The financial landscape of Pakistan is currently experiencing a transformative phase, marked by significant activity and the emergence of key players dedicated to unlocking its full potential. While displaying pockets of robust engagement, the nation’s futures trading industry holds substantial untapped potential. In the year 2024, the Pakistan Mercantile Exchange (PMEX) achieved a notable value traded of approximately PKR 7 trillion, indicating underlying market dynamism. With nearly PKR 1.2 trillion of value traded at PMEX in April 2025, it shattered all previous volume records and closed the month with an average daily traded value of PKR 50 billion. That’s nearly 70% increase compared to same period last year. However, this impressive figure coexists with a relatively low number of active Futures Brokers, numbering around 60 nationwide. Amidst this environment, H.G Markets Private Limited (HG), a constituent company of the esteemed Harvest Group, has distinguished itself as a dominant force, contributing over 40% of the total Value Traded on the entire Exchange. This article delves into the journey of HG and Harvest Group, their origins rooted from the Economic Reforms Act of Pakistan 1992, their role in introducing futures trading to the country, and their strategic vision for significantly augmenting retail participation in this vital market.

A Legacy Built on reform: Harvest Group and the Economic Reforms Act of 1992

In the early 1990s, the nation had recently emerged from periods of significant economic disruption and was poised for liberalization. A landmark piece of legislation, the Protection of Economic Reforms Act, 1992 (Act No. XII of 1992), was enacted by the Pakistani government with the explicit objective of furthering and protecting a series of economic reforms initiated from November 7, 1990, onwards. The Act aimed to cultivate a more liberal climate for savings and investments, foster confidence in the continuity of these reforms, and ultimately stimulate economic growth.

The preamble of the Act unequivocally stated the necessity to “create a liberal environment for savings and investments” and to provide “legal protection to these reforms in order to create confidence in the establishment and continuity of the liberal economic environment created thereby”. To achieve these goals, the Act encompassed several crucial provisions. It broadly defined “economic reforms” to include policies, programs, laws, and regulations implemented since November 7, 1990, covering areas such as privatization, promotion of savings and investments, fiscal incentives for industrialization, and the deregulation of investment, banking, finance, exchange, and payments systems. This comprehensive definition provided a legal framework for a wide array of liberalization measures.

A pivotal provision that significantly reshaped the financial landscape was the freedom granted to bring, hold, sell, and take out foreign currency. Section 4 of the Act bestowed upon all Pakistani citizens (resident within or outside Pakistan) and other persons the unfettered right to bring, hold, sell, transfer, and take foreign exchange in any form into or out of Pakistan. This eliminated the requirement for foreign currency declarations at any stage, thereby promoting greater freedom in managing foreign currency holdings. Furthermore, Section 5 provided significant immunities to foreign currency accounts held in Pakistan, guaranteeing immunity from inquiry by taxation authorities regarding the source of funds, exemption from wealth tax and income tax on account balances and income, secrecy of banking transactions, and no restrictions by the State Bank of Pakistan or other banks on deposits and withdrawals.

The Act also included provisions for the protection of fiscal incentives for setting up industries, ensuring they would not be altered to the disadvantage of investors. It safeguarded the transfer of ownership to the private sector, preventing compulsory re-acquisition. Protection was extended to both foreign and Pakistani investments in various sectors, including industrial, commercial, shares, and financial institutions. Secrecy of banking transactions was mandated for all bona fide transactions, and the government’s financial obligations and contractual commitments were protected. Importantly, Section 3 declared that the provisions of the Economic Reforms Act would override anything contained in other existing laws, including the Foreign Exchange Regulation Act, 1947, the Customs Act, 1969, and the Income Tax Ordinance, 1979, highlighting the primacy of these new reform measures.

The Economic Reforms Act of 1992 played a crucial and direct role in setting the stage for the inception and early success of Harvest Group. The liberalization of foreign exchange regulations was the most significant immediate impact. Prior to this Act, foreign exchange transactions were subject to stringent controls. The 1992 Act deregulated the holding and movement of foreign currency, making it considerably easier for Pakistani citizens and entities to engage with international financial markets and services. This newfound freedom was a prerequisite for Harvest Group’s initial business model, which focused on facilitating clients’ access to international brokerage firms for trading in futures markets.

The Act’s broader aim to foster a liberal environment for savings and investments and provide legal protection to ongoing economic reforms instilled a greater sense of confidence among individuals and businesses in engaging with the financial sector, including exploring international market opportunities. The legal backing signaled the government’s commitment to a more open and market-oriented economy, encouraging entrepreneurial ventures like Harvest Group. The Act’s emphasis on the deregulation of banking and finance systems also contributed to a more conducive environment for the growth of financial services companies, paving the way for future developments in the Pakistani market. Mr. Muhammad Gulraze Mir, the visionary Founder & Chairman Emeritus of Harvest Group, recognizing these emerging opportunities within this environment of evolving financial liberalization, established the first Hong Kong – Pakistan joint venture firm under the Harvest Group banner in 1992. This pioneering initiative marked the beginning of the Group’s long journey, initially focused on introducing Futures trading to the local market by facilitating access to international brokerage firms.

The Global Evolution of Futures Trading: A Necessary Context

The market in which Harvest Group through its brokerage arm; H.G Markets operates in, has a rich and lengthy history, evolving from simple barter systems to today’s sophisticated electronic trading platforms. The origins can be traced back to ancient roots, with some of the earliest known forward contracts recorded in the Babylonian era around 1750 BC. These involved merchants agreeing in advance to deliver goods at a future date. While mentions of similar contracts exist in Ancient Greece and Rome, these were informal arrangements, not part of organized markets.

The first arguably formal futures market emerged in Japan in the 1600s. The Dōjima Rice Exchange in Osaka, established in the early 1700s, is often considered the first formal futures market. Japanese rice merchants and samurai utilized contracts to lock in rice prices for future delivery, driven by market volatility. These contracts, known as “Cho-gomai” (rice coupons), helped samurai manage income and merchants hedge against price swings.

The birth of the modern futures market took place in the United States with the establishment of the Chicago Board of Trade (CBOT) in 1848. Chicago was a major grain hub, but issues with transportation and storage led to massive price volatility. Farmers, grain merchants, and processors needed a method to fix prices ahead of time. This initially led to forward contracts, informal agreements to buy or sell commodities at a future date. By the 1860s, the CBOT introduced the first standardized grain futures contracts, making them legally binding and tradable.

Futures trading remained primarily focused on agricultural commodities until the mid-20th century. A significant catalyst for expansion was the collapse of the Bretton Woods system between 1971 and 1973. The Bretton Woods Agreement, established in 1944, created a fixed exchange rate system where member currencies were pegged to the US dollar, which was convertible to gold at $35/oz. While fostering post-WWII stability, this rigid system proved unsustainable. In 1971, President Nixon suspended the convertibility of the dollar to gold (“Nixon Shock”), and by 1973, the system collapsed, leading most major currencies to adopt floating exchange rates.

The shift to floating exchange rates created currency volatility. Under Bretton Woods, fixed rates meant little need for currency hedging. After 1973, the unpredictability of floating currencies created a demand for hedging tools. This directly led to the birth of financial derivatives, particularly currency and interest rate futures. In 1972, even before the full collapse, the Chicago Mercantile Exchange (CME) launched the International Monetary Market (IMM), introducing the world’s first currency futures contracts. The need to hedge interest rate risk also grew as central banks gained independence and rates became more volatile, leading to the emergence of interest rate futures in the late 1970s and 1980s. This period saw the rapid expansion of futures markets beyond commodities into financial instruments, energy, metals, and more recently, crypto futures.

H.G. Markets: Pioneering and Leading in Pakistan

In 1992, Harvest Group was one of the biggest subscribers of Reuters Money 2000 Terminal for the receiving of Reuters Financial Data, News, and Rates through satellite connections. At that time, the small dish apparatus and internet services were not available. We started with 200 Monitors and Slave Screens of Reuters Terminals in our Karachi and Lahore offices, making Harvest Group a unique financial entity besides the banking institutions who were receiving this information through satellite and terrestrial coaxial cable links.

In 2005, Harvest Group entered into a joint venture with one of the leading and largest brokers; CMC Markets UK, thus becoming the first in Pakistan to introduce online trading.

Built upon the foundation laid by Harvest Group and operating within the evolving global and domestic financial context, H.G Markets Private Limited (HG) was formally incorporated in the year 2013. As a constituent company of Harvest Group, HG inherited the pioneering spirit of the group which had already established a reputation for introducing futures trading in Pakistan by facilitating access to international markets.

Since its incorporation, HG has achieved significant milestones that solidify its position in the Pakistani financial market. The company is a licensed Futures Broker and Securities Broker by the Securities and Exchange Commission of Pakistan (SECP).

Via its PSX and PMEX based brokerage services, HG serves the investment and trading needs of customers across the country. Demonstrating consistent leadership and market penetration, HG has been Pakistan’s No. 1 Futures Broker by Traded Value according to the rankings of PMEX from 2014 to date. Their market-leading position in brokerage activities is supported by policies across all operations to enhance the overall trading experience for investors and traders. HG’s growth is also fueled by building the biggest sales and marketing workforce in the Pakistani financial industry. This workforce of around 400 professionals operates through registered offices branching over 5 cities of Pakistan, enabling significant domestic integration. HG has trained over 40,000 market professionals by conducting bimonthly trainings in all of its offices, ensuring high staff and client literacy. The scope of our trainings includes technical and fundamental analysis of the market by the Institute of Financial Markets of Pakistan (IFMP) certified trainers.

HG has consistently invested in technology and innovation being the first broker to introduce the MT4 and MT5 trading platforms which were later adopted by the PMEX. This ensured fast execution, transparency, and access to real-time data. Trading in mobile accessibility, client dashboards, and secure back-office systems have enhanced the overall experience of market participants, catering to the expectations of tech-savvy client-base.

Leveraged Trading: A Key Concept

A fundamental aspect of futures trading that often contributes to misunderstanding and hesitation among retail investors is leverage. Leveraged trading means controlling a large contract value with only a small upfront payment. In futures trading, this is possible because traders are not required to pay the full value of the contract upfront; instead, they post something called an initial margin. The initial margin is the upfront amount, typically a percentage of the total contract value that must be deposited to enter the trade. It is crucial to understand that the initial margin is not a down payment; it acts as a security deposit.

Leverage allows traders to trade a bigger position with a small amount of capital. For example, if trading a Crude Oil Futures contract with a size of 1,000 barrels at $80 per barrel, the total contract value is $80,000. If the initial margin requirement is 10%, the trader only needs to deposit $8,000 to control $80,000 worth of oil. This represents 10x leverage ($80,000 / $8,000).

The key characteristic of leverage is that it magnifies both profits and losses. Using the same example, if the oil price rises from $80 to $82, the profit is $2 per barrel × 1,000 barrels = $2,000. On the $8,000 margin, this is a 25% return from just a 2.5% price move. However, if the price drops to $78, the trader loses $2,000, which is a 25% loss on the initial capital.

Traders must also be aware of the maintenance margin, which is the minimum amount that must be kept in the account to keep the position open. If losses cause the account balance to fall below the maintenance margin, the exchange may issue a margin call, requesting additional funds to top up the account. Failure to meet a margin call can result in the automatic liquidation of the position. Therefore, proper risk management, including the use of stop-losses and appropriate position sizing, is critically important when engaging in leveraged trading. Understanding this dynamic is vital for responsible participation in the futures market.

Price Action Explained

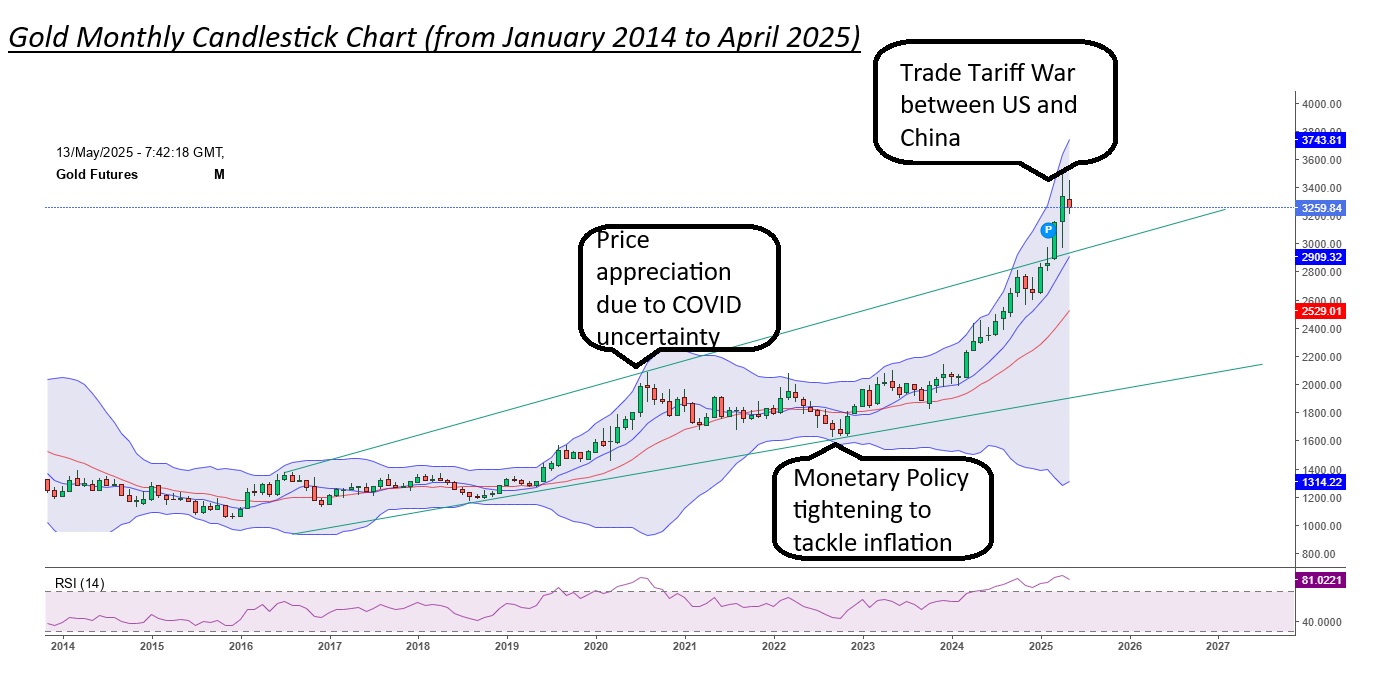

The international gold price trajectory from 2014 to 2025 demonstrates significant fluctuations influenced by global economic and geopolitical factors. The average gold price rose from $1,199.25/oz in 2014 to $2,656.35/oz in 2024. It has already marked a high of $3,509.90/oz in April 2025, with a forecast of $4,000.00/oz for late 2025. Factors driving price changes include an impulsive U.S. dollar, interest rates, geopolitical uncertainties, market volatility, global economic uncertainties, the COVID-19 pandemic (increasing safe-haven demand), inflation concerns, and central bank purchases. Gold has demonstrated its role as a hedge against economic instability, and its upward trajectory in recent years underscores its continued relevance in diversified investment portfolios. The price of gold as of early May 2025, was approximately $3,395 per ounce. This context highlights the importance of gold futures trading as a tool for both speculation and hedging.

Strategic Vision for the Future

H.G Markets operates with a clear strategic vision and ambitious goals for the future of Pakistan’s financial market. A primary focus remains on augmenting the retail-base to increase the futures market participation rate. This vision extends beyond increasing trading volumes to empowering individual investors with the knowledge and tools for confident participation.

Building on the pioneering efforts of Harvest Group, H.G Markets has established itself as a market leader by value. Their journey reflects a commitment to navigating challenges, adapting to technological advancements, and adhering to regulatory standards. However, they recognize that true market maturity and dynamism require broader participation, particularly from retail investors. HG’s strategic focus on enhancing retail participation through multi-channel education, accessibility, and trust-building initiatives is crucial for overcoming existing barriers and unlocking the immense potential of Pakistan’s futures market. By empowering individuals with knowledge and providing seamless trading solutions, H.G Markets is actively contributing to the evolution of a more vibrant, inclusive, and sophisticated financial future for Pakistanis enabling them to access local and international financial markets.

Disclaimer:

H.G Markets Private Limited is not in investment advisory business and acts only as Member of Pakistan Mercantile Exchange and Pakistan Stock Exchange. Trading in securities and commodity futures is subjected to market risk. The amount you may lose is potentially unlimited and can exceed the amount you originally deposited. The information contained herein does not suggest or imply and should not be construed in any manner a guarantee of future performance and / or investment advice. Investors and traders are advised to read the risk disclosure document carefully along with the account opening form.