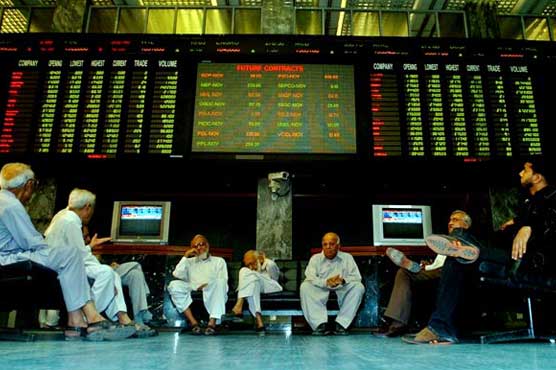

LAHORE: The Pakistan Stock Exchange (PSX) is to remain range-bound with investors preferring to remain cautious following the unsettling political climate in the coutry, which is likely to further heat up in the coming week ahead of the general elections, experts believe.

Talking to Pakistan Today they say that investors would remain on a wait-and-see approach during the next week. They said that key data points to be looked out for include the announcement of the monetary policy, Current Account Deficit (CAD) for June 2018, large scale manufacturing growth data for fiscal 2018, and monthly textile exports data to be released by the Pakistan Bureau of Statistics (PBS).

The next week would undeniably bring another spell of a turbulent trading session which is bound to lock its trajectory to the political situation of the country. Experts are of the view that the ongoing rocky ride would continue which can be attributed to return of the convicted former Prime Minister Nawaz Sharif back in Pakistan, triggering shockwaves across the political spectrum as fears of widespread unrest are to go on.

Experts said that uncertainty is likely to persist until July 25 when General Elections are scheduled to be held. Apart from this, key highlights of the week have been the release of State Bank of Pakistan’s 3rd quarter report highlighting the exacerbating twin deficits problem and growing risks of GDP growth forecasts emanating from a fast-paced rise in inflation. They pointed out amnesty scheme numbers highlighting collection of Rs97 billion in taxes so far, the release of auto sales numbers, receipt of $19.62bn of remittances in fiscal 2018 and the Federal Reserve Board issuing enforcement action with United Bank Limited (UBL).

Last week started off with the accountability court sentencing the former Prime Minister, Nawaz Sharif, his daughter Maryam Nawaz, and son-in-law Captain Safdar, to jail terms with hefty fines. Resultantly, the local bourse lost as much as 1,811 index points from the week’s high of 42,373 points to its low of 38,561. The market finally settled flattish at 40,225 points on last trading day of the week, nudging down by 0.2 per cent.

Sectors that outperformed the benchmark index include Commercial Banks, Textiles, and Technology. On the other hand, Multi-utilities, Cements and Pharmaceuticals were the worst performing sectors of the week. Market activity improved slightly compared to the previous week as ADT rose by 5 per cent to 116 million shares while ADTV climbed up by 27 per cent to $44mn, reflecting investors’ interest in blue chips, trading at historical lows. Foreign investors remained net sellers with a net outflow worth $26.6 million during the week. Most of the selling was witnessed in Banks for $13.7mn, Cements $6.0 million, and Oil & Gas for $5 million.

Amongst specific stocks, United Bank Limited (UBL) reported renewal of agreement with Federal Reserve Bank of New York (Reserve Bank) relating to international remittance business on soft terms and no penalty contrary to market expectations, leading to stock hitting the upper cap in last trading session of the week.

The scrip, however, closed the week down 1 per cent. Moreover, Pakistan Automotive Manufacturers Association (PAMA) released data on automobile sales for June 2018, where despite the slowdown seen in sales during the month, the overall year witnessed a growth of 21 percent with 258 thousand units sold during fiscal 2018.