KARACHI: Bears extended their control on the Pakistan Stock Exchange (PSX) on Wednesday, with the indices nosediving right from word go, triggering a 45-minute ‘market halt’ for the fifth time in last eight sessions.

A market halt is triggered when the KSE-30 Index trades at 5pc for consecutive five minutes.

On the economic front, the State Bank of Pakistan’s Monetary Policy Committee (MPC) on Tuesday slashed the interest rate by 75bps to 12.50pc. On the other hand, global oil prices hit a four-year low after falling to $26.20. Growing tensions regarding a slowdown in economic activities due to the rising number of coronavirus cases also dented investors’ confidence.

As the PSX lost 18pc of its value in the last eight sessions, and with investors witnessing regular market halts, two of the largest sectors by market capitalization, oil & gas exploration and banking, took a cumulative hit of over 20pc.

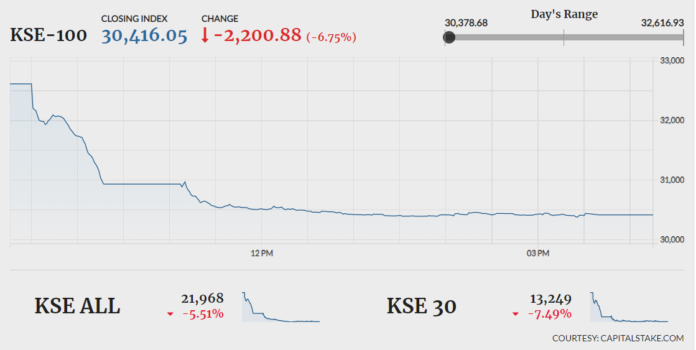

Shedding 2,238.25 points, the KSE-100 Index fell to its intraday low at 30,378.68 soon after the commencement of the session. Failing to find any positive triggers, the index closed lower by 2,200.88 points at 30,416.05.

Among other indices, the KMI-30 Index plunged 3,822.96 points to settle at 46,930.72, while the KSE All Share Index declined 1,279.91 points, closing at 21,968.43. The advancers to decliners ratio stood at 20 to 306.

The overall volumes fell from 240.38 million in the last session to 186.65 million, with traded value standing at Rs5.31 billion. K-Electric Limited (KEL -10.84pc), The Bank of Punjab (BOP -5.41pc) and HBL Investment Fund (HIFA -3.57pc) led the volume chart, exchanging 25.47 million, 19.57 million and 9.10 million shares, respectively.

Sectors that painted the index red painting the benchmark KSE 100 index red included banking (-582.19 points), fertilizer (-320.11 points) and oil & gas exploration (-292.33 points). Among the companies, Habib Bank Limited (HBL -144.90 points), Engro Corporation Limited (ENGRO -142.51 points) and Hub Power Company Limited (HUBC -120.61 points) dented the index the most.