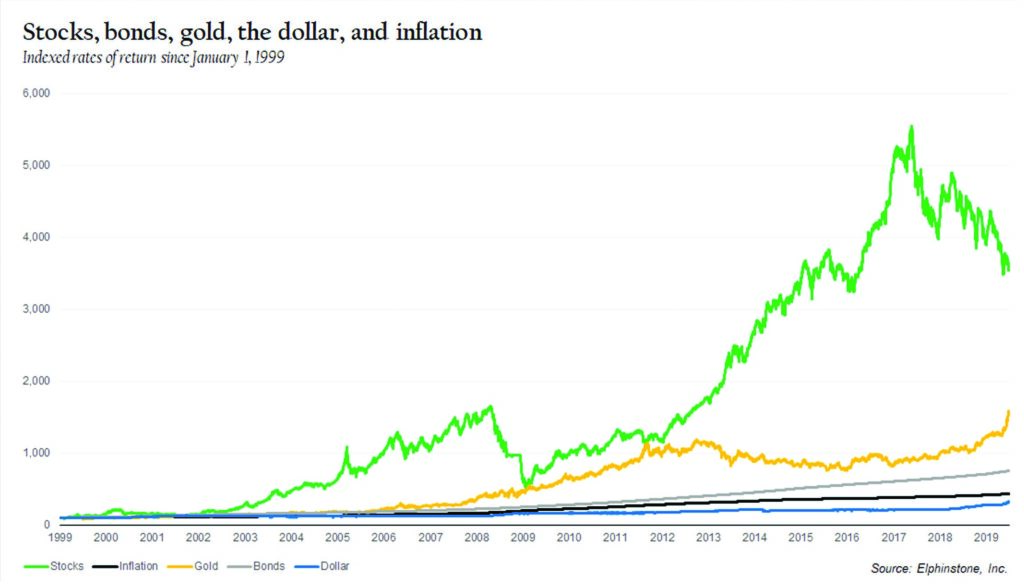

This is the most important chart for any individual considering their personal financial situation. It reflects the data that illustrates an important fact: over the long run, there is simply no asset class that outperforms stocks as an investment. Commodities such as gold, as well as real estate, are popular among most middle class Pakistanis as avenues of investment. A few, more sophisticated investors might consider government bonds as an investment class. But it is only stocks that offer not just protection against inflation, but actual, long term growth in one’s capital. Over the long run, that gain can be quite substantial, nearly tripling the returns on gold and more than five times the returns on bonds. This may be hard to believe at a time when the stock market appears to be undergoing a bear market environment. But it is important to remember for investors who wish to adopt the most sophisticated of investment strategies.

Thanks for the chart. I would have liked to see another line on it that was mentioned in the article but not mapped. That is property because, as you mentioned, it is one of the most popular investment avenues in Pakistan.

Comments are closed.