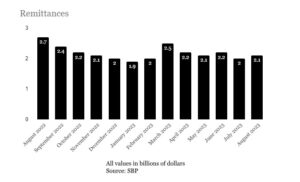

Data shared by the State Bank of Pakistan (SBP) on Monday showed that remittances in August 2023 totalled $2.09 billion. While this was a slight improvement from the previous month, it was a significant decline from August 2022 when remittances amounted to $2.74 billion.

This decline, while concerning, was not unexpected. Remittances have been falling for some time: annual remittances were down for the first time in six years in FY23. And FY24 has not been off to a promising start.

Remittances – FY23 and July-Aug FY24

Over the last decade, remittances have declined annually twice. The first time was in FY17 when they fell by a little over $550 million. The second time was in FY23, but this time the fall was much larger — $4.25 billion. This figure is obviously worrisome. It is a 13.59 percent decline at a time the country needs every dollar it can get. And it is more than half of the central bank’s current reserves, which stand at $7.78 billion as of September 1, 2023.

The downtrend has bled into the current fiscal year, with remittances in the first two months amounting to $4.12 billion, down 21.57 percent from July-August FY23 when they clocked in at $5.26 billion.

According to the latest SBP data, remittances showed a slight improvement on a monthly basis in August, rising by 3.15 percent from July’s figure of $2.03 billion. However, they declined by 23.74 percent from August 2022 when remittances stood at $2.74 billion.

Data showed that remittances from all four main countries decreased on a yearly basis. They were down 11.65 percent from the United States, 10.39 percent from the United Kingdom, 29.24 percent from Saudi Arabia, and 43 percent from the United Arab Emirates.

Meanwhile, remittances from other GCC countries declined by 19.05 percent. However, remittances from European Union countries rose by 3.94 percent.

The downtrend happened due to several reasons, which all boil down to the dollar rate and the currency markets. Pakistanis abroad who want to send money back home through legal routes have two options — either through a bank or currency exchange.These are more formally known as the interbank and open markets, respectively.

Currency markets 101

The interbank market (as the name suggests) is a network of commercial bank treasuries that trade currency, primarily US dollars, among themselves. Broadly speaking, banks make these trades on a daily basis with other banks to manage liquidity needs and adhere to minimum and maximum limits set by the regulator (the SBP) on how much foreign exchange any licensed commercial bank should have on their books at any given time.

The interbank is fed by inflows such as export proceeds, remittances, grants, aid, donations, and foreign direct investment. Any money that comes into the country through these official channels comes in through commercial banks for their clients.

Meanwhile, the open market, or kerb market, primarily consists of foreign currency exchanges where individuals can buy and sell currency. The open market gets its inflows through remittances, travellers exchanging notes, and sometimes savers exchanging the currency they have held on to.

There is usually a difference between the rates in the interbank and open markets. This is primarily because the exchange companies, while not always charging a commission, charge a margin so that they make money.

While it may appear at first glance that the interbank and open markets are not connected, it is not true. Exchange companies maintain foreign currency accounts with commercial banks through which they receive remittances via Money Transfer Operators. They also surrender 100 percent of their foreign currency in these accounts at the end of trading days. In addition, they sell a minimum of 10 percent of US dollars they receive from export of foreign currencies in the interbank market on an ongoing basis. This makes both the markets interconnected.

Pakistanis having a rupee account in a commercial bank can encash foreign currency they receive as remittance in the form of rupees; the conversion rate is based on the rate sheet [slightly lower than the interbank rate] for a particular branch if the amount is small. If the amount is large, then the bank’s treasury will negotiate the rate with the customer. Separately, Pakistanis having a foreign currency account can withdraw money — physical dollars or other currencies — from their bank. They can then sell it in the open market if the rate is higher.

Since May 1999, Pakistan has been following a market-based flexible exchange rate system. However, there have been instances where the SBP, on instruction of the federal government, has intervened in the market to control the exchange rate. This is also what happened last year.

As the country’s dollar reserves declined to a perilous level, the rupee started depreciating rapidly. In an attempt to stop this devaluation, the SBP tried to “manage” the exchange rate and keep it at a level of Rs 220. Consequently, the Exchange Companies Association of Pakistan (ECAP) — exchange companies are regulated by the SBP — also imposed an “artificial cap” on the exchange rate. Did this mean people were only buying and selling dollars at this rate? No. This is where the illegal grey market comes in.

A flourishing grey market

ECAP Secretary General Zafar Paracha laid the blame for the decline in remittances last year squarely on the government’s “contradictory” policies, and more specifically, the decision to impose the artificial cap on the USD-PKR exchange rate that led to a flourishing grey market.

Meanwhile, independent economic analyst A.A.H. Soomro also said the primary reason behind the decline was the gap between the interbank, open and grey market rates.

According to Paracha, the grey market was the busiest last year. Money changers in the grey market do not care about documentation and may be able to sell you dollars even when there is a shortage as long as you’re willing to pay much higher than the ‘official’ rates. If you send your remittance through these money changers, you will also get a higher buying rate.

“As the economic situation worsened in FY23 and foreign exchange reserves fell to a critically low level, the government ‘tightened’ its policy regarding the sale and purchase of US dollars, and imposed an artificial cap on the USD-PKR exchange rate,” Paracha recalled.

The imposition of the artificial cap worsened the exchange rate situation as it led to two different rates in the open market itself.

“So, for instance, the ECAP might want to sell the dollar at Rs 220 but exchange companies would be selling it for Rs 230 or higher. There was a difference of Rs 10-15 in the ‘official’ ECAP rate and the one actually being quoted by exchange companies,” he elaborated. The rates offered by illegal money changers operating in the grey market were Rs 20-25 higher.

If there is a difference of Rs 20-25 between the rates in interbank and open markets, and the grey market, any person would prefer to use informal channels for sending money to Pakistan if opting for the formal ones would mean incurring a loss.

Besides widely different rates in different markets, there was another problem, and it was related to the government’s policy of increased scrutiny of transactions in the open market, making it difficult to buy dollars for individuals.

First, exchange companies would scrutinise the person wanting to buy or sell dollars themselves to decide whether the transaction would be conducted. This data was forwarded to the Financial Monitoring Unit. The ECAP general secretary claimed the FMU functioned “only as a post office” and forwarded the information to government investigation agencies. This intense scrutiny process dissuaded people from coming to the open market as they could easily go to the grey market and trade the greenback without any documentation and at ‘better’ rates, he added.

“Remittances did not actually fall, they were redirected towards the grey market,” Paracha asserted.

The ECAP decided to remove the cap on the exchange rate on January 25, 2023, after which the rupee depreciated by over 10 percent in the interbank market in a single day. And under the agreement it signed with the International Monetary Fund (IMF) in June 2023, the government is bound to adhere to a market-determined exchange rate. So, why are remittances still falling?

That’s because till last week, the gap between the interbank, open, and grey market rates was still quite wide. For example, on August 29, the interbank rate was Rs 303 a dollar. The ‘official’ open market rate shared by the ECAP was Rs 318 a dollar — a difference of Rs 15. Exchange companies that Profit reached out to quoted a sell rate of Rs 323 a dollar — Rs 20 higher than the interbank rate. However, they said they were unable to sell dollars as there was a shortage. This was because dollars were being traded in the grey market and in ‘off the book’ dealings by some exchange companies offering higher rates.

However, the government sprung into action last week and a crackdown was launched against illegal money changers and exchange companies doing ‘off the book’ trades. CEO of Link International Exchange Saleem Amjad said the crackdown improved the supply of dollars in the interbank and open markets, due to which the gap between them narrowed.

Meanwhile, Paracha said the crackdown had “eroded the grey market” from Pakistan. This means we may see improved remittances in the coming months as Pakistanis abroad go back to using formal channels for sending remittances.

Economic uncertainty and market volatility

Assistant Professor of Economics at Institute of Business Administration Karachi and Research Fellow at CBER, Dr Aadil Nakhoda, said the uncertainty in the domestic currency market also had implications. “If depreciation is expected, remittances are likely to reduce as remitters may hold off on their decision to remit foreign currency and take advantage of better conversion rates in the future. They would prefer to save in foreign currency and remit only what is needed,” he commented.

This would make sense considering the rupee’s steep depreciation in recent months. On Jan 25 this year, the rupee closed at Rs 230.89 a dollar. Following the ECAP’s announcement that it would lift the price cap, the rupee closed at Rs 255.43 per dollar the very next day. By the last working day of FY23, the rupee was down to Rs 285.99 per dollar — a depreciation of Rs 30.56 or 13.24 percent. Earlier in September, the rupee fell to a record low of Rs 307.1 — down Rs Rs76.21 or 33.01 percent.

Meanwhile, Soomro noted that keeping US dollars in cash had proven to be a better asset class over the last 2-4 years than equities, real estate or returns on banking products, which had resulted in upper- and middle-class people buying as many dollars as they could to protect themselves from declining purchasing power. According to Topline Securities, the US dollar was the third-best-performing asset in 2022 after gold and one-year Naya Pakistan certificates. This pushed up demand for the greenback and contributed to higher prices.

On the other hand, since the rupee depreciated sharply, those living abroad may have chosen to send a slightly lower amount of dollars — for instance, $500 instead of $650 — to their families for their living expenses, the economic analyst added. “Such two-way unsustainable volatility feeds into confidence crises forcing people to stop investing in rupee-denominated assets.”

This is also connected to the incentives the State Bank of Pakistan offers to attract remittances. The central bank had launched the Sohni Dharti Remittance Programme — a points-based loyalty programme — on November 25, 2021. Under the scheme, remitters are divided into three categories — green gold and platinum. Much like a regular rewards programme, the remitters can use their accrued points to get discounts on government services such as passport renewal fees, PIA tickets and extra luggage charges, and a reduction in duty on mobile phones and vehicles.

Last month, the Ishaq Dar-led Economic Coordination Committee approved several SBP proposals to improve remittances including expanding the Sohni Dharti Remittance Programme and increasing the rate of performance-based cash incentives for financial institutions. However, incentive schemes work better when economic confidence is higher, Nakhoda pointed out.

“Again, for those receiving remittances, the decision is to save abroad in foreign currencies and remit at higher rates if the currency is depreciating vs. investing with weak confidence where returns may not be sufficient. Till economic indicators improve, it is unlikely remittances may increase to higher levels, particularly if those receiving remittances are unlikely to invest,” he commented.

What next?

Nakhoda said the government needs to improve the level of economic confidence. Going back to currency market uncertainty, the professor said there was not much the caretaker setup could do except ensure that expectations of depreciation were lowered. “The aim should be to reduce speculation but not intervene to overvalue or fix currency, which itself ultimately breeds speculation.”

Paracha also called for an end to speculation. The ECAP general secretary also suggested that the government offer direct incentives to remitters. “The Sohni Dharti Remittance Programme has limitations. Who knows whether the overseas Pakistani actually wants to buy a car here, or get his passport renewed? Instead, give him a direct discount. For every $85 he sends, give him an amount equivalent to $100. This discount will incentivise the person to send remittances through legal channels.”

Paracha also blamed the bureaucracy for the delay in implementing the SBP’s proposals. “This should have been the top priority. If we do not prioritise dollar income right now, when will we do it?” he questioned.

The recent crackdown has addressed one of the biggest reasons for the decline in remittances — the different rates and the grey market. However, concerns about the rupee’s depreciation and market volatility remain. Whether the measures will be successful in the long run and the downtrend will be reversed can only be assessed in the coming months.

The internet used to be a safe haven to gather new knowledge in the comfort of your space until these scammers sprouted out of the blue like worms and made it unsafe. I am a country music lover, and Kenny Rogers is my idol. I can remember when a notification from Instagram popped on my screen, Guess who, my idol. I was awed and I can remember myself writing about all his impact in my life. I was so sure I was talking to my idol on Instagram. He did say he wanted to introduce me to this quick money-making scheme because he noticed I have been a loyal fan on his official IG page. My idol can never go wrong in my eyes and didn’t even do any research. I hurriedly joined the scheme. I never knew it was a scammer posing as a celebrity till I had invested $540.000.00. It got worse when I couldn’t access my account or withdraw from my investment, I knew there was a problem after all these happenings. I need to get help from any means to ensure I am not a victim of these parasites. I was glad to be able to be introduced to the best CRYPTOCURRENCY RECOVER EXPERT, Cyber-Genie Genie Hack Pro. I talked to their representative and they assured me of recovering my stolen investment. And as they promised, they didn’t disappoint as they were very confident in their expertise. My stolen investment was successfully recovered and they were the ones who confirmed to me that I was catfished.

“Cybergenie(@)Cyberservices. com”

“Numb + (12525120391)”