LAHORE: The Federal Board of Revenue (FBR) issued Statutory Regulatory Orders (SRO) 204(I)/2023 and 206(I)/2023 on February 21 to maintain the duties it levied upon imported vehicles on March 22. 1571(I)/2022, and SRO 1572(I)/2022 will now lapse on March 31 rather than their originally intended date of February 21. The former pertains to regulatory duties levied on imported vehicles whilst the latter pertains to additional customs duties levied on imported vehicles.

What even is an SRO?

According to the Pakistan Institute of Development Economics (PIDE), an SROs stands for Statutory Regulatory Orders; this refers to all kinds of government regulations carried out by FBR and different ministries through delegated powers. These include SROs in the health sector, in taxes, in commerce, in energy, in the auto sector, etc.

The SROs in question

The two relevant SROs are SRO 204(I)/2023 and SRO 206(I)/2023. These two extend the validity of SROs 1571(I)/2022 and 1572(I)/2022 which were set to expire on February 21. The aforementioned two SROs have now been extended till March 31 verbatim with the only change being the omission of electric vehicles from SRO 1571(I)/2022.

This means that whereas other imported vehicles will continue to have the higher regulatory duties introduced in 2022 intact, electric vehicles will not. Imported electric vehicles will continue to remain exempt from regulatory duties, as they have been since November 21.

Profit utilised the FBRs WEBOC platform to confirm whether this was true, and to no surprise we found that vehicles falling under the HS Code 8703.8090 were exempt from the 100% regulatory duty imposed by SRO 1571(I)/2022. HS Code 8703.8090 is the import code for electric vehicles.

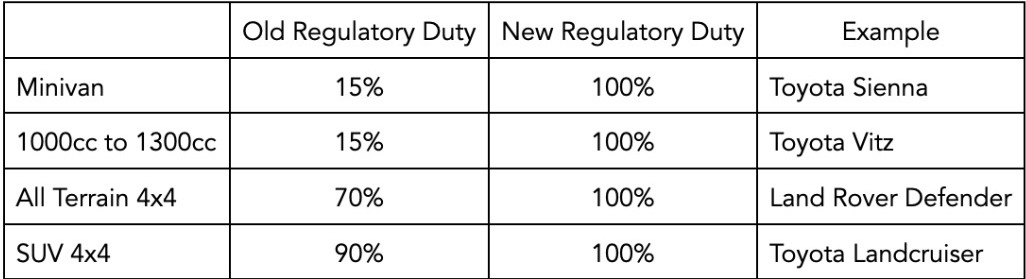

The regulatory duties outlined in SRO 1571(I)/2022, extended by SRO 204(I)/2023 are as follows:

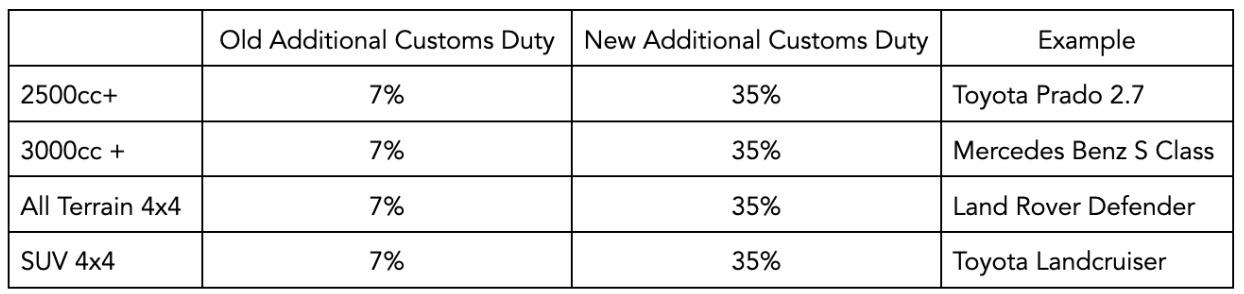

The additional customs duties outlined in SRO 1572(I)/2022, extended by SRO 206(I)/2023 are as follows:

Imported vehicles: Caught between a rock and a hard place

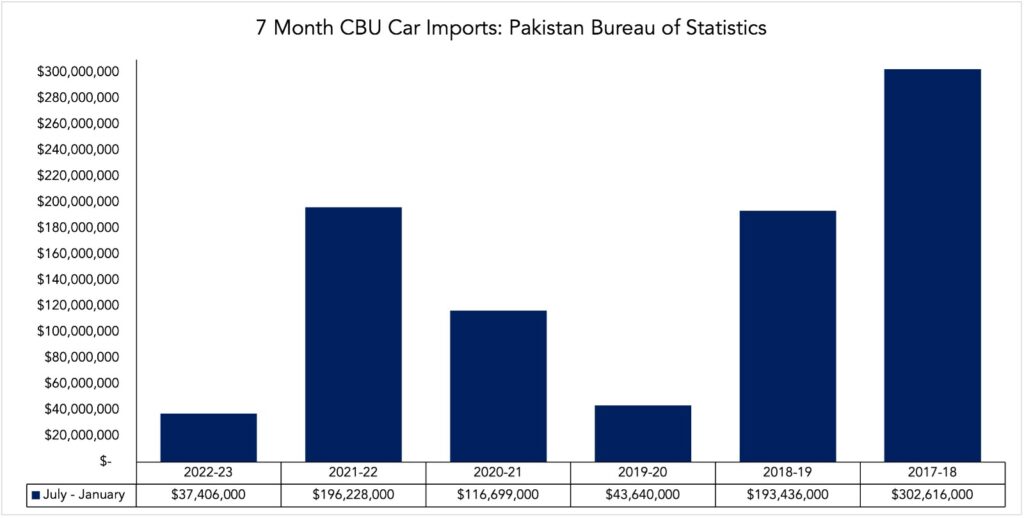

The duties coupled with the devaluation of the Pakistani Rupee, and the import ban over the summer has led to a collapse in the demand for imported vehicles. Looking at import data provided by the Pakistan Bureau of Statistics, seven month (July-January) sales for imported cars are at their lowest in the past six years. The current $37 million in imports is the lowest since the $43 million Pakistan recorded between July 2019 to January 2020.

5 marla house in Murree, surrounded by lush greenery and breathtaking mountain views and located at the heart of Islamabad Murree Expressway, Musyari.

hmm good

Duties are most important thing in business, that can really help a business man to grow their business.

Thanks for such a great article.

Regulatory duties on imported cars can vary significantly from one country to another, and they are typically imposed by governments for various reasons. These duties are designed to regulate the importation of foreign-made vehicles and can serve several purposes.