The state-owned enterprises (SOEs) recorded losses of Rs851 billion in FY24, while their total debt surged to Rs9.2 trillion, nearly matching Pakistan’s total Federal Board of Revenue (FBR) tax receipts, according to the Ministry of Finance’s (MoF) annual report. The report, published under the International Monetary Fund (IMF) programme, highlights severe financial and credit risks posed by these enterprises.

State-owned enterprises (SOEs) in Pakistan operate across eight critical sectors: Financial, Oil & Gas, Power, Infrastructure Transport & ICT, Manufacturing Mining & Engineering, Industrial Estate Development, Trading & Marketing, and Miscellaneous.

After accounting for profits from Pakistan Sovereign Wealth Fund (PSWF) entities, the net aggregate losses stood at Rs521.5 billion. The report revealed that even profitable SOEs struggled with low free cash flow, as their funds were tied up with loss-making entities.

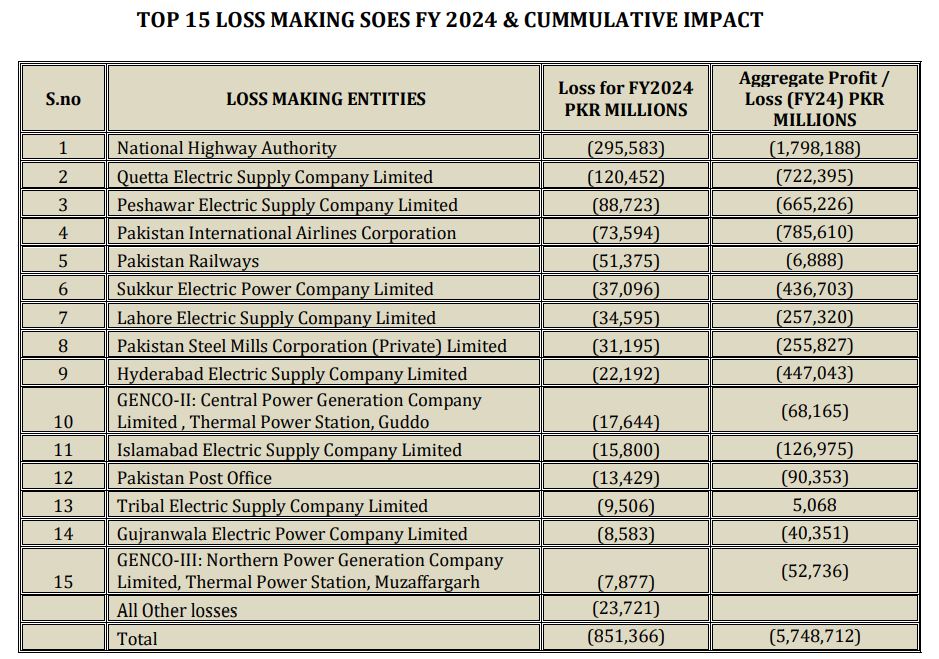

The power sector remained the largest contributor to losses, with the National Highway Authority (NHA) posting the highest single-entity loss at Rs295.5 billion.

Other major loss-makers included Quetta Electric Supply Company (Qesco) at Rs120.4 billion, Peshawar Electric Supply Company (Pesco) at Rs88.7 billion, Pakistan International Airlines (PIA) at Rs73.5 billion, Pakistan Railways at Rs51.3 billion, and Pakistan Steel Mills at Rs31.1 billion. Collectively, these entities eroded Rs2.5 trillion in economic value.

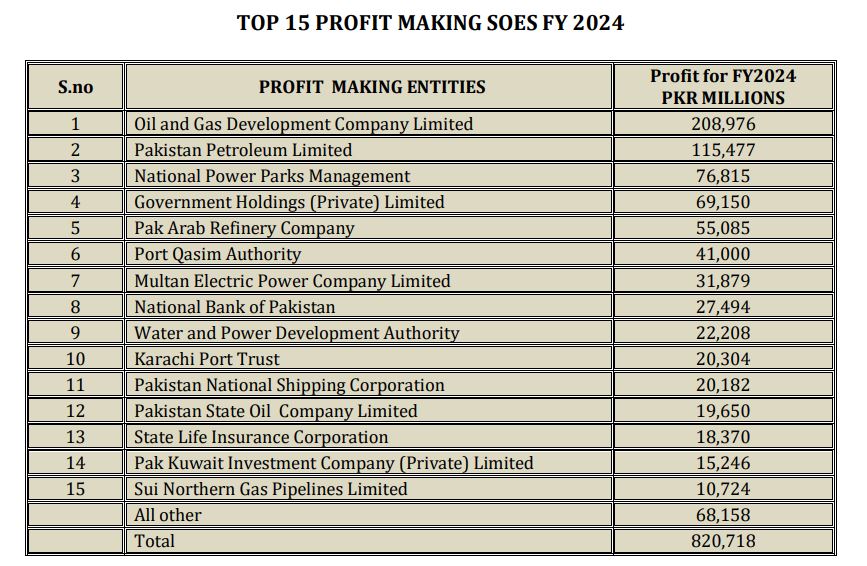

Despite a 5.26% increase in total SOE revenues, reaching Rs13.5 trillion, net losses rose by nearly 89%, despite government interventions that reduced overall losses by 14% through subsidies and grants. SOEs that generated profits reported Rs820 billion in earnings, reflecting a 14.61% increase from the previous year.

The total value of SOE assets grew by 6.37% to Rs38.43 trillion, while liabilities rose by 6.7% to Rs32.57 trillion, leaving net equity at Rs5.86 trillion, a 4.47% increase.

However, high weighted average cost of capital (WACC), ranging from 17% to 22%, resulted in a negative return on equity (ROE) of -0.5% and a return on invested capital (ROIC) of 3.4%. The report warned that the negative economic value added (EVA) of Rs2.5 trillion indicates that SOEs are destroying more value than they generate.

In contrast, profit-making SOEs were led by Oil & Gas Development Company Ltd (OGDCL), which posted Rs208 billion in earnings, followed by Pakistan Petroleum Ltd at Rs115.4 billion and National Power Parks at Rs76.8 billion.

Other key contributors included Government Holding Pvt Ltd (GHPL) at Rs69.1 billion, Pak Arab Refinery Company (PARCO) at Rs55 billion, and Port Qasim Authority at Rs41 billion.

To keep these enterprises operational, the federal government provided financial support amounting to Rs1.58 trillion, which included Rs367 billion in grants, Rs782 billion in subsidies, Rs336 billion in loans, and Rs99 billion in equity injections. This support represented 13% of federal budget revenues and exceeded the federal development program’s allocation.