What is the car buying experience like for the average Pakistani? Many people buy cars in Pakistan without bank financing, which means they pay a lump sum to a car dealership that then delivers the vehicle in the next six or so months. If they want a car immediately, they have to pay an ‘on’ price to drive away with the car the same day.

For people that cannot afford to pay in full, there is bank financing. However, this comes with an interest rate that hovers around 13% and a significant waiting period that depends on the scheme and bank you are using to finance your car. Along with the high-interest rate and waiting period, there are also the issues of expensive insurance, and high taxes.

What can be gauged from this is that buying a car in Pakistan is an unnecessarily complex and expensive process that is exacerbated by the woes of a high interest industry. And with car prices surging in the past couple of years, people looking to buy cars have had even more to be worried about.

With all this going on, what if we told you that the government had just launched a scheme that would lower interest rates to almost half, slash waiting times by half, decrease taxes due on the car, and offer cheaper insurance? Prospective buyers might sing for joy and do a little dance. But then what if we told you that the offer was not available to people living in Pakistan? Prospective buyers might now be confused and offended.

This is exactly what is happening with the Roshan Digital Apni Car Scheme recently launched by the government. Under the scheme, if a non-resident Pakistani wants to buy a car for their family back home, they can finance a car digitally from across the world, at cheaper rates and more conveniently than Pakistanis living in Pakistan can. The idea is that non-resident Pakistanis will buy more cars at home, and send more remittances to do so.

“You give many more subsidies with much less return. Look at what India does with its Non-Resident Indians (NRI). Overseas are your power bank and they’ve never gotten anything in return. We are providing a finance facility like the rest of the world,” Zulfi Bukhari, Special Assistant to Prime Minister for Overseas Pakistanis and Human Resource Development, tells Profit. when asked about the preferential treatment to NRPs given through this scheme while speaking exclusively to Profit.

The answer is just what one would expect from a government official, filled with whataboutery, a comparison with another country, and immense love for NRPs. The only problem is that we have heard it before, and we have been over this before.

It is the same vapid appeasement of expats and desperation for their remittance money. Don’t get us wrong, as far as the deal is concerned, non-resident-Pakistanis are getting a good one through this new scheme. They were also getting a good deal out of the Naya Pakistan Certificates. The problem with these expat-oriented schemes remains the same – the government is providing ridiculously high returns in comparison to global markets but at the cost of excluding local investors from benefiting. The questions are, how much money in remittances can the scheme actually make Pakistan, and what will the repercussions be of not giving this kind of facilitation to tax-paying Pakistanis that live in the country?

What exactly is the Roshan Digital Apni Car Scheme?

Non-resident Pakistanis that have Roshan Digital Accounts will be able to finance a new car through their account across the world. The lowest possible interest rate for Roshan Digital Account holders is approximately 7 percent. For a resident Pakistani, the interest rate hovers at around 13 percent. They will also pay lower insurance fees, registration, and taxation fees. In addition to all this, applicants will get their cars sooner than local buyers. Overall, the cost of getting a car will fall by around 20%.

The Roshan Digital account holder will be the primary customer of the bank. For the purpose of financing a car, a Roshan Apni Car Repayment Account will be set up. This account cannot be used for other transactions and will strictly serve as a non-checking account for payment of monthly rentals.

The account holder will appoint a nominee within Pakistan as a local contact point. You can only appoint one nominee that has to be a spouse, parents, siblings, or child. The vehicle will be registered in the name of the co-applicant/ nominee residing in Pakistan.

In exchange for all of these benefits, the Pakistani government hopes to make bank on remittances. Essentially, these remittances will be the collateral that the government collects to finance the car loan. Shoring up remittances is the goal at the end of the day, and as the spokesperson for the SBP, Abid Qamar, explains “so far all schemes under Roshan Digital were devised to facilitate payments and investment into the country. There was no consumer-based product and so we introduced this scheme.”

Now, this is more beneficial to the government if NRPs choose to go for a lien-based loan because it will mean NRPs invest long term in either Roshan Digital accounts or in the Naya Pakistan Certificates. A lien is essentially a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation. In this case, the repayments of a loan to buy a car. In cases where the borrower does not make timely payments or adhere to his or her agreement, the asset can be seized by the creditor.

For the Roshan Digital Apni Car, you could invest in Naya Pakistan Certificates, or deposit money into your account equivalent to the financing amount. This will be a lien or a pledge equal to the tenure of the financing or maturity. This means that you cannot sell your certificates, repatriate or withdraw from your account while availing of this scheme. It can only be done upon maturity of your certificate or after full settlement of the financing.

Non-Lien based financing is whereby the account holder is paying on the basis of income and remittances. Profit summarizes the minimum income requirement that has been set by different banks. This means that the conditions and criteria depend on banks. Similarly, the decision on whether you can finance new, old, or reconditioned cars falls on the banks and their policies

Is the Apni Car Scheme giving non resident Pakistanis massive savings?

Let’s take a numerical example. For instance a consumer chooses to finance a Changan Alsvin worth Rs 2,449,000 with a down payment of Rs 541,610 over the span of 5 years. If someone chooses to finance the car from within Pakistan, they’ll pay Rs 1,061,362 in interest and insurance payment, compared to Rs 843,934 paid by someone who finances their car through their RDA. This means that through Roshan Digital Apni car, you’re saving 20.49% in interest payments, and 6.19% in the overall price of the car. In absolute terms, through RDA, consumers can save Rs 217,428. This is through their non-lien financing method. It is even cheaper if one chooses to go for lien financing.

So to answer the question, it depends. If you think saving 20.49% on interest and insurance payments, and 6.19% on the price of a car is a massive advantage, then yes, the scheme is unfair to resident Pakistanis for this very reason.

| Bank Name | HBL | Bank Alfalah | Bank Al Habib |

| Criteria | Earning PKR 200,000/ month | Salary: earning $3000/ month Business: earning $4000/ month |

Gulf countries: DHS 10,000/ month

UK, US, Canada, Australia, BAHL Branch/ rep countries: $3000/ month |

Favorite child – and why explained by the SBP.

Pakistanis actually living in Pakistan have a right to be miffed. The government’s standard line is that expats have done a lot for Pakistan over the decades and that it is simply trying to give back to them as no other government has in the past. This admittance of preferential treatment is harrowing when one considers that remittances being sent from abroad are sent out of a love for one’s own family, not some warped sense of devotion to Pakistan’s national interest.

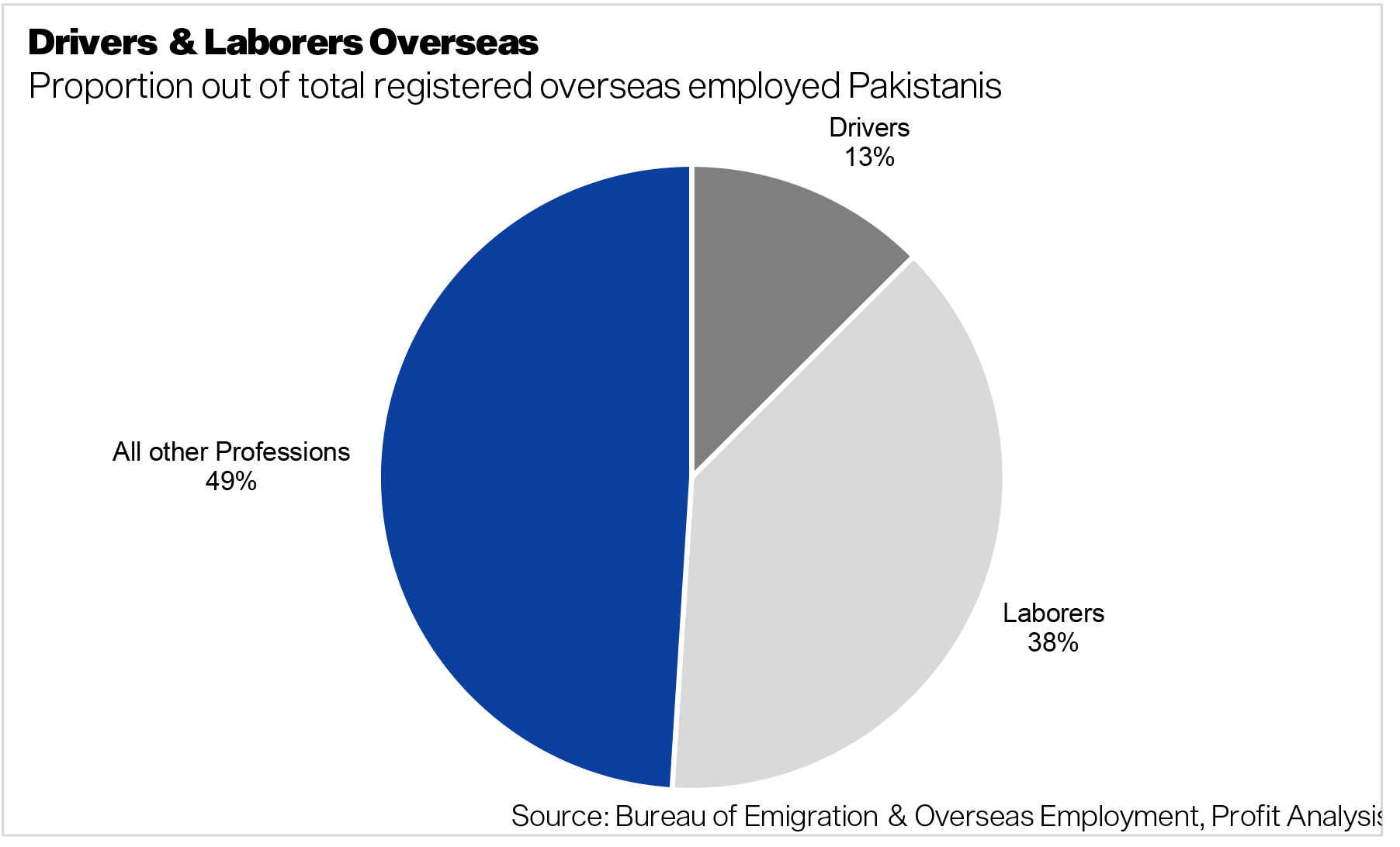

Then there is the question of what kind of NRPs this government in particular likes. As per data released by the Bureau Of Emigration & Overseas Employment, 11,436,280 Workers were registered for overseas employment as of March 2021. A quick analysis of that data shows that 38.47% of expats registered are laborers, 12.53% work as drivers, 6.88% as Masons, and 4.64% as carpenters.

Most of the expats that can afford to buy cars for their families back home are the ones working as accountants, artists, analysts, designers, doctors, engineers, managers, nurses, and teachers, and they make up a grand total of less than 3% of the expat population. It is this small fraction that the government of Pakistan is so enamored with, and for whom they launch schemes like the Roshan Digital Apni Car. Considering these statistics, it is very unlikely that an overwhelming majority of these individuals will be able to finance a car through this scheme. Like most schemes, this too will only work out in favor of those that are well off.

The SBP, however, claims that the comparison between regular financing and this scheme is unfair because regular finance rates are done on the basis of a mortgage. “If someone is not able to pay back the money, the bank seizes that asset. Naya Pakistan Certificates are a much more liquid asset. They save the cost of the bank and that is why they are offering lower rates to non-resident Pakistanis.”

While this explanation makes sense at first, it can be debunked with a simple example.

To put this in numbers, let’s say you have a credit limit of Rs 100,000. For this trip you need an additional limit of Rs 50,000; making your limit Rs 150,000. Banks are often stingy when it comes to increasing credit card limits, while sometimes the process takes time which you may not have.

To overcome this, they ask you to deposit Rs 50,000 into your account and they block that amount. This means you are not allowed to spend it in exchange for an enhanced credit card limit. If you default on this credit, the bank seizes Rs 50,000. This seems like a safe bet for the bank too. Yet, in this case, you are still charged exuberantly high interest on late payments. There is no discount or concession despite the collateral or lien.

What this means is that the only reason the SBP is being benevolent to expats is that they want dollars.

By their own admittance, the SBP’s aim with this scheme is shoring up remittance. What this means is that the only reason the SBP is being benevolent to expats is that they want dollars. “The key intention seems to be increasing remittances, of which this scheme would work just as well as any asset financing scheme,” says Dr. Sheheryar Banuri, a behavioral scientist, public policy expert, and Associate Professor at the University of East Anglia

“One might even argue that this is sensible, as overseas Pakistanis (on average) may carry lower risk profiles than ordinary Pakistanis (and indeed, given more mature credit markets abroad, that further lowers potential default risk. Hence, this is unfair in the same way that the poor facing higher interest rates is unfair. The key intention here is the increase in remittances, and in face of that, the scheme is sensible. Growth is a seeming byproduct, as is the negative environmental impact which would exist with any reduction to the barriers of owning cars.”

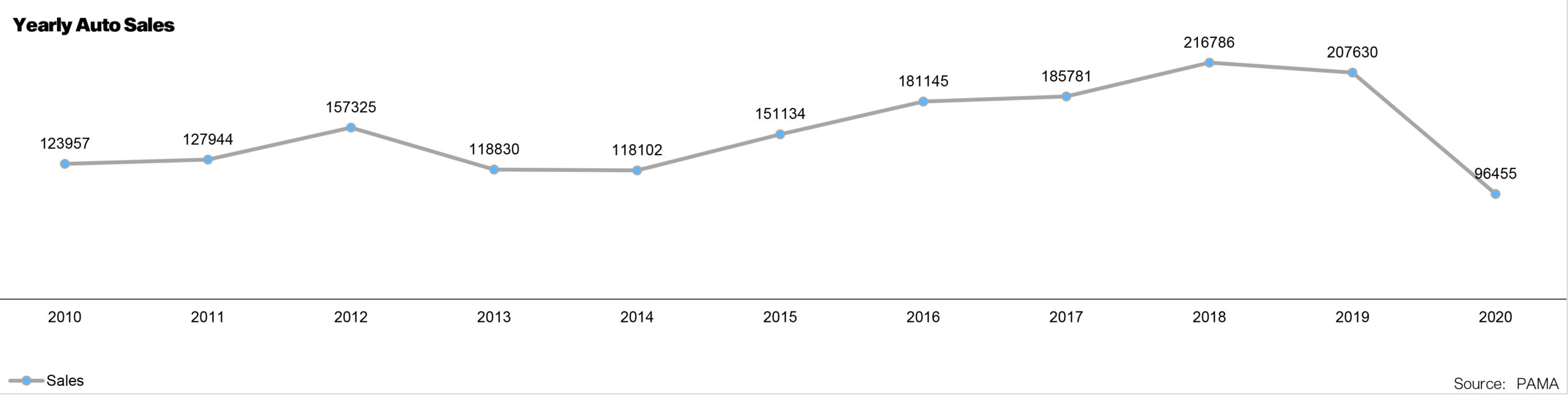

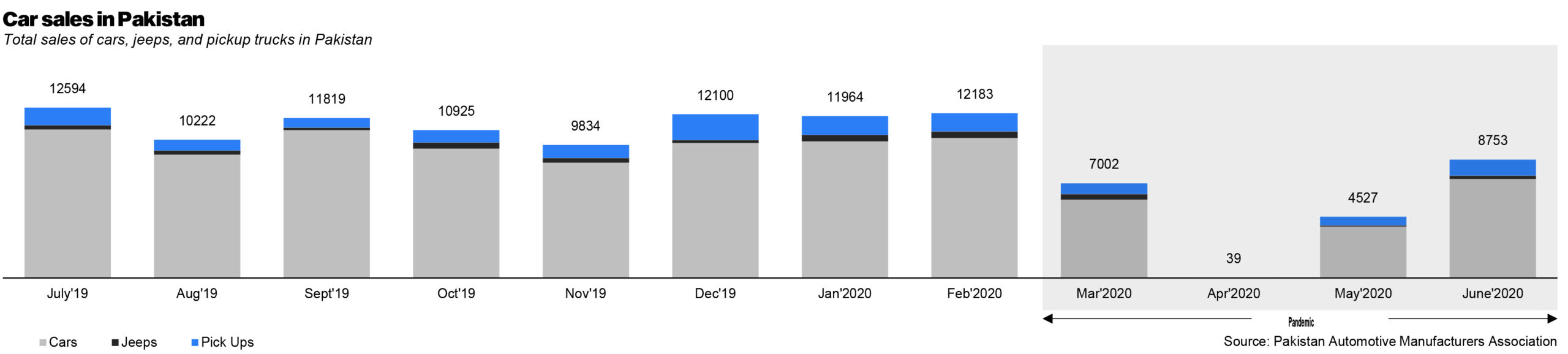

Did the auto industry really need a scheme?

If there are two groups of people that are happy with this arrangement, it is the NRPs and the automobile industry, and making the automobile industry happy these days is a big deal. The SBP has said categorically that their aim was not to help car manufacturers but to do something for NRPs. That has not stopped car manufacturers from scrambling to assure the Prime Minister of their support and that they will deliver cars within 30 days to people that buy them under the scheme. But it is important to try and understand the scale of the impact this will have on the automobile industry because that is our only way of estimating the remittances the country might get from this scheme.

Pakistan’s annual car sales are estimated to be over 180,000 units with market size of Rs550bn ($3.5bn) while the average per car value (including taxes and FED) is around Rs3m (Rs5.3m including car financing on five-year terms). According to the SBP, currently, nine million Pakistanis are residing abroad, out of which around 0.12m have opened RDAs in the last eight months. So far, NRPs are maintaining an average account size of $8,300 out of which 65pc is allocated to Naya Pakistan Certificates (NPCs), 25pc in shares market (PSX) while the rest is allocated in deposit accounts.

According to one report in Dawn, overseas Pakistanis have the potential to buy 10,000-13,000 cars every year during the next two years, which would mean that the annual car demand may increase by 5-7pc, which is positive for local car assemblers. According to one Sherman Analyst that spoke to the media, the Pakistani car market may attract $200-300 million over the next two years. “Assuming 15-2pc of overseas Pakistani families’ open RDAs during next two years and divert 10pc of the funds towards automobiles, the local car market may attract $200-300m during next two years.”

There are some problems with this analysis. For starters, it assumes that 10 percent of funds that are being parked in deposit accounts in RDAs will be utilized for the purchase of local cars. This might be a reasonable enough assumption given the significance of cars in Pakistan as a status symbol, but it is also mostly liberal guesswork.

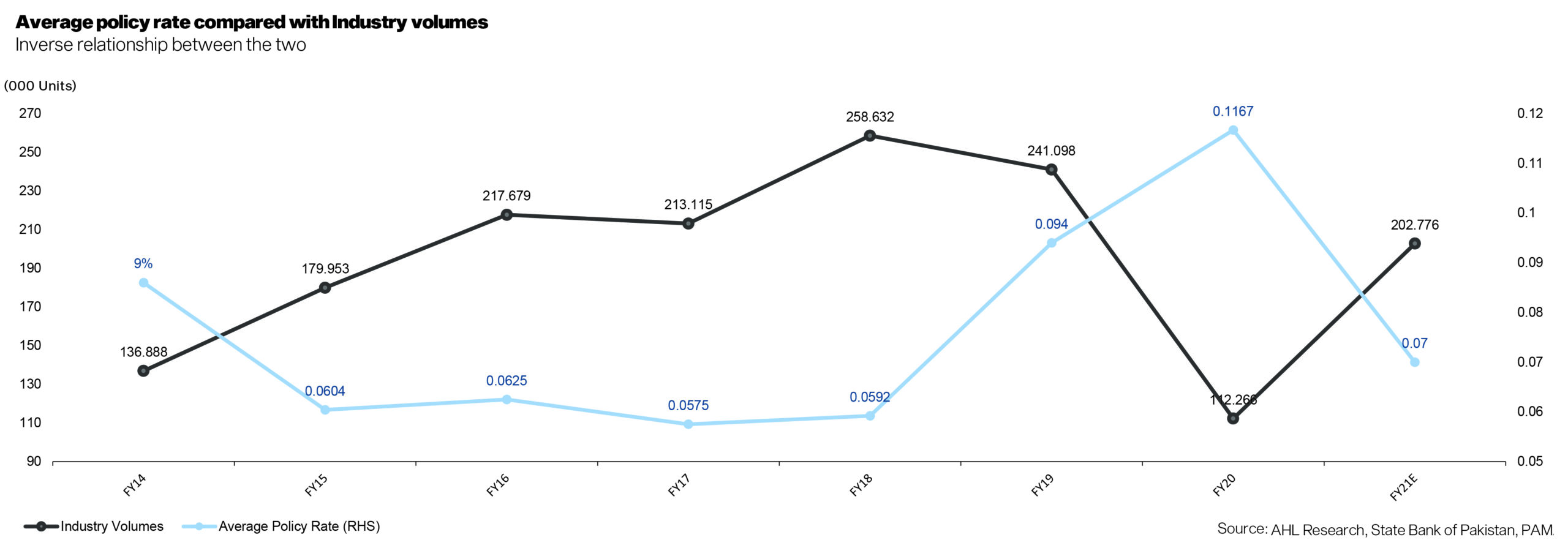

In a report titled “Glory lies beyond the Horizon” issued on 19 April 2021, Arsalan Hanif, an analyst at Arif Habib Limited, said that “We believe volumes are expected to skyrocket in FY21 and are expected to grow by 81% YoY to 202,776 units (112,266 units in 2020). “We expect industry volumes to grow at 3-yr CAGR of 32%.” This report was released before the announcement of the scheme, and despite this positive outlook, Hanif now gives a more conservative estimation of how the scheme might play into things.

“While one cannot be certain how many overseas Pakistanis will avail the scheme, I believe that the scheme will result in a 2-3% increase in volumes or approximately 4,000 – 6,000 units per annum,” he tells Profit.

“It is a very good initiative by the Government of Pakistan and we fully support it and will give delivery within 30 days,” Ali Asghar Jamali, CEO of Indus Motor Company, tells Profit. While he would not comment on the future impact on sales and demand saying they would have to wait and watch, he seemed hopeful that the scheme would benefit both the auto industry and the government.

Hassan Mansha, CEO Hyundai Nishat Motors, on the other hand, was more open with his projections for the future, calling the scheme “very positive” and saying that his company is “anticipating the conversion of a large chunk of used car imports into locally assembled cars which is good for the auto industry at large to achieve economies and revive large scale manufacturing growth in the country.”

“The RDA scheme shall have an expansionary impact in the overall market size which the local industry would benefit from and so do we. We foresee a demand growth of [10%] in short-mid-term from this scheme. Our expectations though would hinge on the banking sector dynamics,” Mansha claims.

The industry is already witnessing growth due to the impact of the AIDP policy entering its last year and showing its full effects. In addition to that, the revitalization of economic activity has played an important role. Consumers are more willing to spend considering lower levels of uncertainty tied to the virus.

The local manufacturing industry has also gained due to strict regulatory requirements that have resulted in fewer imported used cars coming into the country. On the consumer behavior side, we can also see the introduction of new brands and models has been well received by the targeted consumers.

However, it is important to note that the uptick is also due to the cheaper interest rates if compared to a year ago. In addition to that, one could also take into account the increase in remittances and the impact it has on consumption and disposable income. Keeping this in mind, it does not really make sense to promote an industry that did not really need any help and had healed on its own.

The creation of a grey market

The one fear that any reader familiar with the Pakistani car market will have had at the prospect of such a scheme is the possibility of a grey market developing. The problem with this form of concessional lending is that it is creating a distortion in the market for an industry that is not underserved.

Even as car manufacturers gave glowing reviews to the schemes that promised priority delivery, the fears of such a grey market have increased, with the main worry being that through the existence of priority delivery, a grey market emerges where individuals that get their vehicles before others sell their cars on a premium in the market. Anyone that books a car through Roshan Digital is given priority delivery.

Priority delivery varies from brand to brand. For instance, Indus Motors claims to provide cars within a month.

“We aim to deliver after 30 days of receiving full payment. However, multiple factors are associated with delivery time, such as; the vehicle type, specific dealership, color of the vehicle, shipment timing and so on. All customers are equally important to us. However, to facilitate the customers booking through RDA, we will provide them priority delivery through enhancement of our production capacity faster than our plans. Master Changan Motors Limited is always onboard with helping our economy grow and supporting the government in such holistic initiatives.”

Now, companies like Changan claim that the preferential deliveries to RDA holders will not impact the committed delivery time of other customers, but it is difficult to understand how this will not be the case. And since deliveries of cars to regular customers will possibly become slower because of an influx of cars being ordered through the RDA account, deliveries could become even later than expected, beginning a vicious cycle.

“As far as Roshan Digital Apni Car is concerned, we feel that it will create extra demand. Approximately 10% of total volume may come from this stream. As a result we will need more capacity going forward,” admits Mohammad Faisal, COO of KIA Lucky Motors. But he feels that this will result in an overall increase in capacity, which will mean quicker overall deliveries. The lending appetite of banks have improved and automotive dynamics have improved too. Keeping that in mind, we are going to expand soon. We produce every day and make use of as many kits as we have available,” he said. However, he also acknowledged that the global semiconductor shortage, which will likely ease by September, has thrown a spanner in their execution of expansion plans. With such things out of their control happening, this hope that supply to regular customers will not be affected is very hopeful thinking.

To put this in numbers, let’s take the total outstanding car loans which are approximately 272 billion rupees. If we assume the average price of a car at 2 million rupees, that means there are approximately 136,000 cars financed out there. That is enough to show that you have a fine working vibrant market.

But let us say, for instance, you have an uncle in the KSA that is eligible to finance a car through this scheme. He finances a car worth 2 million and names your mom as a nominee (considering he can nominate his siblings). Not only will you enjoy having to pay lower interest rates on the car, but you’ll also get your car sooner. Let’s say the usual delivery time is 6 months that means you’ll get your car in 3 months.

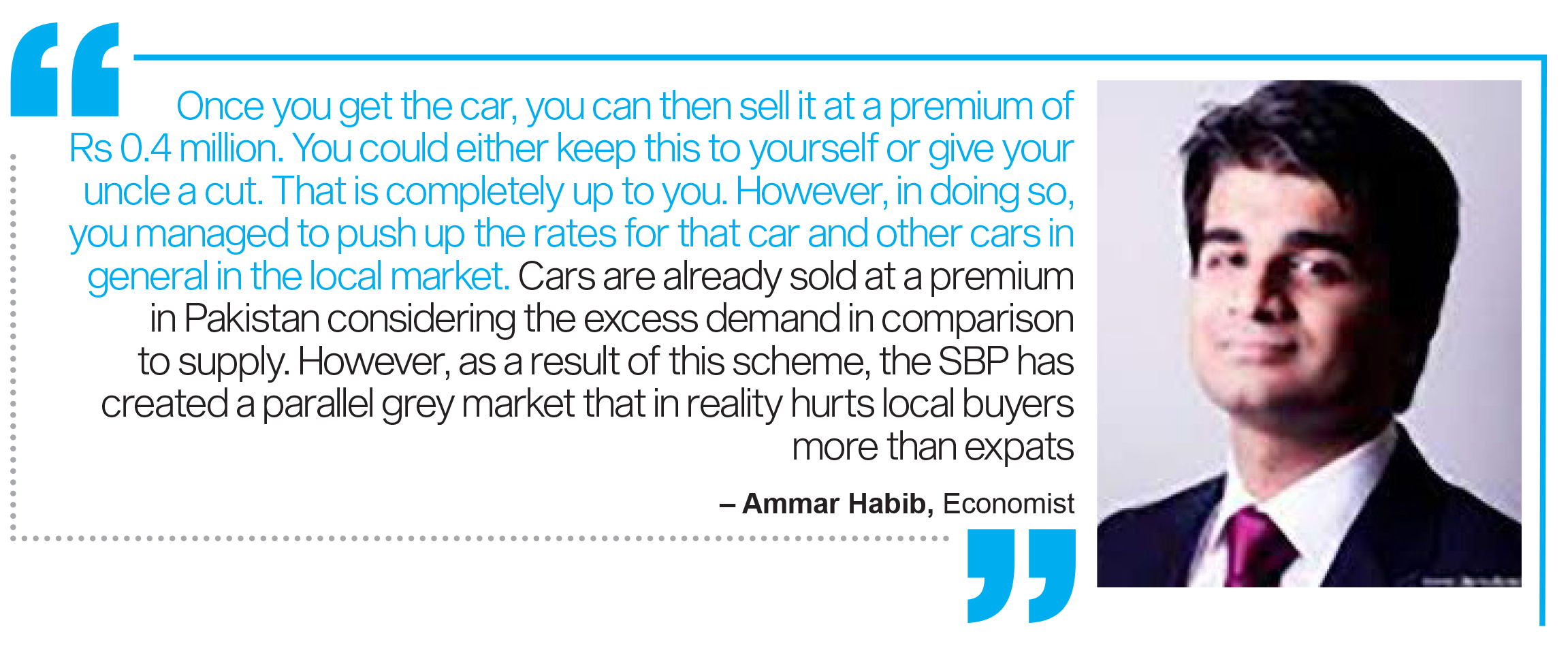

“Once you get the car, you can then sell it at a premium of Rs 0.4 million. You could either keep this to yourself or give your uncle a cut. That is completely up to you. However, in doing so, you managed to push up the rates for that car and other cars in general in the local market. Cars are already sold at a premium in Pakistan considering the excess demand in comparison to supply. However, as a result of this scheme, the SBP has created a parallel grey market that in reality hurts local buyers more than expats,” says Ammar Habib, Economist.

“In addition, while the SBP restricts who can and cannot be nominated as a nominee, in a country like Pakistan where you don’t necessarily need title ownership for assets such as cars, people will often find loopholes,” Habib adds. Another distortion that you may or may not think is a downside is the fact that while this is bringing in remittances, it is also propping up the country’s trade deficit. This is because, in order to manufacture cars in Pakistan, the industry needs to import raw materials and parts that are not made here.

Lower interest rates incentivize more people to buy cars. However, this also results in an increase in the country’s trade deficit. So while we’re working on the current account, the trading account suffers as an unintended consequence.

However, a lot of times automobile manufacturers provide priority delivery to consumers that finance their vehicle through partner banks.

Verdict on the scheme

The scheme seems uncessary. It is pushing up consumption through the sale of cars. While the SBP is not subsidizing the interest rate, it is making it unfair for resident Pakistanis that earn in the country and pay taxes here. Moreover, the scheme is creating a parallel grey market which will require further check to mitigate and control. It is also helping an industry that had been doing fine without the need of such a scheme. Moroever, the environmental impact of this scheme has also been ignored.

The scheme, however, could be said as a means to lure consumers to sign up for Roshan Digital Accounts and to send more money to Pakistan in the form of consumption as opposed to investment.

So what should the State Bank actually be doing? For starters, it needs to stop pulling popularity stunts. It is highly unlikely that the SBP is doing this as a way to lobby for autonomy, but this does show how important autonomy is.

First and foremost, the SBP and government should look towards underserved industries and segments such as SME financing which remains a struggle, student loans, and housing loans. It should also remove all concessions associated with expats due to its greed for dollars.

“Creating a concessional lending scheme for a sector which is not underserved, and which already has a vibrant auto loan market is why we need an independent central bank – so that policies are not designed to support populist whims,” says Habib.

It also needs to stop over-promising especially in the form of faster car deliveries, which is inadvertently making a bigger problem than existed. Reza Baqir needs to stop falling into the whims of the government. He’s the governor of the State Bank, not a finance minister that needs to be reelected.

Good in depth coverage. I would also love to see you cover the “grey market” or “on money” practice in depth.

Well i think any remittance under the car financing scheme will be netted off against the drop in remittance. No body send the money for the holy love of the country.