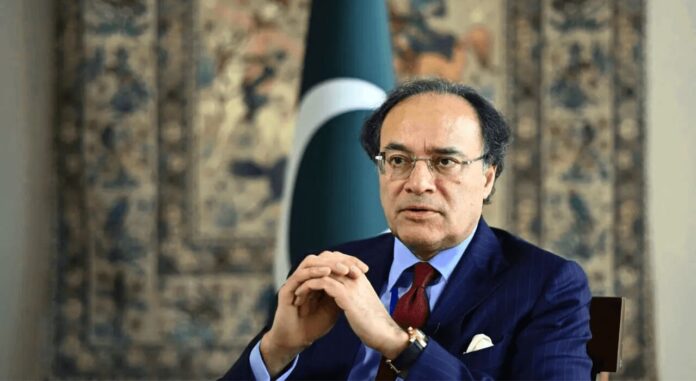

ISLAMABAD: Finance Minister Senator Mohammad Aurangzeb has declared that the government will abolish the label “non-filers” and introduce stringent penalties for those who fail to report their income. These individuals will face severe restrictions affecting their daily lives.

In a recent interview with VOA, the minister revealed that extensive data has been collected on non-filers, including details about their lifestyles, vehicle ownership, and international travel. “We have reached a point where leniency is no longer an option. Those who conceal their income and evade taxes will encounter limitations on essential services,” Aurangzeb stated.

He also outlined plans to alleviate the tax burden on salaried workers while broadening the tax base to include sectors such as retail, wholesale, agriculture, and real estate. “Our goal is to lessen the financial strain on the working class while ensuring that previously untaxed sectors contribute appropriately,” he explained.

Regarding the IMF’s concerns over debt repayment, the finance minister noted that the government has proposed a thorough economic reform strategy. “We had no alternative but to implement these reforms, and we will integrate all untaxed sectors into the tax system,” he said.

Despite a 29% rise in tax revenues last year, Aurangzeb emphasized that the tax-to-GDP ratio remains at a mere 9%, a figure insufficient for economic stability. He credited support from China and Saudi Arabia for helping secure a $7 billion IMF loan, stressing the need for significant reforms to avoid future IMF programs.

“Pakistan cannot sustain its economy with such a low tax-to-GDP ratio. If we want this loan to be the last from the IMF, we must pursue extensive reforms for long-term economic stability,” he added.