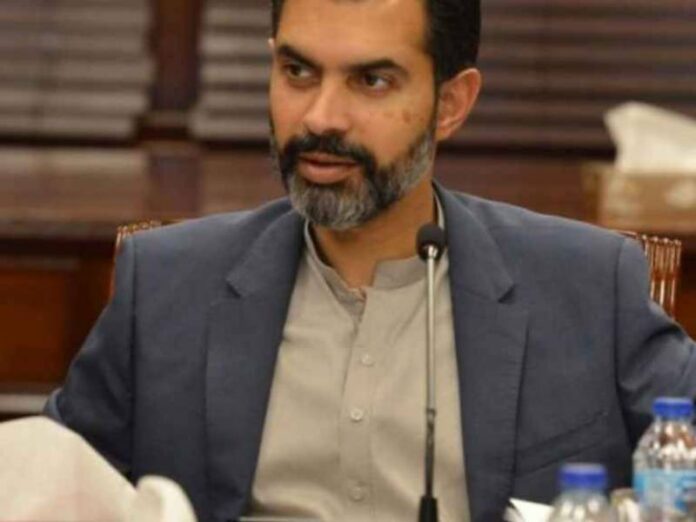

KARACHI: State Bank of Pakistan (SBP) Governor Dr Reza Baqir on Wednesday said that digital transformation of the global Islamic financial services industry had become a necessity for its growth whereas the industry needed to focus on innovative ways of service delivery that aligns with expectations of today’s tech-savvy and convenience-driven customers.

He stated this while addressing the 15th Islamic Finance Services Board (IFSB) Summit 2021, hosted by the Saudi Central Bank in Jeddah.

The theme of the summit was “Islamic Finance and Digital Transformation: Balancing Innovation and Resilience.” Other attendees at the summit included central bank governors of Saudi Arabia, UAE, Bahrain, Indonesia, Oman, and Libya.

The SBP governor emphasised that the Islamic finance industry needed to move to digitise their financial services and transform their processes to improve efficiency, reduce intermediation cost and increase outreach to a wider segments of society.

He pointed out that digitalisation offered tremendous opportunities in achieving a more inclusive financial system for Islamic countries, where a significantly large number of adult population was did not have an experience or history with any bank as compared to the rest of the world.

He advised that development of Shariah and prudential standards related to fintechs and digital banking, by international standards setting bodies such as AAOIFI and IFSB, would prove pivotal for the fast-paced development of global Islamic financial industry and recommended to set up a technical working group to specifically work on these standards.

Moreover, panelists at the session shed light on new regulatory and supervisory challenges for the financial sector regulators posed by technological advancements.

They discussed policy implications of digitalisation that focused on maintaining a balance among financial innovation, integrity and stability.