ISLAMABAD: Jazz CEO Aamir Ibrahim on Tuesday communicated his apprehension regarding the economic outlook of the country and its adverse effects on Jazz’s operations through an internal memo, issued earlier this week, to the company’s employees.

The official communication, obtained by Profit, of the Telco Chief, read, “I am elevating the level of this challenge to critical as we embark upon some tough but necessary decisions.”

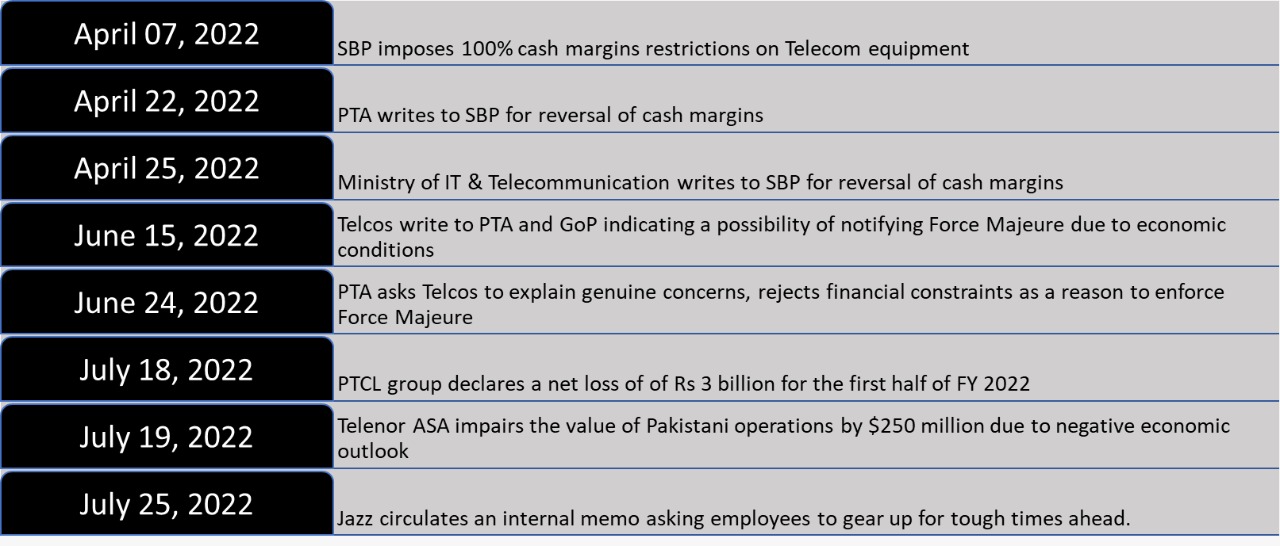

This news adds to the chain of events that emphasizes the bleak position of telecom companies in recent times. The sector is challenged by growing operational costs due to high inflations and surging energy costs. (Read more about it in Profit’s article: Telcos Energy Concerns: Unnecessary Whining or a Genuine Problem?)

Further, the multinational operators in the sector have downgraded their expectation of returns from Pakistani operations due to the high cost of capital and a weakening rupee. The cost of capital is the benchmark rate used to ascertain how much value the cash flows generated in the future would have if compared to the present day. (E.g. A few years back a 250ml juice box was priced at Rs15, today the same thing sells for Rs25. Therefore, the Rs15 today is worth less than what it used to be a few years ago.)

The primary drivers of the Cost of Capital are high rates of interest and risk premium which is a deemed return for undertaking investment in high-risk jurisdictions, and securities. Professor Aswath Damodaran, a renowned economist, recently rated Pakistan’s equity risk premium above 15%, higher than the likes of India, Bangladesh, Egypt, and some African countries.

In light of these developments, Telenor ASA, the parent company of Telenor Pakistan has impaired the value of its local operations. Following this impairment, the recoverable amount of its assets in Pakistan is estimated to be around $600 million down from $850 million. (Read more about it in Profit’s article: Telenor Impairment: Has the group lost hope?)

Moreover, PTCL in its financial results for the half year ended 30 June 2022, declared a net loss of Rs 3 billion due to high operational costs as a result of the surge in energy prices and soaring interest rates deriving up its finance costs.

Jazz’s CEO also highlighted the aforementioned challenges in the internal memo, “ We all have been personally impacted by the rising cost of goods and services. Jazz is not immune to this adverse economic situation. In fact, we are deeply impacted by the interest rate hike and by the sharp rise in electricity and fuel prices.”

Cellular Mobile Operators (CMO) in Pakistan are desperately searching for a business model that can help them break out of the vicious cycle of low average revenues, rising operating costs, and subsequent thin profit margins.

Recent series of events

Jazz network is so bad

Not just jazz even ufone is also terrible customer service how do they expect to perform well if they can’t provide good service you go to their franchise office and they are so terrible with dealing with any complaint I’ve been with ptcl nearly 4 years they are only good at putting up their price’s

Salam,

I Think Jazz Ceo Should Fist Check By Seacking Help AS a Normal Citizen By Dialing 111,or Any Other Help Line Numbers

Bad company or jazz cash to use nahi karna chahye

Jazz is the only quality service operator left , I have tried all other they are just below the standard.

Jazz good network

Jazz signal Tower lagwana hai jagah mere paas hai main adylal road my contacts number 03075385760

Bad compay no doubt

I agreed

Jazz good network

Jaz bhut ghatya network bn gya hai ab specially Karachi mein

Best network

Lodda best

Not good ….not God enough even in cities..in villages it’s worst network ever used.

Ghatya network ha

JazzCash account bhi black kr rha han

Biometric bhi nhi kr rha balance freeze keya howa .

Complain krta han koi reply nhi .

This time jazz is bad network

jazz is so bad not work all time no network

he tel 4g netw. but he not work 3g

Pakistan’s no1 worst and shit and more than worst network is jazz Mobilink