It is tough to be in the State Bank’s shoes right now. Some argue that it is always tough to be in such a position. But what is the challenge this time?

The Bank has to cover more than three ends at once with a reserve that is close to its worst ever. The International Monetary Fund (IMF) has clearly communicated the condition that the rupee should maintain its actual value. However, there is debate about what exactly that actual value entails. Market intervention and government control of the exchange rate are viewed unfavorably by the Fund.

At the same time, for the country’s survival, proper management of the current account is needed. The removal of import checks is necessary to enable consumption and subsequent export.

Last but not least, there is a government in office that wants to control the currency, improve the value of the rupee, and leave office on a high note before the next elections. The Finance Minister, Ishaq Dar, has openly favored undervaluation and considers a strong local currency one of his key objectives.

In such a situation, what is the State Bank doing? Why is it doing that? And what does it mean for the future of the dollar against the rupee?

A One-Way Bet?

By definition, foreign currency is not supposed to be a yield-generating investment. However, in the case of Pakistan, it has somehow outperformed the money market and the stock market. As a result, our peers “invest” in dollars whenever they get the chance. Why is that? Because for them, the dollar is a one-way bet.

Until last month, people believed that the country would fail to secure external financing. They thought that the IMF’s Extended Fund Facility would go down the drain and Pakistan would default on its debt obligations. In such a scenario, the only way to protect their money from devaluation was to hold an asset that would not lose value. For many Pakistanis, that asset was the dollar.

This creates a demand for dollars, not just as a currency but as a store of value. No amount of dollars is enough to satisfy that demand because once people have some, they want more.

While this was happening, various stakeholders were playing games with the dollar. Arbitrary caps were removed, and selling was done in the black market or at enormous spreads. The State Bank has been tackling these issues as they arise.

But over time, with growing fears of default, the demand for dollars continued to increase. On June 27th, the majority of the market went home with a long position, meaning they held onto their current stock, anticipating the interbank rate to reach around 300.

During this time, people left for Eid, markets closed, and businesses halted. Suddenly, the country received approval from the IMF, and sentiment changed. People started second-guessing their decisions. The market, which had a collective long position on the dollar, began to falter.

What happened after the IMF deal?

With the IMF deal in place, it was expected that trading would resume at its closing value before Eid. However, when the banks opened on July 4th, the dollar plummeted by a whole 15 rupees at the start of the session. How did this happen?

The answer lies in sentiment. Although there were payments to be made, it was the 4th of July, a day when New York is closed. Normally, payments don’t occur on such days. An importer can come and perform an exchange transaction at the sales desk, but dollars won’t be provided, even if the bank has them. So the payment would be executed on July 5th. Consequently, the importer did not come to the bank, and the speculation of IMF inflows appreciated the rupee.

Another reason is the flow of remittances and export proceeds. While markets were closed for Eid in Pakistan, they were open worldwide. This meant that whatever remittance and export proceeds were sent during the Eid holidays were processed on July 4th. The sense of availability triggered some players to sell, creating a mild sense of panic.

Saad bin Naseer, the Director of Mettis Global, pointed out that individuals hoarding dollars would likely panic once foreign exchange reserves begin to increase. Consequently, there may be a surge in remittances through official banking channels, as the risky hundi-hawala system may become less attractive.

Later in the day, the exchange rate rose again by a few rupees and has since been increasing, reaching around Rs 277. Interestingly, there are still very few sellers in the market. People believe that this is a temporary correction, and as the country will inevitably return to its usual state of financial and political instability, dollars will become more expensive.

What is the State Bank doing now?

As part of the Stand-By Arrangement with the IMF, there is a letter of intent. This letter includes various commitments from Pakistan to the IMF, but most importantly, it contains the commitment by the State Bank governor to allow the free flow of imports, enabling the rupee to reach its real value.

Over the past 10 months, the State Bank has exercised administrative measures on imports. Whenever someone wants to import something, their bank must obtain prior approval from the State Bank of Pakistan. As a result, the import bill has been reduced significantly. In fact, Pakistan has been able to run consecutive current account surpluses for the first time this decade.

Imports decreased by 31% in FY23 to $55.29 billion, from $80.13 billion in FY 22.

Ideally, a surplus should decrease the value of the rupee, even if the surplus is fundamentally questionable. Because in any case the amount of dollars in circulation has now increased. But why hasn’t the value of the rupee increased? The reason is the State Bank’s buying. To ensure that the rupee-dollar rate reflects its actual value and to accumulate dollar reserves, the State Bank of Pakistan has been a net buyer in recent weeks.

According to sources, the State Bank has deliberately kept the rate high to prevent significant discrepancies between the open market and interbank rates. It’s important to note that the central bank has the prerogative to buy from the open market. In fact, the IMF prefers the central bank to be a net buyer rather than a net seller in a given month. With limits to its intervention, the State Bank is entitled to make purchases and sales to avoid excessive volatility.

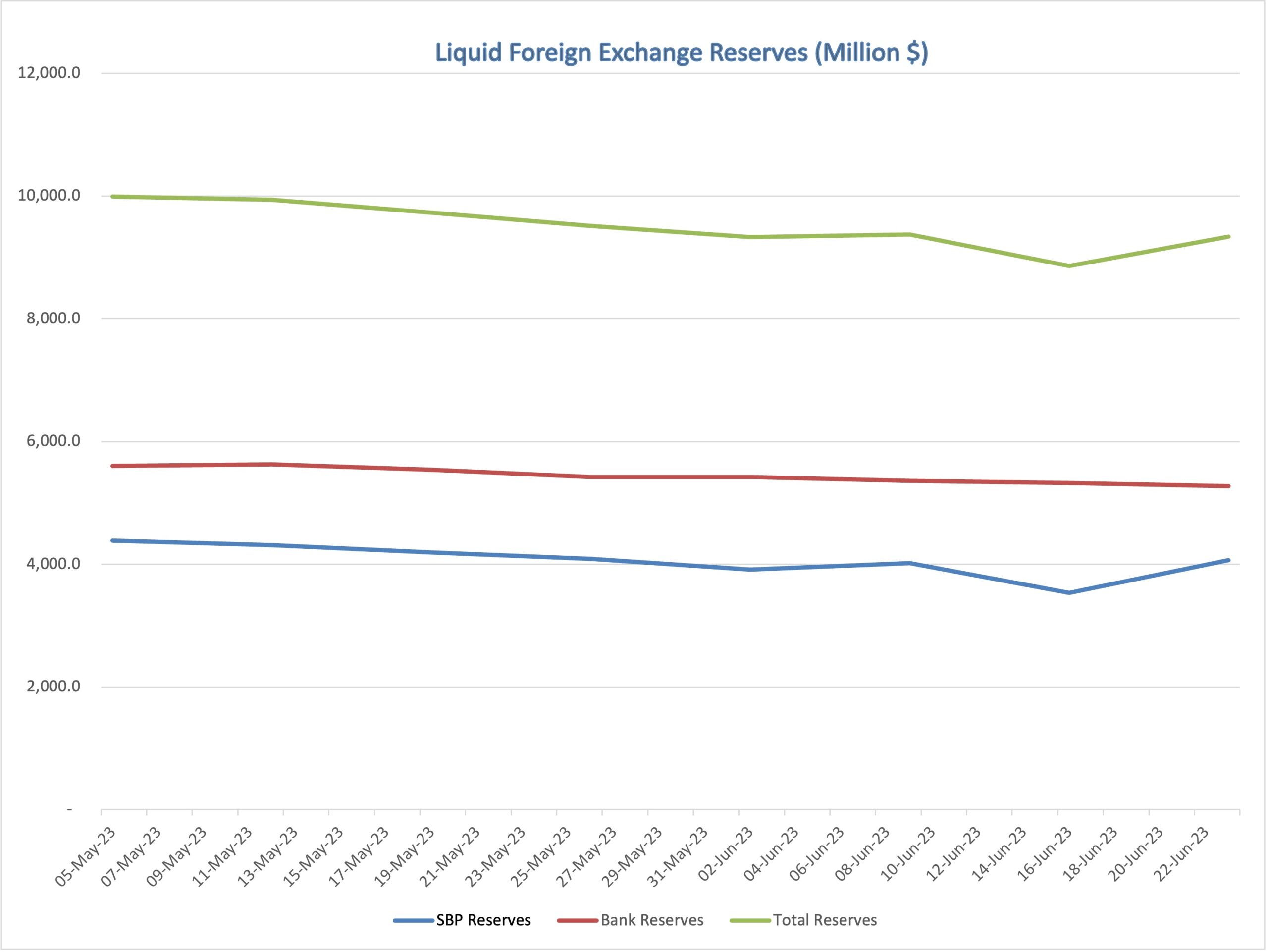

The fact that the State Bank has been buying from the banks periodically, can be seen in the graph below, indicating marginally lower bank reserves for every consequent week. Currently, it is believed the State Bank has negative real reserves, with short-term obligations exceeding its available funds. To prioritize stability, it is crucial for the SBP to build reserves whenever an opportunity arises.

However, the status quo can be jarring. Credible sources have revealed that despite committing to freely flowing imports to the IMF in its letter of intent, the government and the State Bank do not intend to allow imports to flow freely.

This is not open defiance but rather a loophole. Banks do not print dollars; they either buy them from the interbank market or receive them directly from overseas. It has been revealed that the State Bank has instructed banks to maintain their Net Open Position, square. This means that banks can only spend as much as they earn, keeping their inflows and outflows equal. Consequently, imports are substantially limited automatically. Especially for larger banks that have an importer-heavy clientele.

Not only does this mean that the State Bank is controlling the amount of imports again but this has a direct impact on the currency.

This move indicates that even though the State Bank cannot let the open market operators create discrapancies between open market and interbank rates, it still cannot let the dollar go upwards of a certain limit.

Another source privy to the treasury market developments has even suggested that the State Bank is still exerting unofficial control over the opening of Letters of Credit (LCs). If this is true, it could pose a threat to the much-needed IMF program. The State Bank of Pakistan has been contacted for comment on this matter, but no response has been received.

The Implications and effects:

While the entire picture is murky. A few things are certain. The rupee is currently a little below its real value. Ishaq Dar, even with his questionable credibility, is right in saying that the rupee is undervalued. Talking to a private TV channel, Finance Minister Ishaq Dar stated, “Based on the real effective exchange rate (REER), the rupee-dollar parity should be Rs244 to a dollar”. He said this on the back of a statement by Ankur Shukla, South Asia Economist for Bloomberg Economics. He said that, “Pakistan’s rupee is undervalued by about 14%, according to our model.”

The State Bank’s buying position is understandable. With record profits and dwindling foreign reserves, the central bank needs reserves more than ever. And the market needs stability. In fact, one of the reasons why the dollar rate went up after plummeting on the first day of trade after Eid, was because of the State Bank’s buying. But if the imports are indeed, being indirectly controlled, the dollar rate is not representative of the market forces.

The government realizes that the dollar rate needs one last push before it corrects itself for good. It could be in the form of physical inflows or a mere green signal by the State Bank. This makes it risky for banks to hold dollars in their own reserves, so they are now going to be having a short position on dollars. This makes it perfect for the SBP to limit imports through square NOPs.

As of now they are milking the situation for best possible effect. One little nudge to the downside and all the exchange companies, exporters, hoarders and speculators will run to sell. If they do, the rupee goes soaring up. Politically this would be huge for the ruling party but what is on the other side?

Imports would have to start again at some point. For real. The banks cannot be infantilized with their LC operations forever? With properly resumed imports, all the effect created by the orchestrated current account deficit can erode. Who is to say that the value of the dollar might once again go beyond 280. It’s a standoff, a decision theory conundrum.

The bottom line is that there is a shortage of dollars in the market and we stand one panic spree, or one import clearing notification away from a freefall, in either direction.