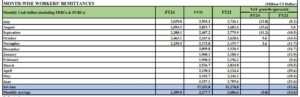

Pakistan received $2.2 billion in remittances from its overseas workers in November 2023, a 4 percent increase from the same month last year, but a 9 percent decrease from October 2023, according to the latest data from the State Bank of Pakistan (SBP).

Workers’ remittances inflow of $11 billion has been recorded during the first five months (July-November) of FY24, a 10 percent decrease from the same period last year, the SBP data showed.

The main sources of remittances in November were Saudi Arabia ($540.3 million), the UAE ($409.4 million), the UK ($341.7 million) and the USA ($261.5 million).

The remittances data comes ahead of the IMF’s executive board meeting on January 11, 2024, where it will decide on the release of the next $700 million tranche from its $3 billion loan programme to Pakistan. Pakistan received the first tranche of $1.2 billion in July 2023.

The IMF has projected that Pakistan’s remittances will decline by $3.5 billion to $29.377 billion in the current fiscal year ending on June 30, 2024, due to the adverse effects of economic downturn.

The IMF has also warned that Pakistan’s oil import bill will increase from $15.3 billion to $17.63 billion in the same period, putting pressure on its foreign exchange reserves and balance of payments.

According to the SBP, Pakistan’s forex reserves held by the central bank dropped by $237 million to $7.020 billion as of December 1, 2023. The country’s total reserves have been decreased by $286 million to $12.107 billion. The SBP expects its reserves to reach $9 billion by the end of the fiscal year.