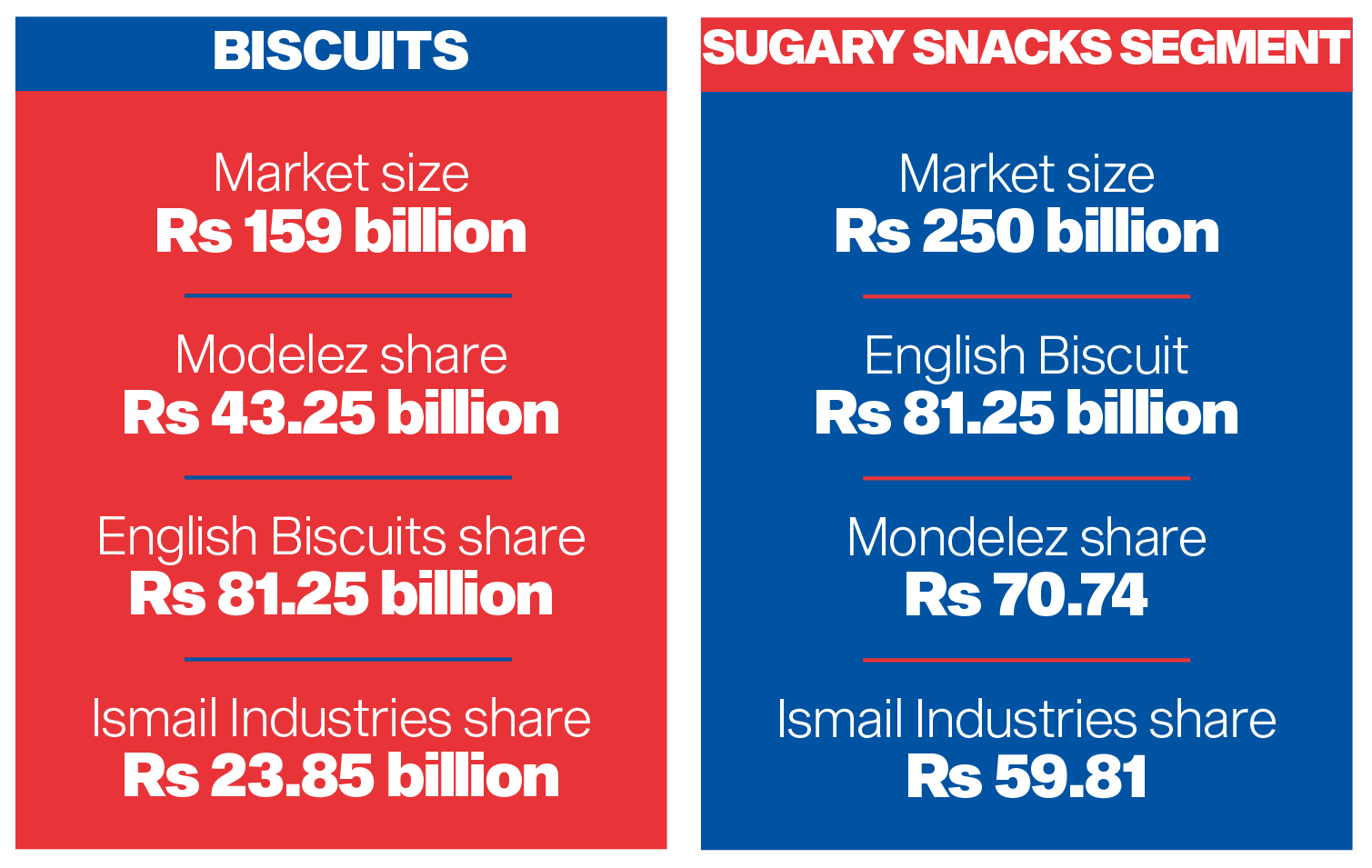

Together, EBM and Mondelez rule over the market for chocolates, confectionery, biscuits, and sugary sweets in Pakistan, which is worth just over Rs 250 billion. Since the share of the biscuits market is the largest out of all the categories EBM is also the biggest company in this business, controlling over Rs 80 billion in total retail sales. Mondelez is fast on its heels with total retail sales worth just over Rs 70 billion. Together the two control nearly two-thirds of the total pie with net retail sales of Rs 150 billion.

And while Mondelez and EBM have created brands that have brought them this success over the course of decades, there is one other competitor that is not far behind. Founded in 1988, Ismail Industries is another local player in the sugar snacks, chocolates, biscuits and confectioneries market that has made a name for itself. Under this Candyland brand name, Ismail Industries have produced some or the most popular snacks in Pakistan including Cocomo and Chilli Milli – both of which are market leaders in their respective categories.

While they are behind EBM and Mondelez it is not by much. Ismail Industries in 2022 recorded gross retail sales of nearly Rs 60 billion, indicating they have a market share of nearly one quarter. What is perhaps even more surprising is the rapid pace at which Ismail Industries has grown and the diversification they have shown in their business.

A sweet affair

Market analysts often lump snacks into one massive category. So in an overall snacks category, for example, EBM would be the leader with the biggest market share followed by Pepsico which has a massive share in the market off the back of its potato crisps brands. But for the sake of this story, Profit wanted to look at a more specific segment of the snacks market: sweets.

To this end we acquired data for three different segments within the snacks market that fall within the category of sugary snacks. These segments included chocolates, biscuits, and sugar confectionery such as candies and jellies. The results are telling.

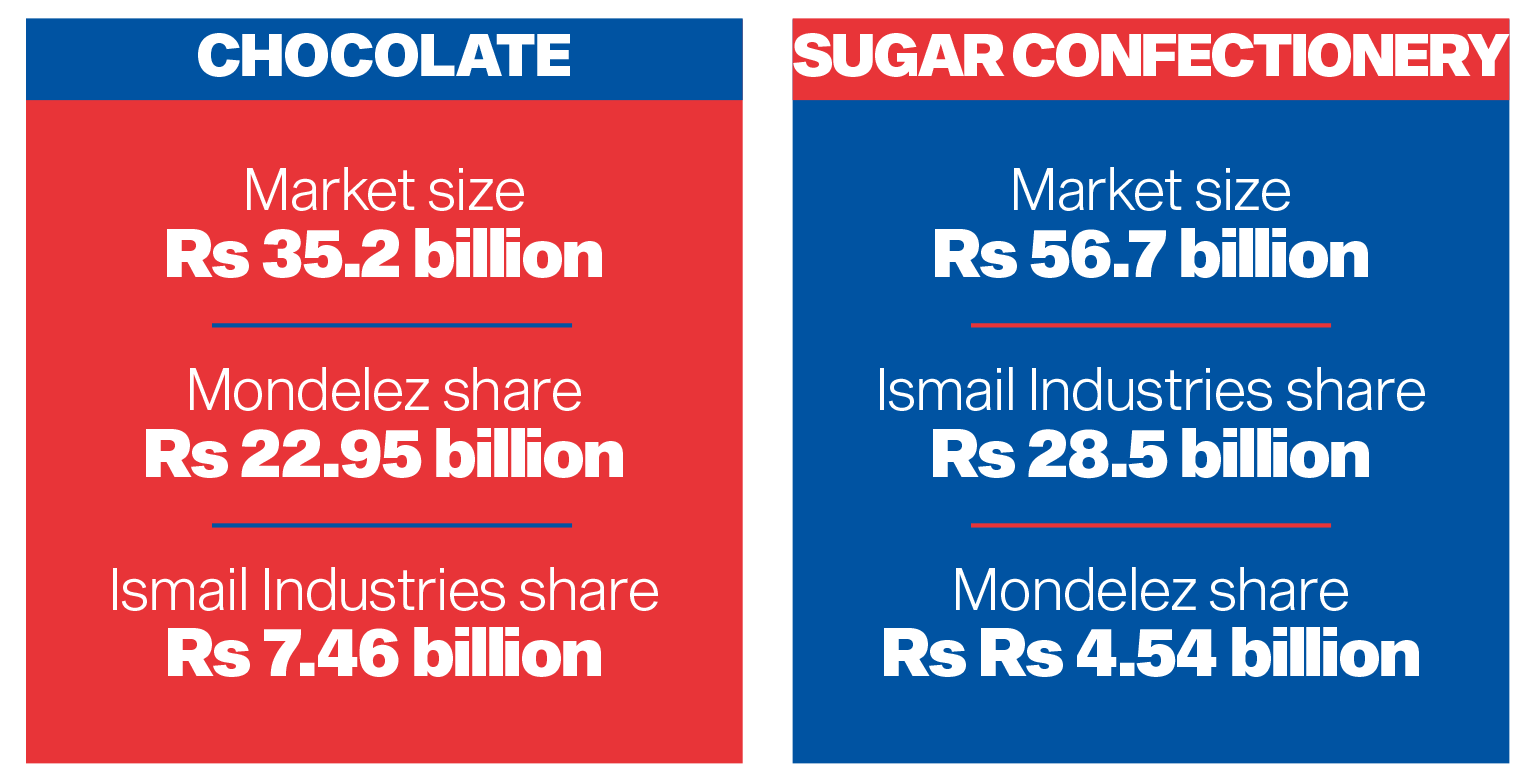

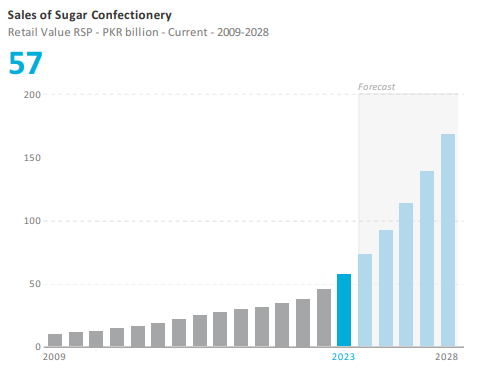

To start off with the overall sugary snacks, the market was worth just over Rs 250 billion in 2022. According to the data acquired by Profit, the biggest segment within this is for biscuits which make up a whopping 63% of the total sugar snacks market with gross sales of Rs 159 billion last year. Candies, jellies and other sugar confectionery comes in at a distant second with gross sales of Rs 56.7 billion in 2022 while gross sales for chocolates were also far behind with gross sales of Rs 35.2 billion.

But these are just the initial numbers estimating the size of the market. Within these segments the distribution of what sells and what doesn’t tells a much larger story.

The biscuit makers

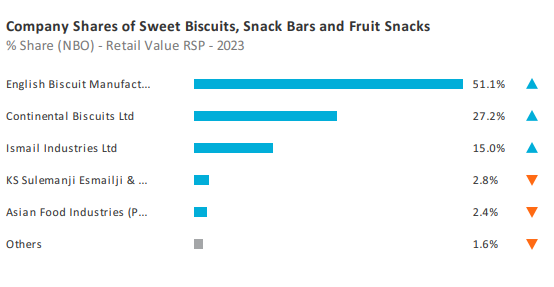

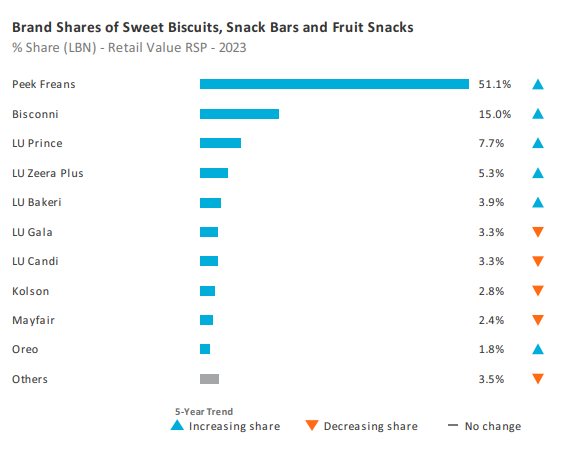

English Biscuit Manufacturers is big. In 2022 the company made gross sales worth over Rs 81 billion which makes them the single largest player in not just the sugary snacks market but in the snacks market overall. According to a Euromonitor report on the overall snacks segment in Pakistan EBM had nearly 18% of the market share in 2023. The closest competitor to them was Pepsico.

This means EBM obviously dominates the sugary snacks market as well. With gross sales of Rs 81 billion it makes up nearly a third of the entire market. What is even more impressive is the fact that EBM produces nothing other than biscuits. They have a diverse portfolio within the biscuits market with major brand names such as Sooper, Marie, Pik biscuits, and others. But outside of this, EBM does not produce any chocolates, toffees, boiled candies, or jellies.

Founded in 1966 under the name Peek Freans by Khawar Masood Butt, EBM entered a market that was mostly dominated by biscuits made in local bakeries. The reason the biscuit market in Pakistan is so massive is because of the high consumption of the sweet treats with tea. Pakistan is one of the largest tea consuming nations in the world, coming in at number four on the annual per-capita tea-consumption scale. The average Pakistani consumes tea made with 1 kilogram of processed tea leaves.

And just as tea is served in homes, offices, and dhabbas all across the country it is consumed along with biscuits. This is why the market for biscuits made gross sales of over Rs 159 billion last year. As the leader in this segment, EBM controls more than half of the market. This dominance has existed for years now and EBM has continued to grow along with the market. In 2014, according to a Nielsen survey, EBM made gross sales worth Rs 22 billion in a biscuit market that back then was a Rs 43 billion industry.

Within the biscuit segment EBM’s dominance is complete. Their closest competitor is Continental Biscuits. Another homegrown company, Continental started operations in 1984 after being founded by Hassan Ali Khan in Karachi. The company controls the LU brand which has the rights to Oreo in Pakistan as well as other iconic biscuits such as Prince, Tuc, Tiger, Candi and Gala. One of the immediate things that becomes clear is that within the biscuits segment EBM and Continental have very different areas of interest.

With their early mover advantage, EBM has focused on producing plain biscuits that go well with chai. Sooper in particular has become popular across the country in both urban and rural settings as the biscuit to be served with tea. Similarly, Marie and other plain dunkable biscuits such as the Pik biscuits have been a big part of EBM’s success. Back in 2014 it was reported that although it has a number of large brands including Rio, Gluco, Peanut Pik and Sandwiches, it is the flagship biscuit Sooper that alone accounts for almost half of the company’s revenues – Sooper is well over the Rs10 billion mark. According to recent estimates the gross sales from Sooper biscuit alone are more than the Rs 30 billion mark now.

Within this initial success they have also continued to expand their line and look towards new kinds of biscuits as well. “We have to continue to invest in Research and Development and assess consumer needs and give them products they want. We take competition seriously,” said Dr Zeelaf Munir in an earlier interview. The daughter of EBM’s founder, Khalid Masood Butt, she currently serves as the company’s Managing Director and CEO. “We had research done, showing that the market was not growing and the consumption of biscuits was low, so a range was created to compete with our own product line,” she adds.

Continental on the other hand has focused less on plain biscuits and more on sandwiched biscuits that are perhaps not as chai-friendly as the products produced by EBM. However Continental has managed to carve out a significant market for itself with a 27.2% share in the Rs 159 billion pie with gross sales worth nearly Rs 43 billion. The interesting thing about Continental Biscuits is that it is actually an affiliated company of Mondelez International and thus this part of the biscuit pie is also Modelez’s share in the biscuits market. Mondelez is actually a relatively new player in Pakistan’s candy and sweets industry.

The company first entered Pakistan in 1993 under the name of Cadbury Pakistan. Its largest-selling and iconic brands in Pakistan include Cadbury Dairy Milk, Tang and Cadbury Eclairs. The company employs more than 200 people in Pakistan, with manufacturing facilities in Hub, Balochistan, and a distribution network throughout the country. Continental biscuits Limited (CBL) was founded in 1984 by Mr. Hasan Ali Khan. It is now a joint venture with Mondelez International with a shareholding of 50.5% and 49.5% respectively.

Enter the Ismails

This is what we know up until now. The sugary snacks segment in Pakistan is worth more than Rs 250 billion and the biggest component in this are biscuits which have a market of around Rs 159 billion. Within this biscuit segment EBM is the leader with gross sales of Rs 81 billion and Continental Biscuits, which is majority owned by Mondelez Pakistan, has sales worth over Rs 43 billion. But a quick glance at the market share breakdown will tell you that there is one more major player in the running.

Ismail Industries comes in at third place on the biscuits market with a 15% share made up of gross sales worth Rs 23.85 billion. This is a little over half of the gross sales made by Continental which is in turn just over half of the total sales that EBM makes. But as we’ve discussed earlier, the reasons behind EBM’s success has been their ability to create biscuits that sell with chai. The fascinating thing about Ismail Industries’ involvement in the biscuit market is that they have done it through a product that is not really a biscuit.

According to the Euromonitor report we have used for this story, Peek Freans is the most sold biscuit brand in Pakistan. And while Continental Biscuits comes in second in terms of gross sales of biscuits, the second most bought brand of biscuits in Pakistan is actually Bisconni. This is owned and operated by Ismail Industries which also runs the famous Candyland brand. Now, Bisconni and Ismail Industries do not have many famous biscuits. Bisconni Chocolato is a chocolate flavoured biscuit that has done well and Bisconi’s Chocolate Chip Cookies have a similar story. But according to Ismail Industries’ own estimations, the biggest seller under the Bisconni brand name is Cocomo.

Cocomo really is a bit of a cultural icon. The small, chocolate filled, round treat is a favourite in school canteens and corner stores around the country. There are passionate debaters on social media that engage in Cocomo discourse and for the few months that Miftah Ismail was finance minister he was asked about Cocomo by almost every single person that interviewed him. In fact, Miftah was regularly hounded about the fact that a Rs 5 pack of Cocomo now contains only three cocomos in it — a matter many interviewers asked the former finance minister about to display the concept of shrinkflation.

{Note: During the course of his ministry, Profit interviewed Miftah Ismail on multiple occasions. Although questions regarding Cocomo were never officially asked, the matter was discussed off the record more than a few times. Mr Ismail was always kind enough to bear with the badgering.}

What is impressive about Ismail Industries being in third place in the biscuits segment is that they did so with a product that barely fits in the biscuit category. This points towards the wild popularity of Cocomo and Ismail Industries’ ability to understand what the consumers want. After all, the company has had a rich history of success in the sweet snacks industry particularly when it comes to candy.

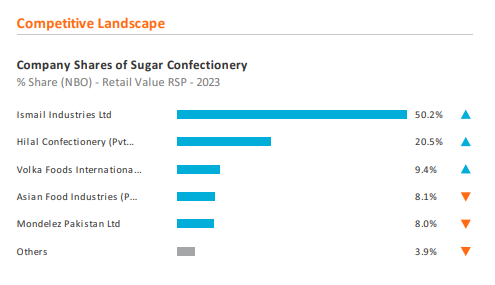

Founded in 1988, the company’s flagship brand has been Candyland. Underneath this the Ismails have remained market leaders in the sugar confectionery segment. In fact, according to a recent report, the most consumed sugary snack in Pakistan is Candyland’s Chilli Milli. They control more than half of the Rs 56.7 billion market that exists in Pakistan. The competition in this segment is not particularly tough. Hilal is number two with less than half of the gross sales total as Ismail and Mitchells has continued to see its fortunes dip. But within the sugar confectionery sector there is one other player that is small in terms of market share but big in stature.

Coming in at number five with an 8% share of the market is Mondelez. While they only made gross sales worth Rs 4.5 billion in this segment last year off products such as Trident gum and Halls lozenges, it is clearly a space in which Mondelez has decided to stick their foot and keep the possibility of growth open. While their primary business is very much in chocolate, Mondelez has a significant stake in the massive biscuits markets thanks to their ownership of Continental Biscuits and is trying to keep the door open on the sugar confectionery market.

Cadbury’s Kingdom

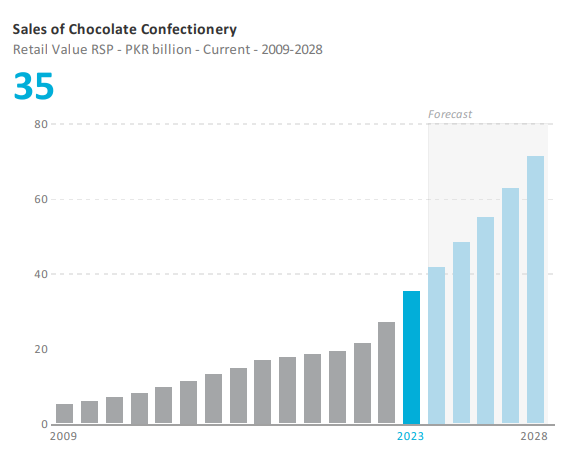

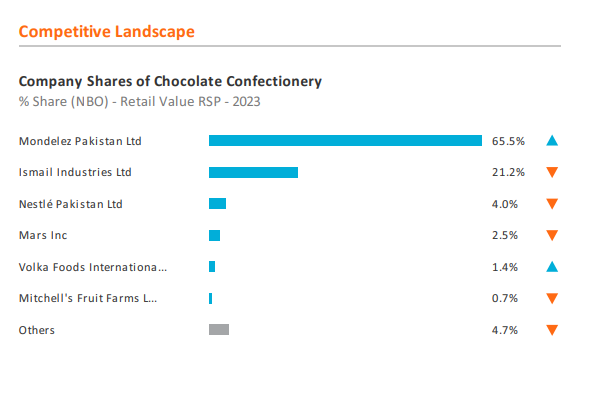

Chocolate is where Mondelez really takes the competition to the cleaners. In the world of chocolate Cadbury is King and Mondelez owns Cadbury. In Pakistan, the total sale of chocolates last year was worth Rs 35.2 billion. This is the smallest segment within the sugar snacks market in Pakistan.

But within this segment, Mondelez has everyone beat and controls over two thirds of the market with gross sales of nearly Rs 23 billion just last year. Within this, the top three most consumed chocolates in Pakistan are all Mondelez products. Cadbury Dairy Milk is the most popular accounting for nearly a third of all chocolate sales in the country followed by Cadbury Dairy Milk Bubbly and Cadbury Perk which both have around 14% and 13% of gross sales respectively.

The reason behind this is simply inertia. Chocolate is an indulgence purchase. Global trends have shown that most snack foods have faced declines in demand over the years as people have become more health conscious. But since chocolate has always been a guilty pleasure and an indulgence, the demand for it has remained relatively inelastic. It is also possible because Cadbury is the most affordable and accessible chocolate bar that is a foreign brand. Other chocolates like Mars, Snickers and Nestle’s KitKat are all acquired tastes and control 0.7% of the market share respectively. These chocolates mix other ingredients such as wafer, caramel, or nuts in it. Cadbury Dairy Milk on the other hand is a no fuss chocolate that is just chocolate without any added frills which is possibly why it is so firmly on top with over 32% of the market share.

While Mondelez is firmly on top in the chocolate industry, this is also another place where Ismail Industries has shown it is a mean competitor. Candyland Now is the fourth largest chocolate on the market in Pakistan after the three Cadbury flagships (Dairy Milk, Bubbly, and Perk) and controls 6% of the overall market. In fact, Ismail Industries has a total market share of 21.2% with gross sales of Rs 7.46 billion. While this is not even close to Mondelez, it is worth pointing out that Ismail Industries has a significantly bigger market share in the chocolate industry than Mondelez does in the sugar confectionery segment. Ismail Industries has more than half the market share of sugar confectionery while Mondelez has barely 8% of that market. In chocolates, which is a smaller segment than sugar confectionery, Ismail Industries has nearly three times the market share that Mondelez does in sugar confectionery.

What Mondelez and EBM might want to keep an eye on

So what can we learn from all of this information? Essentially the biggest player in the sweet snacks market is EBM with gross sales worth Rs 81 billion. But because they are restricted only to biscuits their portfolio is not very diverse. Their sales are only this large because the biscuits segment is larger than the chocolates and sugary confectionery segments combined. At the same time, Mondelez is a competitor to be feared. They are clearly in the lead in the chocolates segment which is the smallest of the three but are also number two on the biscuits segment because of their acquisition of Continental Biscuits.

And then there is Ismail Industries. The case of this company is slightly different. They started off with Candyland in the sugary confectionery segment producing hard candies, boiled sweets, and in particular jellies. Their products such as Chilli Milli and ABC Jelly have performed very well and they are firmly in first place in this segment. But they are also the only company of the three being discussed to be well placed in all three segments. In chocolates, they are behind only Mondelez and in biscuits they come out in third place behind EBM and the Mondelez owned Continental Biscuits. While their share of the market is small, the fact that they got a big chunk of it through a product like Cocomo speaks volumes to how popular their products are.

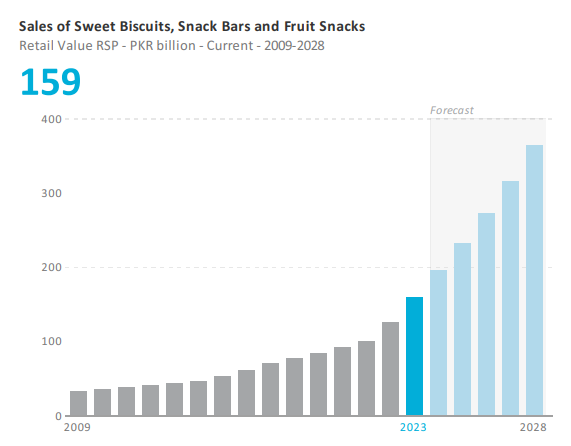

What is also quite impressive is the rate at which Ismail Industries has grown. In 2009 the company had made gross sales worth just over Rs 5.2 billion. According to their financials from last year the company made gross sales of over Rs 62 billion, indicating an increase of more than ten times in the last 15 years. But this growth has also been in line with the rate at which the market has increased. What is more telling is the bigger increase in market share that has taken place in the last five years or so. You see, from 2004 to 2009 the increase in gross sales was from around Rs 1.4 billion to Rs 5.2 billion. But if you see the financials since 2017, the increase in gross sales has been from Rs 24 billion to Rs 62 billion. While this is a smaller percentage increase in the past five years compared to the increase from 2004-09 the increase in comparison to the size of the market is larger.

In the Pakistani market for sweet snacks the two obvious players are EBM and Mondelez. EBM carries a legacy of over six decades and has become a mainstay in Pakistani homes, offices, and cafes. Using their early mover advantage and a hyper-focus on the biscuits segment they have maintained their position as the biggest player in the market. In comparison, Mondelez was actually quite late to the party.

When they first launched as Cadbury Pakistan in 1993 they were simply entering the chocolate market and helped to expand it as well. But with international backing and a huge brand name, Cadbury was able to assert its dominance. Its acquisition of Continental Biscuits Limited soon after entering Pakistan also entrenched it as an overall player in the sugar snacks industry, not just the chocolate segment.

And then there is Ismail Industries. The company that started off with Candlyland and a focus on sugary confectionery has over the years expanded its interests. It struck gold with the introduction of the Bisconni brand when they entered the biscuits segment with products like Cocomo. It has since also extended its reach into chocolates and has become the fourth largest company in the Pakistani snacks industry. Within sugary snacks, it trails only EBM and Mondelez.

What might be concerning for Mondelez and EBM is that even though Ismail Industries is a distant third, they have significant stakes in all three segments of the sugary snacks industry. With their roots firmly in place, Ismail Industries could one day threaten these two giants.

You’ve missed out the massive jump Ismail Industries has taken in exports through its supply of humus alternative to the UN WFP.

The unique thing about Ismail Industries is that they have done it through a product that is not really a biscuit.

Ismail Industries success is based on out of the box innovation.

Good efforts, but your fact & figure making us confused. you should segregate the companies by its products portfolio. we cannot base on Euro monitor data anymore. The export data of Danapak foods & Pearl Confectionery & Hilal Foods and other major companies of Punjab is missing.

what is the source of your percentage table your competitive landscape number percentage ???

how you findthe exact number or these are exact numbers percentage???

Other companies in the market are also increasing their sales and annual profits.