Do you remember the few days in January 2015, when all of Pakistan seemed to run out of petrol and the entire country seemed to shut down for a while? Do you remember feeling frustrated at how ridiculous a situation that was? In a few years, that will happen with natural gas. Not low pressure, or the few hours that it doesn’t come on in the winters. But just flat out: no natural gas for several days at a stretch in the entire country.

Why will that happen? Because this government – like its two predecessors – does not have a clear plan to solve the core problems with Pakistan’s energy crisis. Which is a crying shame, because they, more than any previous government, should be in a good position to solve the problem.

In 2013, when Nawaz Sharif became prime minister for the third time, senior executives at energy companies throughout Pakistan got calls from the prime minister-elect to come meet him and discuss how to solve the nation’s crippling energy crisis. No such calls have gone out, certainly not to the same scale, when the Imran Khan Administration came into office.

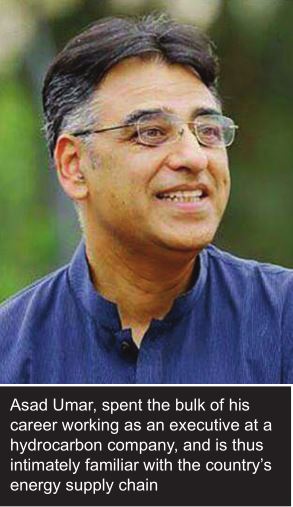

This is not, of course, because the ruling Pakistan Tehreek-e-Insaf (PTI) is any less serious about solving Pakistan’s chronic energy shortage, but because the incoming finance minister, Asad Umar, spent the bulk of his career working as an executive at a hydrocarbon company, and is thus intimately familiar with the country’s energy supply chain.

The PTI appears to have largely ceded ground in policymaking on budgetary and fiscal matters to the civil service (more on that in another article in this issue), which is disappointing enough as it is. But it was hoped that having Asad Umar in charge of economic policy might have resulted in bolder initiatives in the energy sector. Unfortunately, at least for now, that does not appear to be on the cards.

In this, as in many other areas of policy, it appears that the PTI is once again stopping just short of what is actually needed in terms of policy decisions, which in this case would have involved aggressive price hikes early in their tenure.

In order to understand why this would be the case, however, it is important to lay out the context for how Pakistan’s energy sector works, and why this PTI may be inadvertently pushing Pakistan into exacerbating what is already a growing problem: intercorporate circular debt throughout the energy supply chain caused by unpaid bills and stolen electricity and gas.

The interconnected energy grid

Energy, more than most industries, is a highly interconnected sector, and in Pakistan, the overwhelming majority of it is owned and operated by the government of Pakistan. As Khurram Hussain has noted in his writings in Dawn, Pakistan has been particularly fortunate in having built dams for hydroelectric power, and for having discovered large reserves of natural gas relatively early in its existence.

That investment in hydroelectric power, and combined with the abundance of natural gas, has meant that, for a large part of its energy needs, Pakistan has been able to rely on domestic, state-owned resources that have been relatively affordable. For most of its existence, power outages in Pakistan occurred not because the government needed to ration power, but because of faults in the grid.

As things stand today, Pakistan’s fuel mix for electricity generation still largely consists of hydroelectric power and natural gas, with the two accounting for well over half of the country’s primary energy supply. But in terms of importance as a fuel, natural gas is by far the most important.

Combining domestic natural gas production with imports of liquefied natural gas (LNG), the fuel accounted for 44.4% of Pakistan’s primary energy supplies in 2016, according to data from the National Electric Power Regulatory Authority (NEPRA). Primary energy supply refers to the fuel source for the country’s entire energy needs, including electricity generation, fuel for transportation, and any other major use of energy.

No other fuel source comes even close to being as important to Pakistan, and no other fuel source – barring hydroelectricity – is as dominated by domestic production as natural gas. The nation’s national gas grid, thus, is critical to its energy security.

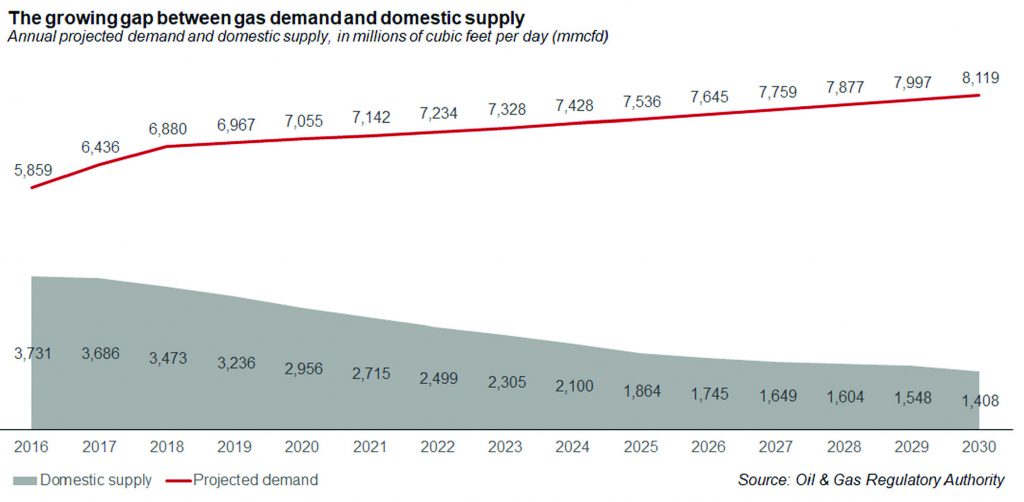

The system consists of 75 natural gas fields spread across all four provinces, which in 2017 generated a total of 3,455 million cubic feet of natural gas per day (mmcfd), according to data from the Oil and Gas Regulatory Authority (OGRA). Another 492 mmcfd was imported in the form of LNG at two terminals located in Karachi and Port Qasim.

This number actually represents a stark decline from the roughly 4,200 mmcfd that Pakistan produced in 2014, the peak year of domestic natural gas production. Since then, most of Pakistan’s major natural gas fields have begun to experience a sharp decline in capacity, which in turn has had a dramatic impact on total domestic production.

As domestic production at existing fields declines, new discoveries are not keeping pace, and even the ones that are discovered to be viable have significantly higher costs of production than the older, larger fields. This is a somewhat natural process: the larger, easier fields get discovered first and have the lowest costs of production. The later fields are smaller, and therefore harder to find, and as a result also require more investment to extract less and less gas.

The budding gas-sector circular debt

This problem first began to arise in the Zardari Administration, when the petroleum engineers at the nation’s state-owned oil and gas companies began to raise the alarm that they were about to hit peak production capacity, following which there would be a precipitous decline. The problem, unfortunately for them, was that they stated that the decline would begin in 2014, a full year after the Zardari Administration expected their term to end, meaning that they never bothered to deal with it.

The Nawaz Administration felt enough of a compulsion to allow for the construction of new LNG import terminals, but never bothered to fix the core problem of diminishing supplies and rising costs.

Indeed both of the previous two administrations continued to allow an increase in the total number of domestic consumer gas connections. Over 300,000 new gas connections were installed over the past five years, according to data from OGRA.

Under the government’s contracts with the oil and gas exploration and production companies, the government is bound to pay for the full cost of exploration and production, plus allowing for a profit margin for the companies themselves. However, the government is not legally bound to pass on the full cost of that oil and gas production to consumers, even though it controls the vast majority of the distribution network, and should in theory be financially incentivised to do so.

In a bid to keep natural gas prices artificially low, the government continued to force the two major gas distribution companies – Sui Northern Gas Pipelines (SNGP) and Sui Southern Gas Company (SSGC) – to continue to supply gas to all of their consumers (domestic, industrial, power generation, fertilizer manufacturers, and commercial) at more or less the same rates, even though the cost at which they were buying natural gas from the exploration and production companies had skyrocketed.

By the time Prime Minister Imran Khan took office, the differential had soared: according to senior officials at the SNGP who briefed the prime minister, the company has a cost basis of natural gas of Rs629 per million British thermal units (mmBtu), but it is selling it to consumers at an average of Rs399 per mmBtu, which amounts to a negative gross margin of -36.6% or Rs230 per unit.

This difference had resulted in the build-up of a more quiet version of inter-corporate circular debt in the gas sector, similar to the more famous problem in the electricity sector. Left unchecked, this problem could cripple the nation’s energy supplies and would ultimately be resolved only through a massive fiscal shock when the government would inevitably have to use taxpayer money to bail out these companies.

What happens next should be obvious: the government should allow the gas companies to raise prices to a level that would pay for their cost of natural gas, plus the cost of maintaining the pipelines and distribution infrastructure.

Alas, this is where we run into the biggest policy choice that every government in Pakistan has refused to make since at least the Musharraf era, and quite possibly, since long before then.

The cost of theft problem

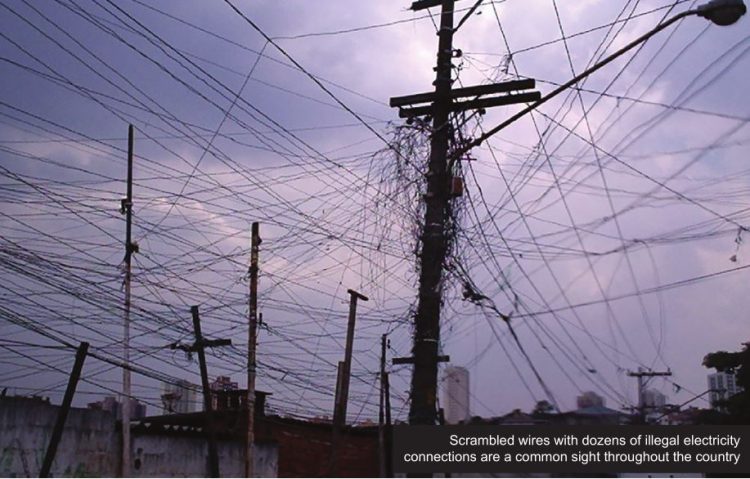

The central problem is what to do with the cost of theft. By now, any rational person needs to accept the following statement as fact: while the vast majority of Pakistanis may not be thieves, an alarmingly large number of our fellow citizens are thieves who have no problem stealing both electricity and natural gas from the national grid, and we as a nation appear to have a very high tolerance for such people.

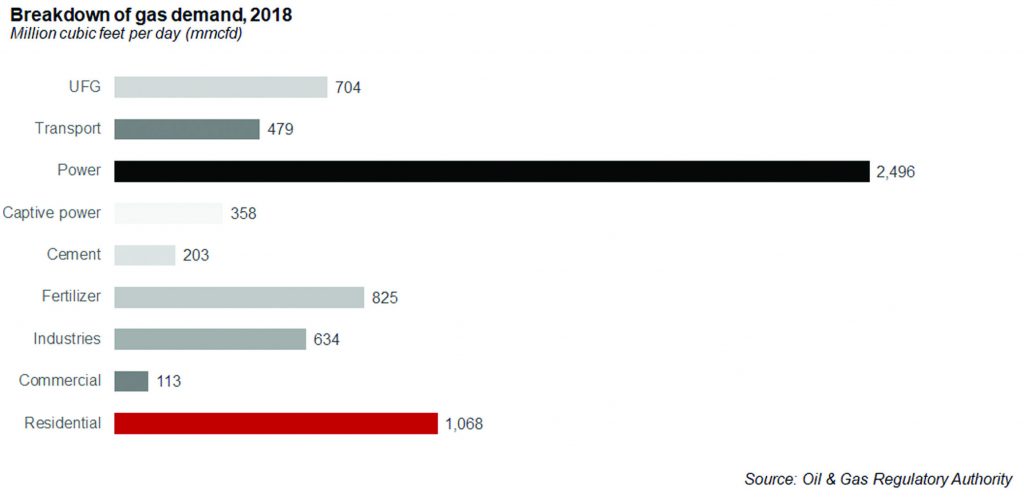

In the realm of natural gas, the terminology for stolen gas is “unaccounted for gas” (UFG). Technically, UFG includes more items than theft, including natural shrinkage of gas as it moves from warmer climates in the southern part of the country where all the gas fields are to colder climates in the northern part of the country where most of the gas is consumed.

But most of it is people stealing the gas outright, either by taking gas from pipelines through illegal connections, or having legal connections, but somehow not paying for them.

In the year 2017, the most recent year for which complete data is available, the government estimates that UFG amounted to 374 mmcfd, or about 9% of the total amount of gas consumed in the country. To put that in context, that amount of gas is enough to run all of K-Electric’s power plants at full capacity, which could power the entire city of Karachi. And most independent energy analysts believe that the government is underestimating the total amount of the theft.

This is the heart of the problem: who should pay for that stolen gas?

The ideal answer, of course, is that gas should not be stolen and that the government should crack down on the people who are stealing it. But think about how many people that is. Even at the government’s numbers, the amount of gas stolen is equal to approximately 47% of the total amount of gas consumed by all of the approximately 9.4 million households that have a natural gas connection.

In other words, the gas is being stolen by millions of people, and a crackdown is at best a very long-term solution.

The other solution, of course, is to simply assume that theft is just a part of the cost of being in the energy business in Pakistan and just build in a certain amount of theft into one’s cost of natural gas. That might seem to be the pragmatic option, but it runs into some very serious challenges, most notable the issue of fairness: why should law-abiding, bill-paying people have to pay for the freeloaders who are literally stealing from them?

That is not just a philosophical question. There is a widespread hypothesis – untested – among policymakers, both within the civil service and outside of it, that allowing for an increase in the cost of natural gas (or electricity for that matter) to the cost of people’s gas or electricity bills will prompt more people to switch over from paying their bills to stealing, causing the cost of theft to go higher, and thus forcing the government to raise the cost again, causing yet more people to start stealing, and on and on in a vicious circle that would only make the problem worse than it is now.

So what can you do?

Well, the government of Pakistan has opted for the easy way out: split the difference, and allow for some stealing to be paid for by bill-paying consumers but not all of it. In the case of natural gas, the amount comes out to almost exactly half: UFG stands at 9% of total gas consumption, but the government restricts its allowance for UFG to 4.5% of total gas sold.

This policy is not entirely without merit. The hope is that the companies are not completely left out in the cold in terms of having to face the cost of theft all on their own, but still have some incentive to try to fix the problem over the long run.

Unfortunately, this idea only works in theory, not in practice. The two major gas utility companies have an annual revenue shortfall that has now hit Rs152 billion ($1.23 billion). The gas that is stolen still has to be paid for, and the government simply wishes away those financial liabilities. In the absence of government subsidies, they have to be financed by bank borrowing, but there are limits to how much banks can lend before they realise that the problem is never going to get solved and they are just throwing good money after bad.

Forcing state-owned companies to crack down on theft is just not working.

The government’s half-baked solution

When a new government is elected, the political capital derived from its electoral victory – however flawed – creates the opportunity for a few months for that government to make bold decisions that may be unpopular but can be sold to the public as necessary, not just because people are willing to give the new government a chance, but also because they can be blamed as necessitated by the previous government’s mistakes. The PTI is still in that phase, but at least for now, appears hell-bent on squandering that opportunity.

In a decision that was greeted with some fanfare in the country’s financial press – and certainly among the nation’s financial community – the government decided to increase the cost of natural gas. In a cabinet meeting, the prime minister allowed for an average of a 46% increase in the gas tariffs that the state-owned gas companies can charge consumers.

For those of you who have quick mathematical skills, you can probably see that this measure will not nearly be enough. A 46% increase in overall tariffs for SNGP, for example, means that its average revenue per mmBtu will go from Rs399 per unit to Rs583 per unit. That still leaves a gap of Rs46 per unit that it needs to finance from somewhere.

In other words, the government is raising rates substantially across the board, but somehow still not actually solving the problem. It will use its political capital and take abuse from supporters, and get absolutely nothing for it in return. In Urdu, such an act would be called gunah-e-belazzat (sin without pleasure).

The impending nationwide gas shutdown

So how does this all result in the nationwide shutdown of the natural gas grid that we referred to earlier in this article? Because Pakistan is running out of domestic sources of gas, and has begun importing it. And foreign sellers are far less forgiving of financial mismanagement than the mostly state-owned companies the government has hitherto been dealing with in the natural gas realm until now.

Luckily for Pakistan, the decline in domestic production appears to have happened right around the time that global prices for oil and LNG sharply declined, resulting in imported LNG being relatively cheaper than it might have been prior to the August 2014 collapse of global oil prices.

But if history is any guide, nobody’s luck lasts forever in the global commodity markets, and Pakistan’s track record is no different. The government went on a massive building spree of oil-fired power plants in the 1900s when oil prices were at record lows, only to be hit with sharp increases in the cost of electricity production when oil prices rose again in the late 2000s and early 2010s.

Demand for natural gas is beginning to skyrocket, even as the government shifts more and more electricity production towards coal (that will still not solve the problem, because the real problem in electricity generation is still theft, not the cost of power generation).

If the government does not fix the problem of paying for the cost of theft in the natural gas sector, it will face exactly the same kind of pressures that it did in oil: domestic financing sources for the gas companies tapped out, and banks unable to finance letters of credit for imports, resulting in a complete shutdown of supplies from abroad, upon which the country will rely on more and more over the next decade and beyond.

Pakistan currently imports about 10% of its total gas supply, but by the year 2030, that number will reach closer to 83%, which is slightly higher than the percentage of our total consumption of oil that is imported. The markets will both have the same dynamics, and hence the dysfunctions that we have already seen in the petroleum realm will also likely play out in the natural gas sector.

Here is how that nightmare scenario will play out: one fine day, the natural gas companies will be told by their bank that they can no longer lend them any money to pay for the gas they are about to import from Qatar. The government of Pakistan at that point will lean on the government of Qatar to let them have some of the gas for free and some on generous financing terms, but the Qatari government will inform Islamabad that it has already done so over the past several months and years and that it has run out of both patience and generosity.

Qatar Petroleum will demand up front payment before it will even dispatch the oil from Doha, and at this point, Islamabad will be scrambling to find money to pay for it. Pakistan’s Foreign Service officers around the world will find themselves in the awkward position of having to go into an emergency begging session with their host governments, hoping to scrape the money from somewhere.

But there will be none to be had, because by that point, all of the ad hoc measures that the nation’s gas system had been surviving on will have been completely exhausted, and hence there will be no more LNG to pump through the nation’s gas pipelines and Sui will have long since run dry.

First, it will be the CNG stations that shut down, then the power plants, then the fertiliser plants, and then finally it will be every single household in the country. Forget having gas to heat your home in the winter or warm your water supply, there will be no gas to cook your food.

If that sounds like an unlikely nightmare scenario, it should not. It can and will happen if the government does not find a way to deal with this problem. And the longer the government waits, the more expensive the solution gets.

The K-Electric solution

So what exactly can the government do? If it cannot ignore the cost of the theft, and if it cannot make honest bill-paying consumers pay for it, and if even splitting the difference does not work, then what does?

Well, we have one success story in Pakistan, but it involves completely changing the incentive structures for the gas companies. That case study is that of K-Electric, the only electricity distribution company in Pakistan that is privatised, and not coincidentally the only utility company in Pakistan that has successfully managed to crack down on theft.

See, the solution is an eventual crack down on theft: dishonest systems can never be sustainable. But in order for the crackdown to happen, the people implementing it need to feel the pinch if they fail to do so. In the case of a private company like K-Electric, the money for that theft has to come from the majority shareholders, who face losses on their investment if they do not stop people from stealing. Who faces the consequences at SNGP if they fail to curb gas theft? Nobody. The company is owned by the government, and its employees and managers know that the government will eventually be forced to pay for the problem, so why bother?

Before coming into office, the PTI had alluded to moving all state-owned companies into an independent management system that may serve as a prelude to privatising at least some of them, though the party’s leaders have not stated a specific desire to privatise the state-owned natural gas distribution companies.

And if they were going to go through the hassle of battling the companies’ unions in their bid to privatise them, the time to announce that decision would have been right around now, and not several months from now, when the sheen from the election victory will have worn off, and the government’s political opponents will have had time to gather strength.

Announcing the tariff increase without addressing the remainder of the problem will please absolutely nobody, and will yield no political or policy benefits. The PTI would do well to remember that in politics, fortune favours the bold.