LAHORE: The Pakistan Automotive Manufacturers Association (PAMA) on Tuesday released total industry sales data for the month of March. The results are damning to say the least with overall sales clocking in at 96,950 units sold across all of PAMA’s members.

This amounts to a month-on-month (MoM) reduction of 14% from the 113,062 units sold in February, and a year-on-year (YoY) 47% from the 184,428 units sold in March of last year.

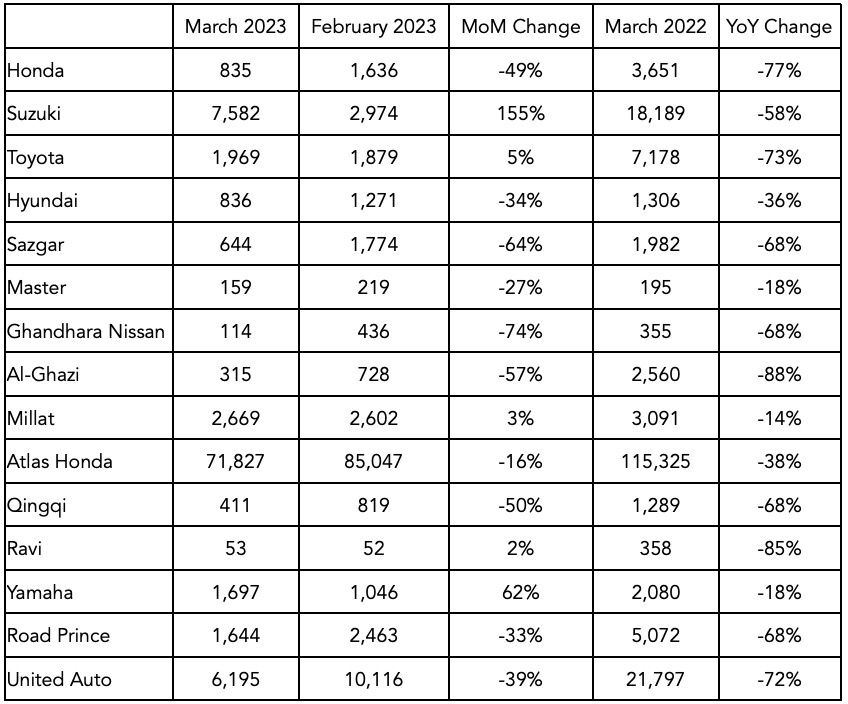

Brand-wise performance

On a YoY basis, not a single company fared better. However, on a MoM basis, Suzuki, Toyota, Millat Tractors, Ravi, and Yamaha came out as beneficiaries in March. Suzuki, in particular, came out swinging with a whopping 155% MoM increase in sales.

In contrast to Suzuki’s rally, Ghandhara Nissan fared the worst on a MoM basis with its 74% sales contraction. On a YoY basis, Millat Tractors fared the best with only a 14% decline in sales whilst its direct competitor Al-Ghazi fared the worst YoY with a sales contraction of 88%.

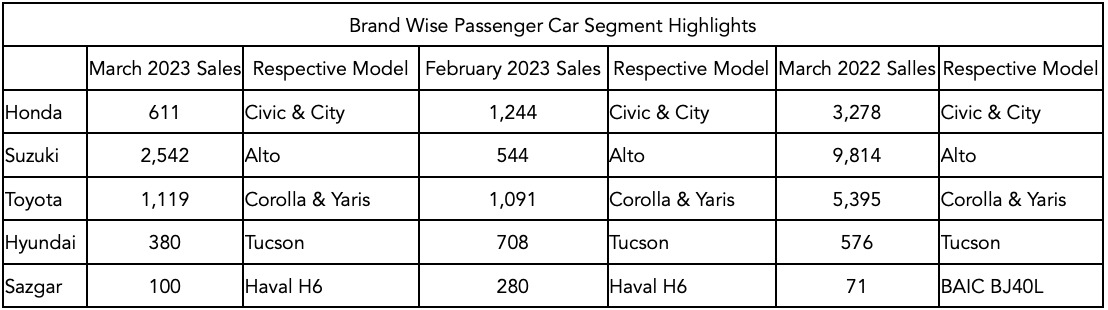

Looking at brand wise best performers in the passenger car category, Honda’s City & Civic, Toyota Corolla & Yaris, Suzuki’s Alto, Hyundai’s Tucson, and Sazgar’s H6 retained their position as their respective brands best selling vehicles from February. The brand-wise winners in the passenger car category have not changed on an annual basis for almost all the companies, apart from Sazgar. It’s best selling passenger vehicle for March 2022 was its BAIC BJ40L.

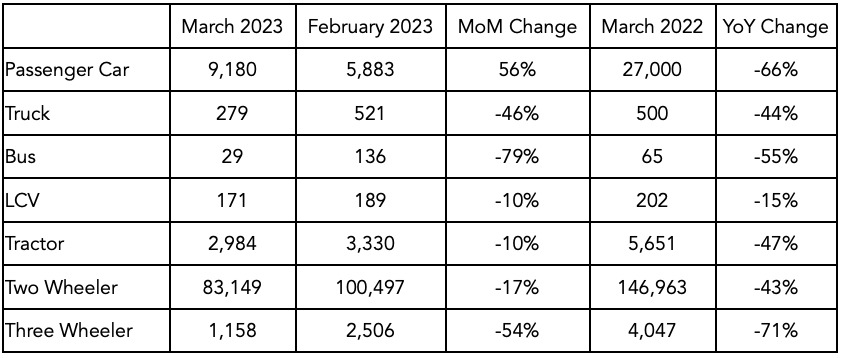

Segment wise performance

Similar to brand wise performance, all automotive segments fared worse on a YoY basis. On a MoM basis, only the passenger car segment fared better by clocking in 56% higher sales than in February 2023.

At the opposite end of the spectrum, buses fared the worst on a MoM basis. Buses saw a 79% MoM contraction in their sales figures. On a YoY, basis light commercial vehicles fared the best due to only recording a decline of 15% whilst three wheelers saw the worst decline at 71%.

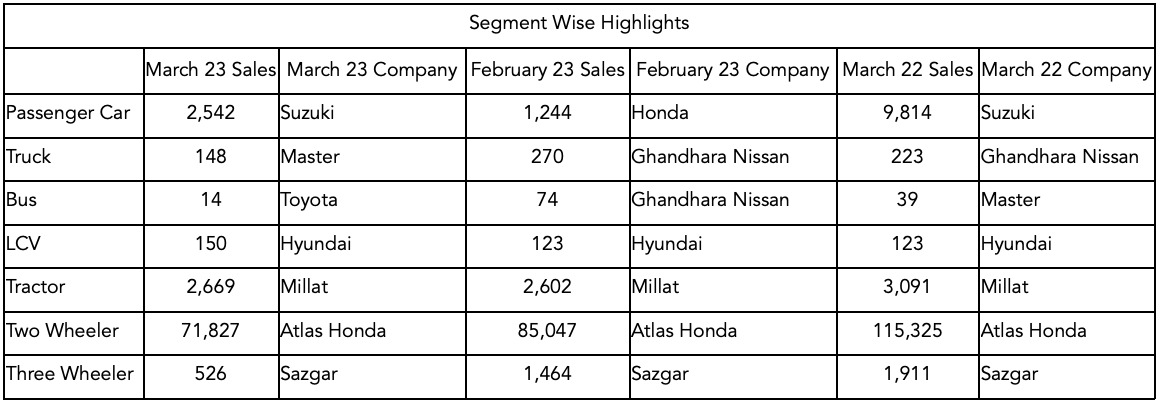

A segment wise analysis reveals that Suzuki recorded the highest sales in the passenger car segments dethroning Honda from February and retaining the position it also held in March 2022.

In the truck segment, Master Motors had the highest sales in the month of March 2023, an aberration from Ghandhara’s dominance seen in February 2023 and March 2022. Toyota dominated the bus segment for March 2023 through its group company Hinopak making for an interesting dynamic when seen in light of the previous month and year which were dominated by Ghandhara Nissan and Master respectively.

The light commercial vehicle, tractor, two wheeler, and three wheeler segments all had their usual winners in the forms of Hyundai, Millat Tractors, Atlas Honda, and Sazgar, respectively.

Unwrapping the carnage

“The numbers are not surprising at all because industry production has nosedived due to unavailability of completely knocked-down kits etc. amid import restrictions. So sales have also taken a hit,” says Mustafa Mustansir, Director of Research and Business Development at Taurus Securities. Similarly, “The recent sales drop in the automobile industry is largely due to import compression policies, and it seems like supply shortfall is outpacing demand decline,” adds Sateesh Balani, Head of Research at Providus Capital.

“I don’t see the situation improving at least for the rest of the current fiscal year. The thing is localisation levels are extremely low except for a few models. Some demand attrition has also taken place due to soaring prices, auto financing becoming expensive due to record high interest rates plus restrictions on consumer financing,” Mustansir muses.

Balani does provide a silver lining to this entire ordeal that the automotive sector is currently victim to, “The current scenario would also create pent-up demand for the future, and whenever supply normalises, we can see a strong rebound in sales. Another factor to watch out will be agricultural output in the country, which is a key determinant of discretionary product demand,”.