After bingeing Season 4 of Netflix’s hit series Money Heist in less than 24 hours of its release, I was overwhelmed at first with emotion over the show, and then with a series of questions that came to my mind.

Does the gold vault in Pakistan flood the way the Bank of Spain’s vault does? Does our State Bank governor know how to operate on gunshot wounds? Does Reza Baqir have very highly skilled bodyguards of the likes of Gandia? How would he respond in such a situation? And does the State Bank of Pakistan also act as a storage of the nation’s biggest secrets immaculately stowed away in suitcases inside a vault.

While those thoughts are certainly entertaining, and encapsulating, the questions I decided to dwell on were the ones relevant to the vulnerabilities of the financial system. After all, this is Profit, a business and economics magazine, (and because, sadly enough, my boss does not pay me to write random conspiracy theories).

Why wouldn’t it be called that, after all? The system is exactly that, a house of paper – looks fancy but is very fragile. Am I then saying that paper currency can collapse? Well, no, I would not go as far to make that claim, but do bear with me.

What does not come as a surprise is that the leading show on Netflix is aptly named La Casa de Papel in its native language. Translated, that means “The House of Paper”.

Why wouldn’t it be called that, after all? The system is exactly that, a house of paper – looks fancy but is very fragile. Am I then saying that paper currency can collapse? Well, no, I would not go as far to make that claim, but do bear with me. As an obsessed fan of both the show and financial systems, I have explored the very concept the show is developed on. I will, however, need one thing from the reader to achieve full effect. Because I will be assuming that the song Bella Ciao is reverberating in your head as you read the wild manifestation of my thoughts on the weaknesses of the system we place our immense trust and lives in.

Before we move to the finances, let’s talk about the show itself. It features a group of anonymous criminals that plan on occupying the Royal Mint of Spain and printing their own money. Technically, you cannot call them robbers.

Now, before you judge me for that absurd statement, hold your horses. The Professor, the mastermind behind the heist in the show, argues that if the European Central Bank can print money and not call it a robbery; why can’t the band of individuals with aliases of random city names do the same? Well, of course, the ECB does not hold people hostage and terrorize them while printing notes like the “criminals” do. The bank, however, does print money and calls it liquidity injections- and may I add, they do all this while they’re dressed in immaculate tailor-fit suits and slickly combed hair.

As per the Professor, the money that the ECB “creates out of nowhere” essentially ends up in the pockets of the rich. He argues, in a Robin Hood-esque way, that the money his gang prints, in contrast to the ECB, will actually end up entering the real economy and not just circulate in the hands of banks. The show argues that quantitative easing and liquidity injections are robberies carried out in broad daylight and are masked under complicated names and jargons with very few actually understanding what’s happening.

The jargons in question

Policy rates are determined keeping in mind inflation targets to keep the rise in prices of goods and services low, and financial markets stable

The State Bank of Pakistan says the monetary policy “strives to strike a balance among multiple and often competing considerations. These include: controlling inflation, ensuring payment system and financial stability, preserving foreign exchange reserves, and supporting private investment.”

Whenever there is a crisis, like the one in 2008, Central Banks around the world are quick to lower their policy rates. Need I point out that owing to the COVID-19 pandemic, central banks, including the SBP, are doing the same thing in the present?

This is done because lower interest rates encourage households to borrow considering how it is now cheaper. This in turn encourages investment and consumption, pumping money and life into the economy.

But like any game of limbo, policy rates have a limit to how low they can go. That is where quantitative easing comes in.

Quantitative easing works through the mass purchase of government bonds. This brings down the yields on the securities and lowers the interest rates offered on all types of loans. In addition, it acts as a stimulus in an economy by increasing the asset prices of a number of financial assets.

The Bank of England defines Quantitative Easing (QE) as “a tool that central banks, like us, can use to inject money directly into the economy”. This definition does not really cut it, so let’s delve a bit deeper.

Central Banks around the world state that they engage in QE in order to boost spending and investment in the economy. In today’s day and age, money could either be physical in the form of banknotes and coins, or digital, like the money we have stowed away in bank accounts.

Quantitative easing is essentially the creation of digital money that goes into the purchase of government debt. This is why asset purchase and QE are used interchangeably.

Does QE further the inequality?

While the Central banks create this money to increase spending, not a lot of it actually ends up in the real economy. A lot of it stays with the rich

In the series, the professor tells a police officer, “The European Central Bank printed 145 billion euros in 2013. That’s exactly what we are doing now. All that money went to banks in different places, and then lent to the rich at low-interest rates. Is anyone calling the ECB a thief?”

So who gains from QE?

Central Banks helped private banks grow in size to a point that they eventually become “too big to fail. These big banks were then given cheap money in times of financial crises in the economy. This was done without the banks being given the responsibility to broaden their lending to segments of the private sector.

By now you must be wondering where the money went? While QE programs around the world have saved the global economy from crashing in the past, they have also inflated asset prices to the extent of forming bubbles. This has created more problems than it can solve.

A portion of that money was used to speculate on assets, while the remaining was reinvested into Central Banks. Absurd, right? The money that was to help commercial banks inject into the economy, was eventually brought back to central banks with the sole purpose of generating interest, and thereby making more money.

And where does Fiat come into play?

“It’s nothing… It’s paper, you see! It’s paper!”

Paper currency initially tied its worth to gold. The gold standard had been abandoned in 1933 however, followed by a complete cut off between the US dollar and gold in 1971. The gold standard was abolished by Nixon, known as the Nixon Shock.

The Professor probably did not have a problem with the material, i.e. paper that currency notes were made from, instead, this was a question on the intrinsic value of paper money and where it is derived from.

Paper currency initially tied its worth to gold. The gold standard had been abandoned in 1933 however, followed by a complete cut off between the US dollar and gold in 1971. The gold standard was abolished by Nixon, known as the Nixon Shock. He said, “We must protect the position of the American dollar as a pillar of monetary stability around the world… I am determined that the American dollar must never again be hostage in the hands of the international speculators.”

Following the events of 1971, no country in the world backs its currency with gold; instead they use the US dollar as the reserve currency of choice. The dollar not only dominates payments in global trade transactions but is also used to price gold! That is pretty weird considering not too long ago, gold used to determine the value of the dollar, but now it’s the other way around.

The fiat monetary system means that paper money is backed by the full faith and credit of the federal government. The mere notion that gold could easily be replaced by “full faith and credit of the Fed” further adds to the question – is the system reliable and what should be the basis of our trust or full faith?

It also begs another question, will a Rs100 note only be worth Rs100 until and unless I believe or have faith it will? But more on that some other time.

Okay, so what about the gold?

In season three and four, the gang was back together to pull off another heist – again with a revolutionary and resistance based motivation.

Now that the Professor was done with currency, he moved on to gold. Why, you ask? To honour the memory of his brother, Berlin, and because you cannot upstage the system without gold. After dropping 50 and 100 euro bills from the skies of Madrid, the gang then intended to steal 90 tonnes of gold from the Bank of Spain, along with exposing some state secrets. This time, I will not relate them to Robin Hood.

The question still remains, why gold – especially after the end of the gold standard, and the logistical issues associated with using it after they escape?

Gold still finds itself to be relevant, especially in modern-day, where countries around the world are reinforcing their gold reserves in order to reduce their dependence on the US dollar. Central Banks have recently been on a purchasing spree for gold and have bought $15.7billion in the first two quarters of the year as a means to diverge their reserves from the US dollar as trade tensions intensified.

In addition, Central banks around the world have bought more than 375 tons of gold, added it to their reserves during the first two quarters of 2019 and carried on in the third quarter of 2019.

Numerous countries around the world have been repatriating gold to eliminate counterparty risks. Eastern European countries such as Serbia, Slovakia, Hungary, Poland, etc. have repatriated gold from the Bank of England. This trend strongly suggests that these countries would rather hold gold than trust other institutions – such as the Bank of England – to hold it for them.

If we were to determine the current price of gold taking into account the gold reserves; the US government holds 8133.46 tonnage, or 260,270,720 ounces while $1.75 trillion are in circulation as of January. This means that each ounce of gold that the US government has should be valued at roughly $6723.77- drastically much more than what it is being priced at right now.

Now that we have somewhat of an idea of the value of gold, we can understand why Central Banks buy it. Countries essentially buy gold in times of inflation due to the inherent value it occupies and the limited supply of gold. Since the precious metal cannot be diluted, it is able to hold on to its value and resist devaluation like currency. But then again, why do they hold it if it isn’t important while printing money? And why does money lose value? Is it because there is no gold associated with its value?

The most important question here being- dont liquidity injections create inflation? And if so, are central banks storing gold to save them from themselves?

How does this all come together for Pakistan?

While QE is more of a developed world concept, the State Bank of Pakistan uses three other tools to meet its goals in the market.

Not too long ago, the State Bank of Pakistan sported a policy rate of 13.25pc after a period of monetary tightening. This was done to keep inflation in check. However, it is not so surprising to see that inflation rose despite a tightened monetary policy.

The Central Bank sets the benchmark interest rate, adjusts its cash and liquidity reserve requirements, and conducts open market operations (OMO). Through these measures, the SBP is able to inject liquidity.

Not too long ago, the State Bank of Pakistan sported a policy rate of 13.25pc after a period of monetary tightening. This was done to keep inflation in check. However, it is not so surprising to see that inflation rose despite a tightened monetary policy. This is more due to the increased cost of operating that businesses had to face. Thereby, while demand was dampened in order to curb inflation, supply-side risks pushed it up again.

The State Bank of Pakistan was then often criticized for the high policy rates in light of the business community’s woes. Despite this low appetite for investment, and obviously loans, banks were able to exploit the private sector.

The policy rate and OMO work in pairs. When the SBP cuts down on its benchmark rate, it buys bonds in order to bring the market interests lower as per the rate cut. The opposite is done in the case of a rate hike.

This, done on a larger scale, would be QE. However, QE also entails the buying of other financial assets, such as mortgage-backed securities, corporate bonds, etc. that are not as safe as t bills and bonds.

If we talk about Pakistan, the government is one of the biggest borrowers. There is a significant factor of crowding out in the private sector. Why lend to private participants when you have the government, and if you do lend to private businesses, why not make the most of it by lending to blue chips?

After all, in a situation where demand growth was creeping, economic activity slowed down, and the government needed more money – the credit risk was obviously impacted.

As far as Pakistan’s gold reserves are concerned, there has been no confirmed information of the valt being able to flood if breached, or containing the nation’s secrets. The reserves, however, are not large in quantum.

The reason for this is primarily due to gold not earning a return other than on sale. Due to the idle nature of this asset and the lack of extra money, Pakistan does not hold on to large gold reserves. However, the size of the reserve has been increasing steadily since 2010, after dramatically falling in 2009.

The reason for this buildup is that gold reserves are primarily an emergency reserve that could be pledged as collateral to raise liquidity in a foreign currency.

So who wins when the SBP “injects liquidity”?

While we do not officially have an example of QE, you need to understand that most liquidity injections end up in the form of buying T-bills, pubs, and sukuks. So even though we do not engage in QE, under the name of QE; the risks in the economy just compel banks to lend to the government.

As of late, this trend has risen considering how the IMF program restricts the government from borrowing directly from the SBP. Instead, the government borrows from commercial banks – crowding out 101.

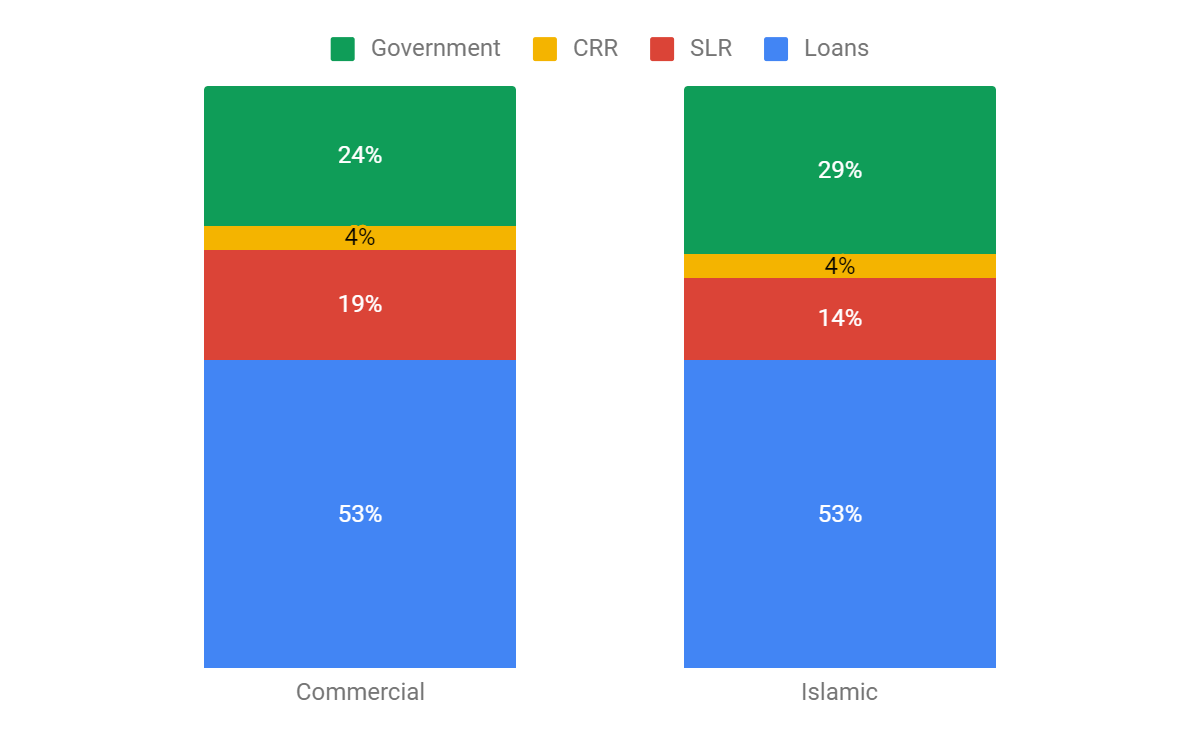

To understand this better, let’s take an example of a recent liquidity injection to understand who benefits from such a step. Pakistan’s loan to deposit ratio has been averaging at approximately 53pc. To make this simple, let’s say a commercial bank has 100 rupees.

It gives 53pc to the private sector and public sector entities like Pakistan International Airlines, Pakistan State Oil and the likes. Out of the remaining 47 rupees, 19 rupees go to the State Bank of Pakistan as a statutory liquidity ratio. This earns commercial banks interest. So 47-19 gives us 28 rupees out of which 4 rupees are again deposited to the State Bank of Pakistan for the Cash Reserve Ratio. This, however, does not earn any interest for the bank. That leaves a commercial bank with 24 rupees. This is all invested in TBills, Sukuks, and PIBs.

The case is similar for Islamic Banks in Pakistan; however, their statutory liquidity ratios are 14pc, rather than 19pc, thereby giving them the opportunity to invest 29pc of their money into government-backed securities.

Recently, to combat the challenges the Pakistani economy will face owing to the global pandemic COVID 19, the central bank has slashed the cash reserve ratio by 1pc bringing it down to 4pc. This resulted in Rs850 billion worth of liquidity being injected into banks.

If we further look at the 53pc that is loaned out to the private sector, it is obvious that a considerable amount of it goes to big corporations and conglomerates, in addition to state-run corporations. It does not go to the mango people. It is not for you and me, it is for them – the blue chips, the Chaudharys, Maliks, Lakhanis, etc.

It is evident that a significant chunk of money that is injected into the economy is injected back into the government. After all, why not? What is safer than betting on the government – especially in times of crisis? Is this where the government stands up and presents itself as a guarantee and merely uses commercial and Islamic banks as an intermediary vehicle to loan out to the small guys?

In the end one has to question who is looking out for the little guy? What about the real economy? Do we just accept our fate and believe in the system the same way we believe in the intrinsic value of a piece of paper dictated by central banks? Do we wait for a day the partisans throw money from the sky?

Do we question who gains on the Rs850 billion injected through a 1pc cut in the cash reserve ratio? Do we question quantitative easing and the intentions behind it – and do we go as far as calling it a systematic money heist?

Author’s Note: This piece in no way encourages individuals to storm the central bank in red jumpsuits and Dali masks. The author bears no responsibility for any such action.

Comments are closed.

It should be 1 percentage point rather than 1 percent. (regarding CRR decrease)

Statutory liquidity ratio does not go to the State Bank of Pakistan. It is maintained in the form of investments in government securities.