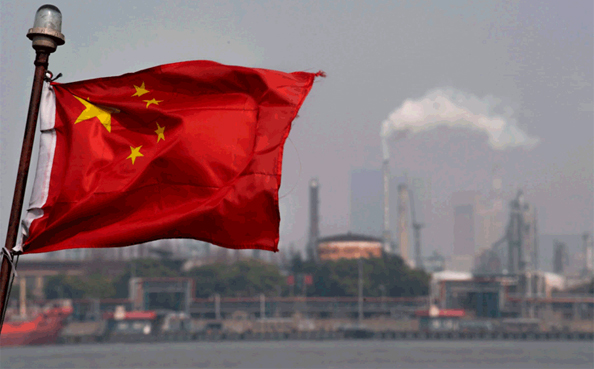

Asian stocks bounced off a two-month low and headed for their best day in seven weeks on Wednesday, as data showing China’s manufacturing activity expanded at the fastest pace in over a decade injected a jolt of optimism in hitherto gloomy markets.

China’s official manufacturing purchasing managers’ index (PMI) stood at 52.6 last month against 50.1 in January and was well ahead of an analyst forecast for 50.5, giving investors hope that China’s recovery can offset a global slowdown.

Hong Kong’s Hang Seng (.HSI) surged 3.2%, with developers and consumer-tech stocks leading and only two stocks falling. Chinese stocks also received a boost, with China’s blue-chip CSI 300 Index (.CSI300) jumping more than 1%.

Japan’s Nikkei (.N225) rose 0.2% and S&P 500 futures gave up early losses to trade flat. European futures rose 0.1%.

“The China February official PMIs and Caixin manufacturing PMI all surprised strongly to the upside, and notably higher than the previous January figures.”

In currency markets, the dollar’s February gains seem to be running out of steam and Asian currencies advanced on the strength of the Chinese data – even as economic updates from India, Australia and South Korea came in weak.

The kiwi dollar , which dropped nearly 4% last month, bounced off its 200-day moving average and rose 0.5% to $0.6217. The yen held at 136.35.

RATES RISK

Keeping gains in check was worry about interest rates staying higher for longer in developed economies, which was been behind a shaky February in stock and bond markets.

The next flush of economic indicators are likely to be crucial as markets gauge whether future rate hikes are sufficiently priced in now.

Hotter-than-expected inflation readings in Europe overnight drove bond selling, before an unexpected dip in U.S. confidence figures offered a glimmer of hope that rate hikes are biting and are perhaps within striking distance of peaking.

Two-year Treasury yields , a guide to short-term U.S. rate expectations, are close to four-month highs, but at 4.8347%, are below a November peak of 4.8830%. Benchmark 10-year yields stood at 3.9396% in Asia.

Commodities rallied with China demand hopes and Brent crude futures were last 0.6% higher at $83.94 a barrel.

Gains steadied after rains in parts of the U.S. winter wheat belt and optimism over a Russia-Ukraine export deal drove investors to liquidate some long positions.

Geopolitics also kept nerves elevated in the background. U.S. President Joe Biden’s visit to Kyiv and Russian President Vladimir Putin’s abandonment of the last remaining nuclear arms control treaty with the U.S. signalled a hardening of positions.

China, which signalled support for Russia by sending its top diplomat to Moscow last week, has issued a call for peace, though it has been met with scepticism and Washington has said in recent days it worries that China could send arms to Russia.

“Should Beijing send Russia arms, it risks a rapid geopolitical breaking of the world economy,” said Rabobank’s research head, Jan Lambregts. “Markets have not even begun to contemplate what this might mean.”

THE ONLY TRUSTED AND GUARANTEED RECOVERY EXPERT TODAY (MR MORRIS GRAY)

Please everyone should be careful and stop being deceived by all these brokers and account managers, they scammed me over $279,000 of my investment capital, they kept on requesting for extra funds before a withdrawal request can be accepted and processed, in the end, I lost all my money. All efforts to reach out to their customer support desk had declined, I found it very hard to move on. God so kind I followed a broadcast that teaches on how scammed victims can recover their fund, I contacted MORRISGRAY830@GMAIL. COM , the email provided for consultation, I got feedback after some hours and I was asked to provide all legal details concerning my investment, I did exactly what they instructed me to do without delay, to my greatest surprise I was able to recover my money back including my profit which my capital generated. I said I will not hold this to myself but share it to the public so that all scammed victims can get their funds back. Contact; MORRISGRAY830@GMAIL,COM…

This post deserves all the praise it receives.