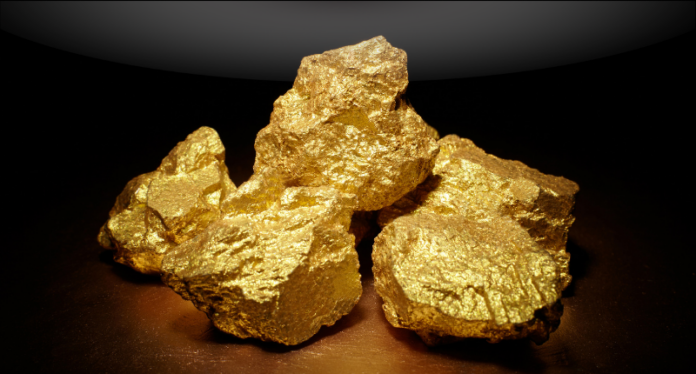

Gold held steady on Monday, kept in check by a strong dollar as investors dialled back bets for further Federal Reserve rate cuts in the near term, while easing U.S.-China trade tensions also crimped bullion demand.

Spot gold was flat at $4,000.65 per ounce, as of 0504 GMT. U.S. gold futures for December delivery rose 0.4% to $4,010 per ounce.

Prices have retreated about 9% from a record high of $4,381.21 hit on October 20, as the dollar climbed to a near three-month high.

“There’s a lack of upside momentum (in gold) due to some technical factors and the dollar remains pretty resilient, so that has a negative impact on gold,” OANDA senior market analyst Kelvin Wong said.

The Fed cut interest rates by 25 basis points on October 29 for the second time this year, but Chair Jerome Powell’s hawkish comments following it placed doubts on further rate-easing in 2025.

Traders now see a 71% chance of a rate cut again in December, down from more than 90% before Powell’s remarks, as per CME’s FedWatch Tool.

Non-yielding gold thrives in a low-interest-rate environment and during economic uncertainties.

Investors have their eyes on other news, including ADP U.S. employment data and ISM PMIs this week, for economic indicators that could alter the Fed’s hawkish stance.

“Safe-haven play has been reduced at this point in time, over the de-escalation of U.S.-China trade tensions. It could also be a rotation towards a much more risk-on play in the equities,” Wong said.

U.S. President Donald Trump said last week that he agreed to trim tariffs on China in exchange for concessions by Beijing on illicit fentanyl trade, U.S. soybean purchases and rare earths exports.

Elsewhere, spot silver rose 0.2% to $48.75 per ounce, platinum climbed 1.5% to $1,590.86 and palladium lost 0.1% to $1,432.18.