- Although the government will likely have to cut its spending over the coming months, there will be limited room for policymakers to cut either current or development expenditure, said the research agency.

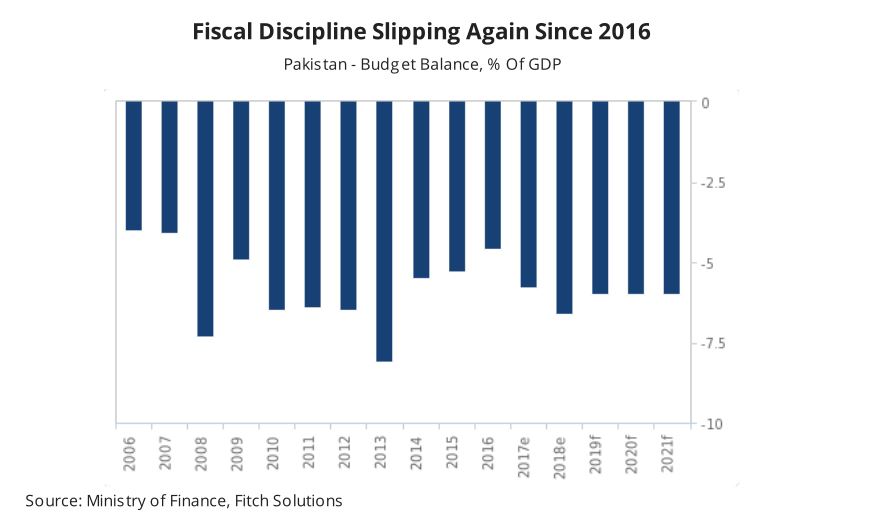

LAHORE: Fitch Solutions in a report released on Monday said it projected Pakistan’s budget deficit to lock in at 6% in the current financial year 2018-19 compared to 5.8% in the previous FY7-18.

The government will probably have to slash its expenditures over the forthcoming months as it focuses to obtain funding from the International Monetary Fund (IMF) under the bailout programme due to weak revenue growth, said the research agency.

It warned that the widening current accounting deficit, weakening currency and sliding foreign exchange reserves indicate that the current fiscal trend where expenditures outmatch revenue growth is untenable.

The research agency revised its projections for the budget deficit as a share of GDP to clock in at 6% in the current financial year 2018-19 (July-June) from 5.8% previously, due to the limited extent to how much the government can decrease expenditure and weak revenue growth.

Pakistan’s budget deficit as a percentage of GDP swelled to 6.6% in FY17-18 from 4.6% in FY15-16, as expenditure on average rose by 13.7% per annum, outmatching revenue at 8.5%, noted Fitch Solutions.

Moreover, this trend persisted in the first quarter (July-September) of current FY18-19, as expenditures soared by 12.1% year-on-year (YoY), whilst revenue rose by 7.5% YoY in the corresponding period.

Consequently, the budget deficit soared by 22.9% YoY to Rs541.7 billion in the first quarter of FY18-19 against Rs440.8 billion in the corresponding period of FY17-18.

It cautioned the rising deficit trend is untenable and anticipates the government to slow its expenditure growth over the coming quarters.

The research agency noted the increasing fiscal deficit had caused a balance of payment crisis that the country was currently facing and indicated it was running out of foreign exchange reserves to finance its imports since import cover was now at less than two months.

To plug the external financing gap, the incumbent government secured financial assistance totalling $6 billion from Saudi Arabia.

Fitch Solution stated the government was aware that it immediately needs to further secure a similar sum from the International Monetary Fund (IMF) funding for the financing of imports and the confidence of creditors to be maintained.

It observed that the main bone of contention was the IMF demands for harsh austerity measures and reforms to state-owned enterprises (SOEs), which the government is reluctant to accept.

The research agency highlighted Pakistan would ultimately clinch an IMF bailout, however, it said there will be limited scope for the government to slash expenditure over the coming months.

According to Fitch Solutions, there was diminutive space for manoeuvring due to a large debt servicing cost servicing cost and huge military budget in terms of current expenditure.

The research agency highlighted ‘Defence Affairs and Service’ accounted for 14.8% of overall current expenditure, whilst domestic servicing cost share was 31.2%.

Already, the government had slashed development expenditure by 40% in the first quarter (July-September) of current FY18-19 and is improbable to attain further savings from this segment, said Fitch Solutions.

Moreover, the revenue growth will stay weak and the need for international assistance comes against a backdrop of slowing economic growth in Pakistan, stated the research agency.

It projected the economic growth to slow down to 4.4% in current FY18-19 and 4.1% in FY19-20; which will probably directly impact the governments’ revenue collection.

The country suffers from a weak tax-to-GDP ratio, an issue the government has admitted and depends majorly (60%) on indirect taxes, said the report.

And the small tax base will hamper the government in raising revenue significantly in the near-term even if it has the intention to do so, explained Fitch Solutions.

While talking about SOEs, the report stated it posted a cumulative net annual loss of Rs44.8 billion in FY15-16 and will mostly continue to be a further drag on public finance over the forthcoming quarters.

Fitch Solutions said the government has voiced its intention to depoliticize the leadership of the behemoths in this area.

“However, rather than undertaking a cleaner break and moving these organisations into private ownership, the government is planning to move them under the umbrella of a sovereign wealth fund along the lines of Malaysia’s Khazanah Nasional, which does not remove them from contingent liabilities,” the report concluded.