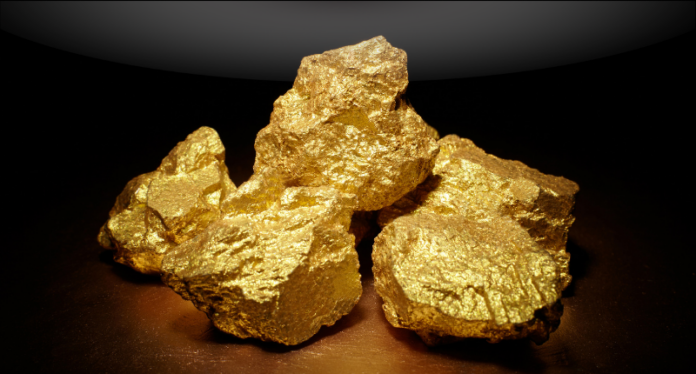

Gold prices regained some lost ground on Tuesday, rising above the $4,000-per-ounce level as a weaker dollar and expectations of further Federal Reserve rate cuts outweighed pressure from signs of a thaw in U.S.-China trade tensions.

Spot gold was up 0.7% at $4,009.39 per ounce, as of 0141 GMT, after dropping more than 3% on Monday to its lowest level since October 10. U.S. gold futures for December delivery rose 0.1% to $4,022.10 per ounce.

“Buyers who were waiting on the sidelines for gold are now being tempted into taking positions at these price levels. Also, we are seeing a bit of softness from the dollar, which is giving gold a reprieve,” said KCM Trade Chief Market Analyst Tim Waterer.

The dollar index was down 0.1% against its rivals, making gold less expensive for other currency holders.

On Sunday, top Chinese and U.S. economic officials hashed out the framework of a trade deal for U.S. President Donald Trump and his Chinese counterpart Xi Jinping to decide on later this week.

Trump said he thought a deal would be reached with China, and announced a flurry of deals on trade and critical minerals in Malaysia with four Southeast Asian nations during the first stop of his five-day Asia trip.

“If Trump and Xi have a productive meeting on trade this week, this could leave gold swimming against the current to some degree. But this could be offset if the Fed delivers a dovish tone with the expected rate cut this week,” Waterer said.

With the Fed widely expected to cut interest rates at the end of its policy meeting on Wednesday, investors are awaiting any forward-looking language from Fed Chair Jerome Powell.

Meanwhile, the European Central Bank and the Bank of Japan are both broadly expected to hold rates steady later this week.

Gold prices have gained about 53% this year, reaching an all-time peak of $4,381.21 on October 20, bolstered by geopolitical and economic uncertainties, rate-cut bets and sustained central bank buying.

Elsewhere, spot silver fell 0.3% to $46.74 per ounce, platinum slipped 1.2% to $1,571.85 and palladium dipped 0.8% to $1,391.15.