Merit Packaging Limited, a leading manufacturer of packaging materials, has announced that it will sell its land and factory building in Korangi Industrial Township, Karachi, to its related party SIZA Services (Private) Limited, for Rs 1.55 billion, amid shareholders approval.

An extraordinary General Meeting (EOGM) of Merit Packaging will be held on Thursday, February 15, 2024, to seek approval of members to dispose off the Land and Factory Building.

The company said that the proceeds from the sale would be used to settle the loan outstanding of Rs 1.45bn towards the lenders namely SIZA (Private) Limited, SIZA Commodities (Private) Limited and Premier Fashions (Private) Limited, which are projected to mature within the next two quarters.

Despite the positive operating profit in 2022 and 2023, the company reported net losses in both years after interest and tax expenses were deducted from operating profits.

More specifically, the company made an operating profit of Rs 0.28 billion in 2023, which was completely wiped off by Rs 0.34 million of financial charges, leading to a net loss of Rs 0.14 billion.

The primary reason for generating net losses in recent years is higher finance costs. In 2023 alone, the reported finance costs were Rs 0.34 billion.

Read This: Merit Packaging is selling off its land and building. Why?

The company forecasts that if proceeds from the sale of the building and land are used to pay Rs 1.5bn loan, then an amount of Rs 0.34 billion will be reduced in finance cost, leading to annual savings before tax of Rs 0.32 billion – all these financial figures are anticipated by the company, if shareholders approve the lease model.

The company will potentially save Rs 0.23 billion after tax per year after selling its land and factory building, leading to savings per share of Rs 1.14.

The proceeds from the land and building will also provide additional liquidity to the Company for the utilization in running and managing the working capital requirement and investment in the profitable business avenues.

The company also said that the purpose of leasing back the land and factory building was to ensure the uninterrupted continuation of the company business and that the directors had no interest in this matter except to the extent of their directorship in the company and payment of remuneration.

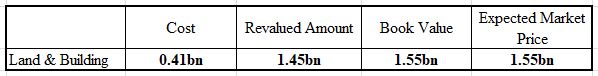

Particulars of assets cost, revalued amount, book value, and expected market price:

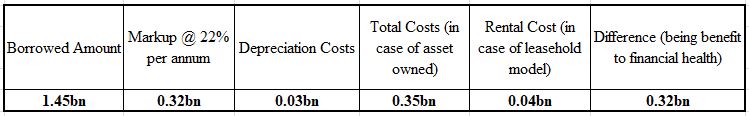

Borrowing costs versus Rental Costs to be borne by the Company:

Therefore, if the shareholders approve the disposal of land and buildings, then potentially this option can help the company save 0.32bn as compared to owing the assets.

THE ONLY LEGITIMATE CRYPTO RECOVERY EXPERT….!!!

Good day Audience, I want to use this great medium to announce this information to the public about Mr MORRIS GRAY. few months back, I was seeking an online BTC investment plan when I got scammed for about $172,000. I was so down and didn’t know what to do until I came across a timeline about Mr MORRIS GRAY. so I reached out to him and to my greatest surprise, they were able to recover all the funds which I had previously lost to the Devils. I am so glad to share this wonderful news with you all because it cost me nothing to announce a good and reliable Hacker as Mr MORRIS GRAY, His direct email is Morris Gray 830 at gmail dot com, WhatsApp: +1 (607) 698-0239…..!!!>