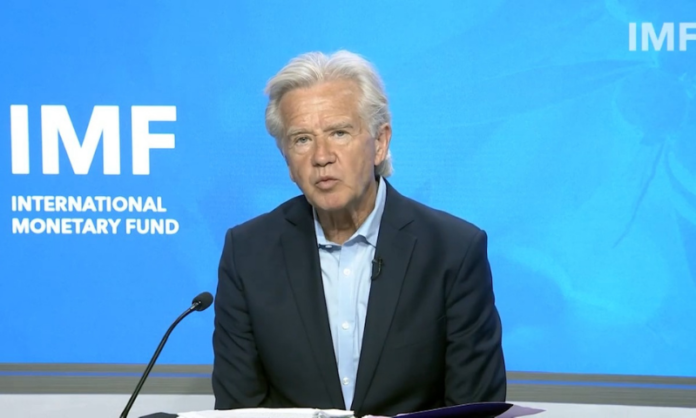

WASHINGTON: The International Monetary Fund (IMF) is holding open, constructive discussions with Pakistan as part of a sixth review of the country’s 39-month, $6 billion financing programme that began in 2019, IMF spokesman Gerry Rice said on Thursday.

Rice declined to say if disbursements under that programme had been halted but said further discussions were needed about Pakistan’s fiscal spending plans, structural reforms, particularly in the tax and energy sectors, and social spending.

IMF staff were unable to complete the talks during a recent mission, but the global lender remained “fully engaged” and aimed to resume the discussions in the period ahead, Rice told a regular IMF briefing.

“We stand ready to continue to support Pakistan,” he said. “As the recovery gains strength, it will be important to accelerate the implementation of policies and reforms needed to address some of the long-standing challenges facing the Pakistani economy.”

Pakistan this month set a target of 4.8 per cent growth in gross domestic product for the 2021-22 financial year and a fiscal deficit target of 6.3pc.

The country surpassed growth projections in the 2020-21 financial year despite a third wave of Covid-19 infections, reaching GDP growth of 3.96pc, after a 0.47pc contraction in 2019-20.

Earlier this month, Finance Minister Shaukat Tarin had said it was not possible for Pakistan to get out of the IMF programme at a time when the economy is reviving.

“It is not possible to get out of the IMF programme at this time,” Tarin had said, adding: “We were forced to go to the IMF.”

“This time the IMF was not friendly with us and the programme was front-loaded and tough,” he further said, comparing the current programme to previous ones with the lender.

He said that the power sector measures would be sustainable and will increase revenue. “This is what IMF wants from Pakistan,” he had remarked.

Unless we are prepared to undertake necessary structural reforms, growth will remain unsustainable. Reforms in FBR and tax structure should be at the top of the line at.