LAHORE: Pakistan Stock Exchange (PSX) started the week with sluggish yet volatile behaviour. Volumes were dull and the market lacked excitement. However, Oil and Gas Exploration sector jumped with oil prices hitting their highest since July 2015 as Saudi Arabia’s crown prince cemented his power with the anti-corruption crackdown. West Texas Intermediate (WTI) crude oil rose by 25 cents to $ 56 a barrel, breaking above $ 56 for the first time since July 2015. Market volumes were down 35 per cent while value traded decreased 33 per cent. The KMI 30 index swelled up by 788.73 points intraday pushed up the sector.

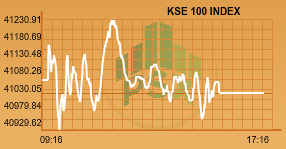

The KSE 100 index rolled up by 168.17 points intraday and down to low of 135.73 points. It settled little changed with a 33.23 points loss at 41,030.77. The KMI 30 index jumped up 401.62 points to 71,071.42 while the KSE All Share Index declined 129.27 points to 29,229.90. The advancers to decliners ratio stood at 98 to 221.

OGDC (+2.3 per cent), PPL (+1.4 per cent), DAWH (+2.9 per cent), MCB (+1 per cent) & POL (+0.9 per cent) contributed the most adding 129pts, while HBL (-1.7 per cent), NESTLE (-3.6 per cent), PAKT (-5 per cent), PSO (-1.4 per cent) & UBL (-0.7 per cent) were lacked behind withholding 110pts.

The market volumes remained thin at 75.43 million with only 45.75 million shares exchanged in the KSE 100 index. Pakistan Telecommunication Company Limited (PTC -1.74 per cent) led the volume chart with 5.58 million shares exchanged in the script. K-Electric Limited (KEL -2.67 per cent) has 4.75 million shares traded followed by Sui Southern Gas Company Limited (SSGC +3.00 per cent), volume 4.69 million.

The oil and gas exploration sector added 1.70 per cent to its market capitalisation to become the largest sector by market capitalisation. Oil and Gas Development Company Limited (OGDC) accelerated 2.31 per cent adding 93 points on expectations of a further increase in international oil prices, Pak Petroleum Limited (PPL) advanced 1.40 per cent, Pakistan Oilfields Limited (POL) inched up 1.00 per cent and Mari Petroleum Company Limited (MARI) raced 0.55 per cent.

Javedan Corporation Limited (JVDC +5.00 per cent) flew to its upper circuit breaker after the declaration of financials for the year 2017 and the first quarter of the current year 2018. The board approved a cash payout of Rs 2.50 and a right issue of 50 per cent at a discount of Rs 25 per share for the year 2017.

Sales of the company expanded 101 per cent to Rs 2.47 billion and pushed net profit up 575 to earnings per share of Rs 7.60.

Meanwhile, the government of Pakistan appointed Citigroup, Standard Chartered, Deutsche Bank, Industrial and Commercial Bank of China to manage conventional sale for possible Islamic bonds and conventional offering this year. The government plans to raise up to $ 2 billion using both conventional & Islamic bank.

Ahead of rising winter demand, the government has also imposed a petroleum levy on locally-produced Liquefied Petroleum Gas (LPG) at the rate of Rs 4,669 per ton (about Rs 7 per KG) with immediate effect. A senior official said the decision was expected to generate around Rs 3 billion to the government and help minimise the differential with import parity price to facilitate greater imports.

Moreover, Army Chief Gen Qamar Javed Bajwa reached Tehran on Sunday on a three-day official visit, the first by a Pakistani army chief in over two decades.

PSX also announced its new MD Richard Morin, a Canadian national. Despite severe opposition from the local brokers, the board of directors nominated Richard and SECP approved his appointment on Monday. He is expected to take charge from December 1, 2017.