In an emergency meeting of the central bank’s Monetary Policy Committee (MPC), the policy rate in the country was raised by 100 basis points (bps) to 22% effective June 27, 2023. The decision comes only two weeks after the last MPC meeting where the interest rate was kept unchanged at 21%.

However, a recent flurry of activity that has found the government scrambling to make last minute changes to secure a deal with the IMF led to the emergency meeting. Analysts believe that the hike in the policy rate is another condition set forth by the IMF.

“This seems to be another IMF condition. Higher rates would increase debt servicing burden on both government and private sector, but if this leads to an IMF program, the positives would outweigh the negative implications, considering fragile macroeconomic conditions”, Fahad Rauf Head of Research at Ismail Iqbal Securities (Pvt.) Limited told Profit.

“The sudden revision of the budget and increase in taxes, uplifting import ban and hiking the policy rate in an emergency meeting are all indicative that these measures have been undertaken to appease the IMF team,” Sana Tawfiq, Senior Analyst at Arif Habib Limited, told Profit

“Although it was an emergency decision which could have had a negative impact on the market, the market will not take it negatively since it shows that the probability of receiving funds from the IMF have increased. Even today the market stood at 1000+”. The benchmark KSE-100 closed at 41,347 points, up 1,371 points.

Was the emergency increase unprecedented?

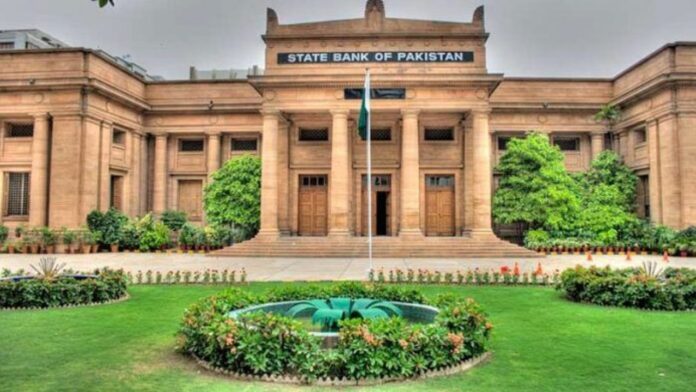

In a press release, the central bank said that after its meeting held on June 12, two pivotal domestic developments have taken place that have slightly worsened the inflation outlook and could potentially intensify the pressure on already strained external accounts. These developments entail the approval of increased taxes, duties, and PDL rates in the FY24 budget by the National Assembly on June 25, 2023, as well as the discontinuation of the import ban by the SBP on June 23, 2023.

The Monetary Policy Committee (MPC) acknowledged these measures as necessary steps toward fulfilling the ongoing International Monetary Fund (IMF) program. It affirmed that these supplementary tax measures are likely to have a direct and indirect impact on inflation, while the relaxation in imports may exert pressure on the foreign exchange market. Consequently, the MPC made the decision to raise the policy rate, ensuring that the real interest rate remains firmly positive on a forward-looking basis.

Undoubtedly, the MPC underlined its conviction that the current course of action, in conjunction with the anticipated culmination of the ongoing IMF program and the government’s steadfast commitment to achieving a primary surplus in FY24, will significantly contribute to mitigating vulnerabilities in the external sector and alleviating economic uncertainties.

IMF equation

For months now, the government of Pakistan has been diligently attempting to appease the IMF in hopes of unlocking a vital tranche of $1.1 billion from the approved $6.5 billion bailout package which was approved in 2019.

Pakistan was able to secure the last tranche of $1.17 billion back in August 2022, after the IMF approved the seventh and eighth reviews of the package. The SBP at the time had more than $8 billion in foreign reserves. However, despite these agreements, macroeconomic stability remained elusive, and the nation faced additional strain due to the catastrophic floods that caused a staggering $30 billion worth of damage.

Early this year, the IMF sent a delegation to Pakistan for a 10-day visit, aiming to negotiate the conditions for the ninth review. However, despite these efforts, the awaited tranche remains undelivered, with the program’s expiry date set for June 30.

Currently, Pakistan finds itself in a dire economic situation, grappling with a host of challenges arising from a balance-of-payment crisis, a devaluing currency, soaring inflation, and substantial debt obligations due later this year. The country’s foreign currency reserves with the central bank have dwindled to a mere $4 billion, sufficient to cover only four weeks of imports. Besides, Pakistan is projected to make payments exceeding $4 billion by this year’s end alone.

Recently, Pakistan presented its budget with an ambitious outlay of $50 billion, touting it as a “responsible” budget. However, the IMF, in its statement, raised questions about certain policies and lamented that it was a missed opportunity to address critical issues.

PM meets IMF MD IMF

On Thursday Jun 22, 2023 Prime Minister Shehbaz Sharif engaged the Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva, urging the IMF to expedite the release of stalled funds. The meeting was held on the sidelines of the Summit for a New Global Financial Pact in Paris.

During the meeting, Prime Minister Shehbaz highlighted the government’s robust economic measures aimed at fostering growth and stability in the nation. He emphasized the successful completion of prerequisites for the 9th review under the Extended Fund Facility (EFF) and reiterated Pakistan’s unwavering commitment to fulfilling its IMF obligations. With heartfelt anticipation, he expressed hope for the prompt disbursement of allocated funds, bolstering ongoing efforts toward economic stabilization and providing much-needed relief.

In response, Kristalina Georgieva, the Managing Director of the IMF, shared the institution’s perspective on the ongoing review process, acknowledging the progress made by Pakistan.

However, unlocking $1.1 billion tranche hinged on meeting specific benchmarks set by the IMF.

Changes in budget

In a consequential move following the meeting, the federal government, in its quest to secure the International Monetary Fund (IMF) loan, imposed an additional Rs 415 billion in taxes as part of the 2023-24 budget on Saturday.

During the conclusion of the budget speech in the National Assembly, Finance Minister Ishaq Dar revealed that Pakistan had engaged in three days of intensive negotiations with IMF officials, resulting in an agreement to implement Rs 215 billion in taxes. This measure was crucial to fulfil the requirements for completing the 9th review under the Extended Fund Facility (EFF), which had been delayed due to the country’s external financing gap.

To further bolster revenue generation, the government raised the Federal Board of Revenue’s (FBR) target from Rs 9.2 trillion to Rs 9.4 trillion for the fiscal year 2023-24. Additionally, the Finance Minister announced a reduction in running expenditures by Rs 85 billion, assuring that this adjustment would not impact the proposed development budget, nor hinder salary and pension increases for federal government employees.

In terms of the overall budget, the federal government’s expenditure for 2023-24 increased marginally from Rs 14.46 trillion to Rs 14.48 trillion, while the pension estimate rose from Rs 761 billion to Rs 801 billion. Moreover, the subsidy estimate reached Rs 1.064 trillion, and grants amounted to Rs 1.405 trillion. As a result of these measures, the Finance Minister predicted a decrease in the overall budget deficit, with a cushion of Rs 300 billion comprising Rs 215 billion in taxes and the Rs 85 billion reduction in running expenditures.