LAHORE: Credit rating agency Moody’s has termed Pakistan’s extension of super-tax on bank’s taxable income in next financial year’s budget for FY 2018-19 as a credit negative move and would keep eroding its revenues.

Moody’s said this extension of super-tax on Pakistani banks till its expiry after 2021 would continue to be a drag on their profits and contribute to existing profitability challenges.

The super tax levied in 2015 for the rehabilitation of internally displaced persons (IDPs) and which continued in 2016, 2017 is currently being charged at 4 percent on banking companies & 3% on non-banking companies having income greater than Rs500 million.

It will be gradually decreased 1 percent per year from FY19 till it’s elimination in 2019 for both banking and non-banking entities but will continue for the rest of the outgoing financial year 2017-18, but the new budget introduced a gradual reduction in the corporate tax rate to 25% by the 2023 tax year from 30% for the 2018 tax year.

The credit rating agency said the super-tax was equivalent to 4 percent of bank’s taxable income for last account year and is levied on its semi-annual results.

However, on Wednesday Taurus Securities in its report said the super-tax could almost wipe-out 7 percent of annual earnings of banks in 2018.

Domestic banks having overseas branches wouldn’t be permitted to file provision claims linked to advances and off-balance sheet items of foreign branches against income from its domestic operations as per Finance Bill 2018.

Taurus Securities in its report said due to these revisions in the Finance Bill 2018, it believed HBL and UBL could be severely impacted due to the recent upsurge in loan losses on their foreign books and lower coverage.

Originally levied in 2015, including the imposition of a uniform tax rate of 35 percent on all sources of incomes (dividends, capital gains too) in the same year constitute a high effective tax rate on banks of around 39%, which has been a drag on their earnings.

Aside from eroding bank earnings, their existing profitability challenges have exacerbated besides narrowing margins from lower yields on government securities (in which the banks invest roughly half of their balance sheet) and one-off costs, including higher pension costs) said Moody’s.

The apex court in February directed banks to increase the minimum monthly pension for retired employees to Rs8,000 and to apply a 5 percent yearly rise from January 2019.

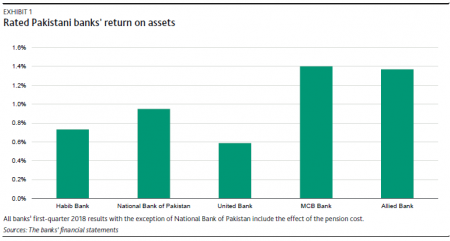

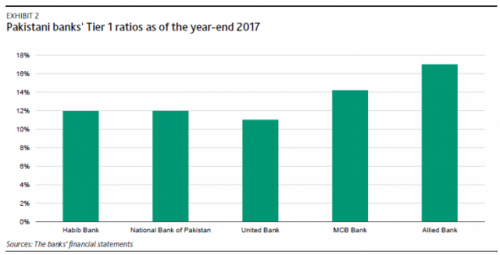

“We expect all rated Pakistani banks to be affected by the tax extension, which we estimate will lower the banks’ return-on-equity ratios by approximately 1%. MCB Bank Limited (B3 stable, b34) and Allied Bank Limited (B3 stable, b3) are better positioned to absorb the negative effects, given their stronger profitability and capitalization,” said Moody’s.

The rating agency said the elimination of super-tax by 2021 would see bank’s effective tax rate coming back to around 35 percent.

It added “the budget announcement also included authorities’ planned increase in borrowings from banks, which are a major source of financing for the government. Authorities project their borrowing from banks will increase by more than 70% to more than PKR1 trillion, which suggests that banks likely will increase their appetite for government securities (amid potentially rising interest rates) at the expense of lending to the private sector.”