Fauji Cement Company Limited (FCCL) and Kot Addu Power Company Limited (KAPCO) have requested a 90-day extension for making the Public Announcement of Offer (PAO) regarding their acquisition of Attock Cement Pakistan Limited (ACPL). The acquirers submitted the request to the Securities and Exchange Commission of Pakistan (SECP) and the Pakistan Stock Exchange (PSX) through an official intimation, citing the need for more time to complete the process.

This extension request follows the Public Announcement of Intention (PAI) made on June 4, 2025, in which the two companies expressed their intention to acquire a majority stake in ACPL from the Pharaon Investment Group Limited Holding S.A.L. The transaction would also result in joint control of Attock Cement Pakistan.

The extension request comes after FCCL, initially partnered with Fauji Foundation for the acquisition, replaced Fauji Foundation with itself as the joint acquirer in an addendum published on November 6, 2025. Despite significant progress, the acquirers stated that ongoing discussions and negotiations with the seller are still underway, making it impossible to meet the original 180-day deadline set by the PAI.

According to the Listed Companies (Substantial Acquisition of Voting Shares and Takeovers) Regulations, 2017, specifically Regulation 7(1), the acquirers have now set a revised deadline for the PAO of March 1, 2026. The request has been formally communicated to SECP and PSX.

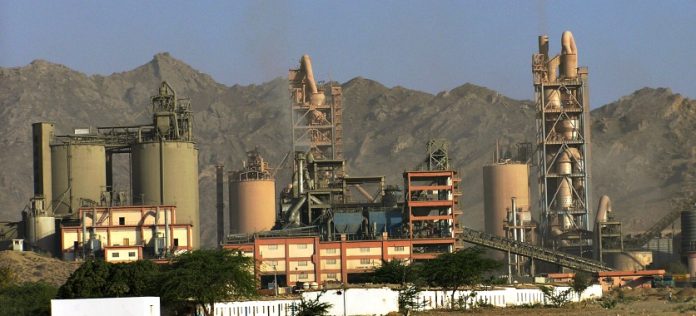

This acquisition is a part of broader consolidation efforts in Pakistan’s cement sector, which has seen increasing interest from larger players looking to expand their market share. Attock Cement, with its well-established brand and strong market presence, remains a valuable asset in Pakistan’s competitive cement industry. The proposed deal would position FCCL and KAPCO as key stakeholders in one of the sector’s top companies, following a series of strategic investments and acquisitions across the industry .