Following KIA’s lead three weeks ago, and MG’s a week later, Toyota, Hyundai, and Honda have all slashed their prices dramatically. Like dominoes, all three have announced their price cuts within a span of two days — with Hyundai and Honda being just hours apart.

The most noteworthy reduction across all models is the Fortuner G, which has seen its price plummet by a staggering Rs 13 lakh. Toyota also holds the distinction for the largest average reduction across its range — with an average cut of Rs 5 lakh, while Honda and Hyundai lag behind at approximately Rs 2 lakh per vehicle.

| Toyota’s Price Changes | ||||

| New Price | Old Price | Difference | Change | |

| Yaris 1.3 MT | Rs 44 lakh | Rs 45 lakh | Rs 1 lakh | 2% |

| Yaris 1.3 CVT | Rs 47 lakh | Rs 48 lakh | Rs 1 lakh | 2% |

| Yaris ATIV MT | Rs 47 lakh | Rs 48 lakh | Rs 1 lakh | 2% |

| Yaris ATIV CVT | Rs 49 lakh | Rs 50 lakh | Rs 1 lakh | 2% |

| Yaris AERO 1.3 | Rs 51 lakh | Rs 52 lakh | Rs 1 lakh | 2% |

| Yaris ATIV X MT | Rs 53 lakh | Rs 54 lakh | Rs 1.2 lakh | 2% |

| Yaris ATIV X CVT | Rs 56 lakh | Rs 58 lakh | Rs 1.2 lakh | 2% |

| Yaris AERO 1.5 | Rs 58 lakh | Rs 60 lakh | Rs 1.2 lakh | 2% |

| Corolla 1.6 MT | Rs 60 lakh | Rs 62 lakh | Rs 2 lakh | 3% |

| Corolla 1.6 CVT | Rs 66 lakh | Rs 68 lakh | Rs 2.1 lakh | 3% |

| Corolla 1.6 SE | Rs 72 lakh | Rs 74 lakh | Rs 2.4 lakh | 3% |

| Corolla 1.8 CVT | Rs 69 lakh | Rs 71 lakh | Rs 2.3 lakh | 3% |

| Corolla 1.8 CVT SR | Rs 75 lakh | Rs 78 lakh | Rs 2.5 lakh | 3% |

| Corolla 1.8 CVT SR Black | Rs 75 lakh | Rs 78 lakh | Rs 2.5 lakh | 3% |

| Revo G MT | Rs 1. 2 crore | Rs 1.24 crore | Rs 4.5 lakh | 4% |

| Revo G AT | Rs 1.25 crore | Rs 1.30 crore | Rs 4.7 lakh | 4% |

| Revo V | Rs 1.38 crore | Rs 1.44 crore | Rs 5.4 lakh | 4% |

| Revo Rocco | Rs 1.44 crore | Rs 1.52 crore | Rs 7.6 lakh | 5% |

| Revo GRS | Rs 1.54 crore | Rs 1.61 crore | Rs 7.9 lakh | 5% |

| Fortuner G | Rs 1.45 crore | Rs 1.58 crore | Rs 13.1 lakh | 8% |

| Fortuner V | Rs 1.70 crore | Rs 1.81 crore | Rs 11 lakh | 6% |

| Fortuner Sigma 4 | Rs 1.80 crore | Rs 1.91 crore | Rs 10.8 lakh | 6% |

| Fortuner Legender | Rs 1.90 crore | Rs 2.01 crore | Rs 11.3 lakh | 6% |

| Fortuner GRS | Rs 1.99 crore | Rs 2.11 crore | Rs 11.9 lakh | 6% |

| Honda’s Price Changes | ||||

| New Price | Old Price | Difference | Change | |

| City 1.2 M/T | Rs 47 lakh | Rs 48 lakh | Rs 1 lakh | 2% |

| City 1.2 CVT | Rs 48 lakh | Rs 49 lakh | Rs 1 lakh | 2% |

| City 1.5 CVT | Rs 54 lakh | Rs 55 lakh | Rs 1.1 lakh | 2% |

| City 1.5 Aspire M/T | Rs 56 lakh | Rs 58 lakh | Rs 1.1 lakh | 2% |

| City 1.5 Aspire A/T | Rs 58 lakh | Rs 60 lakh | Rs 1.3 lakh | 2% |

| BRV | Rs 63 lakh | Rs 65 lakh | Rs 2.3 lakh | 4% |

| HRV VTI | Rs 76 lakh | Rs 79 lakh | Rs 2.5 lakh | 3% |

| HRV VTI-S | Rs 79 lakh | Rs 82 lakh | Rs 3 lakh | 4% |

| Civic | Rs 83 lakh | Rs 86 lakh | Rs 2.7 lakh | 3% |

| Civic Oriel | Rs 87 lakh | Rs 89 lakh | Rs 2.9 lakh | 3% |

| Civic Rs | Rs 99 lakh | Rs 1.02 crore | Rs 3 lakh | 3% |

| Hyundai’s Price Changes | ||||

| New Price | Old Price | Difference | Change | |

| Elantra 1.6 | Rs 64 lakh | Rs 66 lakh | Rs 2 lakh | 3% |

| Elantra 2.0 | Rs 69 lakh | Rs 71 lakh | Rs 2 lakh | 3% |

| Tucson GLS | Rs 72 lakh | Rs 74 lakh | Rs 2 lakh | 3% |

| Tucson GLS Sport | Rs 80 lakh | Rs 82 lakh | Rs 2 lakh | 2% |

| Tucson Ultimate | Rs 87 lakh | Rs 89 lakh | Rs 2 lakh | 2% |

| Sonata 2.0 | Rs 1 crore | Rs 1.03 crore | Rs 3.5 lakh | 3% |

| Sonata 2.5 | Rs 1.09 crore | Rs 1.13 crore | Rs 3.5 lakh | 3% |

| Porter High Deck | Rs 37 lakh | Rs 38 lakh | Rs 1 lakh | 3% |

| Porter Flat Deck | Rs 37 lakh | Rs 38 lakh | Rs 1 lakh | 3% |

| Porter Deck Less | Rs 37 lakh | Rs 38 lakh | Rs 1 lakh | 3% |

| Porter High Deck with AC | Rs 38 lakh | Rs 39 lakh | Rs 1 lakh | 3% |

| Porter Flat Deck with AC | Rs 38 lakh | Rs 39 lakh | Rs 1 lakh | 3% |

| Porter Deck Less with AC | Rs 38 lakh | Rs 39 lakh | Rs 1 lakh | 3% |

What catalysed these drastic price slashes? The immediate catalyst is the stabilisation of the Pakistani Rupee at a rate of $1:Rs 280 after enduring months of volatility. The official interbank rate for the Pakistani Rupee did not mirror the tumult that automotive companies grappled with on importing parts — they experienced significant fluctuations in the open market and liquidity shortages through official channels for various parts of the summer.

However, another contributing factor is automotive manufacturers aligning their prices with the values of vehicles in the secondary market. Syed Asif Ahmed, General Manager of Sales and Marketing at MG Motors, expounded on the significance of both factors to Profit last week when MG decided to revise its prices.

Read more: Hot on KIA’s heels, MG is reducing prices too. Here’s what’s happening

In essence, Ahmed had forecasted to Profit that more price reductions were on the horizon due to the Rupee’s newfound stability and because of the markdown prices vehicles were commanding in the secondary market. For what it’s worth, Ahmed’s prediction proved accurate. Vehicles, even brand new ones, were trading at substantial discounts in the secondary market — ranging from Rs 80,000 to Rs 20 lakh.

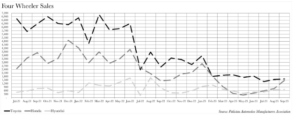

The timing of these downward revisions is also noteworthy. One reason why vehicles were selling for markdown prices in the secondary market is due to a significant contraction in vehicle demand over the past year. Our three protagonists have all seen better days, with their current sales figures paling in comparison to those they achieved in 2021 and 2022.

Will these price reductions breathe new life into sales? According to Muhammad Sabir Shaikh, Chairman of the Association of Pakistan Motorcycle Assemblers, “Sales are likely to remain subdued because prices remain prohibitively high and due to constraints imposed by the State Bank on automotive leasing”.