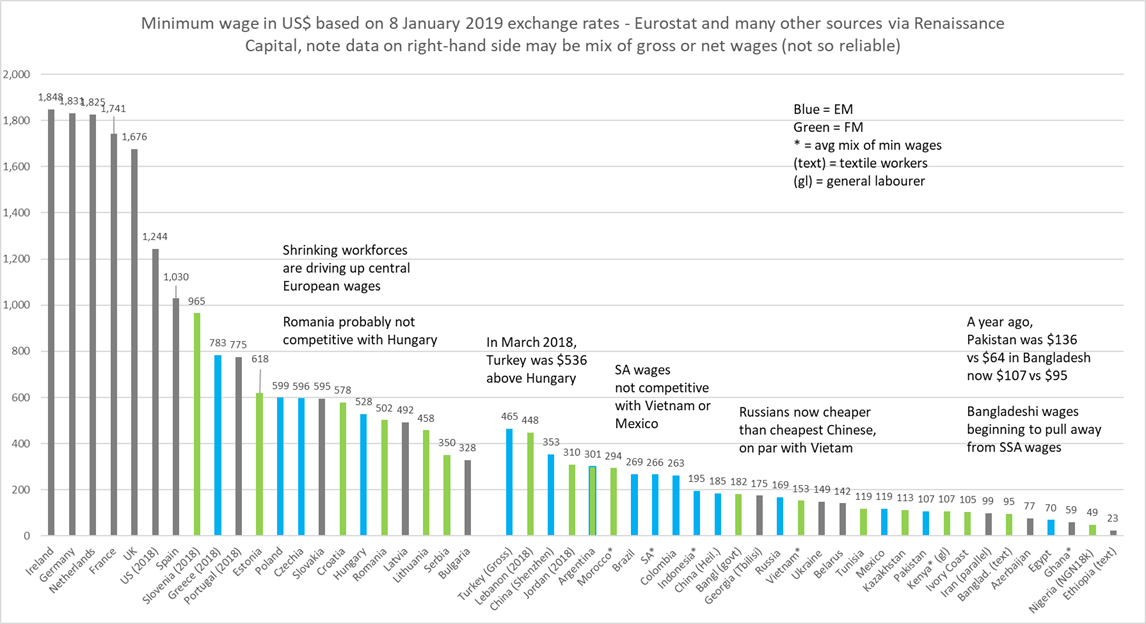

LAHORE: The depreciation of the rupee has reduced the minimum wage to $107 from $124 in June, as of 8th January, according to a report released by Renaissance Capital.

It observed how the gap between Pakistan and Bangladesh had lessened in the past year or so, considering that wages were around 100% higher previously in the former and now are just 13% higher.

According to the report, as Pakistan gets cheaper it would provide more competition to Bangladesh where the minimum wage stood at around $95, up from $63 in 2018 after a hike just weeks before the election.

A year ago, wages in Pakistan were $136 vs $64 in Bangladesh and now the difference stood at $107 compared to $95 currently and it has made big strides in becoming regionally competitive again, said Renaissance Capital.

Although, the report highlighted that the data available for these countries may be a mix of gross or net wages and may not be so reliable.

Interestingly, the minimum wages for workers in Bangladesh have exhibited a rise and are almost at parity with their Pakistani peers, which has encountered a significant erosion due to rupee devaluation.

Renaissance Capital projected the rupee might further depreciate by another 10%.

Moreover, it noted that existing factories were not about to pick up and leave Bangladesh, however, these figures indicate a potential change in future foreign direct investment (FDI) investment flows.

According to the report, Bangladesh’s textile exporters will still attract a successful cluster of FDI, however, when wages exhibit such a tangible shift, investors may contemplate looking to Pakistan or other countries.

“As recently as mid-2018, the figure of $63 in Bangladesh was just $18 above Ghana and three times Ethiopia – now the gap over Ghana has doubled to $36 and is more than four times above Ethiopia.

Note Ethiopia may be much cheaper than Ghana, but its electricity and literacy rates are way lower too,” said the report.

The government has taken various measures to enhance Pakistan’s exports and its competitiveness which has included lowering the electricity and gas tariffs for zero-rated industries.

According to provisional data released by Pakistan Bureau of Statistics (PBS) on Thursday, Pakistan’s exports grew by 1.7% to $11.186 billion during the first half (July-December) of the current financial year 2018-19 compared to $11 billion in the same period last year.

On a month-on-month basis, the country’s exports grew 4% to $2.06 billion in December 2018 compared to November 2018.

Imports for the first half of FY18-19 clocked at $28.126 billion compared to $28.941 billion in the corresponding period of 2017, witnessing a decline of 2.8%.

Additionally, on a year-on-year (YoY) basis, imports plateaued by 8% to $4.493 billion in December 2018 against $4.910 billion in December 2017.

Interestingly, imports on a MoM basis grew by 3% in December 2018 compared to November 2018.

In the last financial year 2017-18, Pakistan’s imports had skyrocketed to all-time highs of $60.9 billion and trade deficit to over $37.6 billion.

Exports failed to keep pace and grew by 14% to $23.228 billion by end of FY17-18.

A report released by Fitch Solutions on Monday had noted Pakistan’s exports would likely to be impacted by a global trade slowdown and negatively impact its economic growth to fall to 4.4% by end of current FY18-19 compared to a thirteen-year high of 5.8% reached in FY17-18.

Talking about exports, the research agency highlighted that despite exports peaking near record-highs in rupee terms, they nosedived 12.8% year-on-year (YoY) in dollar terms during November.

Moreover, it projected little chance of an increase any time soon taking global trade slowdown into consideration.