Last week, Merit Packaging, one of the larger packaging companies in Pakistan, informed the stock exchange that it plans to sell its factory building and land situated in Karachi’s Korangi Industrial area.

And no, this does not mean the company is shutting down its operations. Instead, Merit’s board of directors disclosed their plans to enter a lease or rental agreement for the same property with the prospective purchaser. In simple words, the plan is to sell the factory building, along with the land on which it is built, and rent it back from the new owner of the real estate asset.

The company has called an Extraordinary General Meeting (EGM) on Thursday, February 15, 2024, to get shareholders’ approval for this plan. The resolution will stand passed if 75% or more shareholders present in the EGM vote in favour of the sale.

Why is Merit selling?

Waqas Ghani, Deputy Head of Research at JS Global Capital, told Profit, “During the outgoing year, Merit got its assets revalued and resultantly recorded a surplus of Rs 1.39 billion. In light of this, the company has recently expressed its intent to engage in a sale and leaseback arrangement, anticipating benefits such as immediate cash inflow and enhanced operational flexibility.”

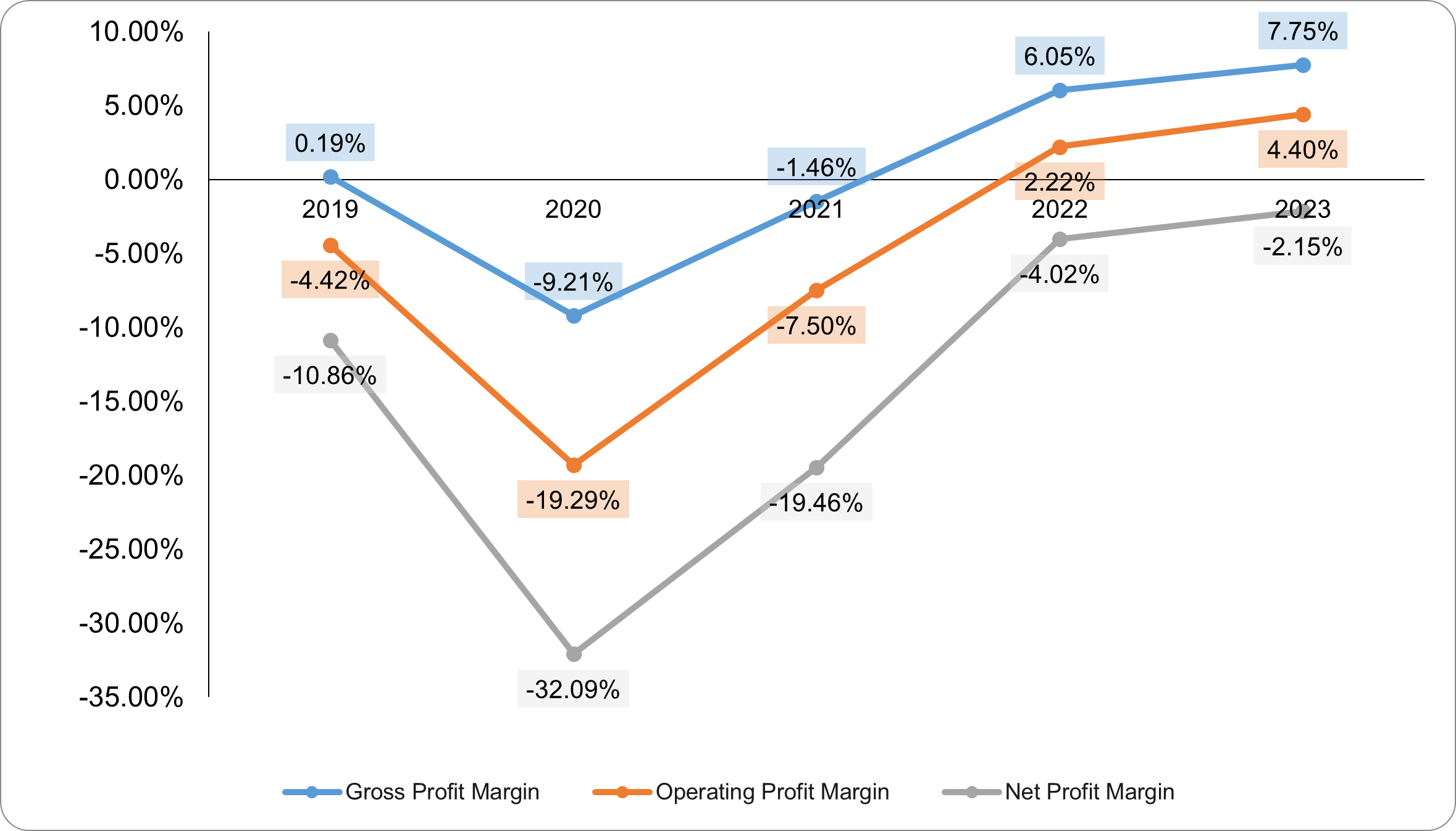

The company has been experiencing losses for at least the last five years. However, in the last two years, there has been some improvement which has allowed the company to post a profit on its operations.

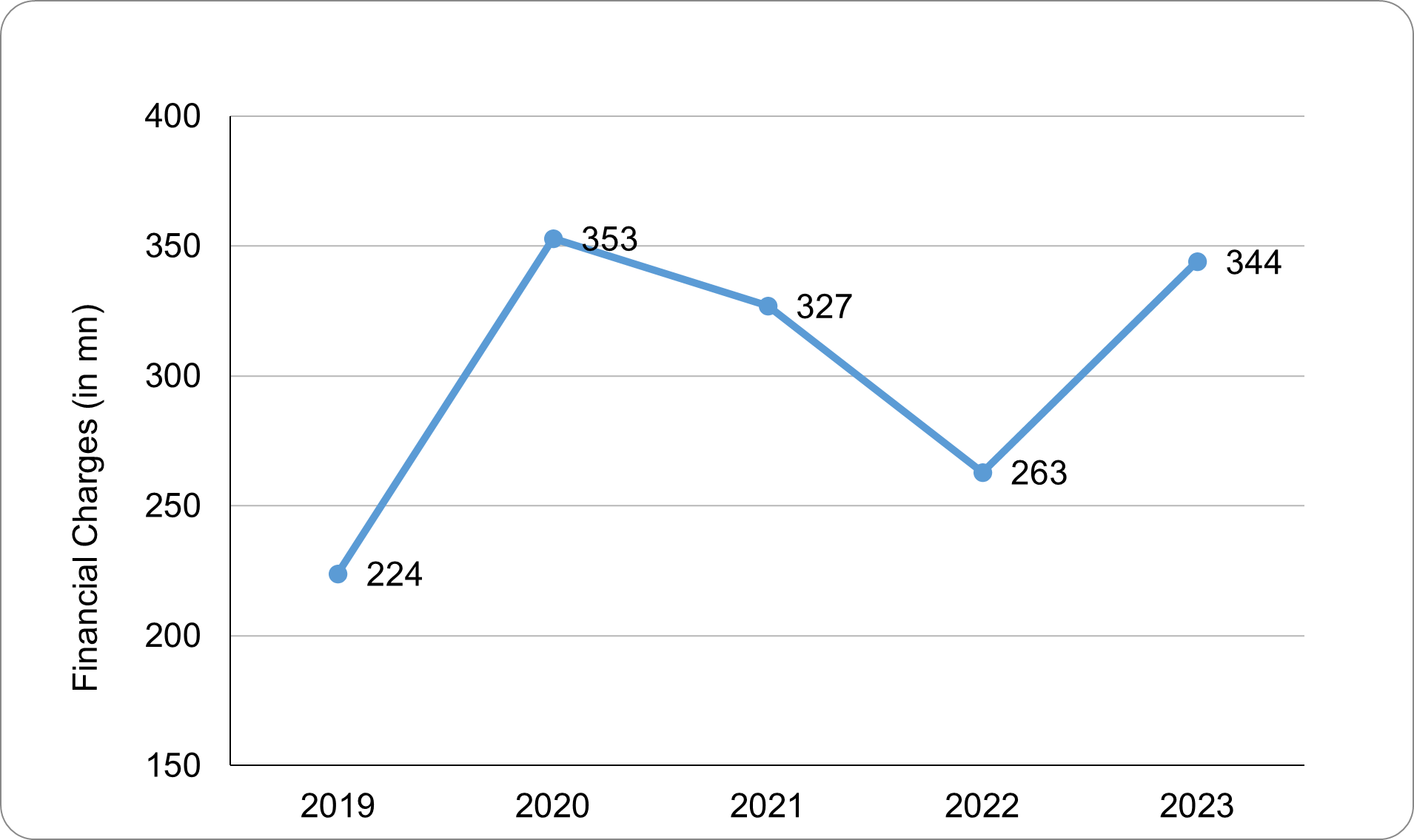

But despite the positive operating profit in 2022 and 2023, Merit Packaging reported net losses in both years after interest and tax expenses were deducted from operating profits. More specifically, the company made an operating profit of Rs 279 million (Rs 28 crores) in 2023, which was completely wiped off by Rs 344 million (Rs 34 crores) of financial charges, leading to a net loss of Rs 136 million (Rs 13 crores).

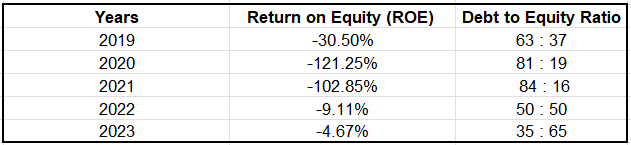

This is despite the fact that the company has actively reduced its dependence on debt over the last few years. Presently, 65% of the company’s assets are financed through shareholders’ money, with only 35% financed through debt. Just two years ago, the balance clearly favoured debt when 84% of the assets were financed through debt. However, this still has not led to decreased interest expense for the company in a high-interest environment, where debt providers now demand more than 22% interest rates.

Iqbal Ali Lakhani, chairman of Merit Packaging, highlighted the same issue in the 2022-2023 annual report. “Despite these macroeconomic challenges, the company has been able to sustain growth momentum and registered a considerable increase in revenue by 51% to Rs 6,340 million and consequently declared a reasonable operating profit of Rs 278 million, however, the same could not be significantly translated into the bottom-line due to hefty surge in finance costs.”

And even though the company did not disclose what it plans to do with the cash it will generate from the sale of its real estate asset, it is likely that the proceeds will help repay expensive debt, leading to lower finance costs going forward.

Editor’s Note: The public announcement by Merit Packaging does leave a lot wanting. Investors should have been informed clearly of the reason for the sale and what the company plans to do with the money. Also, it should be disclosed if a sponsor shareholder is an interested buyer. And even though these points are expected to be disclosed through subsequent announcements, we feel the best practice is to disseminate all price-sensitive information as soon as possible.

How much can Merit save?

The land and building in question were revalued at Rs 1.45 billion (Rs 145 crores) excluding plant and machinery. Assuming it will be sold close to this figure and the company decides to at least repay its long-term debt of Rs 1.3 billion (Rs 130 crores), the company can save approximately Rs 310 million (Rs 31 crores) in finance costs, assuming an interest rate of 24%.

Are shareholders ecstatic?

Given the rental yields in Pakistan range between 3% to 7%, it is reasonable to assume that the rent paid by the company to the new owner of the factory building will be insignificant compared to the reduction in finance costs if the company chooses to pay back its debt. This could potentially make Merit a profitable company once again.

However, right after the announcement, the company’s share price, instead of increasing, dropped from Rs 13.34 to Rs 12.63 – a 5.32% reduction despite increased shares trading volume. A stock broker, on the condition of anonymity, explained this phenomenon, “Since Merit’s share price had consistently increased in the days and weeks prior to the announcement, it is possible that some insiders might have bought the shares before the public announcement, driving up the price then, and are now selling their shares leading to a drop in the price now.”

Only the regulators with access to otherwise confidential trading data may want to investigate this.

Profit reached out to Amir Chapra, CEO Of Merit Packaging, for his comments on all these matters, but he declined to respond stating “I can not disclose any details before the EOGM on 15th Feb, 2024”.