Does anyone even care what the State Bank of Pakistan says any more? We asked around and it looks like nobody really does anymore. Not in the markets anyway.The SBP had been on an extensive spree trying to get the right message out, however, eventually they had to calm the markets through its actions.

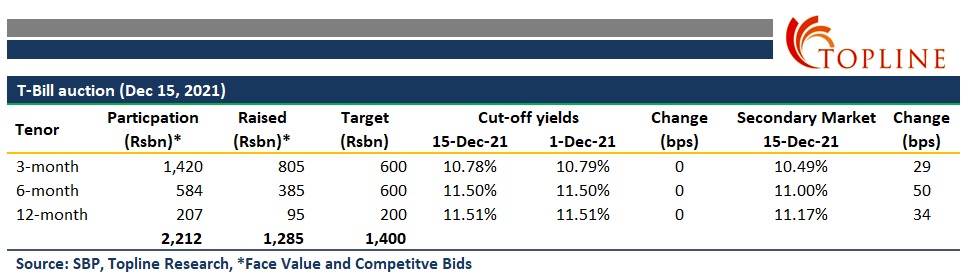

Earlier this week on Tuesday, the Monetary Policy Committee (MPC) at the State Bank of Pakistan (SBP) announced a 100 bps policy rate hike, bringing the policy rate to 9.75%. Within the span of 25 days, there have been two hikes of a cumulative total of 250 bps. The impact of the policy rate hits the debt market. However, as of late, the debt market was and probably still is practically calling the shots getting in ahead of the central bank. As one might imagine, this has rubbed neither the ministry of finance nor the central bank the right way.

“Following today’s rate increase and given the current outlook for the economy, and in particular for inflation and the current account, the MPC felt that the end goal of mildly positive real interest rates on a forward-looking basis was now close to being achieved. Looking ahead, the MPC expects monetary policy settings to remain broadly unchanged in the near-term,” the SBP said in a statement.

This seemed like an attempt to make the markets believe in the fact that the MPC felt that they were close to their goal of mildly positive interest rates. The move was meant to reduce uncertainty, especially at a time when debt markets have been “bullying” the government (Shaukat Tarin’s words, not ours). The finance minister had said that the banks had a dressing down for being too greedy. The irony of that statement is not lost on any of us.

Moreover, the MPC took this a step forward and said that the uncertainty and reaction of market players as “unwarranted”. The statement reads, “across all tenors, secondary market yields, benchmark rates and cut-off rates in the government’s auctions have risen significantly. The MPC noted that this increase appeared unwarranted.”

On Tuesday night, Reza Baqir, the Governor State Bank of Pakistan, went live on Aaj Shahzeb Khanzada Kay Saath where he said categorically that Pakistan is not headed towards a situation where the interest rate in the country could surge to 13.52%. “The last time Pakistan faced such a situation was when there was a severe financial crisis in the country, when the CAD was around $19bn,” he explained. “We are going to take a pause to first look at the effects of the tightening that we have already done, and then we will consider what monetary policy settings should be afterwards,” he said later in the week while talking to Yvonne Man and Rishaad Salamat on ‘Bloomberg Markets: Asia’.

The regulated regulate the regulator

One would wonder why the market isnt taking the SBPs words seriously. Why wouldn’t they? Immediately after announcing the one percentage point hike in the discount rate, the Governor SBP was called into an unscheduled meeting with the Prime Minister. As a result he was absent from a crucial conference call that the central bank holds with bondholders and analysts following every policy rate announcement. His Deputy, Murtaza Syed took up the job and conducted the entire session until near the end when the Governor joined just in time to take two questions after the main presentation had ended. The video has been uploaded online.

“The Governor is in a meeting with the Prime Minister right now and will try to join us before the call is through,” said Murtaza Syed, Deputy Governor SBP as he began the presentation. While one is not entirely sure why the PM summoned the governor on such short notice at such a time, one has to wonder what was so pressing that couldn’t wait. Then again, when the PM calls, you’re supposed to answer – no questions asked.

However, for a minute, let us assume the meeting was unrelated to the policy rate hike and about some other urgent issue, the very fact that the governor was missing in action does not send off the right signals to the participants, especially at a time when the SBP is trying hard to communicate. In addition, while there are no rules for the conference call to be head by the governor, it is the norm. Moving against the norms at a time of uncertainty and market speculation makes the situation worse.

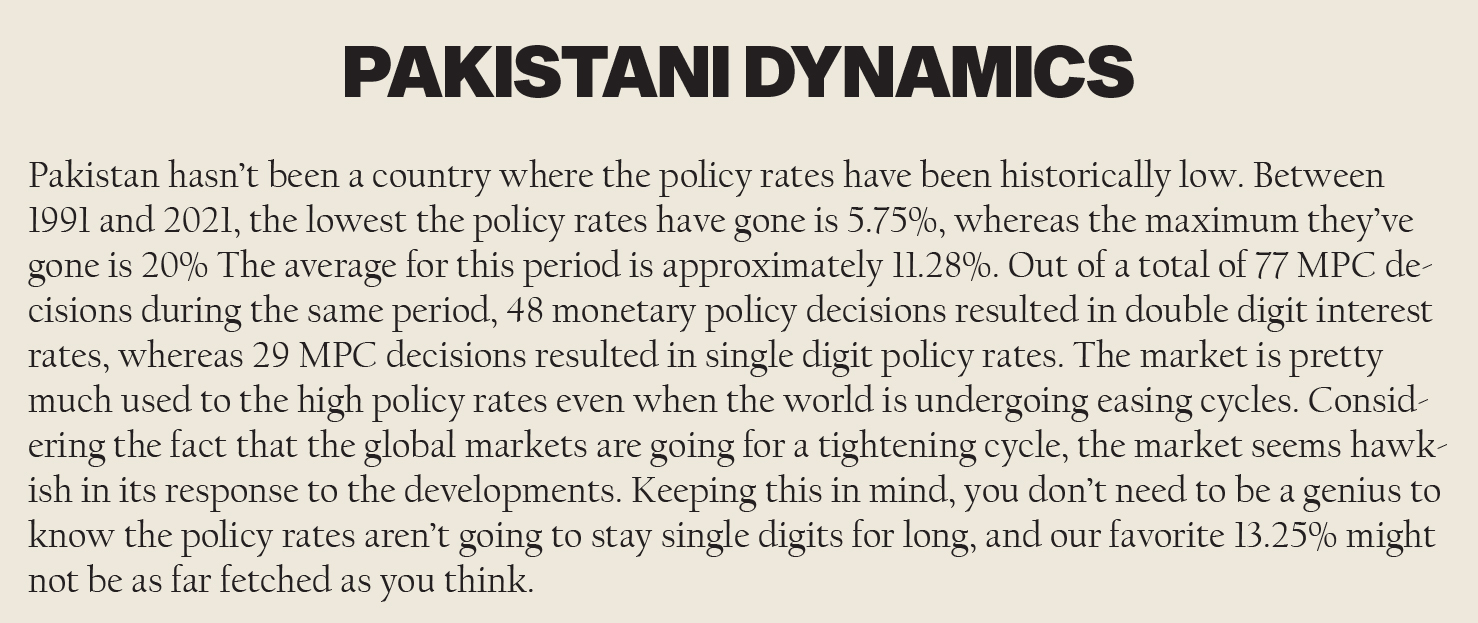

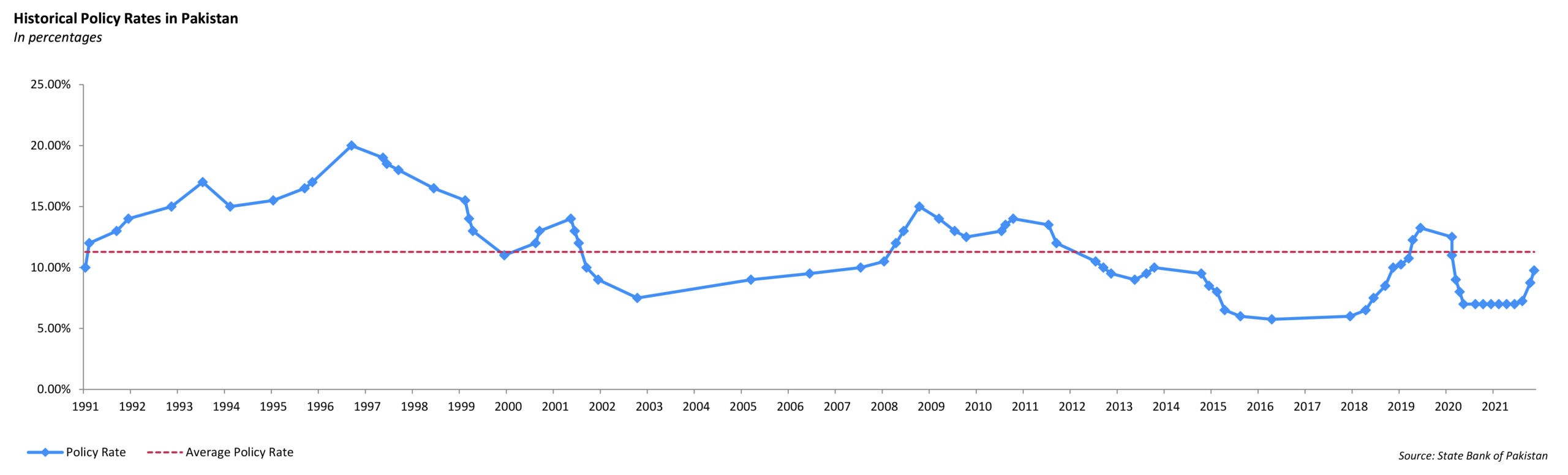

On the December 15 Treasury Bill (T-Bill) auction, cut off yields remained flat despite the fact that the policy rate had shot up by 100bps. The bids in the three month paper are key here. We will get to that later. In an overview, the government was able to borrow Rs 1.37 trillion against the target of Rs 1.4 trillion. It is important to note that T-Bills worth Rs 1.5 trillion matured, and the amount raised included Rs 94.5 billion non competitive bids.

If we break this up, the government borrowed Rs 805 billion through 3 month tenor T- Bills at 10.78%, Rs 385 billion for 6 month tenor at 11.5%, and Rs 95 billion at 11.51% for 12 month. The weighted average yields are up around 30 bps, the cut off for 3 month paper is 100 bps above the policy rate, and 175 bps higher for 6 month paper. On 6M, the spread is a whopping 1.75%

While the market often jokes about the policy rate touching 13.25%, it is funny and interesting to note a bidder bidding Rs 30,000,0000 in 3 month paper against a 13.25% yield per annum. While this bid has obviously been rejected, we appreciate the sense of humor this participant has.

What is to come?

The next T-bill auction is scheduled for Dec 29 to borrow Rs1.2tr against a maturity amount of Rs1.1tr. Prior to Friday’s OMO injection, the cut off yield implied that the market anticipated a policy rate hike in February and May bringing up the policy rate to 10.5% and 11% respectively. The very fact that the participation remains concentrated in the 3 month paper also shows how strongly the market believed in a rate hike.

Moreover, the 6 month KIBOR dropped to 11.26% from 11.54% which is still approximately 100 bps higher than usual spread over the policy rate which also strengthens the expectation of a 100 bps hike in the policy rate. In order to deal with the sentiment, the SBP has been actively trying to communicate through forward guidance and local and international media appearances to calm sentiments. The Ministry of Finance also gave the banks an earful.

The market has the upper hand

Despite the SBP’s multiple attempts to calm down markets, the debt market participants showed little confidence in the forward guidance and chose to ignore. That is when the SBP pulled out the big guns and took a concrete step. The SBP introduced a 63 days OMO injection on Friday in addition to the usual 7 day injection. The amount offered was Rs 1,086 billion in 7-days and Rs 735 billion in 63 days. Through this injection, the SBP accepted quotes Rs 1,086 billion at 9.82% in 7 days tenor, and Rs 689 billion at 9.9% in 63 days.

Open Market Operation is a tool used by a Central Bank (or monetary authority) to inject or mop-up funds, based on the liquidity requirements, from the banking system via the purchase or sale of eligible securities. The SBP does OMOs frequently so the fact that they’re doing an OMO isn’t a surprise. The very fact that they’re doing a 63 day tenor OMO is what is surprising. For context, as per data available from 2008, this is the largest maturity cycle for an OMO. The previous high was 17 days in August 2011. Which is relatively a fraction of 63 days.

All of the 7 day target was met but not entirely for 63 day tenor because the rate that was bid on was lower than what the SBP may have wanted to inject liquidity. The cut off was 9.9%. This means they left out bids that were lower. Based on the data, the highest rate at which bids were received was 10.36%, the lowest bid was 9.5% which is 25 bps lower than the policy rate. This means the SBP did not get too desperate with the OMOs.

The market is seeing this in different ways. “This would signal to the market that SBP is willing to accept fixed return for 2 months, which means policy rates would remain unchanged in the near term,” says Fahad Rauf, Head of Research at Ismail Iqbal Securities. Essentially, this move just cements the markets belief that the January MPC decision will be status quo to stabilize the market. The question remains, what happens afterward.

Another way to look at this is to see this as a liquidity injection to banks so that they can lend it back to the government later while also bringing down yields. This draws semblance to the SBP buying bonds in the secondary market to bring down cost of funds for the Government and limiting banks to charge abnormal spreads.

Basically the OMO operations are a tool to provide funds to the government through the banks considering the government just can’t knock on the SBP’s door to print some money anymore.

You could also say this isn’t really the SBP striking back, instead it’s the SBP falling to the whims of the market. Essentially the equivalent of saying “please take our money and lend it back to us, but hey, hold back on the yields, will you?”

However, with secondary yields coming down following the OMO, one could say the SBPs move did work. Despite that, one can’t really ignore the fact that the market didn’t really believe the SBP until the SBP actually put their money where their mouth is. “The demand for funds was huge, around Rs 2.6 trillion between 15-29 December. The market exploited that,” says Rauf.

Following the injection, the yields for 3 month T-Bills dropped 41 bps day on day, and 34 bps day on day for the 6 month T-Bills. “Forward guidance is just guidance, and this (OMO injection), on the other hand, is a concrete step,” says Rauf.

Will the SBP be able to regain control?

In an exclusive interview with Profit, State Bank Governor Reza Baqir explained how the November 19 MPC sought to put the SBP ahead of the markets. “If the rate increases too much, well above the hundred basis points that the markets were expecting, then that may be counterproductive, because it may signal something that we don’t want to signal” he told Profit at that time. “It may signal that the concerns about developments are actually very pronounced, which is not really the case. So the discussion in the MPC was to strike the right balance. And in the view of the MPC, 50 basis points more than what the market anticipated was considered to be striking the right balance given these considerations.”

The December 1 and December 15 T-Bill auction however have shown that the SBP still has some catching up to do before gaining control again and leading. The December 17 OMO injection however can be seen as the SBP striking back whilst also being seen as the SBP bending over backwards for banks. The question remains, how long will the SBP have to make concrete steps to reinforce their stance. When will their words be enough? When will the SBP lead the market? Lastly, it needs to be said. Sometimes when you communicate and clarify too much, you’ll raise more suspicion and panic. Chill.