ISLAMABAD: The cost of Pakistan’s flagship Reko Diq gold and copper mining project has increased by $1 billion to $7.7 billion following approvals by the boards of Oil and Gas Development Company Limited (OGDCL), Pakistan Petroleum Limited (PPL), and Government Holdings Private Limited (GHPL).

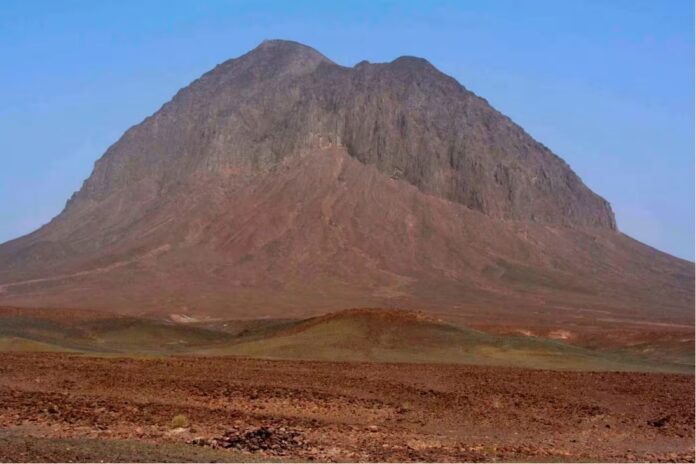

The approvals were granted during the companies’ annual general meetings on Wednesday, where shareholders endorsed the revised financial plan. The rise from the earlier $6.7 billion estimate reflects surging global construction costs, lingering supply chain challenges, and additional infrastructure requirements in Balochistan’s rugged terrain. Despite the escalation, stakeholders reaffirmed their commitment to the project, calling it vital for Pakistan’s mineral sector and foreign exchange earnings.

A source privy to the development confirmed the revised figure but noted that the $7.7bn includes contingencies that may not fully materialise, adding that the actual cost could remain closer to $7bn.

The meetings also discussed a financing arrangement through the Reko Diq Mining Company (RDMC) to provide $350 million to Pakistan Railways for the construction of a dedicated railway line connecting the mine to Port Qasim. The funding, to be extended as a loan under a sovereign guarantee from the federal government, will form part of the Main Line-III (ML-3) project. Pakistan Railways would be required to complete the railway track within three years to ensure timely mineral transport.

Mining activity at Reko Diq is scheduled to begin before the end of 2025, with commercial production expected by 2028. Over its projected lifespan, the project is anticipated to generate about $90 billion in revenues, making it one of the most significant mining ventures in Pakistan’s history.

Industry sources said the simultaneous approval of the revised financial plan and the commitment to rail financing marked an important milestone in moving the long-delayed project towards execution. They added that the railway link would address a critical logistical challenge while reducing immediate fiscal pressure on the federal government.

The Reko Diq project, located in Balochistan, is also expected to generate thousands of direct and indirect jobs, stimulate local businesses, and create new opportunities for regional development. For Islamabad, it represents both an economic lifeline and a test of its ability to implement mega-projects in collaboration with international investors.

Reko Diq Mining Company (RDMC) is jointly owned by Barrick Gold Corporation (50%), the Government of Pakistan (25%), and the Government of Balochistan (25%), with the latter split between a fully funded stake and a free-carried basis. The project was restructured under this ownership framework in December 2022 to pave the way for its revival.

Prime Minister Shehbaz Sharif has previously directed authorities to ensure the Reko Diq mining project is linked to the railway network by 2028 to support future cargo and export needs.

It is also pertinent to mention that the project is also expected to generate thousands of direct and indirect jobs, stimulate local businesses, and create opportunities for regional development in one of Pakistan’s most underdeveloped provinces. For Islamabad, it represents both an economic lifeline and a test of its ability to execute mega-projects in partnership with international investors.