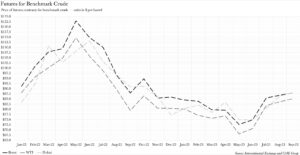

From dire to disastrous. Within a mere day of the Government of Pakistan recalibrating petroleum prices in light of the Rupee’s depreciation, Pakistanis have been jolted awake as global crude markets skyrocketed. Future contracts for all three benchmark crudes — Brent, West Texas Intermediary, and Dubai Fateh — have reached their peak since October of last year.

More critically, the spot prices of all the principal oil blends that Pakistan imports have also reached their penultimate level in 2023. This, in fact, may be the sole glimmer of hope in this situation. However, when taking into account the wider macroeconomic landscape, this portends nothing short of a calamity if prices do not nosedive again on Monday.

“The escalating energy prices in the immediate term will ignite higher fuel prices at the pump for us,” forewarns Ahfaz Mustafa, CEO of Ismail Iqbal Securities. He elaborates, “This will inevitably sustain high inflation and exert additional pressure on the Rs USD parity.” He cautions, however, that this scenario will only come to fruition if the prices persistently remain elevated.

So, what on earth is going on?

Why have crude prices peaked?

Mustafa elucidates that global oil prices have surged due to constricted supplies, stemming from depleting US inventories and the likelihood of oil production cuts by OPEC+.

What does he imply by that? On August 31st, Deputy Prime Minister Alexander Novak was quoted by Russian media as saying that “Russia has agreed on further curbs to its oil exports with OPEC+ partners, and the full details of the deal will be announced next week.”

Russia has been reining in its crude exports as part of the OPEC+ group’s endeavours to prop up prices amid global economic frailty in recent months. The country is set to diminish its export reduction to 300,000 b/d in September from 500,000 b/d in August. Novak, who has supervised Russian coordination with OPEC+, previously said that an extension of the curbs into October was being contemplated.

The mooted Russian export cut comes alongside a 1 million barrel per day production cut by OPEC+ partner Saudi Arabia, which is also due to expire at the end of September. The kingdom has yet to divulge its intentions for October, and Saudi officials did not revert to queries promptly. The Saudi cuts have confined its crude production at 9 million barrels per day — the lowest level in more than two years.

The extant Saudi and Russian measures come on top of some 1.2 million barrels per day in collective OPEC+ voluntary output reductions that have been in force since May.

Nonetheless, this is not happening in isolation. US inventories of crude oil plummeted last week, even as refinery activity unexpectedly slackened, according to data released on Wednesday by the Energy Information Administration (EIA). Commercial crude-oil stockpiles plunged by 10.6 million barrels last week to 422.9 million barrels and are now 3% below the five-year average, the EIA said.

The drawdowns in the US are attributed to a blend of record demand, producer supply cuts, weaker futures, and soaring storage costs.

Now that we know what the global situation is like, how grim is it going to be for Pakistan?

The woes of being an oil importing country during economic turmoil

Global crude markets could not have picked a more inauspicious time to rally. This is not to say that most in the industry were not envisaging something, as Saudi Arabia had been paring production across August, but the uptick in prices comes scarcely 24 hours after the Government of Pakistan revised petroleum prices, whereby both diesel and petrol have now for the first time in Pakistan’s history crossed Rs 300 a litre.

So, what is up with the specific crude blends that Pakistan imports? Until June 2022, the UAE was the preeminent source of oil imports, accounting for a staggering 56%, followed by Saudi Arabia at 34%, and Kuwait trailing at 4%. These import statistics were provided by the Trade and Development Authority of Pakistan. Alas, data beyond this period remains elusive.

Across these blends, Arab Light from Saudi Arabia ended the day at $90.27 per barrel, not the highest this year. Arab Light instead peaked back in August when it traded for $91.5 a barrel on 10th August. Murban from the UAE ended the day with futures contract for the blend trading at $89.87 per barrel, the highest for the blend this entire year. The daily prices for the remaining blends had not been updated at the time of writing. However, blends across the UAE, Kuwait, and Qatar were all at their second highest daily price for the year, akin to Arab Light, with the highest also coming the week Arab Light peaked.

What does all this portend?

Yousuf Farooq, Director Research at Chase Securities, cautions that “a crude rally would be inflationary and decelerate the pace of disinflation”. He adds that it “could potentially delay interest rate declines anticipated in 2HFY24”. Furthermore, he warns that “an increase in crude prices would also dampen demand for other products and have a decelerating effect on the economy”. He concludes that “it is now extremely unlikely that the government could counter this with a reduction in taxes”.

Is there anything Pakistan can do to avert the fate painted by Farooq other than pray for Monday to be kind to us? Not really.

Naveed Vakil, Chief Operating Officer at AKD Securities, explains that “for Pakistan under an IMF program, this is concerning where we have agreed with an average levy level as part of conditions with the fund”. He also points out that “this coupled with continuing weakness in Rs versus the USD means pump prices face upside risk”.