The Pakistan Tehreek i Insaaf (PTI) government has had a few hallmark policies and talking points. As the anti-corruption party, from the very beginning they are the ones that were supposed to clean things up by going digital and introducing e-governance as a wide ranging concept. They were also supposed to expand the tax net, work on transparency, and go after tax evaders.

How successful they have been in these endeavours is another question. The aggressive, untargeted methods the government has chosen to bring in more people into the tax paying fold and increase revenues have been questionable, and the efficiency of projects such as the Prime Minister’s complaint portal has been a mixed bag.

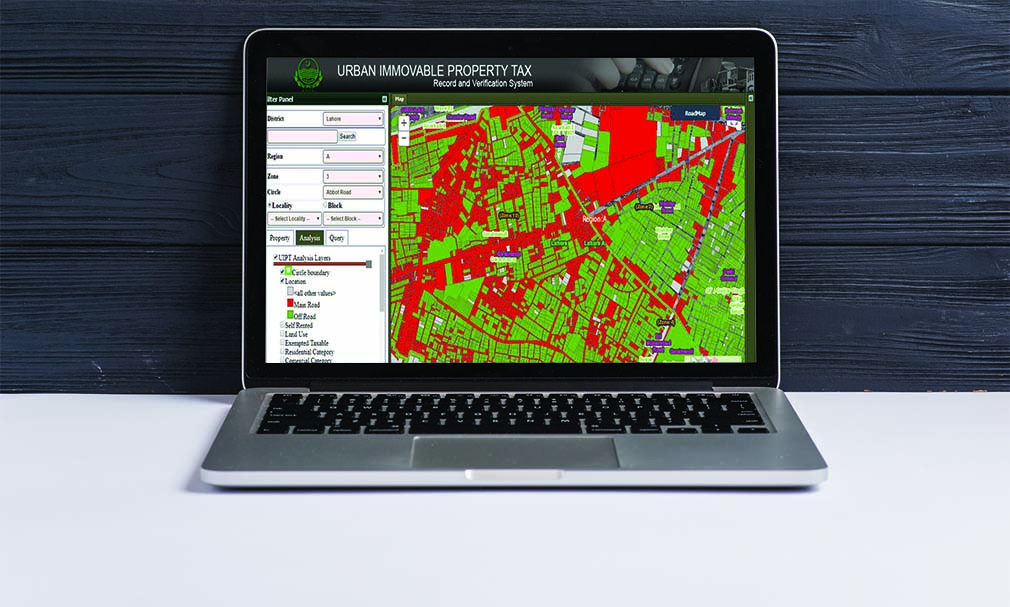

One project, however, which encompasses most of these ambitions is the Excise and Taxation department’s planned computerization of the Urban Immovable Property Tax (UIPT).The proposed shift to digital would create a comprehensive repository of data of properties, which can then be used for tax calculation and system generated tax payment challans. But how exactly does investing in this help the government combat tax evasion and help improve transparency in property acquisition?

More importantly, with a decade long history, how is the project initiated by previous governments faring in a PTI government in Punjab, which has always had a tilt towards such actions. As things stand, all the data of the UPIT has been digitized in 36 districts of Punjab and the project was completed in September 2019. According to data, before computerization there were 3.4 million registered units, a number that has risen to 5.1 million since digitization. Profit takes a look at the scale, the need, the history, the grueling process, and most importantly the cost, that went into this project.

Why go digital?

The computerization would achieve a number of targets, but the most obvious one would be the people over at Excise Taxation and Narcotics Control (EC&NT) getting a much needed break on the property tax front. Evasion in property tax has long been a prime trouble for the department, especially since the 90s, when the country first took the easy but lazy route of indirect taxation, which has made the tax establishment unable to collect effectively, which in turn means that any aggressive revenue collection drive is likely to impact the salaried and lower-classes the most, draining their disposable income.

Naturally, of course, the ET&NC department has responded defensively. The need to move to a computerized system shows that they were missing something. And while they claim to be consistently meeting the set targets of collection of property tax, they do admit that the process of collecting property tax is very hectic and inefficient.

“Tax evasion cases are particularly high when it comes to property tax, that is true. When it comes to collections, we are facing two basic issues: the first one is corrupt officials, and the second is the many, many extended areas that are building around major cities” says ET&NC Director Rizwan Sherwani.

Sherwani seems to be pointing towards the many housing societies that are so far flung that they are out of reach. Add to this the fact that their buying and selling process of land is so complex and localised, and it is nearly impossible to keep a regulatory check on them. “Take Lahore as an example” he says. “If we talk about Punjab’s provincial capital, houses, commercial markets, and plazas are mushrooming in new housing societies and areas everyday. The rate at which such projects are popping up is greater than the department can keep up with, and registering them will take time.”

The depth of the problem, and a short history

The director chiefly blames the rate of expansion of cities and corrupt officials for property tax evasion. But many of the officers under him believe that another reason for the high rate of tax evasion is the manual record system. In fact, it is this very manual record system that allows field staff of the department to easily swing the record one way or the other by tempering or hiding the actual details of any property in question. And since it is all done manually, nobody would be the wiser.

For example if there is a property which is under the commercial category, it would have a hefty tax on it. But this can easily be avoided with the compliance of field staff, who can convert the nature of tax from commercial to domestic with a few squiggles of their pen, without breaking a sweat in the entire process. These practices have been causing significant losses to the treasury.

Property tax plays an important role in the fiscal revenue system of the provincial and local government in Punjab. However, its full potential was not in being harnessed due to various loopholes, shortcomings and the misuse of authority at various levels.

The idea to computerize UIPT goes back to 2007, when the Government of Punjab, following a Non-Lending Technical Assistance (NLTA) supported by the World Bank, notified a policy framework for decentralized and integrated administration of Urban Immovable Property Tax and the Medium Term Tax Policy Framework 2007-2012.

The World Bank had been supporting the Government of Punjab in the design and implementation of the UIPT Reforms in the province. A draft bill by the name of ‘Punjab Immovable Property Tax Act, 2008’ was also prepared in close consultation with all stakeholders.

Subsequently, the then Chief Minister constituted a committee headed by the Additional Chief Secretary Punjab, with a mandate to formulate and submit recommendations. Consequently, the Policy Framework for Decentralization and Integrated Administration of Urban Immovable Property Tax was approved and notified.

Further, as per commitment of Government of Punjab with Asian Development Bank (ADB), under the policy matrix (SP-II) of the PRMP, it was decided that GIS based collection of UIPT will be piloted in three of the UIPT Circles of Lahore. The efforts made in this regard did not yield any positive results and failed to provide a workable solution.

Thereafter, it was decided to implement the pilot project in the entire district. Hence a Memorandum of Understanding (MOU) was signed amongst the ET&NC department of Punjab, the Urban Sector Planning & Management Services Unit (USPMSU), and the Punjab Resource Management Program (PRMP) to carry out this experiment in the Sialkot district as a pilot project.

This was followed by the Urban Unit beginning work on developing a GIS based database and software for the computerization of UIPT in Sialkot district with the financial assistance of the World Bank. It was completed within a time period of about three months. The software and database was developed in-house by the Urban Unit and pilot was launched by the end of December, 2011 in Sialkot district. However, the software designed had the potential of implementation across the entire province. It all depended on how things would go in Sialkot.

The project was started with the main objectives of plugging leakages in tax revenue streams, and increasing in revenue earned through UIPT and removing trust deficits and standardization of calculations. It was also aimed to develop a centralized database for strong monitoring, effective decision making, and to help decrease the workload by speeding up daily processes and increasing efficiency and effectiveness.

With the project, the ET&NC department had hoped for an image boost as well. From the sluggish, corrupt department that it had gained a reputation for being, there were hopes that people and property investors would be reassured by the department’s shift towards becoming a modern, enigmatic, transparent, and fair department that depended on empirical facts rather than staff discretion.

The cost factor

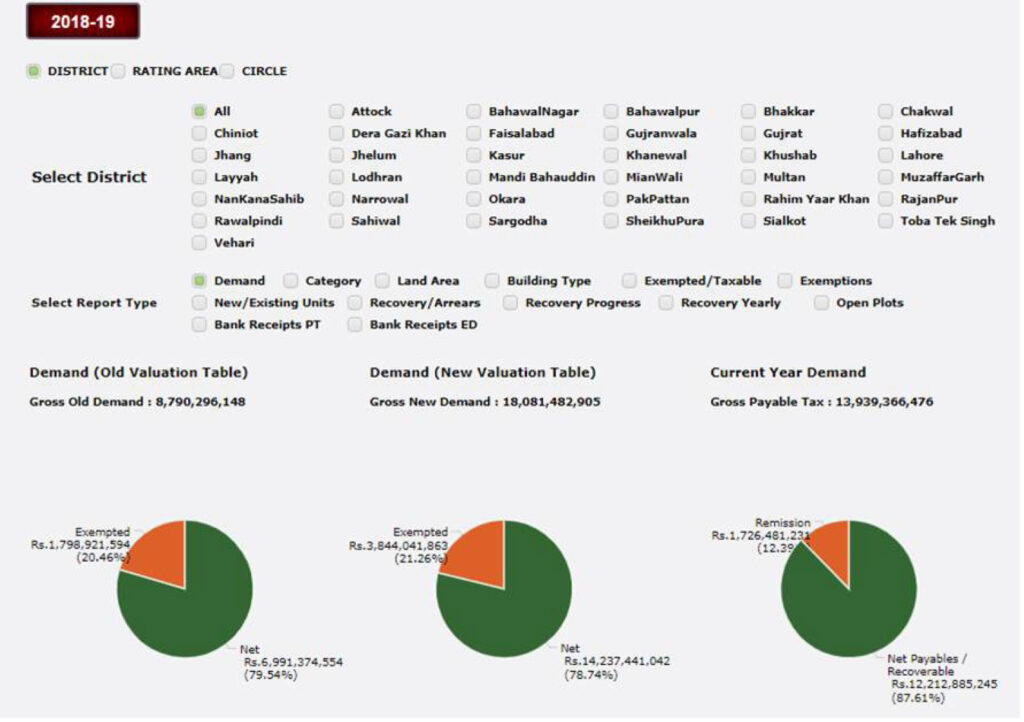

The results were astounding. After undertaking the pilot project in Sialkot, according to a rough estimate, the computerization is supposed to have directly resulted in a 25% increase in property taxation. With the glowing results, the Government of Punjab was quick to agree to extend the computerization of property tax to five large districts under the UIPT Phase-I, which includes Lahore, Faisalabad, Gujranwala, Rawalpindi & Multan covering approximately 70% of the total revenue generated by the Punjab Government through Urban Immovable Property Tax collection. But was the government getting the needed bang for its buck? What followed was a complex example of what government projects often go through to get their hands on funding.

To determine this, ET&NC initiated a summary to the then Chief Minister Punjab, Mian Shehbaz Sharif, on 10th June, 2013 with a total project cost of RS971.856 Million which included an amount of RS316.234 million for IT support, infrastructure, and recurring cost of one year.

Further, keeping in view timeline and operational expediency, it was requested to waive off approval of the Austerity Committee for procurement of IT and related equipment which was although not supported by Finance Department and it was proposed to route the case through PPRA. The said summary was approved by the Chief Minister on 22nd July, 2013.

In accordance with this approval, the Urban Unit started implementation of the project. Meanwhile, on further directions of the secretary finance, a sub-committee was constituted to rationalize the proposed cost of project. The sub-committee recommended a reduced cost of RS 653.007 Million and excluded 5% overhead from the component of Urban Unit, which was RS 475.728 Million.

Further, as funding of RS 50 Million for this project was available with the Urban Unit under the World Bank’s project naming Punjab Cities Governance Improvement Project (PCGIP), therefore the funding of Urban Unit’s component was reduced to RS 499.514 Million. The said proposal in continuation of Summary was submitted by ET&NC Department to Finance Department.

The Urban Unit’s component was further proposed to be rationalized by the Finance Department to an amount of RS 445.886 Million as a supplementary grant during year 2013-14, after adjusting RS 50 Million to be funded from PCGIP. The said proposal was endorsed by the then Chief Minister Punjab on 10th February, 2014.

As a result, the Urban Unit signed a contract with ET&NC department on 12th February, 2014 to execute the project within a period of twelve months starting from 1st July, 2013 till 30th June, 2014. The execution period was further requested to be extended till 30th June, 2015.

This was then approved by the Chief Minister on 11th July, 2015. Later on, the ET&NC department, through a summary to the Chief Minister in May 2016, requested an additional amount of Rs.59.209 Million being the cost over-run incurred by the Urban Unit. It was rationalized by the committee constituted under the chairmanship of Finance Minister.

It was then directed to make a request for the funds during the next financial year, as the supplementary grant was closed at that time due to finalization of budget. It was finally after this arduous process that Mian Shehbaz Sharif as the Chief Minister approved placement of matter before the Standing Committee of Cabinet on Finance & Development for consideration and appropriate decision in December 2016.

It took 18 meetings of the Standing Committee of Cabinet on Finance & Developmentbefore the entire matter was briefed by the Secretary ET&NCD and the standing committee approved a Rs.59.209 Million through supplementary grant, during FY 2016-17 to meet the liability of cost over-run.

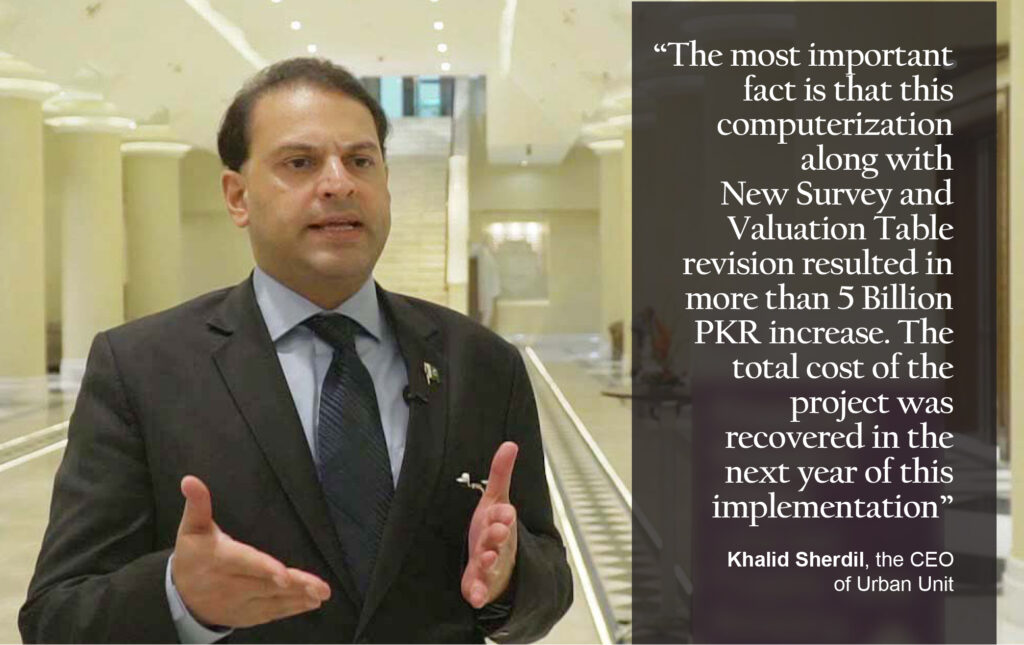

“The most important fact is that this computerization along with New Survey and Valuation Table revision resulted in more than 5 Billion PKR increase. The total cost of the project was recovered in the next year of this implementation” claims Khalid Sherdil, the CEO of Urban Unit. But how far has Urban Unit been successful in delivering what the Punjab government went through so many steps to try and pull off?

Project Execution Processes

Before the start of this project, the ET&NC was maintaining its property tax record on manual registers which included:

PT-1 registers contains property description like its Serial No., Property Unit No., Owner & Occupier details, Total Land & Covered Area, Usage of the property, No. of Plinth, Self/Rented details, Gross Annual Rental Value etc. Whereas;

PT-8 registers contained the previous 5 years of tax records of each payee/assessee which helps to observe their trend of payment.

In accordance with the approval of the Chief Minister granted on 22nd July, 2013, the Urban Unit, in addition to Sialkot, started implementation of project in five large districts i.e. Lahore, Rawalpindi, Multan, Gujranwala and Faisalabad. The Urban Unit hired about 350 field surveyors, 40 supervisors and 700 data entry operators. A data entry lab was also established in five large districts for the purpose of data entry and related activities.

“The Urban Unit provided their services to ET&NC in technology intervention for the betterment of daily processes. The process included all the processes like scanning of existing PT-1 & PT-8 registers of ET&NC, data entry in UIPT Software (Digitalization), printing of DVLs (Draft Valuation Lists)” says Khalid Sherdil, the CEO of Urban Unit.

The critical role that Urban Unit has in this entire effort cannot be overstated.The initial step was to scan and store this data. For this purpose, different teams were formulated and equipped with IT equipment like high resolution digital cameras, stand, special light bulbs, laptops, external hard drives etc. These teams visited each district to carry out their assigned tasks and the process of digitizing existing data went on rapidly.

Meanwhile, data entry labs were also established where data entry operators were hired for incorporation of this scanned data into the property tax software to have a centralized database. The data from scanned PT-1 & PT-8 images was provided for entry into the UIPT System. PT-1 & PT-8 images were also uploaded against each property unit for accuracy, evidence & record keeping.

In order to ensure correctness of data, a double input method was established, in which data was entered by data entry operators, and then being thoroughly checked by supervisors. This data was further re-verified by concerned officials of ET&NC Department as per draft valuation lists prepared and provided to them. After checking those registers (DVLs), the concerned officials of ET&NC signed those DVLs and returned to the Urban Unit for rectification in the UIPT System.

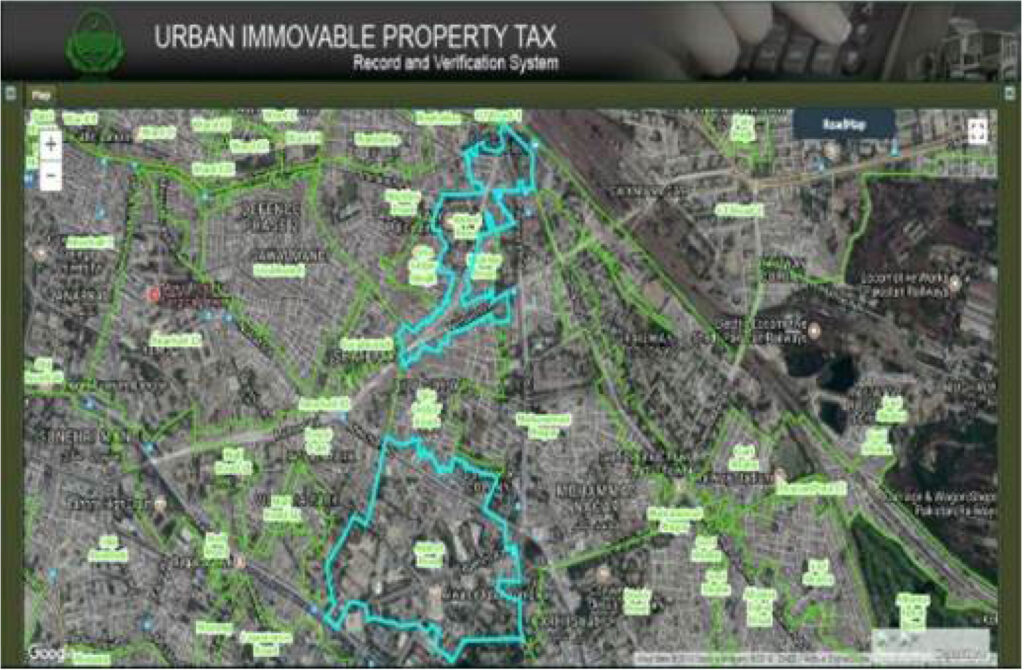

A satellite imagery system was also purchased for the purpose of integration of MIS with Geographical Information System (GIS). A team of GIS professionals digitized each property unit on the satellite imagery as individual ‘parcels’. A list was created by locality of these parcels, containing property unit numbers and unique form numbers were provided to the surveyors hired by the Urban Unit. Surveyors accompanied by ET&NCD officials conducted physical survey of each property unit by taking a picture and filling a form. Both surveyor of Urban Unit and Tax Inspectors signed the survey forms containing updated details of each property.

Detail of each property unit along with property image, after detailed lab verification, was uploaded on the dashboard of Urban Immovable Property Tax (UIPT) developed by the Urban Unit.

Results

An outcome of this exercise was the generation of computerized tax challan forms for the taxpayers. One-time centralized colored tax challan forms (PT-10) of all six districts, which included Sialkot as pilot district, were printed by the Urban Unit and provided to client department for delivery to property tax payers. Since a unique property number was assigned to each property unit, therefore it facilitated each taxpayer to calculate its property tax from the link provided on the official website of ET&NC Department.

In order to train the concerned field officials of ET&NC, teams of Urban Unit visited each district to deliver two days training on UIPT system to ensure smooth execution & implementation.

New UIPT System was deployed in the field offices by providing I.P addresses & domain wise login details to the concerned officials of ET&NC department. The Data Centre was established to manage huge traffic and bulk of daily transactions and its real time impact display on the dashboard.

But what is happening with all of this data that was collected and digitized? According to Director General of the ET&NC department, Suhail Shahzad, it is being given right back to the public directly.

“We are giving the public access to their data and empowering them, because without empowering them we cannot eliminate red tapism. Without giving the access of information to the public, we cannot even start the accountability of corrupt elements,” he says.

What he hopes will happen is that the open flow of information will allow people to access their tax records as well as have more transparency when situations of buying or selling of property come up.

“The revenue collection targets increase every year but the actual issue was the realization and their reconciliation of taxable income. All the taxable income from Punjab comes to the government’s account and previously there was a gap of four to six months between realization and reconciliation but now this gap will reduce gradually,” he explained.

“We want to quicken all the procedures, like realization of revenue, recoveries and troubles and making a decision making policy on daily basis. In our model property tax is sustainable tax and the target of current FY 2019-20 is 14.3 Billion rupees.”