–Central bank terms latest increase in inflation as ‘transitory’ in nature

–SBP says projection for real GDP growth for FY20 likely to be revised downward

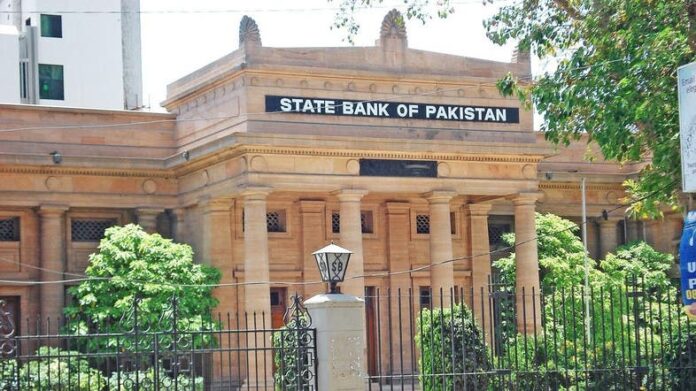

KARACHI: The State Bank of Pakistan (SBP) on Tuesday announced to maintain the policy rate at 13.25 per cent for the next two months in a bid to curtail inflation that remains unchanged at 11-12pc for the financial year 2020-21.

In a press conference, the SBP’s Monetary Policy Committee (MPC) said that the decision was indispensable since the bank’s projection for the inflation had remained unchanged. Inflation was recorded at 12.6pc in December 2019 and 12.7pc in November 2019.

This was in line with the last monetary policy review in November 2019, where SBP had again projected average inflation for FY20 to remain broadly unchanged at 11-12pc.

“The MPC viewed the latest increase in CPI [Consumer Price Inflation] as primarily transitory in nature,” the central bank said in a statement.

Terming the recent food inflation as ‘supply-side shocks’, the statement said that the “second rate effects on inflation from supply-side shocks have not materialized, and inflation expectations remain broadly anchored”.

SBP Governor Reza Baqir told reporters that the interest rate was comparatively low, at 8.4pc, when it was raised in July 2019. But despite a consistent increase in inflation in the previous months, the overall inflation outlook was stable as it (inflation) would be brought down to 5-7pc over the next two years.

He explained the real interest rate or the nominal interest rate minus inflation was currently around 1-2pc. “Historically in Pakistan, the real interest rate has hovered around 3pc.”

When asked by Pakistan Today about real interest rates, the SBP governor said despite concerns regarding the real interest rate entering a negative territory, the anticipated inflation was to be below 12pc, and so the SBP was complying with the IMF [International Monetary Fund] terms.

The SBP statement added that in reaching the latest decision, the MPC considered key economic developments since the last meeting, in the real, external, and fiscal sectors.

Despite the recent increase in food prices, the inflation outlook would improve, the MPC said, adding the current account deficit contracted by 75pc to $2.15 billion during the first half of FY20.

“This has led the SBP to build up its foreign exchange reserves up to $11.73 billion as of January 17, 2020.”

The statement also listed the recent appreciation of the exchange rate after the introduction of the market-based exchange rate and ongoing fiscal consolidation.

On the other hand, the SBP said its projection for real GDP growth for FY20 was likely to be revised downward. In its last review, the central bank kept its projection for GDP growth for FY20 unchanged at around 3.5pc.

The SBP governor said the government was committed to its goals to ramp up exports by increasing the Long-Term Financing Facility (LTFF) to Rs200 billion for the entire exports in order to increase the export base and reduce dependency on few commodities.

Addressing the concerns regarding the T-bill inflows and their sustainability, Reza Baqir said an increase in inflows was strongly attributed to a surge in confidence in the credit-worthiness of Pakistani rupee-denominated bonds.

He further said the exchange rate system reforms helped Pakistan with its global perception.

Talking about yields, the governor said the banks now had a space to deploy their resources in lending. Furthermore, the greater demand in yields means that the government expenses with regard to government interest expense is going down and will help deepen the bond market. Currently, investments make up 3.8pc of the total fixed income market.

The unchanged policy rate is in line with market expectations, as almost all major investment banks had predicted that the policy rate would remain unchanged at 13.25pc, due to the risks of inflation.

In a survey about policy rate expectations compiled by the Intermarket Securities, all 29 research houses predicted that the SBP would maintain status quo on the policy rate.

Similarly, in a recent survey by the CFA Society of Pakistan of individual CFA charter holders, as many as 97pc of those surveyed believed no change would occur in the policy rate. In fact, a small sliver (3pc) predicted that the rate would increase by as much as 50 basis points, to 13.75pc.

The new unchanged policy rate negates the earlier claims made by the government officials including President Dr Arif Alvi who had hinted at a possible decrease in the interest rate owing to a “thriving economy”.

Market analysts believe that a cut in the policy rate will happen much later in the year. Previously, a cut was predicted in mid-March, but now due to rising inflation in Pakistan, any new announcement to cut the rate is expected in July or September this year.

SBP had last changed the policy rate on July 16, 2019, to 13.25pc with a rise of 100 basis points. At the time, it cited increased potential inflation owing to a rise in utility costs.

The central bank further kept the policy rate unchanged in its reviews on September 16 and November 2 last year.

At the start of 2019, the policy rate was 10pc. Subsequent policy reviews – in January, March, May and July– increased the policy rate by a total of 325 basis points.

Pakistani economy has the seventh-highest policy rate in the world, which is well above the world average of 6.38pc. Other countries with a policy rate of 13.25pc include Egypt and Tajikistan.

In addition, Pakistan is one of the few countries that has moved toward tightening in the span of 12 months.

Historically, Pakistan’s policy rate has always been on the higher side. Between the period 1992 and 2019, the highest policy rate was set at 19.75pc, and the lowest at 5.75pc.

With additional reporting by Ariba Shahid