It is generally assumed that if one is the owner of a large plant in Bin Qasim Port – which one has spent a lot of funds on and installed ‘state-of-the-art’ machinery at – that, at the bare minimum, one would like to keep this plant open.

But if one’s plant chiefly manufactures a singular product, and demand for that product dwindles: then what?

That is the predicament that Lotte Chemical Pakistan Limited (Lotte Chemicals) finds itself in. The year 2023 has not been kind to the company; indeed, recurring suspensions in plant operations have become a defining feature, painting a tumultuous picture for the company.

On October 17, 2023, Lotte Chemicals once again announced to the Pakistan Stock Exchange (PSX) that it was temporarily suspending operations at its plant from October 18 to October 29. The reason cited? “Lower downstream demand and the need for effective inventory and production management.”

But October 30 came and went, and the expected resumption of plant operations never materialised. Instead, the company declared an extension of the suspension until November 12, once again attributing it to “decreased downstream demand”.

Cumulatively, plant operations have been suspended for twenty-six days. There has been no subsequent communication on the PSX about whether operations have recommenced.

This is only the second time operations at the plant have been suspended. Previously, on March 14, 2023, the company had announced a shutdown from March 15 with no specified reopening date. Operations resumed on May 1 after a considerable 47-day hiatus

The supply chain

Lotte Chemicals keeps blaming “low downstream demand”. Before understanding what is happening with demand, let’s explain downstream industries, which refers to the goods or services that arise further along in the supply chain, closer to the end consumers or users of those goods or services.

What does the supply chain look like in this case? Lotte Chemicals produces purified terephthalic acid, or PTA (we’ll get to the scale of production in just a bit). PTA is one of the primary raw materials used in the production of polyethylene terephthalate, or PET resin. This resin is used in two ways: first, to make PET bottles, which are plastic bottles used for packaging various liquids such as water, carbonated drinks, juices, sauces and oils. Second, it is used to manufacture polyester fibres, which can be further processed to create polyester staple fibre, or PSF. PSF is used in textiles, cushioning material, carpets, and non-woven fabrics.

More than 70% of PSF is supplied to the textile value chain, i.e. the spinning sector, according to the Pakistan Credit Rating Agency Limited (PACRA)’s Polyester report of February 2023, The remaining PSF is supplied to the PET packaging industry.

Now, saying Lotte Chemicals simply produces PTA is a bit of an understatement. It is in fact the sole domestic producer of PTA in Pakistan. The company began its life in 1996, when ICI Pakistan Ltd decided to construct a PTA plant, with the plant becoming operational in 1998. The plant business separated from ICI in 2000, and was bought in 2008 by AzkoNobel, and then in September 2009 by Lotte, a a South Korean conglomerate (hence the name change to Lotte Chemical Pakistan Ltd.)

That plant has the capacity to produce 520,000 tonnes of PTA annually. Which is just as well, as Pakistan’s total demand for PTA stands at roughly 700,000 tons annually, according to Rao Aamir Ali, a senior analyst at Arif Habib Limited. The remaining 200,000 tons of PTA is imported. That means Lotte Chemical’s market share domestically is 100%, while its overall market share stands at around 70%.

Since its inception, Lotte Chemicals has focused on meeting Pakistan’s PTA demand. However, if domestic demand slows down, Lotte Chemicals exports to other countries, as its product meets international quality standards and is well accepted by customers in Asia and the Middle East region.

Similarly, Lotte Chemicals also imports from Asia and Middle East: specifically, paraxylene (PX), which is one of the two key raw materials along with crude oil required to make PTA. That means the price and production on PTA depends on the cost prices of these two (imported) materials.

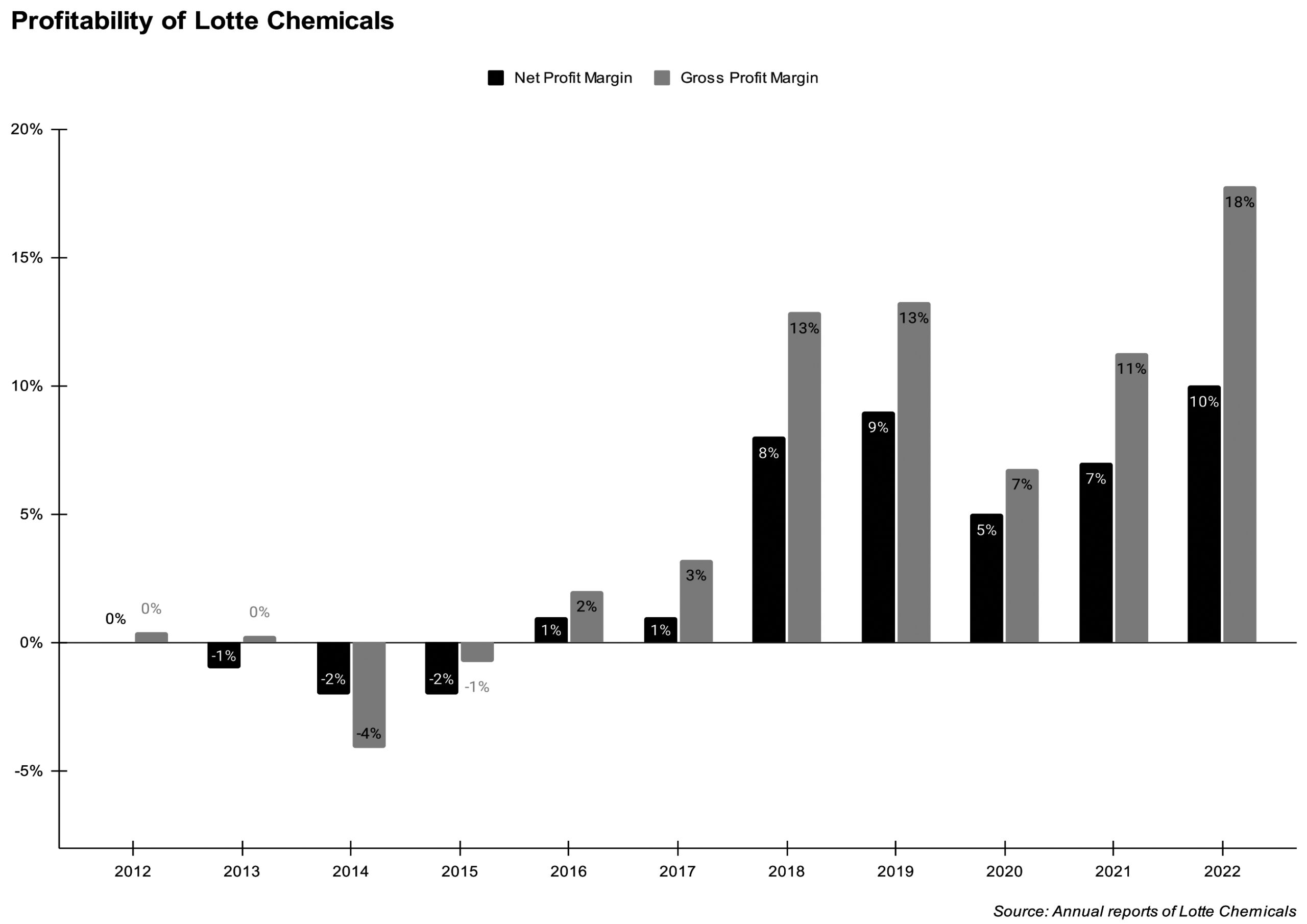

Lotte’s financials 2013-2021

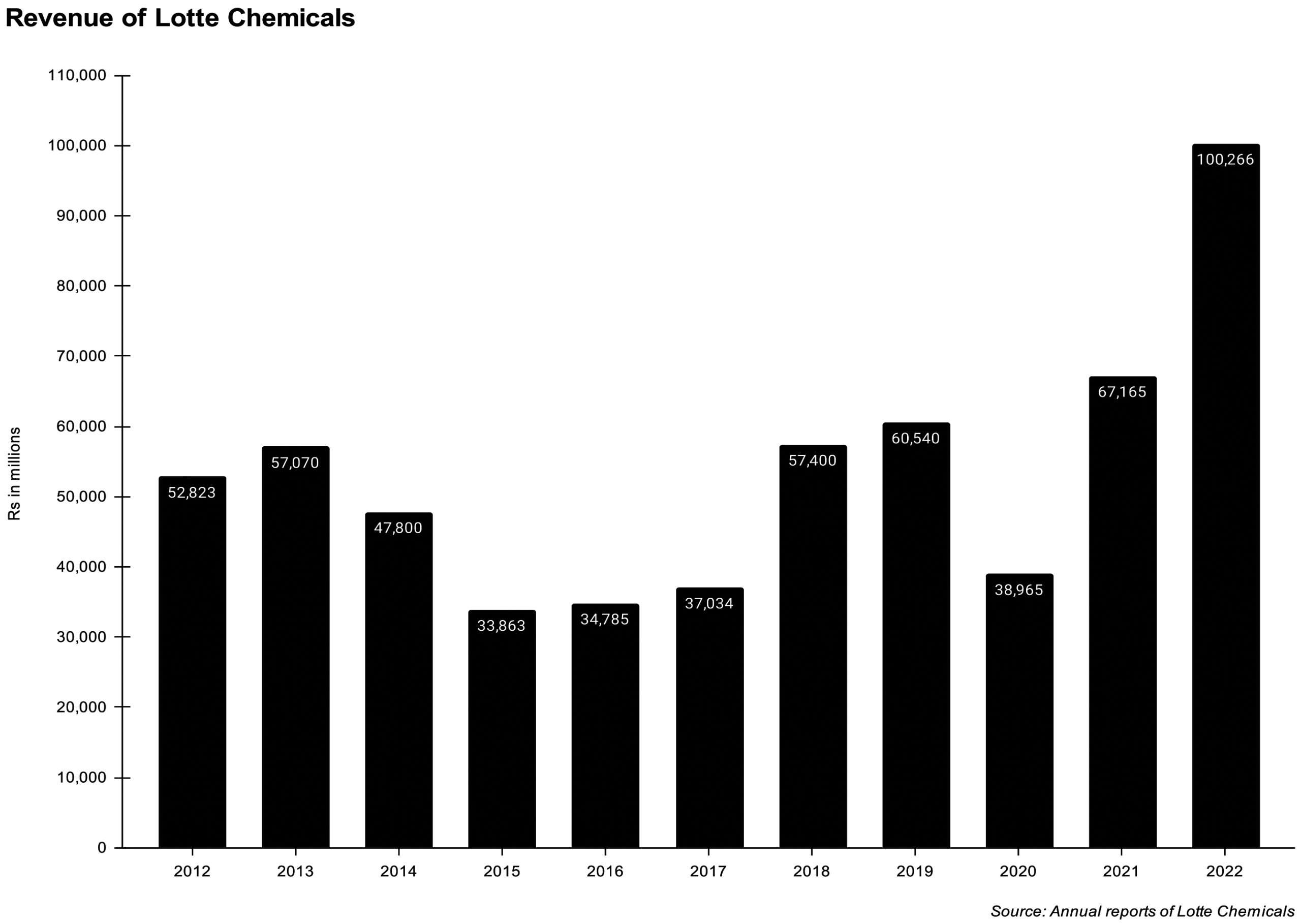

As expected of a sole producer, Lotte Chemicals’s revenues have generally increased. The only times revenue declined were during the period 2014-2015 and in 2020, due to Covid-19.

In 2014, a 16% drop in revenues occurred, mainly due to lower PTA prices. The reduced PTA margin against PX, higher energy costs, coupled with inventory losses due a drop in price of PTA at year-end, led to a decreased overall profit margin. Moreover, the company had to bore outward freight charges as export sales increased, resulting in increased distribution and selling expenses. Consequently, the company’s net loss doubled to Rs 1,100 million as compared to Rs 498 million in the previous year.

The year 2015 again brought challenging conditions for the local polyester industry due to increased taxation, higher energy costs, and reduced textile exports. This strained PSF producers who were facing tough price competition from inexpensive imports, particularly from China. Moreover, the PET industry saw reduced demand due to bottle industries adopting cost-cutting measures with lighter bottles. All of this culminated into a 3% decrease in sales volume for Lotte Chemicals, as compared to 2014.

However, at the end of 2015, the domestic PSF industry successfully levied duties on Chinese PSF producers, which contributed to Lotte Chemicals’ turnaround in 2016. That year, the anti-dumping duties and better boosted Pakistan’s domestic polyester industry. Consequently, there was a notable 15% surge in PTA demand, leading Lotte Chemicals to attain an unprecedented domestic sales record of 492,192 tonnes.

Over the next few years, Lotte Chemicals witnessed a steady rise in revenue, barring a substantial 36% decline in 2020 attributed to global lockdowns that affected PTA demand. Consequently, the company underwent a 54-day plant shutdown, causing a 14% reduction in production and a 12% decrease in sales volumes. The gross profit margin tumbled to 6.8%, while the net profit margin plummeted to around 5% in 2020.

However, the gloom was fleeting as 2021 heralded resurgence for Lotte Chemicals, fueled by heightened demand and improved prices. That resulted in a remarkable 72% surge in revenue, and an impressive 11% gross profit margin in 2021.

Gloomy predictions in 2022

Despite the improvement in revenues and margins noted in the 2022 annual report for Lotte Chemicals, heightened inflation significantly impacted consumer behavior. This resulted in a decrease in consumer spending, with individuals prioritizing essential goods over luxury items such as textiles. Consequently, domestic demand for PTA in 2022 declined by 6% compared to the previous year.

In fact, the 2022 annual report foresaw a tough road ahead in 2023, due to sluggish global economic growth, hinting at an imminent global recession. The report predicted the prevailing shortage of foreign exchange in Pakistan presented significant obstacles in fulfilling downstream customers’ PTA demand, thereby further complicating operational dynamics.

The year 2023: downstream industries wobble

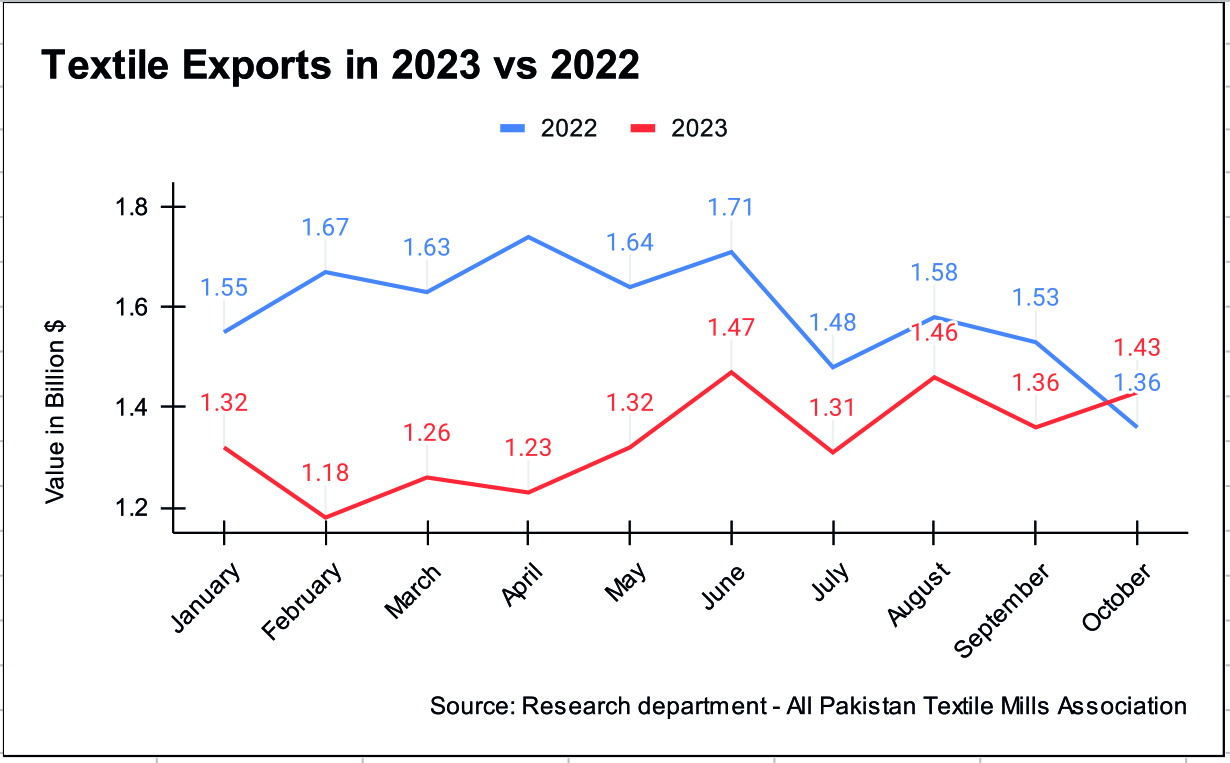

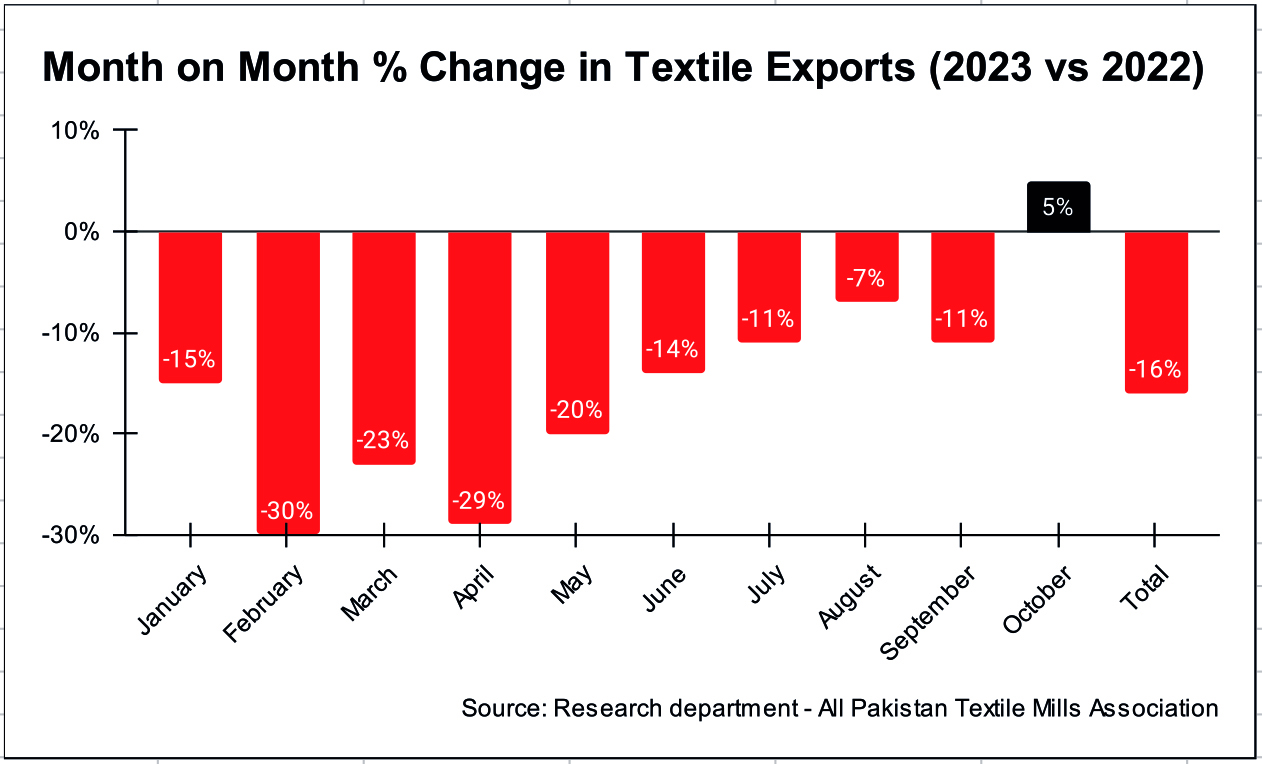

And then 2023 happened. The textile industry was hit by the double setbacks of dwindling exports and operational setbacks. The initial nine months of the year witnessed a stark decline in textile exports compared to the previous year. This downturn forced several companies to either temporarily shut down or scale back their operations. Notably, textile industry entities like Shahzad Textile Mills Limited and Elahi Cotton Mills Limited announced temporary closures in October alone, mirroring the industry’s distress.

According to Ali, Lotte Chemicals had to suspend plant operations for the second time in nearly seven months, due to declining demand in the downstream industry.

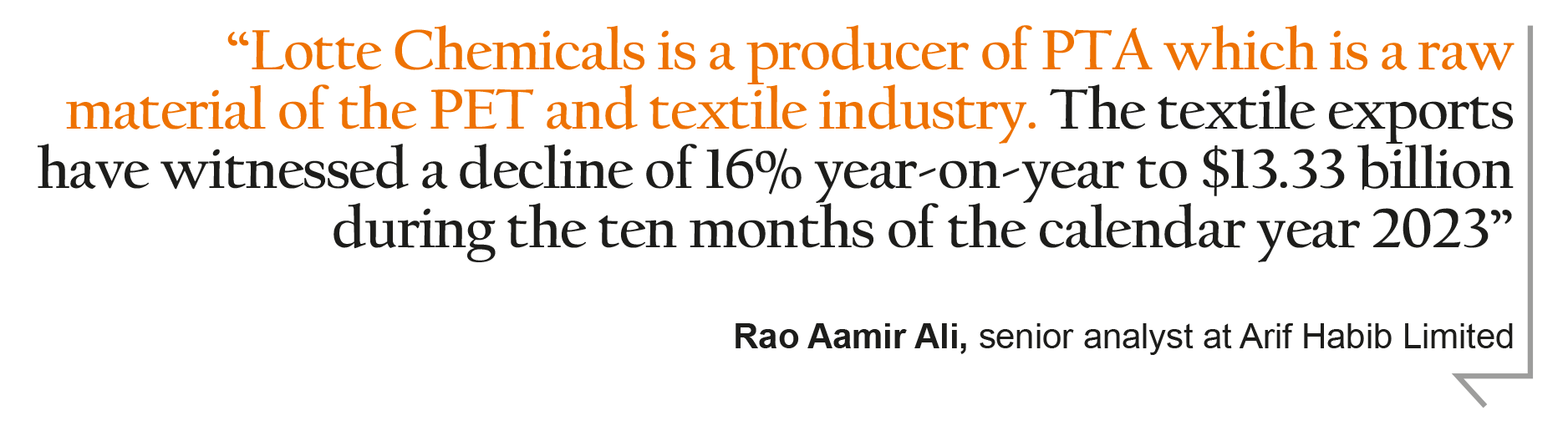

“Lotte Chemicals is a producer of PTA which is a raw material of the PET and textile industry. The textile exports have witnessed a decline of 16% year-on-year to $13.33 billion during the ten months of calendar year 2023,” said Ali.

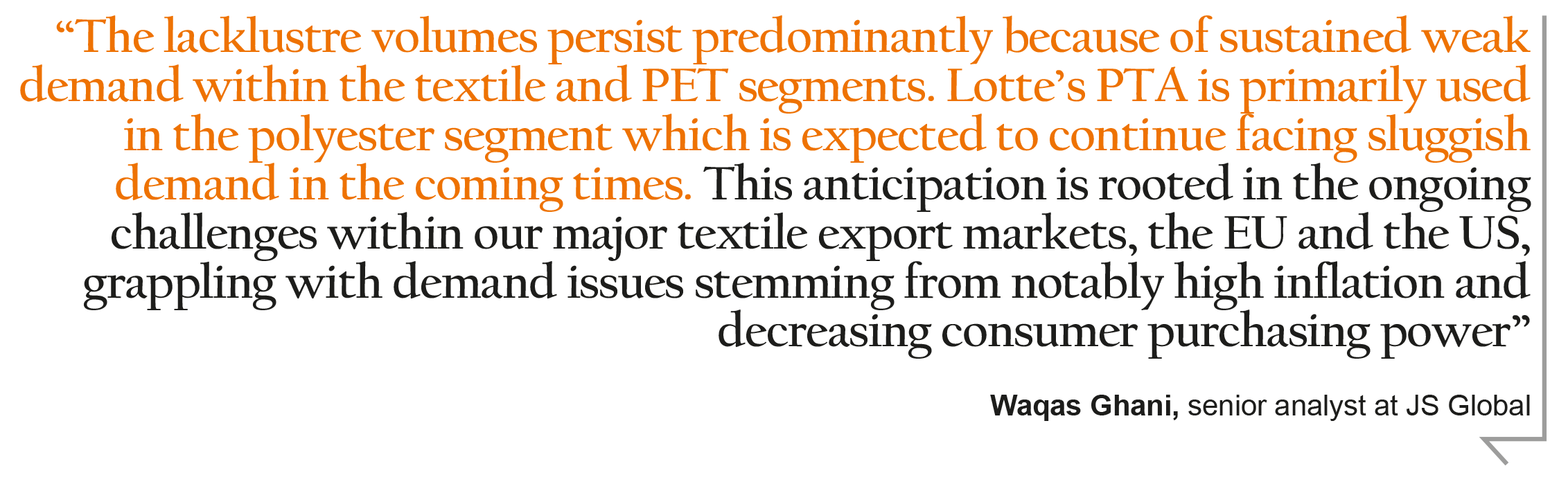

Echoing similar sentiments, Waqas Ghani, deputy head of research at JS Global said, “The lacklustre volumes persist predominantly because of sustained weak demand within the textile and PET segments.”

“Lotte’s PTA is primarily used in the polyester segment which is expected to continue facing sluggish demand in the coming times. This anticipation is rooted in the ongoing challenges within our major textile export markets, the EU and the US, grappling with demand issues stemming from notably high inflation and decreasing consumer purchasing power,” highlighted Ghani.

Just like the textile industry, demand within the PET industry has also declined. According to a PACRA rating report of Pakistan Synthetics Limited (a player in the PET industry), the tough economic environment has reduced the purchasing power of the consumer and had a negative impact on the food and beverage segment.

In the chemicals industry, other chemical companies have also been grappling with plant shutdowns in 2023. Take for example Sitara Peroxide Limited (Sitara Peroxide), which also suspended plant operations twice in 2023. Sitara Peroxide suspended plant operations for 49 days from January 13 to March 2 owing to economic downturn, maintenance delays, and unresolved import issues.

However, this resumption of operations did not last long. From July 7, Sitara Peroxide witnessed recurrent shutdowns spanning weeks and months. Issues with raw material availability and the need for extensive maintenance work led to multiple interruptions, totaling over 100 days of suspended operations. On November 7, 2023, Sitara Peroxide announced plant operations suspension for another 30 days.

The financial hit to Lotte Chemicals

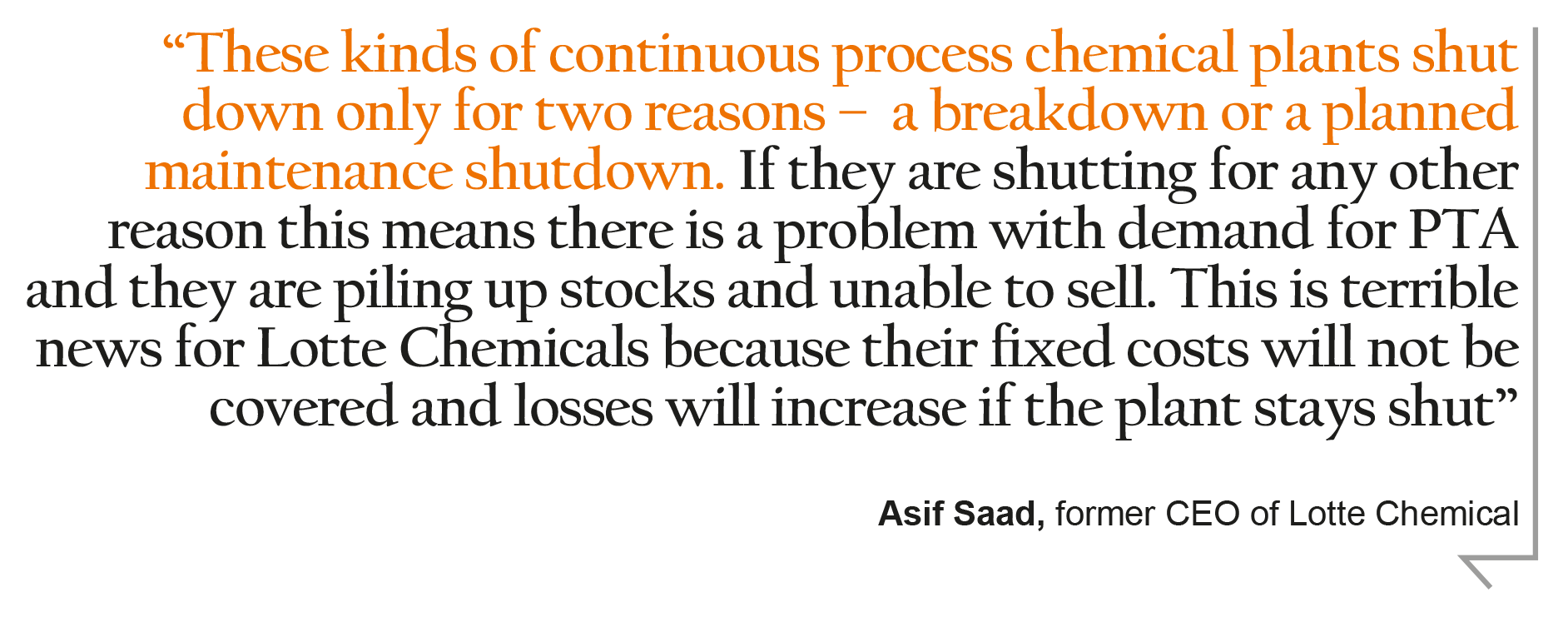

Profit reached out to Asif Saad, who was previously CEO of Lotte Chemicals between January 2008 and April 2014. He said, “These kinds of continuous process chemical plants shut down only for two reasons – a breakdown or a planned maintenance shutdown. If they are shutting for any other reason this means there is a problem with demand for PTA and they are piling up stocks and unable to sell. This is terrible news for Lotte Chemicals because their fixed costs will not be covered and losses will increase if the plant stays shut.”

[Saad would certainly know: during his tenure as CEO, Lotte Chemicals faced three plant shutdowns, in 2010, 2012, and 2013 respectively. In 2010 and 2013, operations were suspended due to overhauling of the plant which is carried out periodically for maintenance purposes. In 2012, an 11-day outage was caused by a sudden shutdown of a supplier’s manufacturing facilities.]

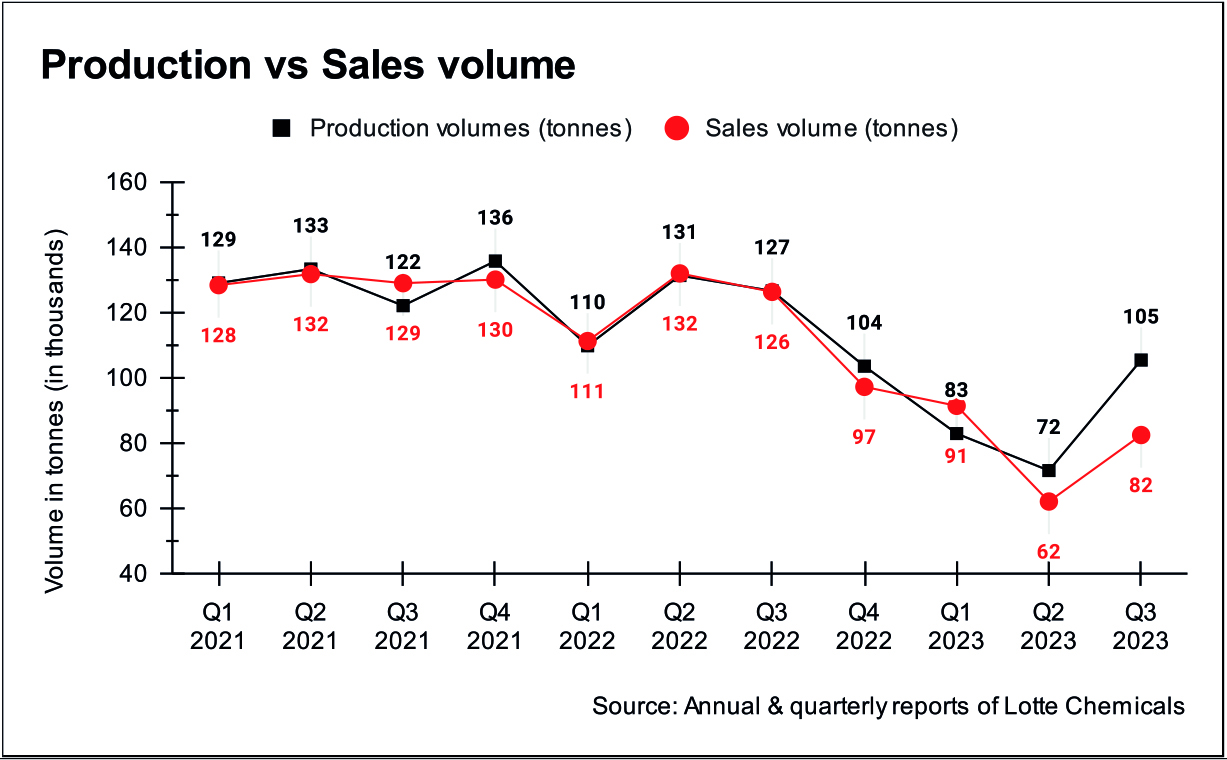

Things are certainly not looking good this year. In the first quarter of 2023, plant operations were suspended for 17 days, causing a 20% drop in production volume and a 6% decline in sales compared to the previous quarter. The reduced availability of PTA due to foreign exchange constraints led to producers curtailing operations. Despite this, demand remained resilient due to Ramadan, and revenues increased by 9% due to increased PTA prices, generating a gross profit of Rs 4,439 million.

Things are certainly not looking good this year. In the first quarter of 2023, plant operations were suspended for 17 days, causing a 20% drop in production volume and a 6% decline in sales compared to the previous quarter. The reduced availability of PTA due to foreign exchange constraints led to producers curtailing operations. Despite this, demand remained resilient due to Ramadan, and revenues increased by 9% due to increased PTA prices, generating a gross profit of Rs 4,439 million.

Moving into the second quarter, plant operations remained suspended from the previous quarter, extending through the entire month of April and recommencing only on May 1. This prolonged halt stemmed from sluggish downstream sales and unavailability of raw materials exacerbated by the prevailing economic conditions. Consequently, the extended suspension took a toll on both production and sales volumes, culminating in a staggering 45% drop in revenue compared to the preceding year. Consequently, the gross profit dwindled to Rs 2,000 million.

In the third quarter, while plant operations were not halted, sales and production volumes were significantly lower; demand had been affected by high energy costs, exchange rate volatility, and inflation. This resulted in a 20% decrease in revenue compared to the previous year, and a lower gross profit of Rs 3,417 million.

So, inflationary pressures, soaring energy expenses, currency constraints, high operational costs: will things look up for Lotte Chemicals anytime soon? Hardly: Ali told Profit that the government’s recent hike in gas prices from Rs 1,100 per mmbtu to Rs 2,400 per mmbtu, is set to inflate input expenses for Lotte Chemicals. Coupled with this, the global PTA margin remains meagre, standing at approximately $100 per ton. And downstream industries persistently show a noticeable dip in demand.

Lotte Chemicals is beholden to both global and domestic external factors beyond its control. Things will have to change swiftly, or the company might have to prepare for a third plant shutdown – not of its own making.

you have forgotten to mention that Lotte has sold this plant to Lucky group.

the photo attached in your article is the Lotte chemical titan in malaysia, not pakistan. Please remove and replace with correct photos to avoid misleading

yes right

Hello! It’s truly enjoyable to communicate with you here. Your shared thoughts are interesting and thought-provoking.

Reading this information from different perspectives is a pleasure for me.

I would always like to follow your meaningful and positive contributions. Have a great day!