ISLAMABAD: The Central Directorate of National Savings (CDNS) reduces profit rates on Short Term Savings Certificates (STSCs), effective December 2024, due to declining inflation in the country.

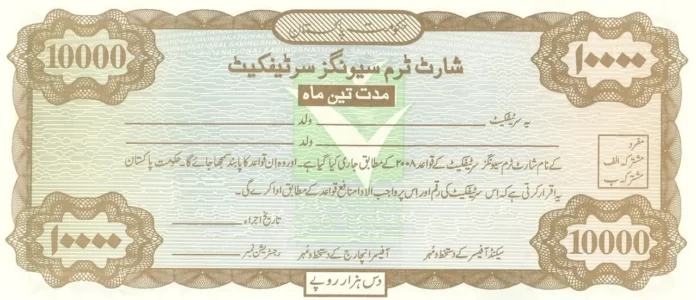

Introduced in 2012, STSCs cater to short-term funding needs of investors and offer maturity options of three months, six months, and one year. Available to Pakistani nationals and Overseas Pakistanis, these certificates allow investments starting from Rs10,000 with no upper limit and can be pledged as security.

Under the revised rates, a three-month maturity certificate now offers a profit rate of 12.76 percent, yielding Rs3,190 on an investment of Rs100,000, down from the previous 14.32 percent, which yielded Rs3,580.

The profit rate for six-month maturity certificates is now 12.74 percent, providing Rs6,370 on the same investment, compared to the earlier rate of 13.46 percent, which yielded Rs6,730.

One-year maturity certificates now provide a return of Rs12,380 with a rate of 12.38 percent, reduced from prior levels.

The taxation on profits from these certificates remains linked to the investor’s tax status. Individuals listed in the Active Taxpayer List (ATL) are subject to a withholding tax of 15 percent, while non-filers are taxed at 30 percent, regardless of the investment date or profit amount.

On December 11, the federal government announced a substantial reduction in profit rates for National Savings schemes. The profit rate for savings accounts has dropped from 16 percent to 13.5 percent, a decrease of 250 basis points, aligning with broader interest rate revisions for various schemes.

Profit rates for regular income certificates and defense savings certificates have also been revised. Regular income certificates now offer 12.1 percent, down by 10 basis points, while adjustments in profit rates for other schemes, such as the Savings Account, Sarwa Islamic Term, and the Islamic Savings Account, have also been made. The Islamic Savings Account profit rate has decreased by 72 basis points, now standing at 10.44 percent.