In the middle of a tumultuous year for the economy and a highly unstable socio-political environment, Pakistan’s banking sector managed to have a year of relative financial stability in 2022. In a new report the PWC has reported that most benchmarks have signified a sustainable year.

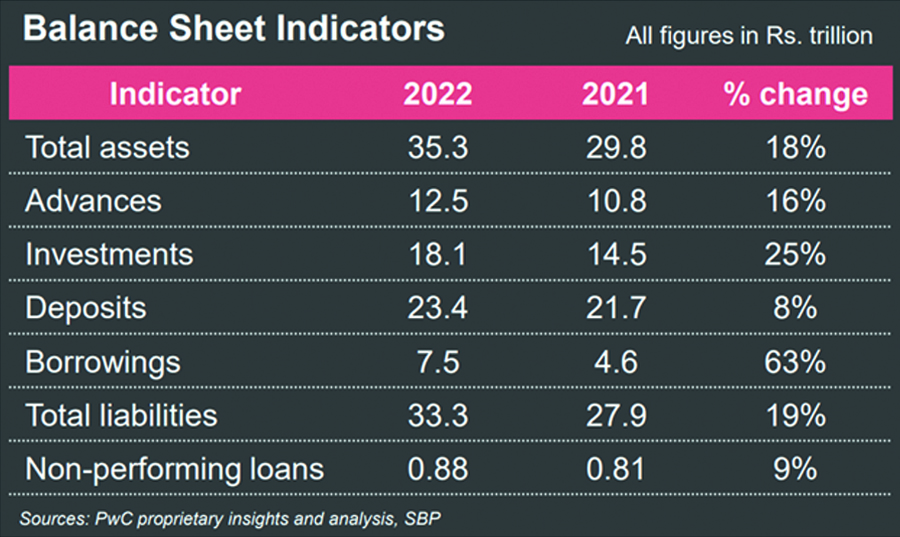

On the balance sheet side, both assets and liabilities grew moderately. Profitability also increased by more than 20%. We will look at each of these indicators in detail. But there were also very particular anomalies and unique trends in the banking sector’s 2022 performance. So what were the findings of the report and what are the future challenges and opportunities that need to be navigated?

Deposits

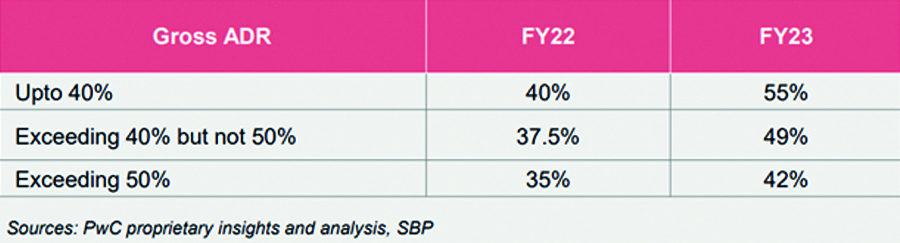

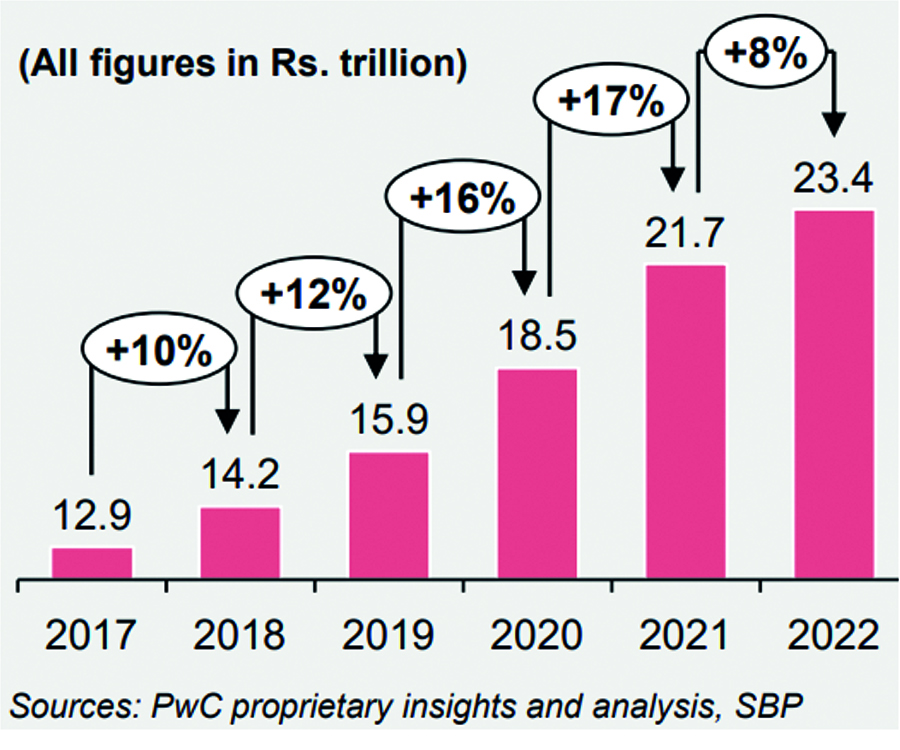

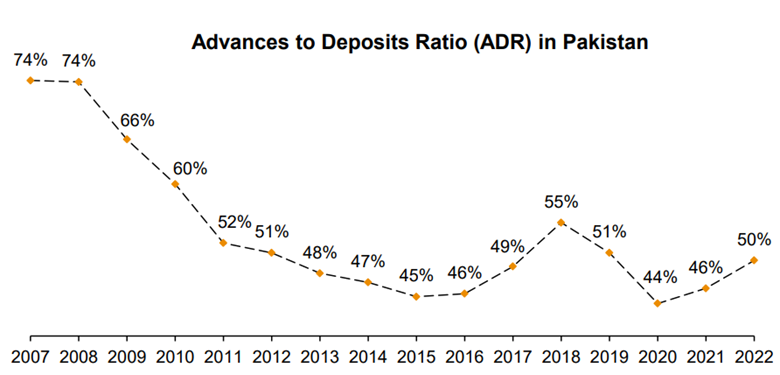

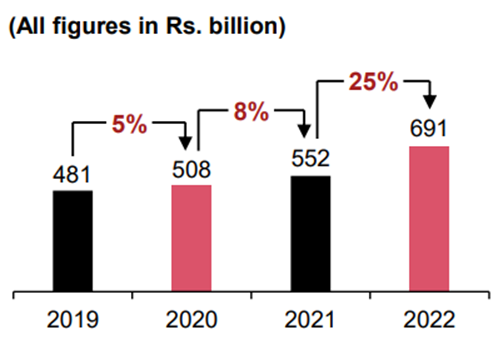

On the liabilities side, deposits have recorded steady accretion over the last five years. In 2022 there was a modest rise of 8% which is the smallest increase in the last five years. In the preceding years, the increase in deposits had been in double digits. The small increase can be attributed to the Advance to Deposit ratio (ADR) tax that was levied on the banking sector. Banks were supposed to maintain an ADR of at least 50%, failing to do so would result in higher taxes.

Theoretically, there were two ways through which the banks could improve this ratio: by either increasing advances (loans to the private sector) or decreasing deposits.

Hence for the first time in the last twenty-one years (prior data is not available), in the last month of a financial year, banks opted to decrease their deposits. This also marks a break from the traditional pattern where banks would artificially hold onto deposits to meet performance goals and inflate their deposits in December, only to release them in January was a first.

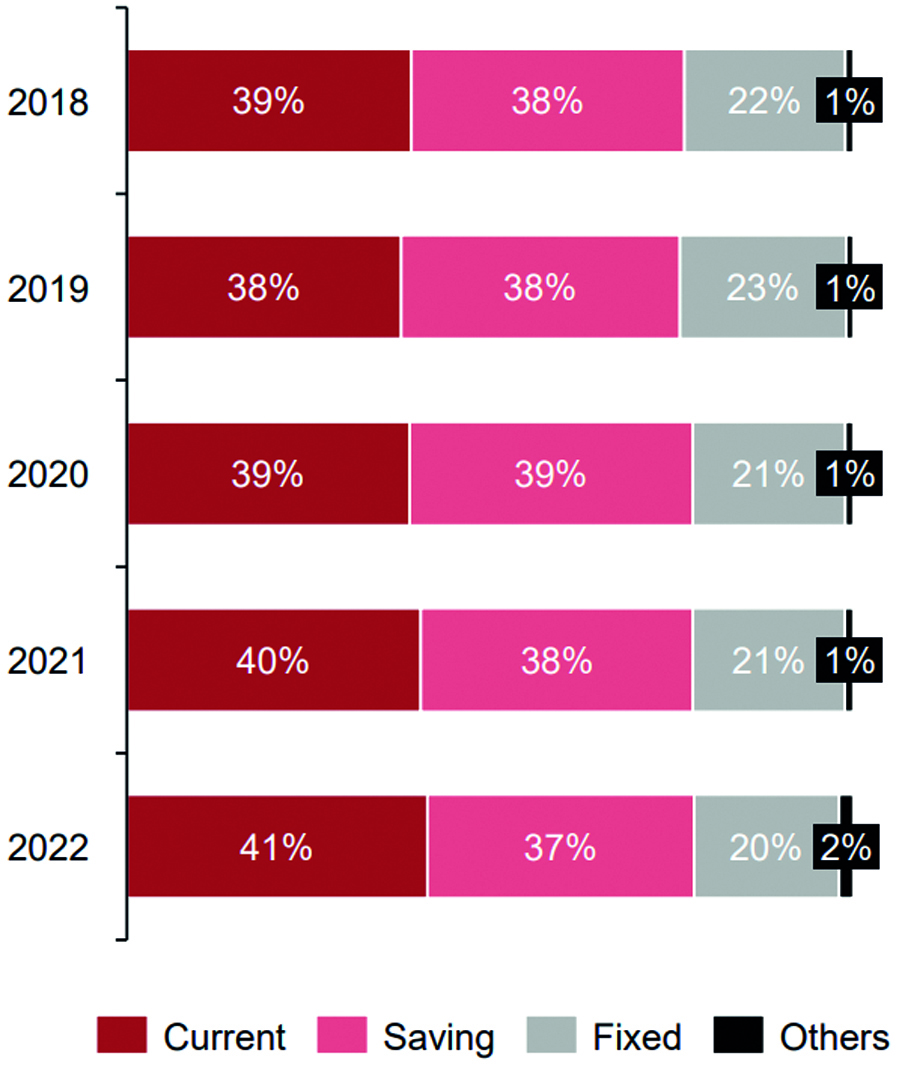

This is also evident from the graph below where deposits increased by only 8% in 2022.

The customer deposit mix remained broadly consistent, with low-cost deposits i.e. current account deposits and saving deposits accounting for 78% of total deposits. Current account made up for majority of deposits at 41%.

Advances

Advances are loans extended to the private sector. Advances (loans) exhibited year-on-year growth of a whopping 16% in 2022.

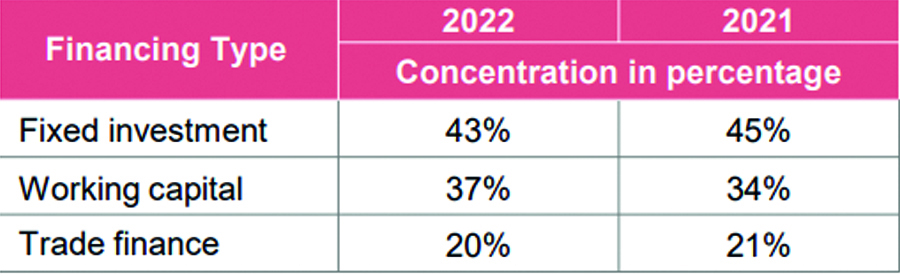

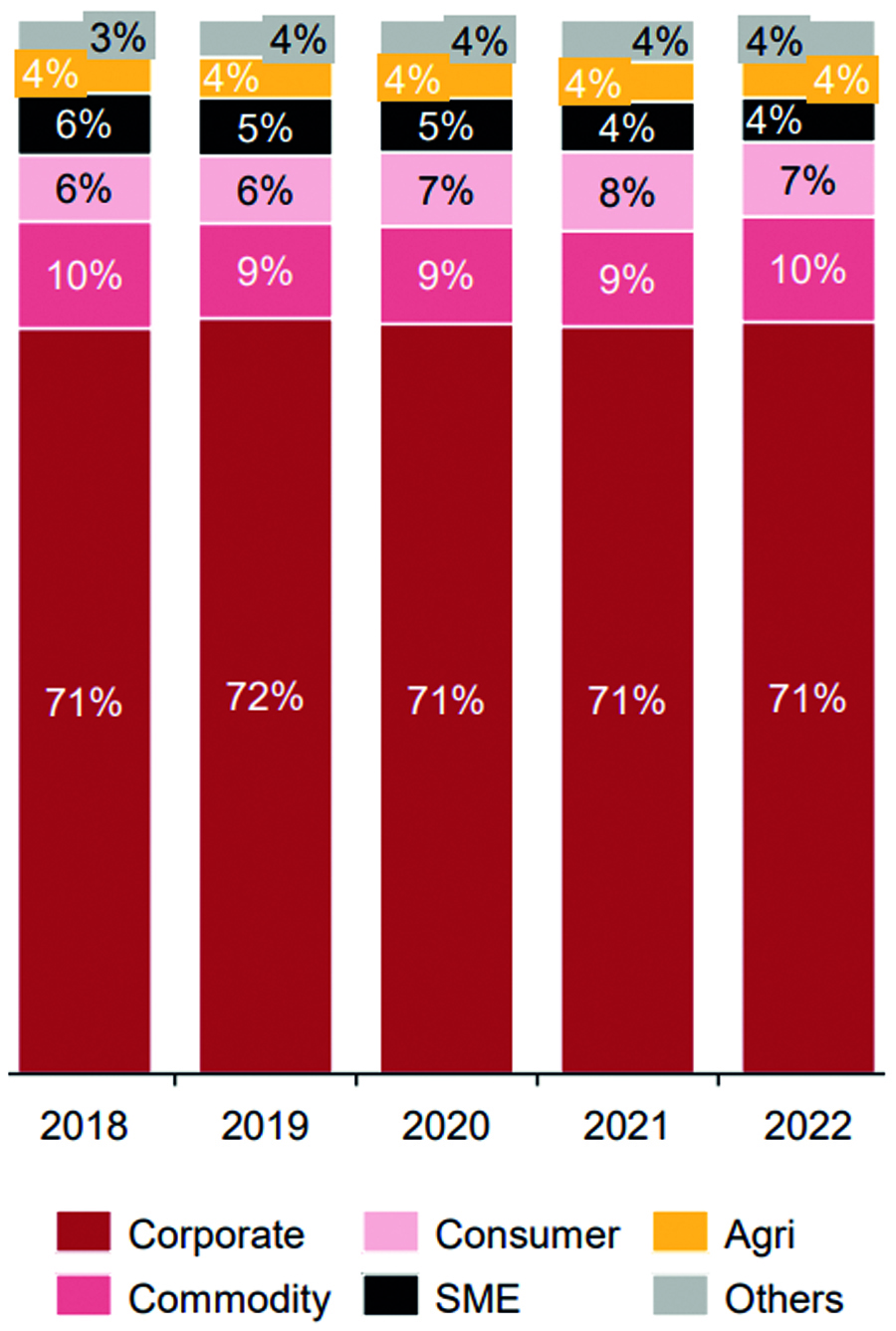

For the past five years, there has been a consistent trend in the allocation of loans, with approximately 70% of them consistently directed towards corporates. The financing type for corporates is as follows:

Banks seem to be tactfully handling their exposure by being cautious with loan financing in fixed investment, which exhibits a higher Non-Performing Loan (NPL) ratio of 9.2% as concentration of loans for fixed investment has decreased by 200 basis point. On the other hand, it appears that trade finance is constrained, possibly as a response to the import restrictions imposed in the latter part of 2022. However, in response to changing circumstances, there has been a noticeable shift in funding towards working capital, which carries a relatively lower NPL ratio of 7.4% as the concentration of loans for working capital has increased by 300 basis points.

The credit portfolio of the banks was predominantly allocated to a selected group of industries, which together make up more than 50% of the portfolio. These key industries include textile, energy production and transmission, individual borrowers, agri-business, and financial services.

Lending to SMEs and Agri-business

The allocation of loans to priority segments, namely Small and Medium Enterprises (SME) and Agriculture, has been relatively low, accounting for less than 8% of the total loans. Specifically, SME loans constitute 4.2% of the portfolio, while Agriculture loans account for 3.6%. Moreover, these penetration levels have been witnessing a decline over the past several years. This declining trend highlights the need for attention and support to bolster lending in these crucial sectors to foster their growth and development.

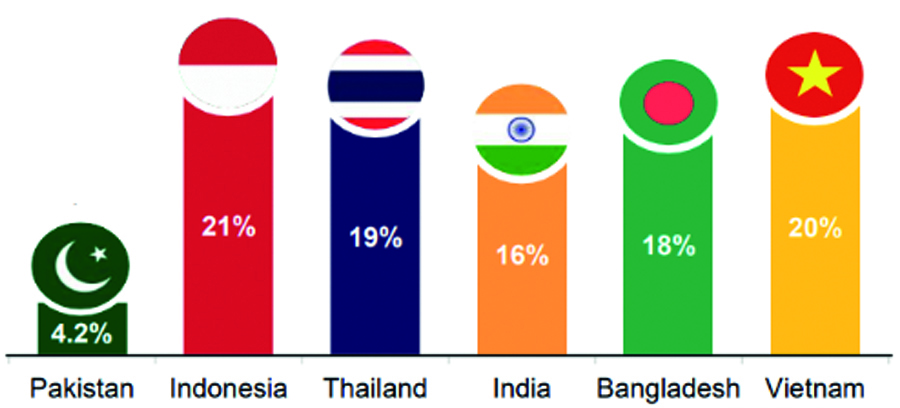

The state of SME credit intervention in Pakistan, when compared to certain regional economies, is disheartening, presenting a significant untapped opportunity. A mere 4.2% of loans have been directed towards SMEs in Pakistan, making it the lowest among its regional counterparts. This concerning situation has seen a gradual decline since 2007, attributed to various factors.

Among the primary reasons for this contraction are the historical experiences with Non-Performing Loans (NPLs) that have influenced risk perceptions, as well as limited credit appetite and capabilities. Additionally, the lack of access to reliable and credible data has hindered effective decision-making in lending to SMEs.

Nevertheless, there are promising examples in the industry where innovative approaches have led to successful service of SME and agri segments. Niche business models, tailored risk assessments, skilled workforce, and advanced technology integration have proven effective in catering to the needs of these segments. Recently, the emergence of collaborations with fintech and agritech companies has also contributed to improved access and support for SMEs and the agricultural sector. These partnerships leverage technology to bridge the gap and address the challenges faced by SMEs and agri-businesses, potentially paving the way for their growth and prosperity.

In the current precarious economic climate, where credit risks may be heightened owing to ever-increasing policy rate which increases costs for businesses and other business costs, banks would have to improvise their credit appetite and readiness to lend to such segments and work on real capacity augmentation for effective penetration.

To improve lending to SMEs and agri-businesses, some major enablement support is required to create the right ecosystem in relation to SME and agri lending.

Mr. Salim Raza, Former Governor State Bank of Pakistan has expressed his insights on the subject “In Brazil, China, India, Turkey and other major emerging jurisdictions, development finance is also fueled by public sector development banks. For example, in India there is a separate institution for SMEs and another one for agriculture. Our development banks are very small with next to zero contribution. To rejuvenate priority segments, we need to have a fully functional Planning Commission and a priority-sector led industrial policy with clear objectives for next 3-5 years, vitalisation of special enterprise zones and specialised banks to deal with SME and Agri,” he says.

“Another key imperative is to support data enabled credits/ digital credits. For this, a national level collaborative effort has to be put in place for big data/ registry, with the intervention of Government, regulators, banking and all industry stakeholders who can enable/ contribute alternate data for optimum credit bureau infrastructure.”

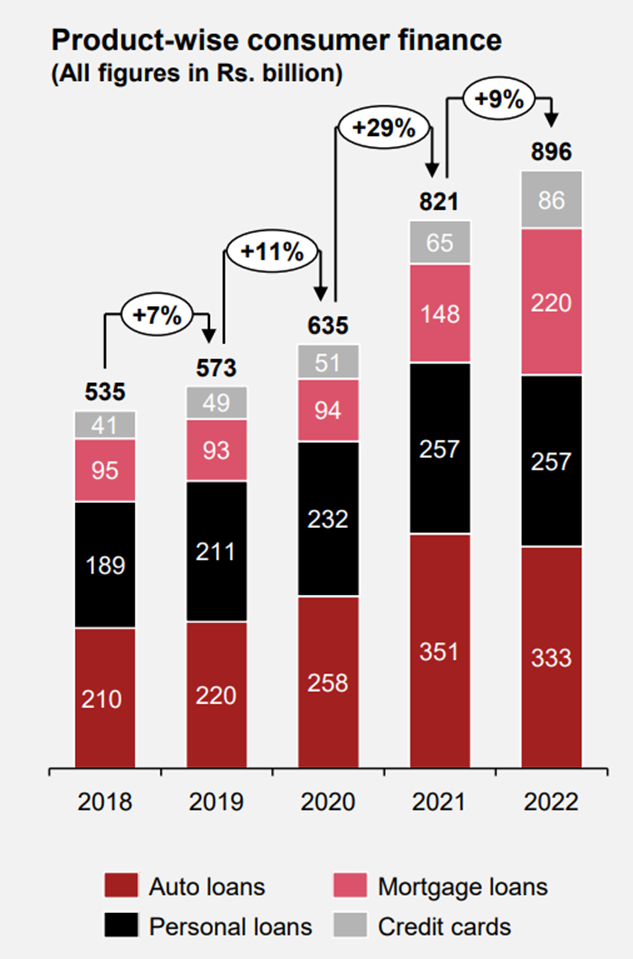

Consumer finance

Consumer finance refers to financial services offered to individuals. It posted a modest growth of 9%. It accounted for 7.1% of total advances which is a slight decrease as compared to the preceding year figure in 2021. Notably, mortgage finance witnessed remarkable traction, soaring by approximately 50% during the year. Additionally, the credit cards portfolio experienced a significant boost of 32%. However, auto loans experienced a contraction, declining by 5% during the same period.

Overall Lending to private sector

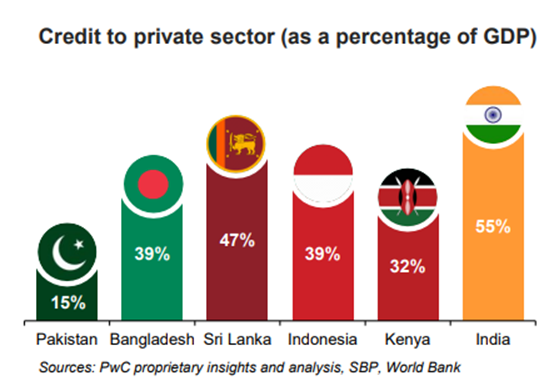

The lending to the private sector in Pakistan, amounting to 15% of GDP, is notably lower when compared to certain other jurisdictions. As previously discussed, adopting a more inclusive credit strategy targeted towards priority sectors and segments could play a pivotal role in elevating this crucial benchmark to a more reasonable level in the medium to long term. By strategically focusing on priority areas, such as SMEs and agriculture, and implementing supportive policies and measures, the potential for a substantial increase in lending to the private sector becomes feasible. This not only fosters economic growth but also enhances financial inclusivity and stability, ultimately contributing to the nation’s overall prosperity.

“With Pakistan’s private sector credit to GDP ratio of 15% (as of Dec-20) and ADR at 50% (as of Dec-22), its positioning relative to certain emerging economies reflects large untapped potential to scale development finance.” explains Salim Raza

It is a sentiment echoed by others. According to Muhammad Aurangzeb, President and CEO of HBL, as a front-runner the banking sector has to rethink and revamp business models. “A deeper sector understanding is required to penetrate the SME and agriculture space. Banks have historically been inclined to a collateral based lending model. This approach warrants a complete transformation towards more interactive, cash flow based lending to better serve these sectors,” he says.

Non-Performing Loans:

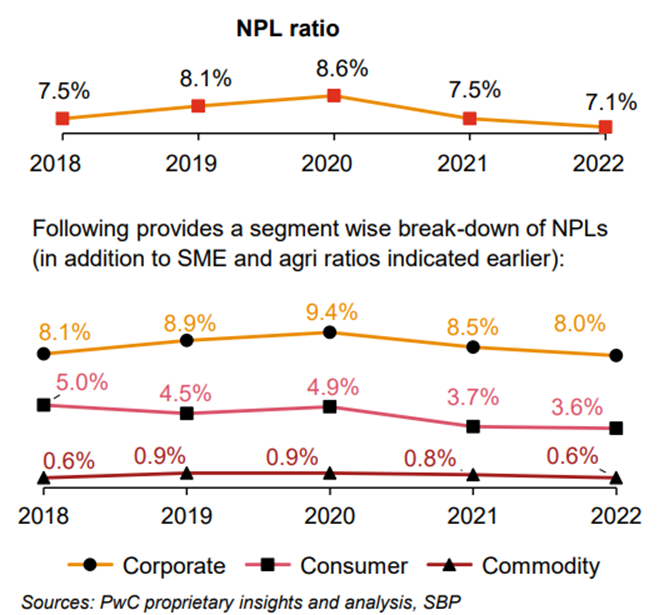

The enhanced performance in managing Non-Performing Loans (NPLs) indicates that banks have adeptly navigated the current challenges by exercising cautious financing on a limited scale. However, it’s important to note that credit allocation to vulnerable sectors remains minimal.

“The prevailing economic situation in the country suggests that while banks may be inclined towards lending and expanding their balance sheets, an initiative incentivised by support from SBP, they may be confronted with the challenge of NPLs over the next couple of years,” commented Mr Yousaf Hussain, President & CEO, Faysal Bank Limited

Investment

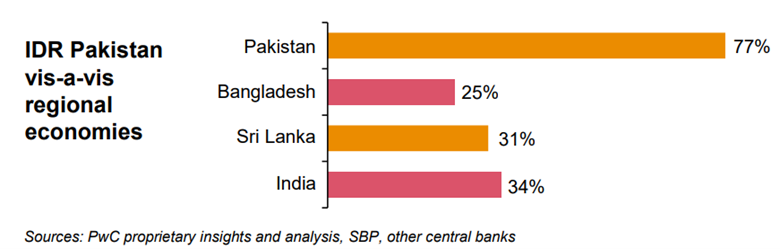

Investments usually refer to investments in government securities like Pakistan Investment Bonds (PIBs) and Treasury bills (T-bills). Investments surged by 25% with ~90% concentration in government securities. Investments in government securities offer risk-free returns which incentivises banks to place funds, resulting in a lower ADR. Another reason for the high IDR is the government’s reliance on domestic debt.

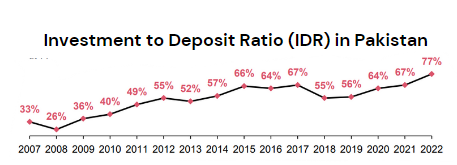

Consequently, Investments to Deposits Ratio (IDR) has been rising. IDR in Pakistan is the highest as compared to other regional countries like Bangladesh, Sri Lanka and India. According to the recent data released by the State Bank of Pakistan, as of June 2023, IDR stands at 82%. On the other hand, ADR has been decreasing consistently. ADR decreased from 70+% in 2007 to 50% in 2022. According to the recent data released by the State Bank of Pakistan, as of June 2023, ADR stands at 48%.

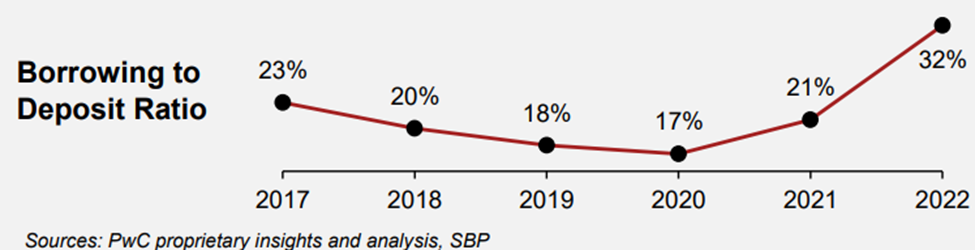

Borrowing

Borrowing increased dramatically in 2022, an increase of 1100 basis points. A striking upward trend in borrowings has been observed, particularly evident in the last two years. Notably, there has been a remarkable exponential increase of 63%, amounting to Rs. 7.5 trillion, compared to Rs. 4.6 trillion as of December 2021. These borrowings were most probably to finance investments in government securities.

Profitability and taxation impacts

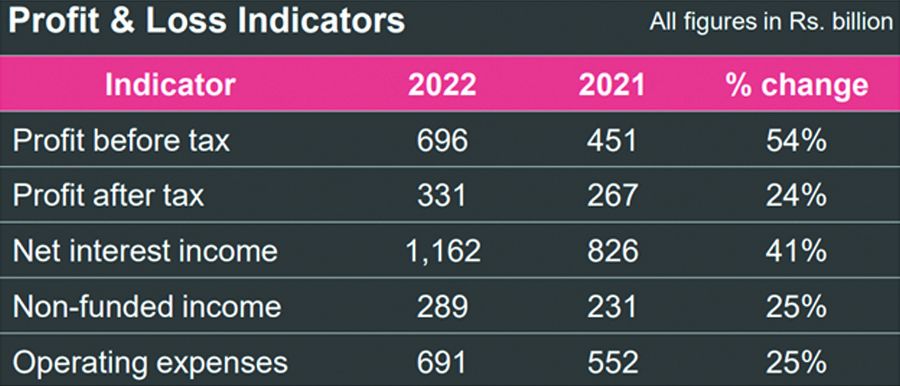

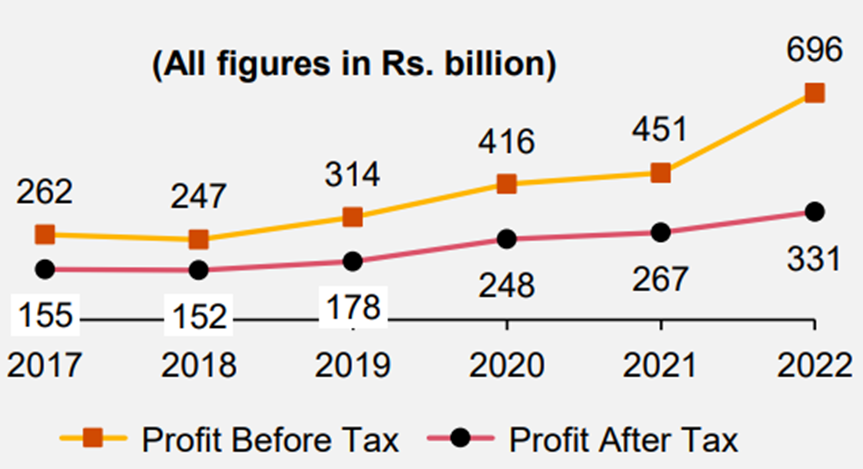

Profitability, Return on Asset (RoA), and Return on Equity (RoE) amplified sharply on the back of higher spreads and non-funded income from different avenues. However, it is worth noting that the positive trajectory of baseline profitability was somewhat dampened by tax charges. These tax implications had a disproportionate impact, moderating the overall profitability growth, despite the other favourable factors contributing to the amplified financial performance.

As the following graph shows, profit before tax increased from Rs 451 billion in 2021 to Rs 696 billion in 2022, an increase of more than 50%. However profit after tax in 2022 was only Rs 331 billion, which is approximately 50% of the profit before tax figure. This means that banks paid almost 50% of their profits in taxes.

For FY22, tax rates were raised from 35% to 45% (effective tax rates jumped to 49% from 39% in 2021). Moreover, as mentioned earlier, an additional tax on income from federal government securities, linked with ADR was also introduced which increased the tax burden on the banking sector. Nevertheless, the sector was still able to maintain its profitability.

Markup Income

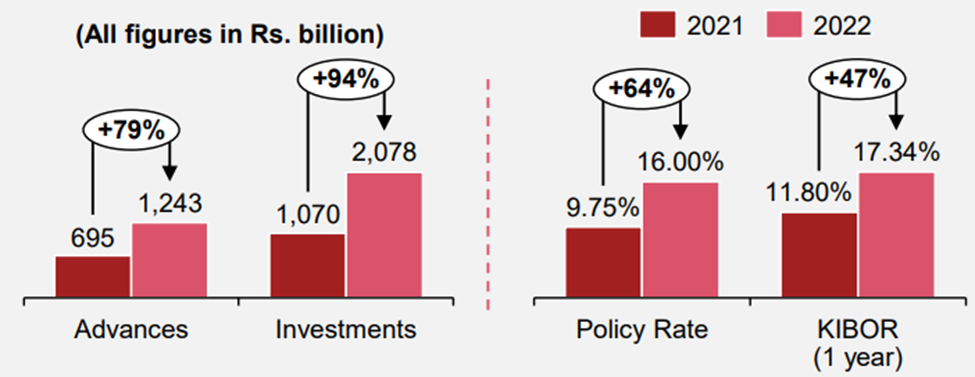

Mark-up income is the interest based income. It is the core income for the banking sector. Mark-up income increased considerably to Rs 3.4 trillion, at the back of rising policy rates. Below provides a comparison of mark-up income from advances and investments, along with SBP policy rate and one-year KIBOR as of Dec-22 vs. Dec-21.

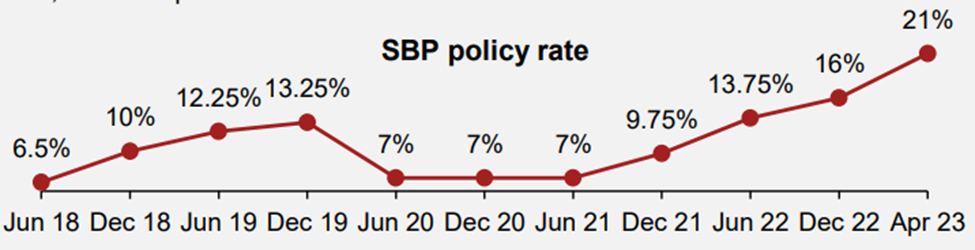

Policy rate further increased to 21% in April 2023, in the backdrop of economic uncertainties and rising inflation, generating a cumulative impact of 1,400 basis points since June 2021.

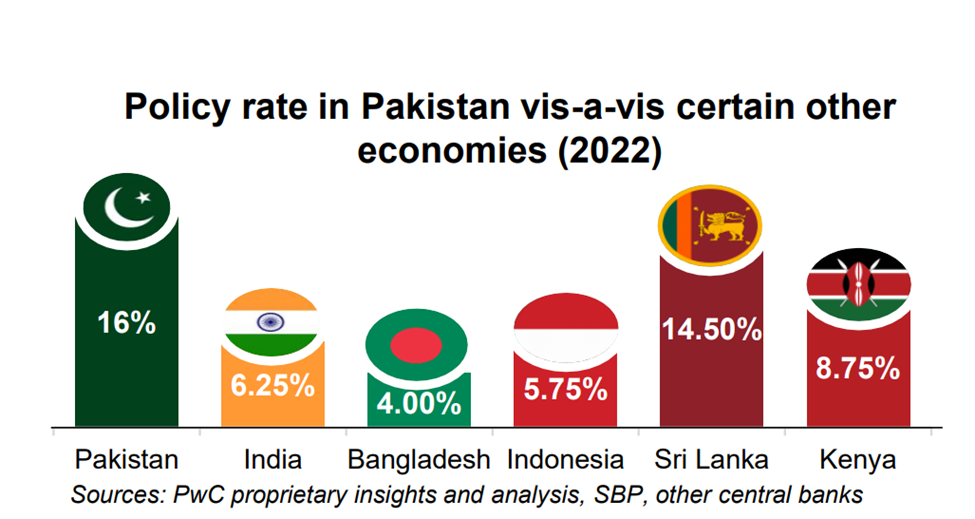

The policy rate in Pakistan as of Dec-22 is much higher relative to certain other economies, even higher than that of Sri Lanka. This resulted in improved earnings for the banking sector.

Operating expenses:

Operating expenses registered an increase of 25% in 2022, which is the highest increase as compared to relatively lower variations during the last few years. However, with a strong revenue base (75% growth in mark-up income), the industry’s cost-to-income ratio improved to 48% compared to 53% in Dec-21.

Conclusion

The banking sector in 2022 demonstrated remarkable resilience and growth. Despite taxation challenges, the sector’s adaptability and strategic focus on key areas are key drivers of its continued success.

banking is the best sector in pakistan for long term investment.

the best sector invest in bank shares and sleep.