Over the past one year, Pakistan has faced various challenges on both the micro and macro frontiers, impacting the general public and businesses alike. A key culprit behind this misery were record high inflation rates, which eroded the purchasing power of the populace. In response, we witnessed interest rates soaring to 22%, marking the highest in the country’s history.

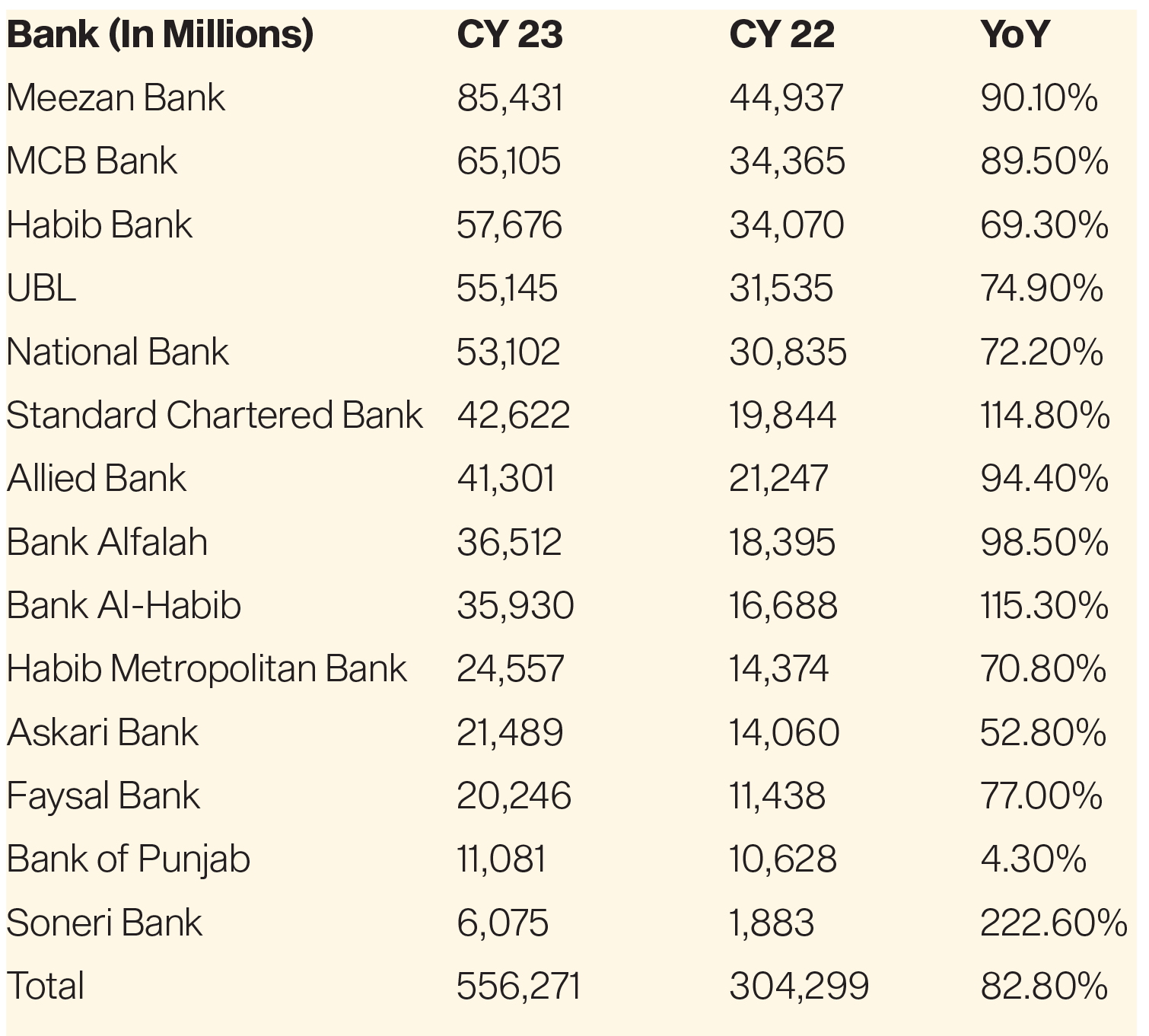

In the midst of these challenges, an anomaly surfaced in the shape of Pakistan’s banking sector, which achieved its highest profitability in a single financial year in 2023. The sector collectively earned profits of Rs. 556 billion which was the highest in their history. The reason for the rise was due to the interest income that the banks earned and the hike in interest rates of around 600 basis points during the year. This led to banks earning profits which were 85% higher than the previous year.

When the performances of the banks are analyzed, one player stands out: Meezan Bank. The bank was able to earn net profits of more than Rs 85 billion while the next best result saw MCB earn Rs. 65 billion. Next in line are the three biggest banks of the country with Habib Bank, UBL and National Bank of Pakistan earning around Rs 57 billion, Rs 55 billion and Rs 53 billion respectively.

The question then arises, what is Meezan Bank doing which no other bank is able to do. Banks like National Bank, Habib Bank and UBL have asset bases which are in excess of Rs. 5 trillion, Rs. 4.6 trillion and Rs. 3 trillion respectively. What is Meezan Bank doing with a smaller asset base of Rs. 2.5 trillion which is able to yield almost double the profits compared to these behemoths? Profit dives deeper into the numbers.

Function of a Bank

Function of a Bank

A bank might seem like an institution that cannot be compared to a traditional business. On a closer look, however, they are not too different from a manufacturing business. A manufacturing business takes raw materials, converts it into finished goods and then charges a premium for the value addition. It takes the raw materials from suppliers who become its creditors. It sells its goods to wholesalers or the market who becomes its assets.

Banks are the same way. The only difference is that the raw material for banks is money.

Banks take deposits from its customers and money from its lenders and then give these deposits out in the form of leases and loans to its customers. They charge a higher rate of interest to its borrowers and give a lower return to its depositors. The difference in the middle is the primary income of the bank. They can also charge fees to its customers for using their services, however, the primary focus of a banker is to maximize the difference between the interest it earns from its assets and the interest it gives out to its depositors.

Minimum Deposit Rate (MDR)

Now that the money making process of a bank is known, it is vital to know that banks are regulated by the State Bank of Pakistan (SBP) and they provide the different regulations and instructions that need to be abided by. From capital reserve requirements to the deposits being given out, the State Bank has the power to mandate banks.

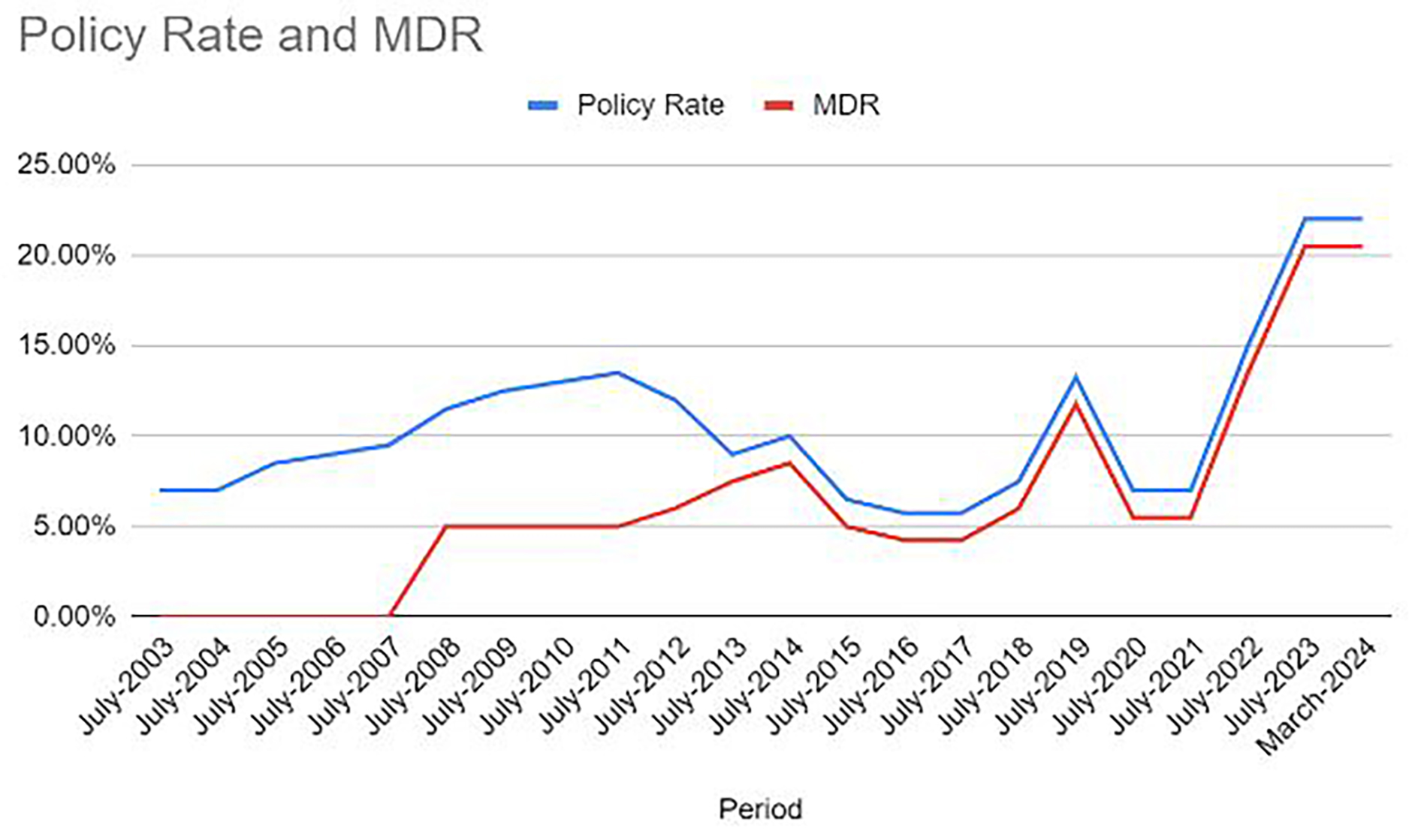

From time to time, the SBP has used its power to put into place a minimum deposit rate which is mandated on the banks. Before 2008, banks were allowed to give any return to their depositors as they chose. In 2008, a circular was released mandating the banks to pay out a minimum profit rate of 5% per annum to all categories of investors on their savings accounts. Later in 2012, this rate was increased to 6% per annum and in 2013, the minimum deposit rate was set to be 50 basis points below the SBP Repo Rate. In other words, this was going to be 150 basis or 1.5% below the prevailing policy rate.

The role of the State Bank to mandate such a return was based on the fact that the policy rate in the economy was much higher and it needed the depositors to be compensated accordingly. When the policy rate and MDR are seen, the trend has been that the gap was hovering around 9.5% before an MDR was put into place and has been stuck at 1.5% since the latest circular came into effect.

In the circular mandating this rate, it was also stated that Islamic Banks would not be mandated to a minimum deposit rate and they would be allowed to pay according to a profit and loss sharing ratio that the State Bank had set earlier.

The rationale for this move was the fact that Islamic Banks cannot give out fixed rate of return as it would not make them Shariah Compliant which meant that they could not be mandated to give out a minimum rate to their depositors. This meant that now conventional banks would be required to give a return to its depositors not less than 1.5% of the prevailing interest rates while the Islamic banks could set a rate which was approved by its Shariah Board and then submitted to the State Bank.

In addition to that, Islamic banks argued that they did not have a liquid and developed market of assets which could be compared to the instruments available in the conventional market. Due to lower avenues of investments, the banks could not guarantee a return on their investments and needed the market to mature before any such restriction could be placed on them. There was also an incentive for Islamic banks to be set up in the country by allowing them to limit their cost and set up such services.

Views of the industry

Experts in the field have differing views of the rates being provided by the Islamic Banks. Mustafa Mustansir, Director Research and Business Development at Taurus Securities Limited, states that, “fixing a rate of return on Islamic Deposits is inherently against the principles of Shariah. At the same time, while for some depositors putting money in Islamic banks has religious connotation to it, there is still some competition for deposits in the market which makes Islamic banks offer somewhat competitive rates on deposits.”

“The profit calculation mechanism in both banking models are totally different; one has a profit-sharing model whereas the other guarantees a return. Islamic banks are regulated to keep a minimum 50% share of profits (if materialized) on funds invested in savings products by depositors (Mudarabah accounts). Will their business be viable if the profit-sharing ratio is increased in favor of depositors?” says Nadeem Hussain, Coach at Raqami Islamic Digital Bank.

Sana Tawfik, Deputy Head of Research at Arif Habib Limited, states that “Islamic banks have a lower cost of deposit due to no requirement of MDR being mandated on them. This compromises the return earned by the depositors compared to a conventional bank. Making this return mandatory means that people are encouraged to save. Before any such provision, banks were giving out variable returns to depositors and rates improved near quarter end in the shape of a deposit wars.”

Mohammad Aitazaz Farooqui, Head of Research at Providus Capital, says “The return of Islamic banks offer to their depositors are substantially lower than MDR whereas the asset deployment isn’t at a substantial disadvantageous position relative to conventional banks. It is reflected in the better interest margins of the Islamic banks.”

“Conventional banks must pay MDR of policy rate – 150 bps which is currently 20.5%. The reason for no MDR for Islamic banking is that SBP is still unable to identify products on which they set the MDR” states Yousuf Saeed, CFA Charterholder & Head of Research at Darson Securities.

In terms of the commercial side of the banks Mustansir feels that “if Islamic banks can manage to get deposits at lower rates than the rest of the banking industry and then place them in assets earning similar yields, then why not? Other banks can follow the same with their Islamic banking windows or products too can’t they?”

This trend of opening up Islamic banks and branches as a subsidiary of conventional banks is already being seen with many of the banks providing an Islamic alternative to the market. This can seem like a race towards the bottom where depositors are being sacrificed for the sake of better profitability.

So the question then arises whether the banking system is being divided into two tiers and if there is a need to scrape MDR altogether. Islamic banks were given an exemption from MDR at a time when the Islamic finance market did not have the same amount of sukuks. This has changed in recent years where frequency and value of sukuk bonds being floated in the market has changed. In the face of this new reality, is there merit in saying that the market needs to take cognizance of this new reality?

Mustansir feels that MDR has its importance because conventional banks still account for the majority of the depositors in the country. This depositor base will suffer in case any such action is taken. There are banking systems that exist all over the world where both systems are running in parallel to each other and in order to scrap such a return would depend on the macroeconomic conditions of the country. Saeed opines that “For conventional industry, [MDR] is serving its purpose and giving rightful return to depositors. It should not be scrapped as it would lead to depositors withdrawing their deposits from the accounts due to a lower return.”

Hussain feels that if MDR is removed, it will lead the Islamic banks “to provide a higher return, Islamic banks will have to venture towards riskier products/financing on the asset side. Conventional banks would in essence be generating the same returns through risk-free investments in PIBs whereas Islamic banks, due to a lower rate on Sukuk and a profit-sharing ratio in effect, will have to extend financing to relatively riskier portfolios (at higher rates) to bridge that gap. The results of such a move will result in losses/reduced profit in two areas; losses/severely reduced profits to Islamic banks in case they follow their current model, increased number of NPLs.”

Tawfiq argues that “the quantum of sukuks is much higher now and the depositors are saving a higher amount at the banks which means that the banks are not facing the same issue of liquidity that they were facing in the late 2000s. Depositors are currently saving at Islamic banks due to the nature of the deposits, however, these depositors need to be protected in a better manner before they decide to head down the conventional route as well. There are talks currently going on between the State Bank and the Islamic Banks in relation to MDR and something is in the works to facilitate the depositors with better returns.”

Saeed says that MDR is actually seen beneficial in a country where rate of investment is low due to the population being oriented towards consumption. In such an environment, MDR makes sure that saving is attractive for the market. Tawfik seconds this notion as the country is looking to increase its investment to GDP ratio and by providing better returns to the depositor which will funnel more savings translating into investment in the country.

When brokerage houses like Taurus Securities do analyze the banking sector, they consider the cost of funds and deposits of the banks in their valuation models for both types of banks. Mustansir says that such an analysis shows higher return on equity for Islamic banks due to their lower cost structure reflective of the reality.

Farooqui says that in order to encourage savings and implement proper transmission of monetary policy, deposit rates should be mandated as competition alone will not guarantee fair treatment of all depositors. In terms of the return on equity, Islamic banks do end up generating better return on equity due to lower cost of deposits and similar asset return profiles.

Behavior of Interest Rates

With the country seeing record high interest rates of 22% since June of 2023, it becomes apparent why banks have been making the amount of profits that they are. From 2004 till 2023, interest rates have gone from 7% to a low of 5.75% in 2016 to a high of 22% for the last 9 months. This has flipped the operations and functions of the bank.

In normal circumstances, the banks would be crying for a cut in the policy rate. No business or individual would be willing to borrow at such rates and considering that the rate applicable to the consumers is indexed to the policy rate and higher than that, banks would not be able to attract parties interested in taking a loan from them.

On the other hand, with banks offering such attractive deposit rates, businesses and individuals would actually look to save and earn interest on their deposits rather than look to use that money for anything else. The sky high interest rates would also make banks skeptical in terms of loaning money to business as the risk of default is much higher and business might default in an economy with such high interest rates and low economic activity.

In Pakistan, this has not taken place. With private credit on the decline, the government has stepped in and started to mop up most of the liquidity that is available in the market. Through its Pakistan Investment Bonds (PIBs) and Treasury Bills (T-Bills), the government has looked to loan money from the banks. Banks are also willing to lend to the government as it is a risk free option and the government will always honor its debts. They are the ones responsible for printing the money and would just print more of the local currency in order to pay back its loans.

Recently, the newly elected Prime Minister actually lambasted the banks for investing in T-BIlls and PIBs and “sleeping” while their investments gathered profits. What the PM didn’t realize was that the day these banks would stop funding the government through its investments, the operations of the government would grind to a halt and the government would lose out financing for its day to day operations. So maybe Mr Pot needs to have a look in the mirror before calling the Kettle Bank Limited black.

This is the new reality which exists due to the rampant borrowing of the government and the capacity of banks to invest in high yielding government bonds while borrowing from the discount window of the State Bank and taking deposits from its depositors.

A new development that has taken place is that in parallel to government bonds, there are Shariah Compliant Sukuk investments being offered where Islamic banks have invested in the sukuk issues by the government and have been able to earn similar returns as compared to the conventional bonds.

This leads to a win-win situation for the Islamic banks. Conventional banks have to run after depositors in order to make sure their competitor banks are not able to secure these deposits. Once these deposits are secured, the banks have to give out a constant minimum return to these depositors. Islamic banks have it much easier. There are only a few banks which are offering truly Islamic banking in the country and even those banks can set a deposit rate which is acceptable to them rather than one mandated by the State Bank.

This is the true reason why Islamic banks are able to earn the return that they see while conventional banks have to face the reality of shrinking margins and higher costs. The person losing out in the end is the depositor who is maintaining an account at an Islamic bank and the winners are the shareholders of the bank who get to reap higher profits.

The Shamshad Akhtar Factor

A few months ago, the then caretaker Finance Minister; Mrs Shamshad Akhtar, did state that the State Bank should impose a minimum deposit rate for Islamic Banks as well. This saw the share price of these banks as it was expected that their earnings could fall in the coming period. This was a change in the behavior of finance ministers who used to talk about shifting money from the bottom line of banks to the national exchequer. For the first time, the new proposal would actually benefit the depositors for a change.

A quaint solution to this problem would be to index the deposit rate to a benchmark which moves and changes with the policy rate allowing for the depositors to get a more fair and equitable return.

A sensitivity analysis carried out by Arif Habib Limited for the September earnings of the banks showed that for every 1% increase in the minimum deposit rate mandated on the Islamic banks, Meezan would see its earnings fall by Rs 2.27 per share. Any such rate change will be felt in the bottom line.

The numbers behind the MDR divide

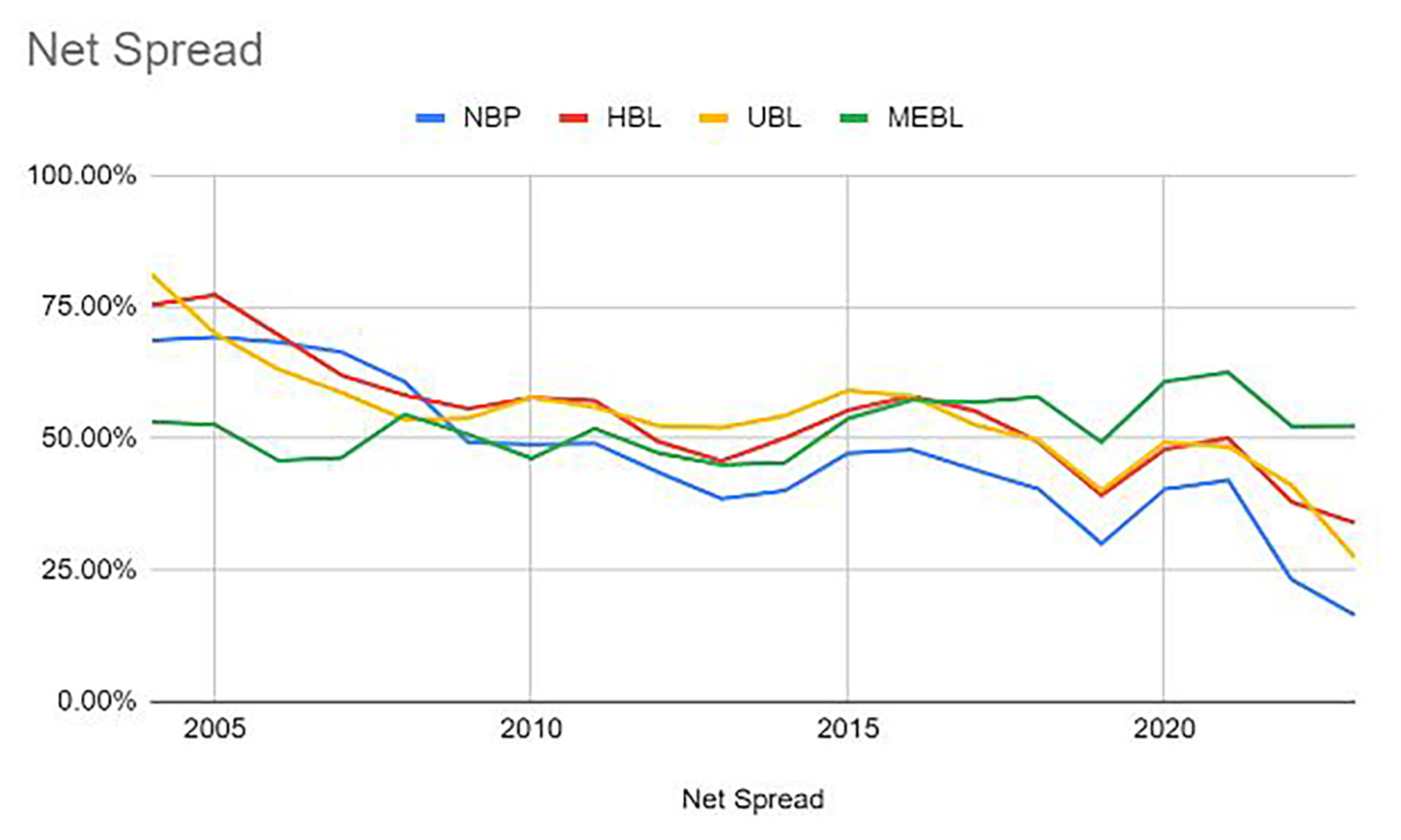

In order to analyze the data and numbers behind this divide, Meezan Bank has been compared to National Bank of Pakistan, Habib Bank and UBL which are three of the biggest banks operating in the country. In terms of analysis, the first trend that has been seen is the net spread percentage. This is the interest earned by the bank on its assets less the interest expenses which has been paid out to its creditors as a percentage of its interest earned.

In a manufacturing business, this would be considered the gross profit margin. How much the company is earning for every product that it manufactures and sells. In this case it represents how much money the bank is keeping after taking away much of its direct costs of yielding that interest income.

In 2005, the conventional banks were earning a return of more than 70% meaning they got to keep Rs 7 out of every Rs. 10 that it was earning. After the MDR mandate was put in place, 2023 shows the banks earning only 30% in terms of its net spread. In comparison, the Islamic banks were earning around 50% in terms of their net spread in 2005 which has stayed constant till now.

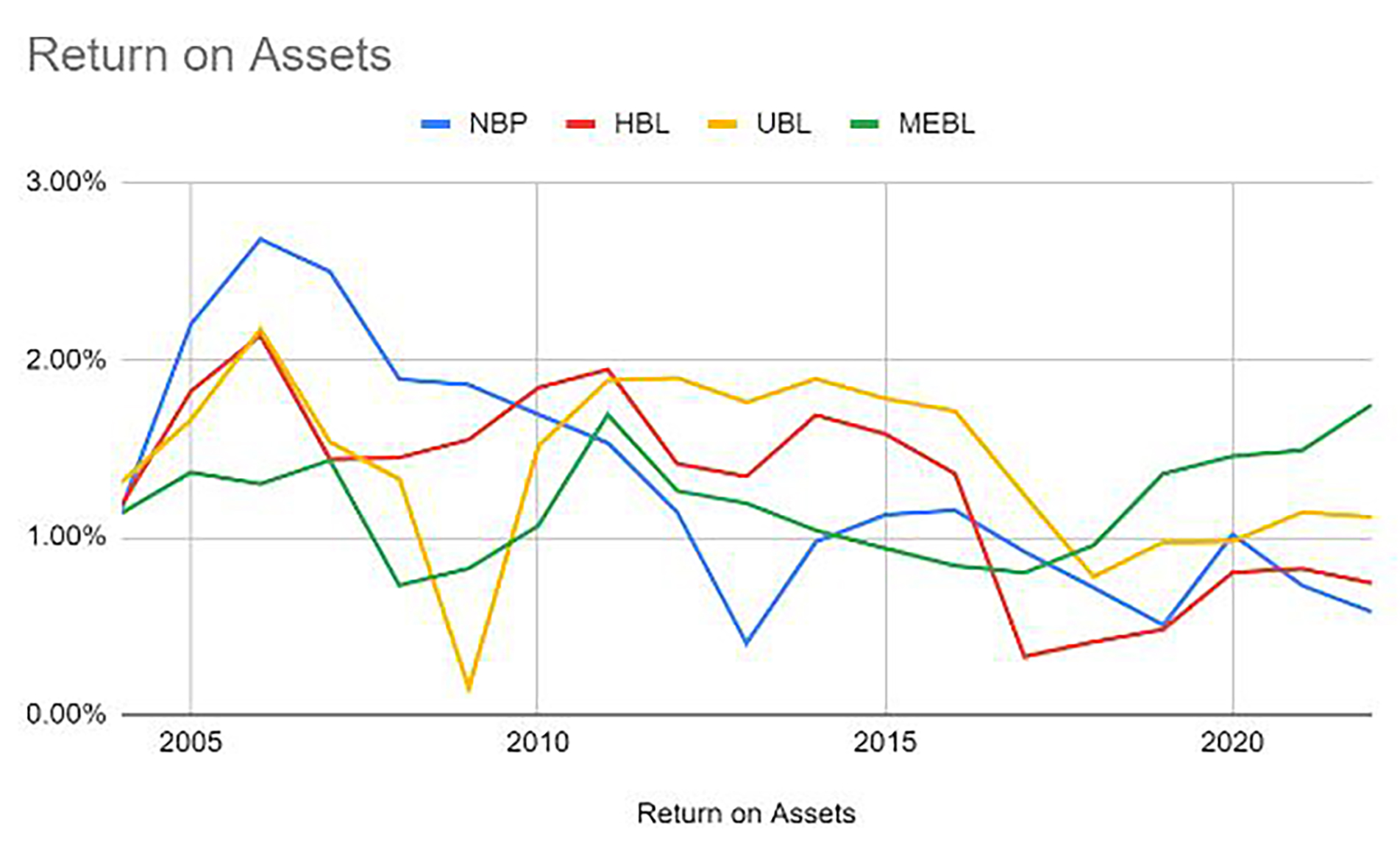

In terms of return on assets (ROA), there is a similar pattern where Meezan was only earning 1.37% in terms of its assets as net profit while National Bank, Habib Bank and UBL earned 2.2%, 1.82% and 1.66% respectively. Over time, the returns for the conventional banks fell and in 2022, Meezan saw ROA of 1.75% while National Bank, Habib Bank and UBL earned 0.58%, 0.74% and 1.11%.

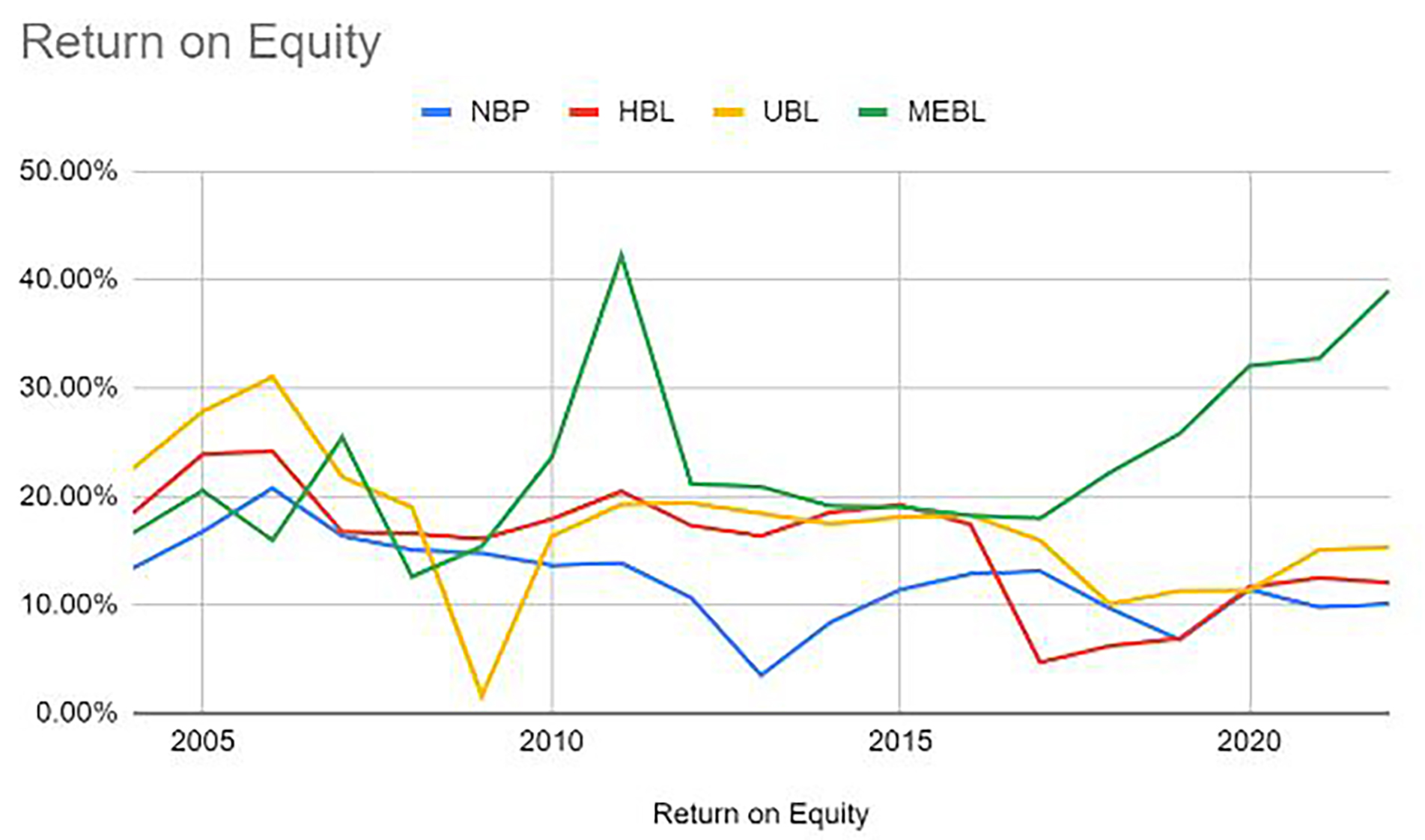

Due to the low equity requirement of banks, the results of its return on assets are magnified when seen in terms of its return on equity (ROE). Conventional banks like National Bank, Habib Bank and UBL had ROE of 17%, 24% and 28% in 2005 which fell to 10%, 12% and 15% while Meezan saw its ROE go from 21% in 2005 to 39% in 2022. To put this in context, the ROE of Meezan was more than the ROE of the biggest three banks of Pakistan combined.

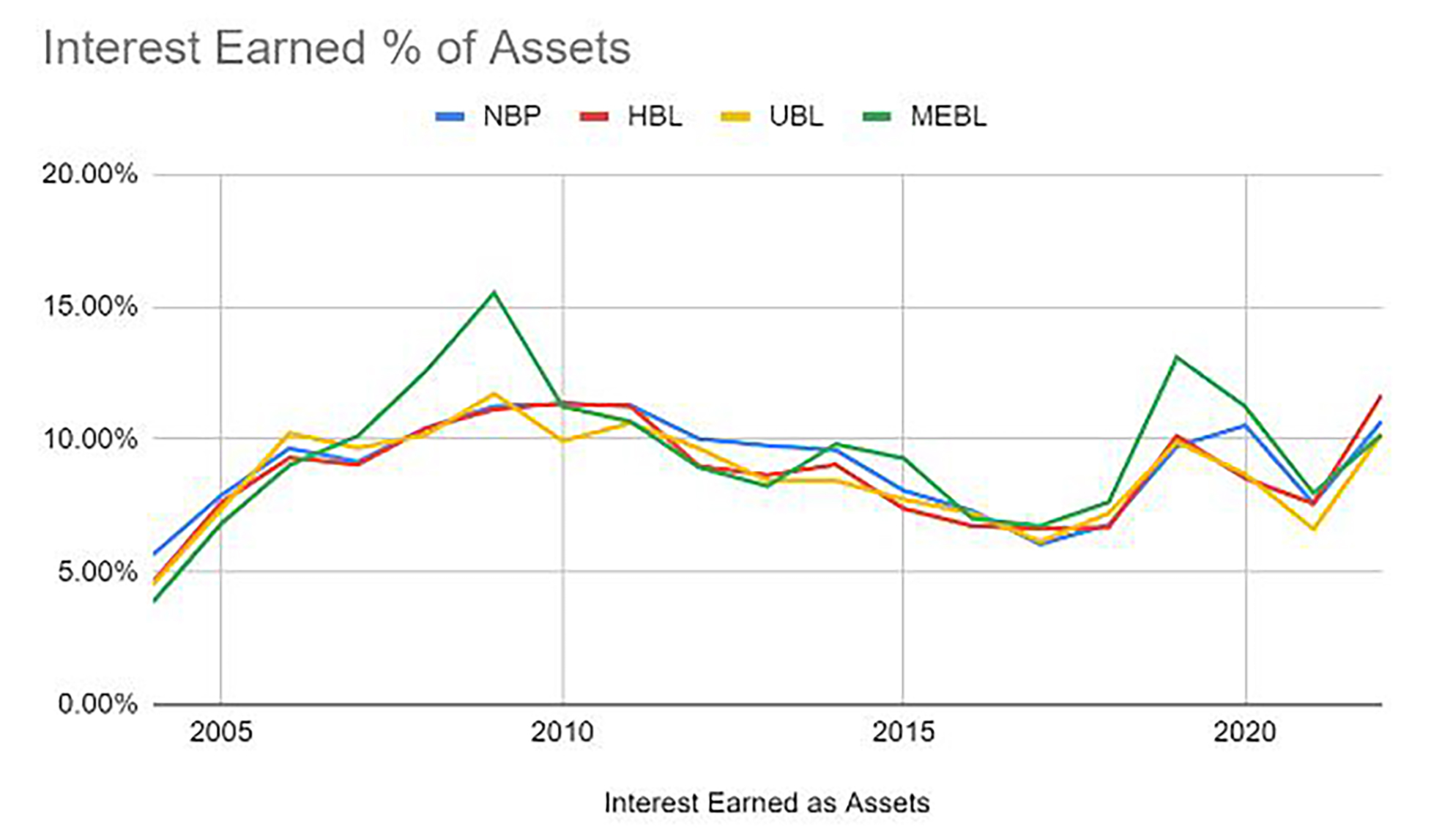

The investments of the Islamic banks yielded returns equal to those of the conventional banks. As interest rates have moved, Islamic banks’ earned interest as a percentage of assets have stayed similar to the ones of conventional banks. This means that the assets available for investment to both systems are the same and both of them are yielding a return based on the assets of the sector themselves. As of 2022, Meezan earned a return of 10% from its investment which matched the conventional banks.

On the other hand, the expense as a percentage of assets was around 1% for all banks in 2004 which increased to 7% for National Bank, 6% for Habib Bank and 5% for UBL. This percentage was lowest at 4% for Meezan Bank. This shows that the interest earned is similar while the cost is the lowest for Islamic banks.

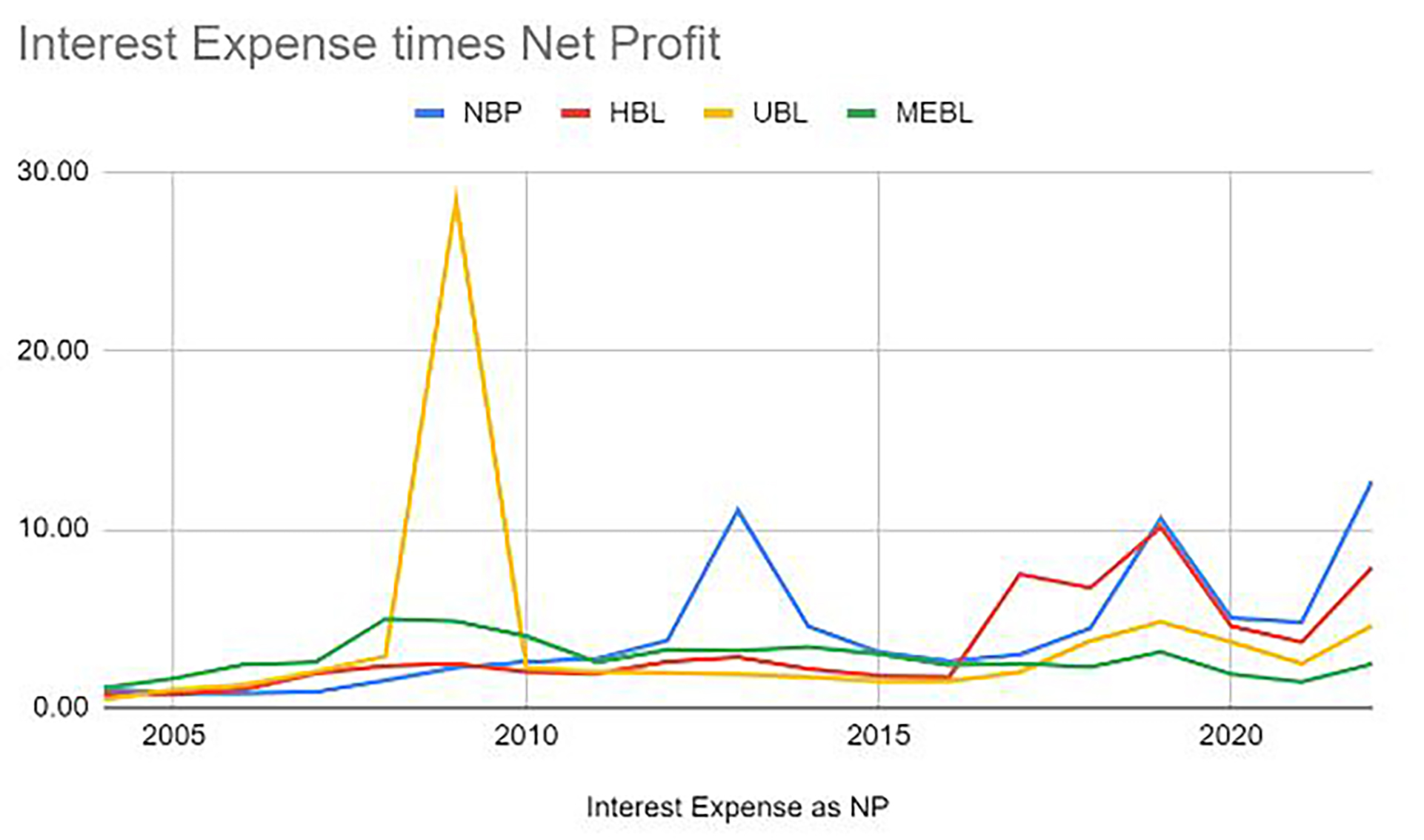

All this debate can be boiled down to the fact that interest expense, which used to be 1 to 1 in terms of net profit has now gone to 13 times, 8 times and 5 times for National Bank, Habib Bank and UBL while Meezan Bank has seen its interest expense go to 2.5 times of its net profit. This shows that the ratio of the expense has increased by at least 5 times for conventional banks while it has increased by only 2.5 times for Meezan Bank.

All this debate can be boiled down to the fact that interest expense, which used to be 1 to 1 in terms of net profit has now gone to 13 times, 8 times and 5 times for National Bank, Habib Bank and UBL while Meezan Bank has seen its interest expense go to 2.5 times of its net profit. This shows that the ratio of the expense has increased by at least 5 times for conventional banks while it has increased by only 2.5 times for Meezan Bank.

I`m happy sharing this experiences to testify about a great and powerful spell caster, my husband left me and the kids for 2 weeks when I called him he didn’t pick up when he came back home the 3rd week he told me he wanted a divorce I was so sad I cried all night he left again I was so lonely the next day I was searching for something online when I found a spell caster called DR PETER who have helped so many people with their problems so I contacted him with my problems he told me it will take 24 hours and my husband will be back to me I did everything he told me to do and the next day my husband came back kneeling and begging he canceled the divorce we are now happy together DR PETER can help you

WhatsApp +1 (646) 494-4360

Eventually banks earns from depositors money The primary focus of all banks is to give maximum return from the interest it earns from its services and further investments from depositors money and in return they are very miser to give profits to its depositors from their money from which they actually earns

Wonderful information is in this article.