The Pakistan Stock Exchange witnessed a sharp decline for the second consecutive day, with the benchmark KSE-100 Index dropping over 1,300 points, a 1.46% decrease, settling below 89,000 points on Thursday.

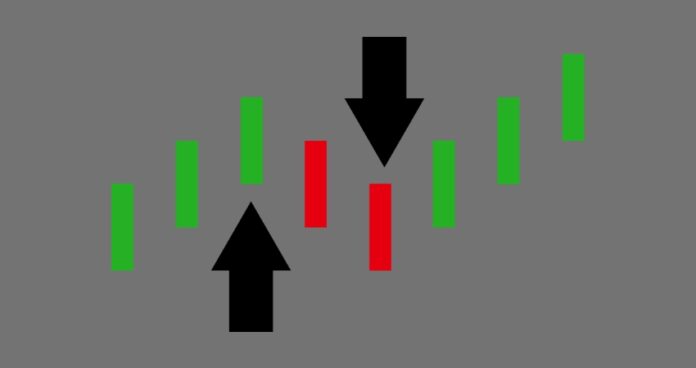

According to the PSX website, the market opened on a positive note and touched 90,700 points in the early hours of trading. However, the index could not sustain positivity and fell below the 90,000 level.

After observing high volatility, the index settled at 88,966.76 level, shedding 1319.80 points or 1.46% compared to the previous close of 90,286.56 points.

The pullback, occurring just days ahead of the central bank’s monetary policy meeting, is attributed to profit-taking by institutional investors in an overbought market.

This downturn, halting a prolonged rally, follows a previous day’s decline where the market lost 577.52 points.

The PSX has remained on a winning streak during recent weeks mainly due to positive corporate results and anticipation of another rate cut by the State Bank of Pakistan (SBP) which ignited investor confidence.

Many economists expect the SBP to cut its key policy rate by 200 basis points in its upcoming Monetary Policy Committee (MPC) meeting scheduled for November 4, 2024.

This would be the fourth consecutive reduction since June.

The PSX posted a net gain of 5.6% last week, with the KSE-100 index reaching its highest-ever closing of 89,993.96 points, just shy of the 90,000 mark.

This was the highest weekly return in 27 weeks and the 47th-highest weekly return since the index’s inception.