My first job out of college was at a brokerage firm in New York whose offices were just two blocks north of the Roosevelt Hotel in Midtown Manhattan, the luxury hotel owned by Pakistan International Airlines (PIA). As a young Pakistani entering the world of global finance, it was hard not to feel a sense of pride every time I passed by that hotel on my way to work every day. Here was a magnificent hotel in the heart of the largest financial center in the world, owned by my government.

In launching the Pakistan Banao Certificates, the government of Pakistan is appealing to the nostalgic patriotism of people like me: relatively high-earning professionals outside Pakistan who feel that sense of pride when we see our homeland well-represented in our countries of residence.

Essentially, the finance ministry’s argument is this: why invest in a US treasury bond when you could earn much more on a Government of Pakistan bond? Sure, the international ratings agencies rate Pakistan’s sovereign credit rating at B-minus, a junk-bond rating, but you know your government will not default on you. So why not invest with us instead?

It is a good pitch, and I must confess, quite tempting on the surface. I am too young to be investing in bonds, but for people who are older, it appears to be an attractive investment option, with the added advantage of appearing to help the homeland.

But that is not how one should decide on where to invest one’s hard-earned money. Investments should appeal to the head, not the heart. And no investment should ever be viewed in isolation: an investment is only a good one if it is better than the next best alternative. Apply both of these filters to the Pakistan Banao Certificates, and one gets a different picture from the one the finance ministry is trying to sell.

For this analysis, we first compare the Pakistan Banao Certificates to other bonds issued by similarly-rated governments, and even to other bonds issued by the government of Pakistan itself. Then, the analysis moves beyond the ratings to a more fundamentals-level analysis of why the government even needs the bonds, and whether it is a good idea for expatriate Pakistanis to be investing in the bond.

Comparing Pakistan Banao Certificates to the alternatives

The most intuitive question to ask when analyzing an investment is this: what else could I be doing with my money? The more sophisticated iteration of that question is: what else could I be doing with my money, given the level of risk I am willing to tolerate?

The premise of this portion of the analysis is that, as an investor whose currency of investment is the United States dollar, one has access to a wide variety of options from across the world. An investor should be indifferent as to where the particular investment comes from, so long as the risk level is the same, and the return is higher than an investment of comparable risk.

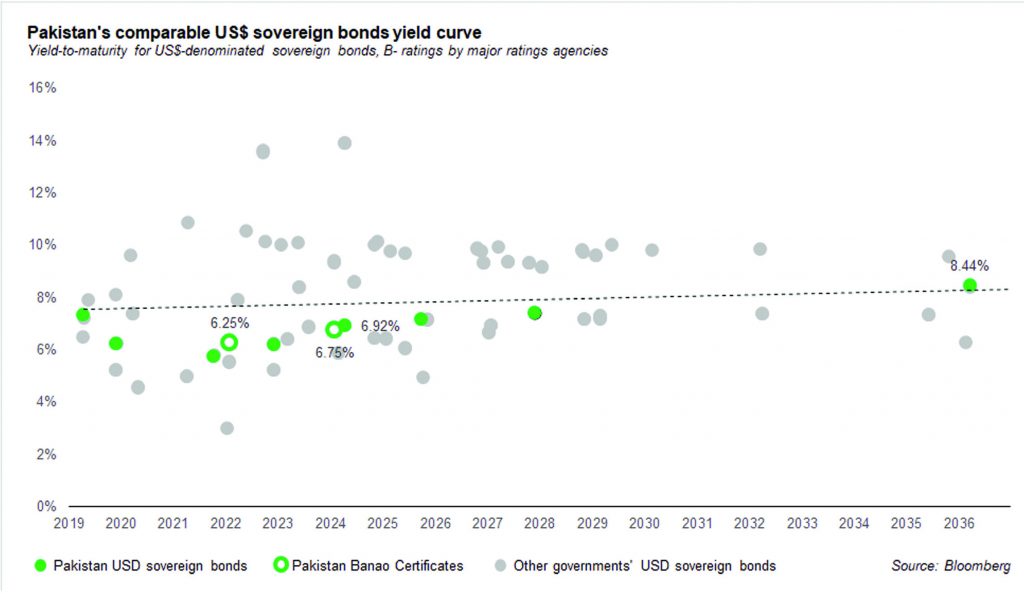

Our analysis of the peer group of Pakistan’s government bonds relied on sovereign credit ratings compiled by the three big ratings agencies in the world: Standard & Poor’s, Moody’s, and Fitch. We analysed ratings data as of March 5, 2019, and relied on countries that shared the same rating with Pakistan in at least two of the three ratings issued by the three major issuers, or at least one, in cases where there were only two or fewer active ratings.

That results in a sample set of 22 countries with which Pakistan shares a rating. Standard & Poor’s and Fitch rate Pakistan at B-minus, and Moody’s rates Pakistan at the equivalent B3. All three ratings are well within junk bond territory.

Of those 22 countries, only 16 had US dollar-denominated sovereign bonds, a total of 198 bonds, to be precise. Yet not all of those bonds were directly comparable to Pakistan’s government bonds, which are all non-callable (meaning the government cannot do an early repayment), and repay the full principal amount at maturity. Excluding those callable bonds, we got a sample of 99 bonds that were most directly comparable to the government of Pakistan’s bonds.

That set of 99 bonds, including the 16 previously issued bonds (and their sub-issues) from the government of Pakistan, plus the two Pakistan Banao Certificates, were then plotted on a scatter plot, with the x-axis representing the maturity date, and the y-axis representing the yield-to-maturity (a measure of a bond’s rate of return that factors in any changes in its price as well as the time left to maturity).

These 117 bonds, in other words, have the exact same issuer creditworthiness risk, no call risk, and the only variation is that of maturity risk (bonds maturing later are seen as riskier, and hence maturity risk is an important consideration), which is plotted on the chart. Using a simple, single-variable linear regression, we get a line that represents what might be seen as the yield curve for all B-minus-rated bonds.

The one thing that is immediately clear is that the Pakistan’s sovereign bonds yield systematically lower than the overall group of bonds with a similar risk profile. That lends at least some credence to the government’s hypothesis that perhaps Pakistan’s bond rating is lower than it can justifiably be. The market appears to value Pakistan’s bonds higher (and therefore they have lower yields-to-maturity) than just their credit rating would imply.

Having said that, the fact that all three of the ratings agencies have the exact same credit rating for Pakistan suggests that perhaps the market is more optimistic about Pakistan’s fiscal prospects than may be warranted by Pakistan’s own government’s performance. It is likely that the market is pricing in the fact that Pakistan has never defaulted on its foreign debt obligations, in large part because it has almost always had access to bailouts from the International Monetary Fund (IMF) owing to Islamabad’s close relationship with the United States.

Given the fact that Pakistan’s relationship with the United States is now much more strained than it has ever been in its history, perhaps that optimism is unwarranted. Hence, it seems reasonable to assume that the B-minus rating is likely an accurate reflection of Pakistan’s fiscal risk profile.

Based on that assumption that Pakistan’s credit rating is accurate, it is clear that for just about any bond issued by the government of Pakistan, there is a bond with a similar credit risk and maturity, but higher yield-to-maturity. For instance, the 3-year Pakistan Banao Certificate yields 6.25% per year and matures in February 2022. However, there is a bond issued by the government of Ecuador that matures just one month later, but has a 7.89% yield-to-maturity. And there is a bond issued by the government of Lebanon maturing just three months later than the 3-year Pakistan Banao Certificate and has a 10.55% yield-to-maturity.

If I can invest in any US dollar-denominated bond, and I want to invest for three years, why would I pick the Pakistan Banao Certificate and not the bond issued by the government of Lebanon?

The 5-year Pakistan Banao Certificate fares even worse because its 6.75% yield is lower than another bond issued by the government of Pakistan that matures just 2 months later and has a 6.92% yield-to-maturity. That is before we even begin to compare it against bonds of other governments that mature around the same time, such as the one issued by the government of Zambia that currently yields 13.89% per year.

Simply put, the only attraction of the Pakistan Banao Certificate is that it is issued by one’s own government, and has relatively lower minimum investment requirements: a minimum of $5,000 investment, with higher investments allowed in $1,000 increments. That lower investment threshold may be attractive to some investors, though bond mutual funds or real-estate investment trusts in both the United States and Europe can offer similarly lower minimum thresholds with comparable yields, and higher liquidity.

The (lack of) restructuring problem

But beyond this sheer numbers (our apologies to our readers who got an involuntary tour of bond mathematics in the previous section), there is a larger question that needs to be addressed: why is the government of Pakistan even raising this bond in the first place? Any good investor needs to know what their money will be used for, and hence it is important to understand both the stated and implied purpose of this bond issue.

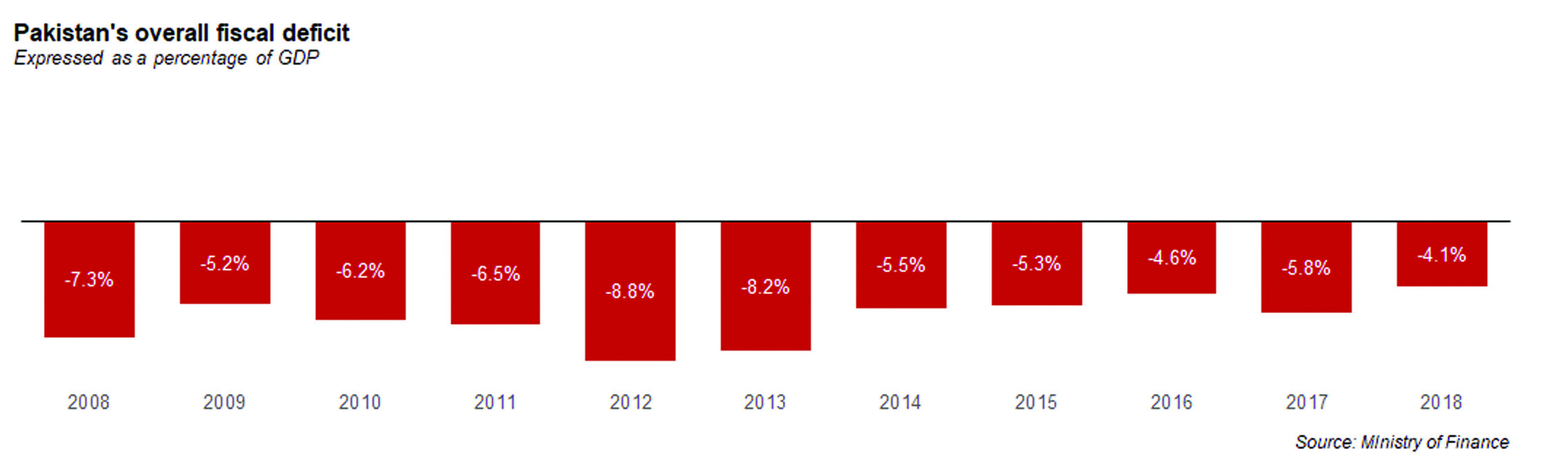

The stated purpose is relatively straightforward. Pakistan faces a significant balance of payments crisis and urgently needs foreign exchange reserves to refinance our US dollar-denominated liabilities to external creditors, whether they be countries that have exported goods to Pakistan, or whether they be lenders and nations that have lent money to the government of Pakistan.

But that narrow, immediate goal comes against a larger backdrop of what appears on the surface to be a larger national plan: a permanent restructuring of the government of Pakistan to end the need for this kind of bailout in the future.

“This will be Pakistan’s last IMF programme,” said Finance Minister Asad Umar, at a press conference in Karachi in November 2018, reflecting a desire on the part of the Imran Khan Administration to “break the begging bowl”, in the words of the prime minister.

In other words, if Pakistan were a company, this would be a distressed debt investment for a company seeking to restructure its assets in order to avoid bankruptcy. (Not to gild a lily, but a distressed debt investment typically commands a significantly higher yield than what the government of Pakistan is offering.)

To assess this investment, therefore, one needs to look at the larger plan. What exactly does the government of Pakistan plan to do in order to put the country on a path out of the chronic cycle of fiscal crises that we have been in for the past seven decades of our existence. (Note to people who believe their parents and grandparents’ tales that Pakistan was ever a well-run government: those were lies.)

The problem, unfortunately, is that despite the very best of intentions, the Pakistan Tehrik-e-Insaf’s (PTI) plan for the Pakistani economy is no better than that of its predecessors because it does not address the structural problems plaguing the Pakistani economy: the fact that the government is over-involved in some segments of the economy (e.g. energy, transportation) which in turn hinder it from performing its core functions (e.g. education, health, infrastructure) well.

The finance minister’s dilemma

Before delving into what is wrong with the plan, it is important to understand why Finance Minister Asad Umar has settled on such a monumentally inadequate plan. The problem has a lot to do with the nature of Pakistani politics in general, and Imran Khan’s arrogant “savior complex” personality disorder in particular, as well as some mistakes Asad Umar made early in his political career.

The story starts in 2012. The fraternity of Pakistan’s financial journalists is a relatively small one, and Engro is an important enough company to Pakistan’s economy that most people who cover the country’s business and economy knew who Asad Umar was when he announced that he would be leaving his job as CEO of Engro Corporation to join the PTI. He was a widely admired CEO, which is why, at a time when many newspapers still considered the PTI to be the gadfly of Pakistani politics, Asad Umar’s announcement largely got favourable press coverage. (I am guilty of that favourable coverage myself, having written what can be described as a largely positive article about the announcement.)

A narrative soon started building: the PTI was bringing in highly intelligent people into its ranks, people who had previously been apolitical, but could potentially contribute a lot to the formulation of sound economic policy. And Asad Umar was the posterchild for that narrative. Imran Khan would handle the political rhetoric that would galvanise the masses, but men like Asad Umar would be the cabinet ministers who actually crafted economic policy that would turn the economy around, even if it meant occasionally upsetting voters.

And when Imran Khan was wooing these people to join the party, that is highly likely to have been the deal that was offered to them. Unfortunately for Umar, he seems to have taken that promise a little too seriously, at least at the beginning.

In the first few press conferences after he joined the party, particularly before and after the 2013 election, Umar was clearly operating on a different wavelength to Imran Khan. The future prime minister would go off on a populist tangent, and Umar would be visibly disinterested in the comments by his party’s leader. When asked questions directly, he would direct the financial journalists in the room to reach out to him directly.

In the cutthroat world of Pakistani politics, that mild dissent was enough to get Asad Umar exiled to the backrooms of PTI’s leadership. He was too prominent a figure to be completely sidelined, but think about how much you heard about him and his so-called policy unit in the Khyber-Pakhtunkhwa government between 2013 and 2018. Hardly anything at all.

Since then, Umar has learnt more about the harsh nature of Pakistani politics and has made it a point to never even mildly appear to contradict the populist narrative of Prime Minister Imran Khan publicly, or even in one-on-one interviews. That obsequiousness has earned him the coveted slot of finance minister in the cabinet, effectively the prime minister’s deputy, but it has come at the cost of him being able to express himself more openly, and thus made the PTI more susceptible to the populist inclinations of the prime minister.

The structural problem

The fundamental structural problem faced by the government of Pakistan is as follows:

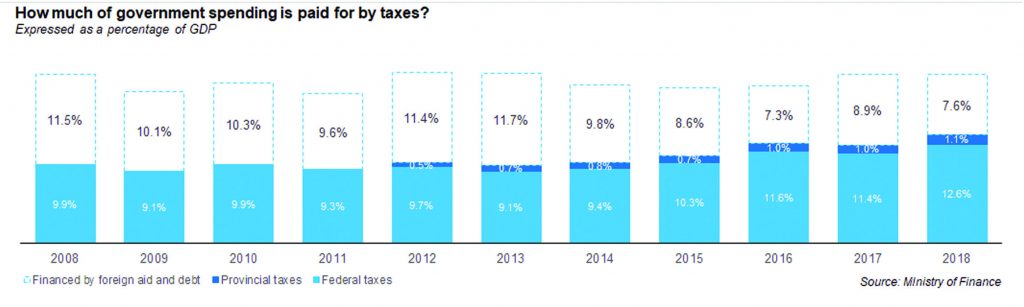

- It makes no effort to tax the wealthy, both the urban industrial elite and the rural agricultural elite.

- It buys the upper middle class’ silence by offering highly subsidized energy costs.

- It buys off the organized labour unions by maintaining large, inefficient state-owned enterprises to employ them.

- It ignores absolutely everyone else.

Virtually nobody in this chain is overtaxed, not even the salaried class, who love complaining about their taxes. As a result, the government never has enough money to keep it going, turning itself from a functional entity into effectively a Ponzi scheme, where the hope is that the foreign-funded bailouts keep pace with the rising scale of the government’s operations.

The revenue problem is a hard one to solve, one that will take years, if not decades to solve. But the giveaways to the upper middle class and the labour unions can be solved more urgently, largely through privatization and elimination of energy subsidies.

On the matter of reducing energy subsidies, the government has made some incremental progress, but nothing that addresses the structural problem of theft, and the fact that the government effectively ends up paying for rampant theft in both the electricity and natural gas grids almost entirely through a backdoor bailout of the energy system by calling it “clearing circular debt”.

But on the question of ridding the government of the burden of the annual bailouts of the perennially dysfunctional state-owned enterprises, the government has made no progress, except for that window dressing maneuver that is Sarmaya-e-Pakistan Ltd.

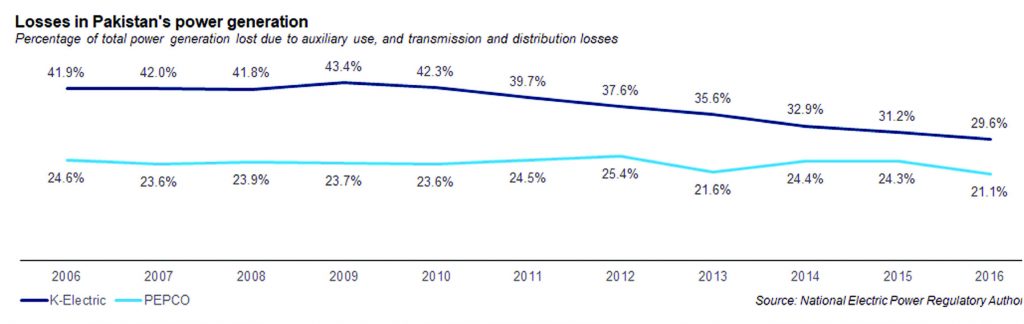

And the truth is that both privatisation and eliminating energy subsidies are related. The most critically dysfunctional companies owned by the government of Pakistan are energy companies, which is why it is not really possible for the government to crack down on theft of electricity and gas. Take a look at the chart that compares line losses at K-Electric, the only privately owned electricity utility in Pakistan, versus those of the state-owned companies. Officially, the state-owned companies have lower losses, but those loss levels have remained stagnant over the past decade, whereas private ownership has caused losses at K-Electric to plummet.

State ownership in Pakistan is a failed experiment of the 1970s and needs to be gotten rid of. The sooner the government realizes that, the better off the entire country will be. Unfortunately, the PTI-led administration appears hell bent on trying yet another iteration of the same old idea: “Previous governments failed to fix the problem because they were corrupt. We will be able to fix it because we are better than they were.”

Why Sarmaya-e-Pakistan will fail

The government believes it can solve the problem of losses at state-owned enterprises by uniting them under a single holding company called Sarmaya-e-Pakistan Ltd and then running that similar to the sovereign wealth funds of other governments.

Of course, because nobody in the PTI cabinet knows how the government functions, what they have actually agreed to is a massive power grab by the civil servants in the finance ministry. All of the state-owned enterprises are currently owned by different ministries, but under the new structure, they would all be owned by the finance ministry, with the finance secretary as the CEO of the holding company.

How on earth does that solve anything?

The employees of these companies would remain subject to government rules, including protections against being removed from their jobs for their incompetence. There will be no motivation by the civil servants running the holding company to behave any differently that the other civil servants who were previously running the state-owned companies individually.

And the board of directors of Sarmaya-e-Pakistan, while suitably filled with people with impressive private sector credentials, does not have the power to hire and fire the CEO, since the CEO is by default the finance secretary, who is always appointed by the finance minister, occasionally in consultation with the prime minister.

“The board of directors of any company has only one serious power: hiring and firing the CEO. Once they have done that, they can do nothing else. So, if a board does not have that power, it is useless. It does not matter who you appoint to that board. They will be able to change nothing,” said one CEO of a prominent publicly listed Pakistani company to me once.

You know who that CEO was?

Asad Umar.

The Writer just compared Retail Investment with Corporate Investment. Retail Bonds are different than Sovereign/Corporate Bonds and are always lower in yield than the Corporate Bonds. Just like National Savings Certificate. Which has a lower yield as compared to T-Bills/PIBs.

Comparing PBC with Sovereign Bonds of other countries are like comparing Apple with Oranges

The writer assumes that Pakistan’s credit rating will remain unchanged at B-. If you just take a look at all the countries that are in B-, they all are known defaulters with very volatile economic history. Pakistan’s ratings just got downgraded and with IMF they will once again go back to B and in future may improve further. So comparison of 6.25% yield should be made with bonds in B category.

Above all, how much confident Pakistani investors would be on investing in Ecuador or Lebanon’s bonds that are offering merely 1% more than Pakistan’s bonds? For one they don’t know much about these countries so forget about investing in these countries whereas they know all about Pakistan.

You forgot the main rule in investments in bonds. It has a big risk that all your principal investments would go to 0 in case of default. You are treating it as an investment in stocks or equities where the investment goes up and down. When you invest in a junk bond, the main consideration isn’t the yield, it is the possibility that the country wouldn’t default. Even if you make 10% income on a bond investment every year, and make that 10% return for 10 years, it will still be worse than the possibility of a default during those 10 years which will make you lose all your money. Pakistan has never defaulted whereas all the alternatives have defaulted in past. So doesn’t that count anything?

I believe it is a very good deal for overseas investors, especially Pakistanis, as in current environment where you have little avenues for investments, you can’t get a risk free US Dollar investment at 6.45% return.

I have read the whole article written by the author and have also read carefully the replies including yours. I don’t belong to Finance sector but yes I’m an individual always hungry to Discover new upcoming opportunities for investments related to real estate and forex. So now that I have read the whole article which was very informative no doubt about it. Have also read your reply upon it which is also very valid and makes me think in both directions of the author and you. How would I be as a reader in a better position to understand the sarmaya e Pakistan bond whether to invest or not ? As the matter of fact if I’m not given more information on this by either one of you or both or you Sir. I would be left out wandering as a confused person who probably would have invested in it without going thru the information provided by both you which is valid in my perspective. But I wouldn’t go forward to a decision about sarmaya e Pakistan bonds as I’m left out confused.

Hi,

Well for an investor, he or she has to think the best available options out there.

Suppose you have a hundred thousand dollar to invest. Or if you have wealth in Rupees, you need to buy dollars at a rate of 140 USD/PKR today so you should have 1 crore 40 lacs available to buy a bond of $100,000/= A 5 year investments in these bonds would give you yearly return of $6250/- every year for 5 years = So you’ll have $132,500 in 5 years. Now USD exchange rate won’t be 140 for sure in all those years… Even with 40% depreciation over 5 years (or 8% depreciation annually which is less than expected) USD/PKR would be close to 200 after 5 years. So at that time you can convert that money ($132,500) to Rs 26,250,00/- (2 crores sixty two thousand five hundred). So in 5 years from your Rupee based investment would almost double. Where else can you find that kind of returns?

The above all depends on two main things – the exchange rate in future which we all know would keep on getting higher after every year due to huge foreign debts and the risk of default. The higher it goes the bigger would be the return percentage. As long as Pakistan Govt won’t default on its bonds, which is an unlikely event, the expected return rate on Pak Govt bonds would be a lot higher than 6.25%.

Wonderful maths appreciated. Makes sense to me. Thank you very much.

@ Khurram not sure how much you know about finance if you are counting the fact that the PKR will significantly lose value as some sort of return of this investment ? This is a junk investment and the return offered does not cover the risk. I agree with the author.

So you think future expectations have no role to play in finance and return on investment? Ever thought about investments in equities (stock market), futures, forwards, swaps and options?

The actual RoI always takes into account the future expectations and when you are dealing with a fixed income investment that is demoniated in a FOREIGN CURRENCY then the realized return is always the sum of the return from interest and FX income/loss. Basic ‘International Finance’ – if you’ve studied it.

All these ratings agencies gave AAA to junk bonds and brought down the world economy.

Too much of this article rested on the accuracy of these rating agencies that we know have operated on self interest and preservation.

Interesting Read and very informative comments – the Mof guaranteed instrument provide better return in comparison to bank deposit, US$ hedged so no exchange rate risk, rating however is for corporate and not of a much advantage to a retail investors i.e. improved rating will not attract new investors to buy these bonds at premium

On a separate note GoP / MoF should work aggressively to get a rating advisory from topnotch international firms and make sure there rating gets improved the experience is this is all about perception

Khurram you are an idiot. The economy is tanking and you are in your own lala land thinking you will get a ROI in this Ponzi scheme.

Over the years Bahria Town has emerged as kind of a model for modern communities living in Pakistan. Its creativity has introduced a housing scheme in the nation which affects the individuals’ way of life. In addition, it will set an idea for different organizations in Pakistan to evolve. Bahria has earned better than an average reputation for itself just as for Pakistan. Furthermore, it is securing positive changes in the lives of the people so they have the choice to live in an ensured and calm condition.

Over the years, Bahia Town has emerged as a kind of model for modern society living in Pakistan. Creativity has introduced housing plans across the country that affect individual lifestyles. Bahria has a well-reputed organization in Pakistan. It also brings positive changes in the lives of the people, which gives them the option to live in a stable and calm environment.

Hi Guys,

I have a simple question. As economist claims that Pak. always have high risk of Default due to huge debts. Will investors of PBC be able to get back its profits and principal amount in that worst case.

Two comments

1. Pakistan government has attracted huge investment through national savings certificates in local currency. It cannot default and in worst case scenario will print more currency. The risk is real rate of return will be low or negative

2. In Pakistan bano certificates, if government defaults then May be at least they will opt option to pay you in PKR, so at least till that time investment earns a moderate return and protected from exchange exposure

PML(N) also had a similar scheme. When NZ detonated the nuclear bomb, all foreign aid was stopped. He ceased all FOREX accounts and then paid the equivalent amount in rupees. They can always print more rupees. But what do you get out of it, and what do you do with the Rupees you have and is devaluing continuously. I went though this once, not again. Sorry.

The writer was comparing Pakistan with Lebanon. Please go and check current status of Lebabon Govt bonds. It’s not the right approach.

Farooq Tirmizi honestly wasted not only his time but the readers as well. This entire article does not support the headline at all. Speculation with the least bit of knowledge. Look at what happened to Lebanon now. What is wrong with you Farooq? Were you paid by the indian govt. to write this article?

The bonds are a great investment, the yield aside, even helping your company just a by small amount, goes a long way. Maybe you won’t be able to see the fruit of your labor. But your next generations might. It is sad that even “educated” individuals think this way. The yields from these bonds are better than any USD Term deposit you can have anywhere in the world right now.

I recommend waiting for the Sharia compliant version for now.

I am late to the party, but the fact remains that the headline is ClickBait and completely misleading. Author tries to establish his credentials by alluding to having worked at the WallStreet. Undfortunately his thesis fails on multiple levels:

#1 compares apples and oranges High ticket Bonds vs. Low barrier to entry certificates

#2 Assumes that the reader has option to scan the rates vs. maturities and selct the best combination. Doesnt work that way for reatil

#3

#3 Hijacks his own article to do an adhominim commentary on Pakistan’s socio/political problems

This is BAD press, and at the very least editors should modrate what they publish. Please dont rubbish Pakistan for the sake of selling your ink

Ali Jaffery

30+ Years of Global Finance veteren and award winning investor

I agree with Ali Jaffery,

I have invested myself in Pakistan Banao Certificates and I am pretty satisfied with the return and service. Where in world you can get this return..!!! You can not compare Pakistan with other default countries. Keep investing and Keep Earning.

Can somebody please advise me on:

What happens if Govt. of Pakistan defaults on Naya Pakistan Certificates? Do we lose the principal too?

Cheers.

Comments are closed.